Author: Binance Blog Source: Binance Translation: Shan Ouba, Jinse Finance

Summary

Bitcoin halving is designed to regulate the supply of new BTC tokens and has historically impacted token supply dynamics, market sentiment, and adoption rates.

Halving events tend to increase Bitcoin’s popularity, leading to increases in both price and adoption. They also stimulate discussion about blockchain technology, Bitcoin network dynamics, and cryptocurrency as a distinct asset class.

While historical patterns show Bitcoin price increases and wider adoption in the months following halving events, it is important to note that the upcoming April 20 halving event is already proving unprecedented in several important ways.

The Bitcoin halving, an event embedded at the core of the original cryptocurrency’s value proposition, is more than just a footnote in the annals of digital finance; it is an ecosystem-wide shift that reshapes market dynamics and investor sentiment each time it occurs. In this article, we take a closer look at the multifaceted impact of the Bitcoin halving on the digital asset industry, revealing its implications beyond short-term price fluctuations. With the next halving event expected to occur in the third week of April, it is instructive to review historical data. However, the observed patterns by no means guarantee a similar outcome this time around: the current cycle is unfolding in a unique context and has proven to differ from historical precedent in some important ways.

Ancient history

Halving is a fundamental mechanism written into the Bitcoin protocol that regulates the issuance of new tokens by periodically reducing mining rewards. This deliberate reduction, designed to curb the rate of new BTC creation, plays a pivotal role in shaping Bitcoin’s token economics and supply dynamics, reinforcing its deflationary properties and supporting its value proposition.

From a historical perspective, Bitcoin halving events have had a significant impact on the cryptocurrency industry and the broader financial ecosystem. By reviewing the halving events in 2012, 2016, and 2020, we can observe how halving events affect some recurring patterns in the crypto world. These events act as inflection points, catalyzing fluctuations in market sentiment and investor behavior, and punctuating the evolving narrative of Bitcoin as the locomotive of the crypto ecosystem.

150 days later

When dissecting the consequences of the halving event, we cannot ignore its huge impact on BTC's price and market capitalization. At the heart of the halving mechanism lies the principle of "scarcity," a quality that attracts investors seeking a limited asset, thereby driving the value of the asset up. With reduced supply and increased demand, at least in theory, the stage is set for price increases, which usually materialize gradually over the months following the halving, rather than happening immediately.

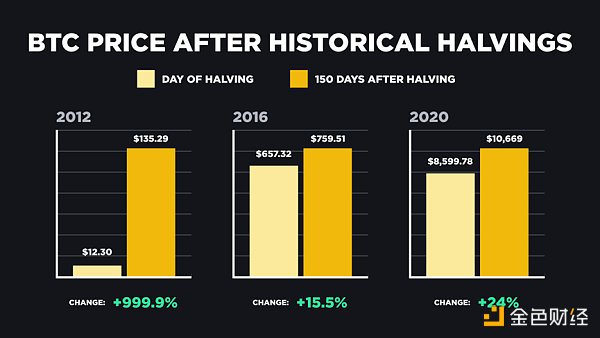

Historically, Bitcoin has experienced significant price increases within 5-6 months after each halving event. For example, 150 days after the three previous halving events in 2012, 2016, and 2020, BTC prices rose by 999%, 15%, and 24%, respectively.

In the four-year cycle between each halving event, BTC has reached a new all-time high. In the 2020-2024 cycle, this new high occurred in October 2022, when Bitcoin broke through the $66,000 mark. The upcoming 2024 halving event is unique in that for the first time in Bitcoin's history, a new high was set before the halving, in early March 2024. Whether this is a warm-up before the new high after the halving, or a much-sought-after peak that occurs too early, remains to be seen.

The mechanism by which halving events affect prices may be through shaping market sentiment and investor perception. In addition to creating expectations in the cryptocurrency community, halving events also provide narrative material for the advantages of algorithmic monetary policy and the deflationary nature of digital assets, thereby sparking interest among people outside the crypto circle and attracting new participants to join.

