Written by: Lucas Kiely, Chief Investment Officer of Yield App, CoinTelegraph

Compiled by: Baishui, Jinse Finance

The timeline for the Bitcoin halving is ticking, and the ETF frenzy seems to have accelerated the timeline. In fact, we are only a few weeks away from the big event. So it’s no surprise that the halving is now a topic that crypto investors and the media can talk about. However, while we can still expect some predictable trading behavior after the big day, we are now in a very different market that requires a different trading strategy.

In the past three cycles, the halving was preceded by a massive spike in volatility. We typically expect a 30%-40% sell-off within an average of 480 days after the halving date, followed by a massive rally to new all-time highs. But this time, a spot Bitcoin ETF changed everything.

To understand where Bitcoin’s price is headed in the future, we need to look more closely at the asset’s volatility. In recent months, as excitement built ahead of the halving, we’ve seen the expected retracements. However, by the standards of previous cycles, these retracements have been anemic. This time around, Bitcoin’s correction has been much smaller, not exceeding 25%. In fact, the latest drop was only around 15% before BTC rallied again to the $70,000 mark.

This more subdued sell-off portends a more subdued rally once we’ve gone through the halving. There is no doubt that Bitcoin will see a routine sell-off after the halving, and it will certainly hit new all-time highs after the halving. Again, for traditional investors, the returns will still look more exciting. But don’t expect the 600%+ price increase we saw after the last halving in 2020. Those days are over.

So why is this happening? There are two factors at play here. First, the proportion of long-term Bitcoin holders has reached a record high of about 14 million Bitcoins - more than 70% of the total circulating supply of 19,670,043 Bitcoins. In recent months, record amounts of Bitcoin have been withdrawn from exchanges to cold wallets as more and more holders adopt the "diamond hand" approach.

Percentage of total Bitcoin supply held by long-term holders from 2009 to 2024. Source: Glassnode

But what really caused a significant shift in the situation was the arrival of spot Bitcoin ETFs. Today, ETFs absorb more BTC supply from the market than miners supply. Since its launch, spot BTC ETFs have absorbed an average of about 10,000 BTC per day, while miners only produce 900 BTC per day. This exacerbates scarcity and causes prices to rise.

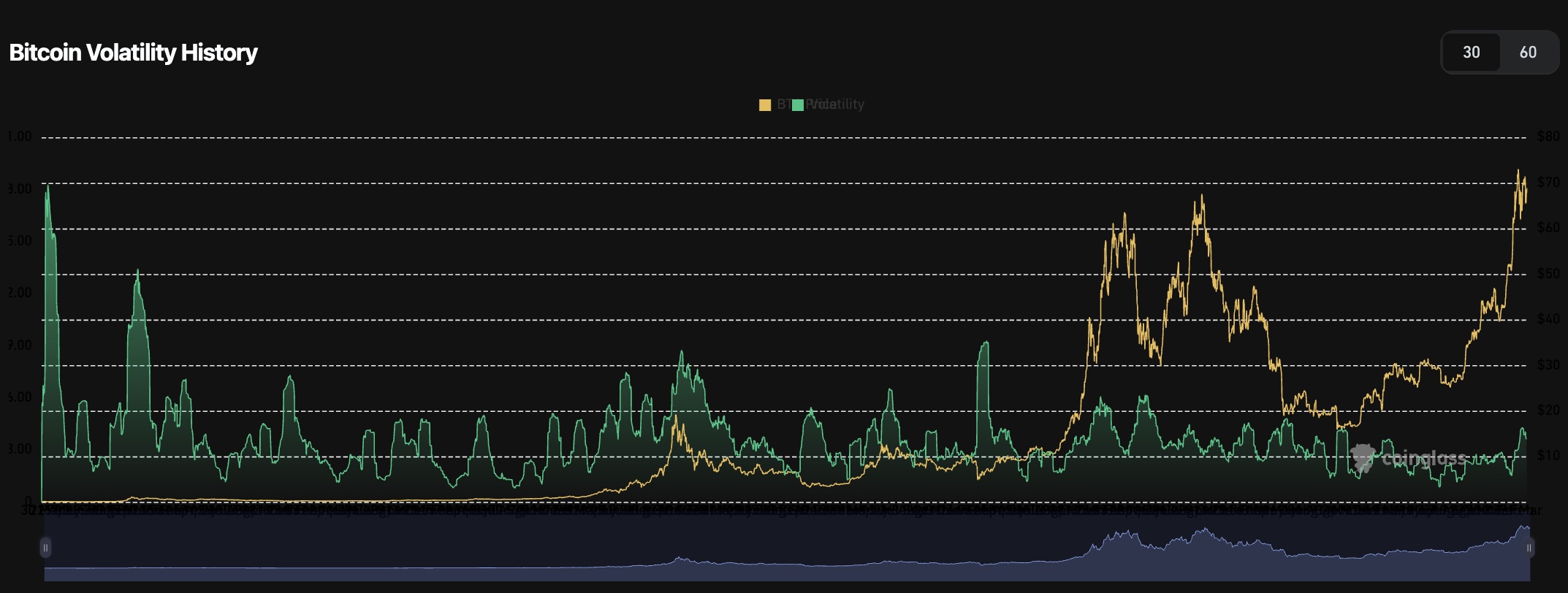

But crucially, it also means a significant drop in long-term volatility, as ETF investors take a longer-term view than the average crypto trader. While volatility has recently surged as the halving event approaches, it remains well below levels seen during previous halvings. CoinGlass data shows that BTC/USD 30-day historical volatility has fallen from a high of nearly 18% in April 2013 to around 4% at the time of writing. You’d expect to see this percentage on a U.S. equity fund prospectus, not on a cryptocurrency price chart.

Bitcoin price (yellow) and Bitcoin volatility (green) from April 2013 to April 2024. Source: CoinGlass

This is because the investors entering spot Bitcoin ETFs now are the same retail investors and institutions that have poured trillions of dollars into the S&P 500 ETFs. They are long-term holders, with a minimum investment period of three years, and their decisions to buy or sell investments are based on long-term drivers such as macroeconomic conditions, structural market changes, and long-term return potential.

So what does this mean for investors looking to profit from the halving? They must think more like traditional equity investors than crypto investors. They must swap Messari for Morningstar (a global traditional fund data provider) to measure the rise and fall of the assets under management of spot Bitcoin ETFs. They must pay close attention to the behavior of long-term holders, because they are now the ones in charge.

If they want a 600% return, they’ll have to look elsewhere. That’s not what we’ll see after the Bitcoin halving. The tradeoff, though, will be steadier, more reliable returns that don’t unduly distort the volatility of a typical balanced portfolio. For most investors, that’s more attractive than an asset that has a 50/50 chance of skyrocketing or disappearing completely.