author | Frontier Lab

1. Project Overview

Ethena is a stablecoin protocol that converts valuable assets (BTC and its mapped assets, Ethereum and its LSD assets, USDT, etc.) into BTC or ETH short positions through futures contracts, and issues a stablecoin USDe that is 1:1 equivalent to the US dollar based on the position value.

2. Core Principles

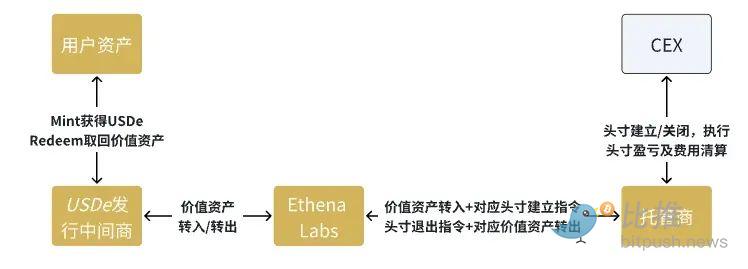

Ethena adopts a whitelist system, and ordinary users mint and redeem USDe through intermediaries.

The user sends a minting application to the middleman. After receiving the user's valuable assets, the middleman sends a minting application to the protocol. The ethena protocol opens an eth or BTC short position of equal value based on the value of the received assets, and then sends USDe of equal value to the short position to the middleman, who sends it to the user to complete the minting process.

The user sends a redemption request to the middleman. After receiving the user's USDe, the middleman sends a redemption request to the protocol. The ethena protocol closes the short position of the corresponding value based on the amount of USDe received, and then sends the corresponding mortgage assets to the middleman, who then sends them to the user to complete the redemption process.

3. Project Innovation

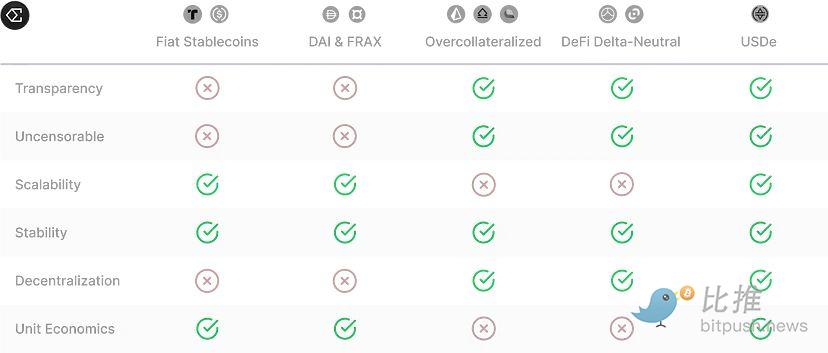

1. Cleverly solves the "stablecoin triangle" dilemma

The triangular dilemma of stablecoins, namely price stability, asset efficiency of collateral, and decentralization, is difficult to be optimized at the same time. At the same time, traditional stablecoins also face prominent problems such as account review risks and over-reliance on banks. The collapse of Silicon Valley Bank is still fresh in the memory of USDC holders. On the day of the news release, the USDC price deviated from the anchor price by as much as 12%. USDDe cleverly solved these dilemmas!

Figure 1 Comparison of the advantages and disadvantages of major stablecoins. By comparison, it can be seen that USDe has achieved a stable price anchored at 1 US dollar under the premise of 100% utilization of mortgage assets!

2. Special decentralized design principles

USDe has created a unique way of independent custody of collateral, that is, the collateral that should have been recharged to CEX or DEX for short positions is independently held by a third party, thereby indirectly achieving the "decentralization" of centralized transactions. Ethena Labs uses Copper, Ceffu, and Fireblocks as custody and over-the-counter trading service providers.

Users can use the verification service to verify all collateral of the protocol (currently not open to ordinary users). Ethena Labs is able to achieve this mechanism thanks to the strong support of its investors, including Binance , OKX , Bybit , Deribit , and Arthur Hayes ( Bitmex ). It is precisely because of this special relationship that the four major exchanges have opened the door to convenience for it!

Figure 2 USDe Mint and Redeem user fund flow

3. Portfolio as covered asset

Stablecoins that use assets other than fiat currencies as collateral cannot avoid the depegging problem caused by price fluctuations of the collateralized assets. Taking DAI as an example, these stablecoins all use over-collateralization to cope with asset price fluctuations, but they still cannot avoid the possibility of collateralized assets being liquidated due to price declines.