Beyond price

In addition to price-related effects and increased attention, and partly due to these factors, halvings are associated with significant long-term increases in adoption metrics. Bitcoin’s higher visibility in the period before and after the halving incentivizes more newcomers to explore and potentially purchase the digital currency, thereby increasing its user base.

Additionally, Bitcoin halving events prompt a reassessment of the cryptocurrency's underlying technology and network dynamics as miners cope with this shift. Discussions around network security, transaction fees, and scalability solutions will intensify. Improvements in these areas enhance the robustness of the Bitcoin network and boost confidence among users and businesses, thereby creating an environment conducive to adoption. Halvings also tend to reduce miners' profit margins, leading to increased pressure on miners to sell Bitcoin and accelerating the consolidation of mining pools and mining operations.

With each halving event, the need for efficiency and innovation becomes more pronounced, driving technological advances that can not only improve the performance of the Bitcoin network but also increase its appeal to a wider audience.

Let’s examine a simple adoption metric - the number of active Bitcoin addresses - using the same 150-day window as for price dynamics. In the first 150 days after each previous halving event, the number of new Bitcoin addresses grew by 83% in 2012, 101% in 2016, and 11% in 2020.

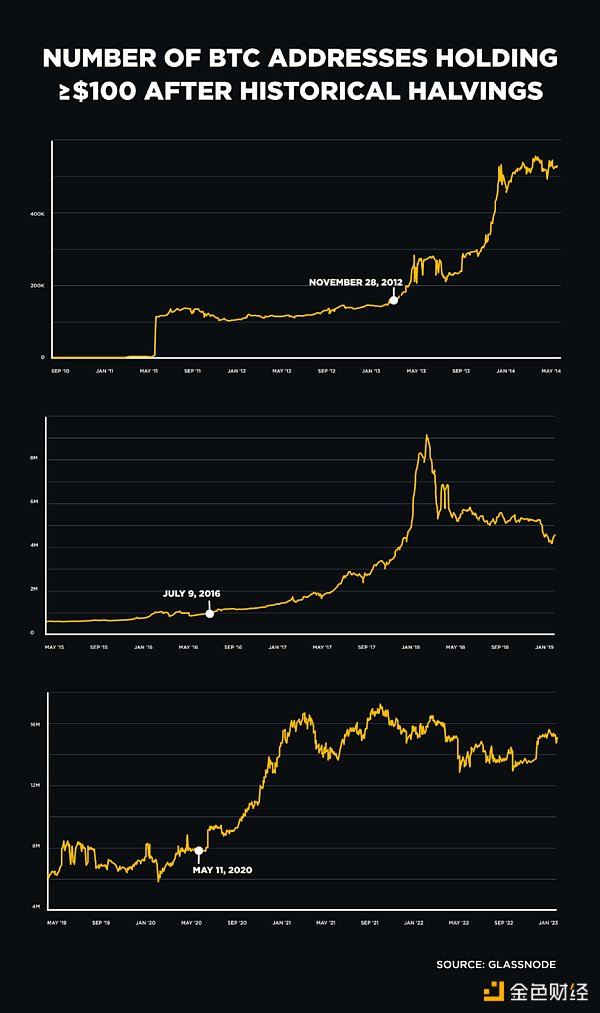

The number of addresses holding $100 or more in Bitcoin (a rough proxy for the number of retail investors) grew by 12% in 2012 and 6% in 2020, respectively, and remained roughly unchanged in the 150 days following the 2020 halving. While these are not perfect measures of adoption dynamics and sentiment (one person can create multiple wallets, for example), they hint at the direction and magnitude of trends following past halving events.

Similarly, institutional interest in Bitcoin also tends to surge around halving events, fueled by Bitcoin’s narrative as a store of value and potential inflation hedge. Endorsements from prominent corporate coffers and well-known investors validate BTC’s legitimacy as an investable asset class, further fueling adoption. As institutional money flows into the cryptocurrency market, infrastructure and products are emerging, paving the way for mass adoption by traditional financial institutions and retail investors alike.

