Source: Liu Jiaolian

There are two or three branches of peach blossoms outside the bamboo. It's the time when the puffer fish wants to come.

Unknowingly, we have bid farewell to the warm and cold March, and bid farewell to the first quarter of 2024. In March, BTC (Bitcoin) opened at 62.7k, with a maximum of 73.8k (a new historical high), a minimum of 59k (pin inserted on March 6), and a closing of 70.4k. The month successfully closed above $70,000, which was the highest monthly closing price in history. , which is a full $10,000 higher than the closing price of 60.4k in October 2021 in the last bull market.

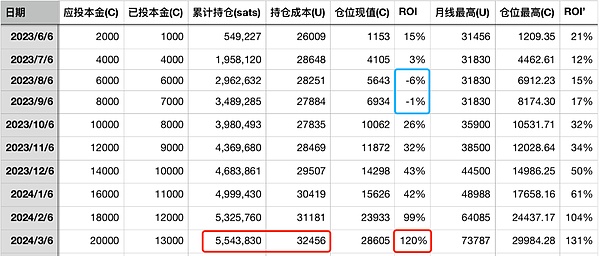

Since March closed higher, we still skipped adding positions on dips this time. From June 2023 to March 2024, the position has been added 12 times, with a cumulative position of 5.54 million satoshis, a holding cost of more than 30,000 dollars, and a return rate of 120%.

In addition, it can be seen that in August and September last year (2023), when the yield fell back to negative values and fell into floating losses, it should be a good time to increase efforts to increase positions.

Bit is a hundred feet tall and can pick up stars with his hands.

Don't dare to speak loudly for fear of frightening the people in heaven.

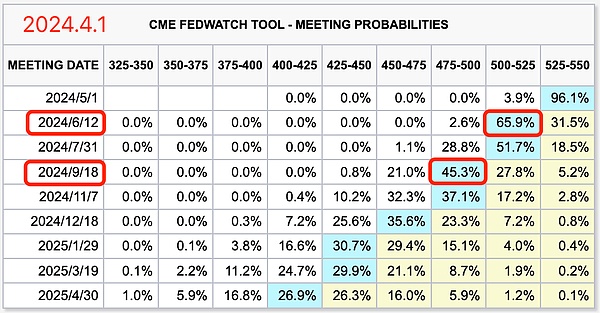

"Heavenly Man" Powell (Chairman of the Federal Reserve) suddenly made a hawkish stance, saying that it is not advisable to enter the interest rate cut channel too quickly, which caused the expectations of an interest rate cut in June to disappear.

The chart above shows that the market's expected probability of an interest rate cut in June has dropped to less than 3%, and currently more than 65% of expectations are to keep interest rates unchanged at the current level. The earliest interest rate cut is expected to be in September.

The pressure is on Treasury Secretary Yellen.

It is reported that Yellen will visit Beijing again in April.

She came here last July and established two working groups.

This time she came to us again. It must have been a lot of pressure.

After all, "Huashan Sword Discussion" is nearing its final stage.

It is Yellen's unshirkable responsibility to work for a soft landing.

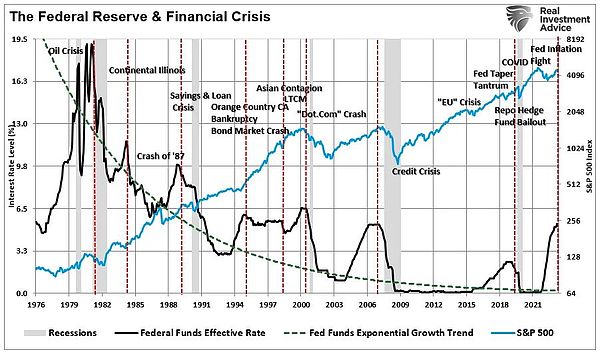

The Federal Reserve's approach has always been to be "cooked duck with a tough mouth" and "never look back until you hit the wall." The market had to collapse and he would die before the boss reluctantly opened the channel for interest rate cuts. This point has been consistent from the time of the Volcker shock in the 1980s to today.

Some people look back at historical data and say that as soon as the Federal Reserve cuts interest rates, the market collapses. This is the opposite of cause and effect.

In fact, it should be said the other way around: It was precisely because the market was about to collapse that the Federal Reserve quickly put down its magic weapon of high interest rates and cut interest rates to save the market.

