The Market

14 days until the Bitcoin Halving. The Fixed Range Volume Profile since BTC broke out of the $52k range to its new ATH in late February has centered around $68k, a level similar to the previous ATH reached in November 2021. BTC is entering a price discovery phase as the market is looking for more confirmation to sustain the new ATH level.

What could that confirmation be?

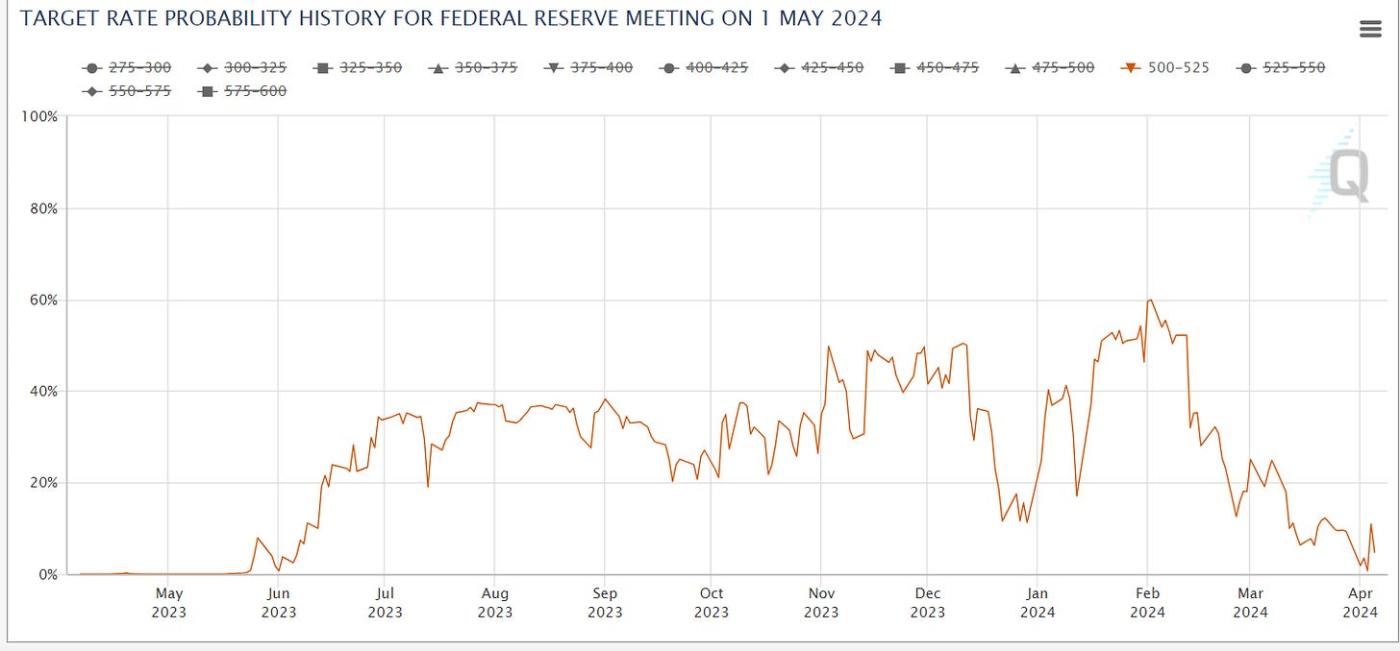

On the macro side, the March jobs report shows higher than expected employment gains, making a May rate cut very unlikely. We are not expecting a liquidity-driven rally soon, but risky assets haven't reacted badly to the job data either, reverting part of the selloff ahead of the jobs report. Given that lower rate cut expectation hasn’t driven big risky asset selloffs, we don’t expect BTC price to be negatively impacted in the near term.

The Geopolitical risk is on the rise as the Israel-Iran conflict escalates, driving a close to 10% rally in Oil and Gold in the past month. We expect BTC to potentially benefit from geopolitical uncertainty with its value proposition as digital gold, especially as the sales effort on spot BTC ETFs ramp up. In fact, the Bitwise CEO is even asking the SEC to delay the ETH ETF decision as all the issuers are focusing on selling BTC ETFs.

Then there is halving itself. There is always a question of how much the market has priced in the halving event. In 2016, BTC sold off ~30% right around halving, reflecting buying the rumor and selling the news. In 2020, the selloff happened about two months earlier, and BTC rallied right through the halving. This time, two new dynamics have emerged:

Spot ETF demand

As we mentioned in previous weeklies, spot ETF inflow is often 10X magnitudes bigger than the BTC production, which makes a more dominant impact on the BTC price, at least in the short term.