USDe transforms assets into an investment portfolio and changes the portfolio's Delta to "0" (actually infinitely close to 0), thus completely avoiding the impact of asset price fluctuations on the anchor value.

IV. Project Risks

1. Price difference risk of ETH and BTC derivative assets

Ethena uses pledged Ethereum assets (such as Lido 's stETH) as margin for short ETHUSD and ETHUSDT perpetual positions on CeFi exchanges. Due to the risk control mechanism of the exchange, this margin asset is usually valued based on the price and liquidity of the independent market within the exchange. Once the liquidity and valuation of the collateral decrease, the value of the margin decreases, and the position is at risk of being liquidated.

However, after the Shanghai upgrade, the probability of this risk occurring is very low, because the price difference between stETH and ETH has never exceeded 0.3%.

2. Risk of insufficient maintenance margin (liquidation) of positions

The exchange determines the user's "maintenance margin" requirement for the position, and if the value of the user's collateral falls below this requirement, the user's position begins to be gradually liquidated. "Liquidation" does not mean that Ethena immediately loses all collateral. It refers to the process by which the exchange gradually reduces the risk exposure of the protocol's position. "Liquidation" will cause the protocol to incur realized losses.

Since Ethena uses stETH and other products as margin, when the price rises, the value of the margin also rises, which has little impact on the forced liquidation price. Since the proportion of stETH as margin is only 90%/95%, its short position will only face the risk of insufficient maintenance margin when the price of Ethereum rises 5/10 times.

3. Risk of Exchange Bankruptcy

Ethena retains full control and ownership of collateral assets through OTC settlement providers and never deposits any collateral on any exchange. This limits the size of Ethena’s losses in the event of a unique risk event on any one exchange, thereby limiting the size of outstanding profits and losses at OTC settlement providers between settlement cycles.

In the event of an exchange failure, Ethena will delegate collateral to another exchange and hedge the outstanding delta previously covered by the failed exchange. In the event of an exchange failure, derivative positions will be considered closed and Ethena will no longer have any obligations on the exchange property.

In response to the above three risks, the mechanism designed by Ethena simulates and calculates the possible losses caused by each risk, and establishes a reserve fund to deal with any risks that may arise!

5. Core Product USDe

1. The guise of stablecoins

From the above analysis, USDe is not a real stablecoin, but more like an "interest-free bond". USDe holders are creditors, and Ethena Labs is the debtor. The debtor Ethena Labs borrowed the user's valuable assets (denominated in US dollars, not the special currency standard in the cryptocurrency market) , converted them into stETH to obtain Ethereum staking income, and then used stETH as margin to conduct arbitrage transactions on the perpetual contract funding rate and the forward delivery contract basis on CEX.

Ethena Labs uses USDe to earn points in various scenarios and obtain ENA airdrops, a protocol token, for marketing, aiming to expand the issuance scale of USDe, obtain more "interest-free capital", and thus expand its own arbitrage scale and income!

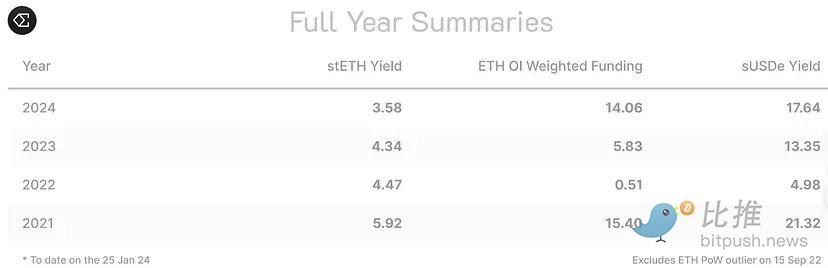

Figure 3: Historical data calculation, annual results of staking income + arbitrage income

It can be clearly seen from Figure 3 that even during the severe bear market in the cryptocurrency market in 2022, during which the FTX closure, the LUNA death incident and the bankruptcy of 3AC occurred, this trading strategy can still achieve an annual return of 4.98%, so the high certainty of this strategy prompted Ethena Labs to stimulate the issuance of USDe through various marketing methods!