Why does the Li Tianwang Pagoda never leave your hand and is held in the palm of your hand every day? Because when King Li Tianwang was holding the pagoda in his hand, he was Nezha's father; once he put down the pagoda, he became Nezha's enemy. (Chapter 38 of "Journey to the West" writes clearly: "... When the father saw his son wielding a sword... the king of heaven was shocked and pale.... Why was he so frightened?... I was busy at home today, so I didn't support the tower. He was afraid that Nezha had the intention of revenge, so he was frightened and turned pale. But he immediately turned back, took the golden pagoda from the base, and held it in his hand...")

The Federal Reserve holds the pagoda, and the market kneels down and kowtows at it, admiring it every day. It's just that this man-made pagoda is no better than the pagoda made by Buddha. It is ultimately unstable and unsupportable.

The pagoda that is being held will always be put down, and the market will rise in retaliation. If the harvest is not successful and the market is released, it will declare another depreciation of the US dollar and the failure of the Federal Reserve.

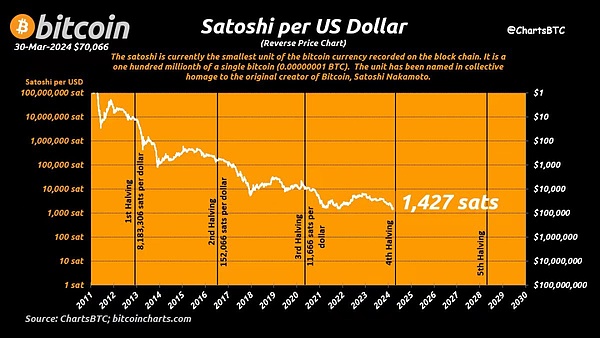

USD depreciation relative to Bitcoin

Gold and Bitcoin, which have skyrocketed since October last year and hit new highs repeatedly, are just like the two swords held by Nezha, holding back the Federal Reserve's knife that is slashing at the world. The Fed was shocked, so Powell came out to sing hawks and hurriedly brought out the magic weapon.

gold

Bitcoin

BTC (Bitcoin) has closed higher for seven consecutive months in September, October, November, December, January, February, and March. From the closing price of 27k in September, it rose all the way to the closing price of 70.4k in March, an increase of 160%.

As Jiao Lian wrote: " Every buyer of gold, every patient hoarder of cakes, is a strategic alliance and a united front to fight against cattle from across the mountain. And all those who participate in this united front will benefit from the substantial increase in the assets in their hands." The rise benefited from the Fed's failure and another collapse of U.S. finance. "

The article also clearly points out that the internal force driving the rise of gold and BTC is: the defense of exchange rates by major countries + foreign exchange controls by major countries.

At that time, Jiaolian made a metaphor in language that people in the crypto can understand: " This is equivalent to a certain platform being temporarily unable to withdraw coins, which plays a disguised role of locking up positions, which is more conducive to price increases. Think back to the end of 2020. At that time, there was a moment of panic, but one of the effects of disguised lock-up is to promote the start of the bull market from the end of 2020 to the beginning of 2021. "

Half a year has passed, and looking back now, I can see that the first four steps of the script I wrote in September have been completed. BTC has also been successfully pushed by major domestic forces to break through all-time highs and start a technical bull market.

Now, the script is still short of the final scene:

" The fifth step is when the Federal Reserve discovers that the U.S. dollar assets attracted by high interest rates have not continued to flow back to the United States and U.S. Treasury bonds, but have turned around and gone to another channel midway and entered our pot, the Federal Reserve will become anxious. U.S. Financial Without the support of returning capital, the system and domestic dollar assets will soon be unsustainable, and there will be another financial collapse like the subprime mortgage crisis and the financial turmoil.

" Of course, this time the Fed should be more sensitive and act more decisively than in 2007-2008. And it will also launch a new tool BTFP in early 2023. Finally, if something goes wrong, I believe the Fed will immediately step forward to block the breach. , printing money quickly, and devaluing the dollar to save the building from collapse. "

Although it seems that the U.S. stock market is rising very well now, I am enjoying myself eating hot pot and singing songs. But will this train suddenly be like the opening scene of "Let the Bullets Fly", when it hits Zhang Mazi's ax blocking the track, suddenly overturns, the car is destroyed, and everyone is killed, leaving only the county magistrate's wife, and the county magistrate becomes Where is the master?

There's still half a year left, we'll see.

Teach the chain to blindly guess, what triggered this crisis is likely to be the bursting of the AI bubble. This bubble is epic (AGI completely eliminates human beings and so on), this trading is also epic (capital fantasy linkage), and the collapse is likely to be epic as well.

Overturned the county magistrate's train, turned the county magistrate into a master, slept with the county magistrate's wife, and Zhang Mazi came to be the county magistrate.

If the epic bubble burst really happens, then maybe that brief panic callback will be the last chance to get on the Bitcoin train before it reaches $100,000.