The growth of the Bitcoin ecosystem

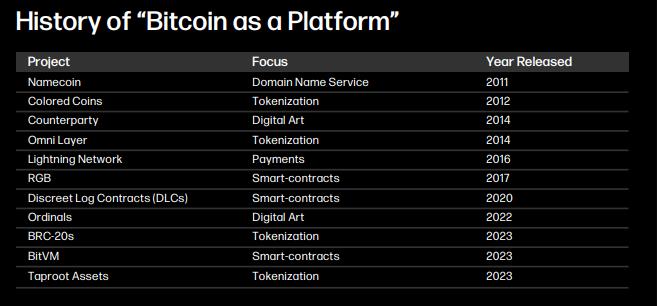

The Ordinals frenzy has opened the Pandora box of bringing utilities to Bitcoin. Although the bitcoin chain does not support smart contract functions, many innovative approaches have emerged to bring utility to Bitcoin. Despite failed attempts in earlier years such as Namecoin or Colored Coins, we think this time is different as we are experiencing two fundamental changes for the bitcoin chain. One is the Taproot upgrade in November 2021, which significantly improved bitcoin chain’s scalability. The second is the introduction of mainstream capital through the spot ETFs, which will fundamentally change the market structure for Bitcoin. We expect a lot of buy-and-hold capital would like to earn some yield on the Bitcoin, which currently cannot be satisfied without taking counterparty risk. Last but not least, miners, the biggest stakeholder in the Bitcoin ecosystem, have a strong incentive to increase transaction fee revenue as the block reward continues to decline.

Source: Galaxy

We already have a few catalysts playing out for the Bitcoin ecosystem. Stacks, the most established Bitcoin L2, plans to go through Nakamoto Upgrade during Halving, which will reduce its blocktime from ten minutes to seconds, making it practical for more dApps to build on Stacks.

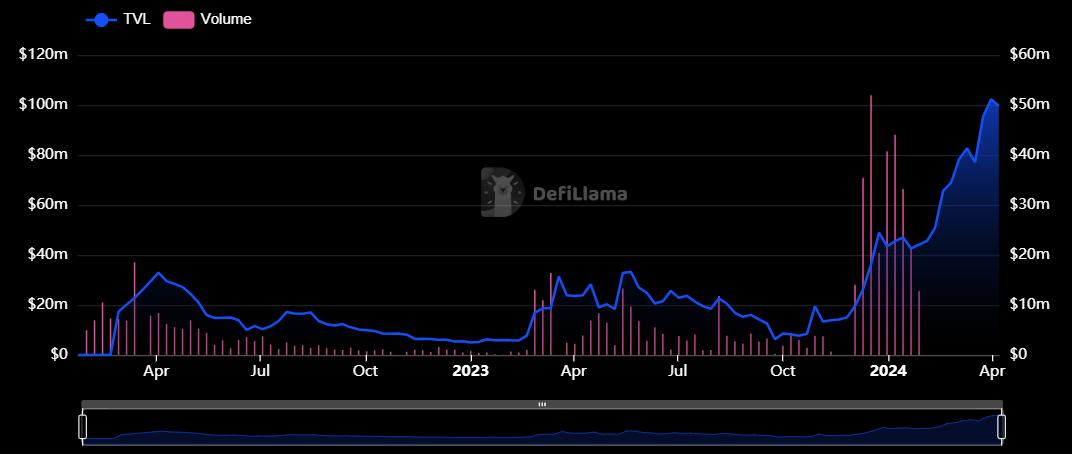

ALEX, the largest DeFi protocol on Stacks, has grown more than 10X in TVL and Trading Volume since last October, indicating increased activity in the Bitcoin ecosystem.

Source: DeFiLlama on ALEX protocol

Those who doubt the demand for Bitcoin utility can take a look at Merlin chain, a ZK rollup on bitcoin, which attracted $3.5B TVL in less than a month, exceeding the TVL growth record set by Blast. Admittedly, most of the TVL is from staking in the Merlin Seal program, where users stake BTC to earn M-points for future Merlin token distribution.

Core DAO, an Alt L1 chain powered by Bitcoin staking, has just announced their Core Ignition incentive program to reward users to bridge assets to the Core chain and participate in on-chain activities. We expect more Bitcoin ecosystem projects to launch tokens or incentive programs around halving, attracting BTC holders to stake and participate in DeFi activities, which could provide powerful tailwinds for the BTC price.