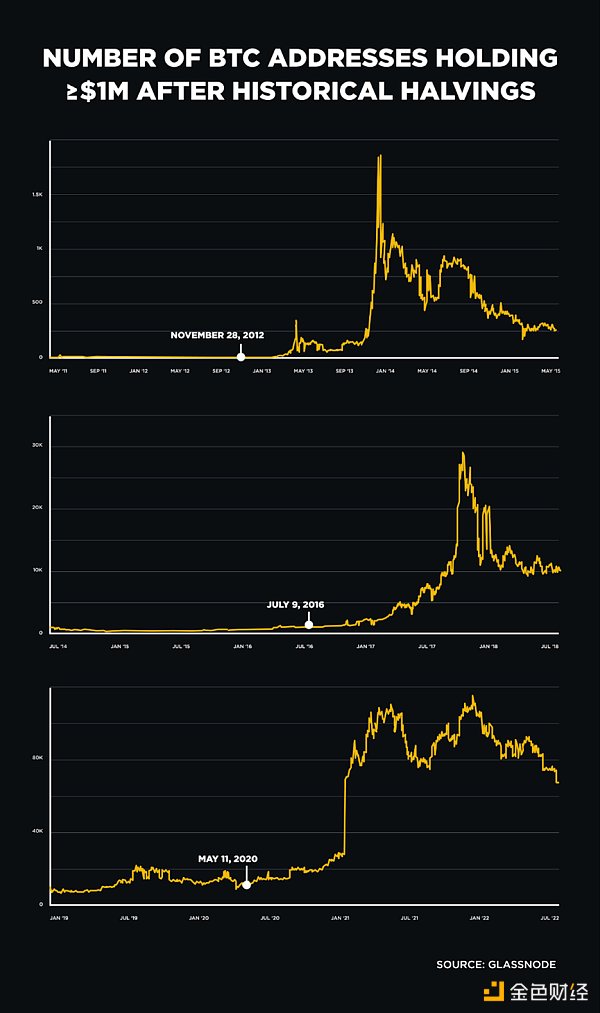

For example, the number of wallets holding more than $1 million, which can be seen as an indicator of professional or institutional investment activity, grew by thousands of percent in 2012, 10% in 2016, and 43% in 2020.

What happens next?

The upcoming Bitcoin halving event in April will take place against an unprecedented backdrop of a massive inflow of funds from the industry and centralized exchanges (such as Binance) on the one hand, and a surge in institutional participation brought about by the approval of a spot Bitcoin ETF in the United States on the other.

This, coupled with a surge in Layer 2 solutions and DeFi activity, all of which increase the utility of the network, creates a very bullish situation for the Bitcoin ecosystem and the broader cryptocurrency space.

However, it is still important to note that despite the bullish backdrop for the 2024 halving event, its dynamics and impacts are not guaranteed to be the same as previous halving events. Each halving represents a unique node in Bitcoin’s evolution, subject to changing market conditions, technological advances, and regulatory developments. Therefore, while optimistic about the transformative potential of the 2024 halving event, it is prudent to acknowledge the inherent unpredictability of market dynamics and the need to remain vigilant in the ever-changing digital asset landscape.

Each Bitcoin halving represents a major shift in the crypto industry, with far-reaching implications for adoption and market evolution. In addition to its direct impact on price and investor sentiment, Bitcoin halvings also spur increased interest and awareness, institutional participation, and technological innovation, laying the foundation for the continued growth and maturity of digital finance. Bitcoin halvings also spur increased interest and awareness, institutional participation, and technological innovation, laying the foundation for the continued growth and maturity of digital finance. As we navigate the evolving cryptocurrency landscape, the significance of Bitcoin halvings is a testament to the industry’s enduring strength and resilience.