DeFi Update

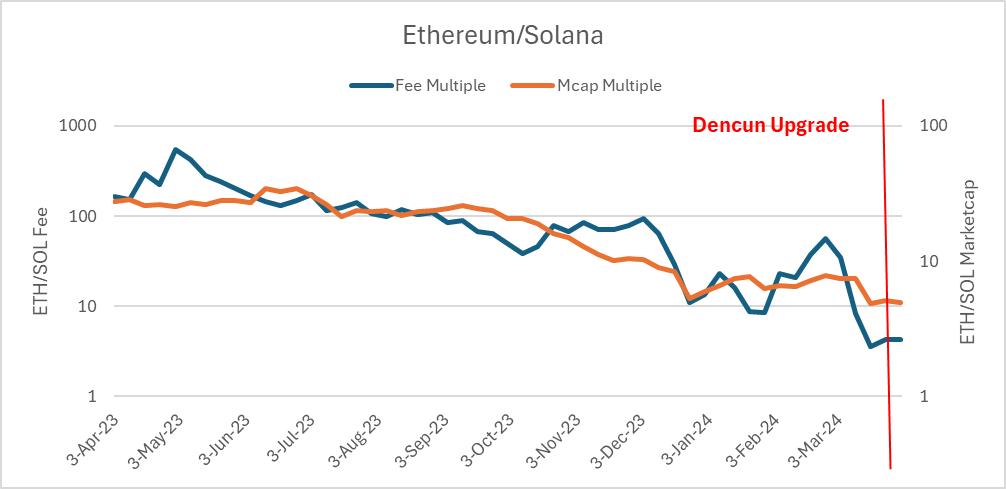

Since the Dencun upgrade on March 11, Ethereum fee has dropped significantly thanks to the drop in DA cost and as more transactions move to L2s. Ethereum used to earn 100X more fees than Solana as recently as last summer, but now it’s only earning 4X more fees. In the meantime, Ethereum’s market cap has declined from 24X that of Solana’s to 4.9X. From a valuation perspective, Solana’s market cap has more room to catch up with Ethereum’s as their fee earning capability converges.

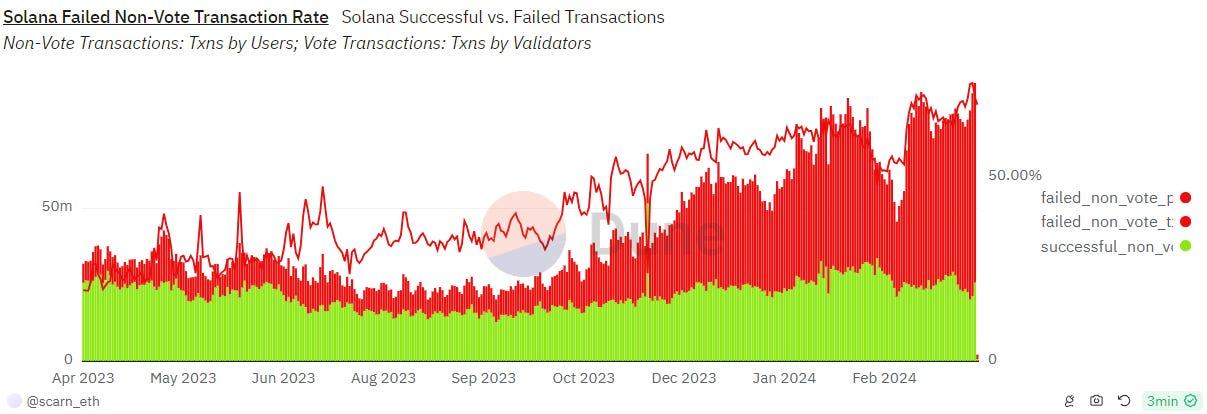

As overall activities increase on Solana, the number of failed transactions due to smart contract logic, such as slippage limit hits, etc. has also increased. Recent data shows a failure rate as high as 75%. Although ~95% of the failed transactions can be attributed to bots activities, this still creates an unpleasant user experience as their transactions fail to execute. If the network congestion issue is not solved, there is a risk that Solana could be a victim of its own success.

Source: Artemis, Decentral Park Capital

We see encouraging developments from marquee Solana infrastructure projects to address the network challenge. For example, Metaplex has just introduced a new NFT standard Metaplex Core, making minting faster and reducing network needs by 80% on Solana. Jito and Anza are also working at the validator client level to address the congestion issue. There are also tools available for dApps on Solana to improve user experience when congestion happens, such as the alert stack developed by Dialect. Finally, Firedancer, the much anticipated new validator that could drastically improve Solana’s performance, could be the long term fix for the network challenge. It’s live on test net and rumored to go mainnet by H2 2024. We are hopeful for Solana’s continued success in gaining market share and believe the current episodes of network congestion are a good stress test for the network and will scalate the infrastructure development. What didn’t kill Solana could make it stronger.

DeFi Update

Top 100 MCAP Winners

CORE (+85.55%)

Ethena (+63.44%)

Pendle (+43.52%)

Nervos Network (+27.70%)

Bitget Token (+26.25%)

Top 100 MCAP Losers

Conflux (-25.69%)

Aptos (-22.72%)

Dogwifhat (-22.24%)

Wormhole (-21.89%)

FLOKI (-21.49%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.