2. Agreement income and distribution

2.1 Income distribution is not “generous”

Ethena Labs has never publicly released the distribution method of its protocol revenue. Currently, there are three main destinations for revenue:

a. Allocate to the reserve fund. The allocation percentage is unknown. According to the official reserve fund analysis document, it may be 50% in the initial stage and will be reduced to 20%-10% in the later stage. The reserve fund is used to deal with any possible risk events.

b. Allocated to USDe pledgers, i.e. sUSDe holders. Users holding USDe cannot share the protocol income (i.e. the so-called “interest” in the market). Instead, they need to stake USDe and convert it into sUSDe. Only those holding sUSDe can enjoy “interest income”.

sUSDe is not determined based on the actual income of the protocol, but the official will announce an APY figure every 7 days for everyone's reference. After sUSD is generated, it can be unstaked after 7 days, so the distribution of interest is also based on a 7-day cycle. Through recent digital observations, Ethena Labs distributes 20-25% of the protocol income to sUSDe holders. The current APY still looks "attractive" because the USDe pledge rate is less than 25%, and the small number of distributors naturally increases the APY.

Converting USDe to sUSDe is a process of giving up debt claims within a limited time. During the pledge period, USDe holders as creditors cannot redeem and have given up their 7-day debt claims by default. Naturally, Ethena Labs does not need to worry about the redemption pressure brought by this part of USDe. Therefore, the "interest" is obtained in exchange for giving up debt claims, not a risk-free reward. If a major risk event occurs in the agreement during the pledge period, the loss of sUSDe holders will inevitably be greater than that of USDe holders!

c. The rest is controlled by the foundation (team) and used for daily operating expenses.

In summary, currently only sUSDe holders can enjoy the protocol’s income, which is what the market calls “interest”. Currently, this part is less than 1/3 of the protocol’s income, and most of the income is controlled by the team. As the sUSDe/USDe ratio expands, whether the protocol will allocate more income to sUSDe holders remains to be seen. If Ethena Labs wants to maintain the stability of the protocol, it is inevitable to increase the distribution ratio of this part.

2.2 The speed of making money is extremely profitable

The current protocol's main income comes from ETH staking income and arbitrage trading income from futures contract rates/basis.

2.2.1 Simple calculation of agreement income

According to official statistics, a simple calculation of its agreement income is:

4% (Ethereum staking yield) + 7.5% (calculated based on the average of the fee arbitrage yield data over the past four years) = 11.5%. Ethena Labs has no capital cost, so as the scale of issuance expands, its operating costs can be ignored!

Agreement revenue = USDe issuance scale * 11.5% = 230 million US dollars. The issuance scale may change. 230 million US dollars/365 days = 630,000 US dollars/day. This is just a conservative estimate!

After deducting the distribution to sUSDe holders, the protocol's net income = $230 million*0.8=$184 million.

2.2.2 Calculation of Agreement Income

Another way of estimation is mentioned in the official document that in the initial stage, Ethena Labs may allocate 50% of its income to the reserve fund. Since February 20, the reserve fund has grown to 32 million US dollars. After the agreement raised 16 million US dollars on February 16, the fund increased by 8 million US dollars. It can be judged that 9 million US dollars is the initial investment of the team, so it can be estimated that in the past 1.5 months, Ethena Labs has obtained (3200-900)*2=4600 US dollars in revenue!

After deducting the distribution to sUSDe holders, the protocol's net income = $46 million*0.8=$36.8 million, which is only 1.5 months' income level!

The astonishing revenue growth is due to the rapid expansion of USDe issuance and the high level of Fundfee brought about by the booming cryptocurrency market in February.

2.2.3 Optimistic calculation of protocol revenue

Arthur Hayes, the founder of Bitmex, has a more radical estimate. He believes that if 100% of USDe is staked, the future protocol will attribute 80% of the profits to the staked sUSDe and 20% to the Ethena protocol.

Ethena protocol annual income = USDe scale * (Ethereum staking yield 4% + ETH Perp Swap funding rate 20%) * (1–80% * sUSDe total / USDe total)

If the pledge ratio does not increase, referring to the current USDDe scale of 2 billion US dollars, the annual income of Ethena protocol = 20*24%*(1–80%*(5/20)) = 384 million US dollars

Arthur Hayes believes that the sUSDe/USDe ratio of 50% is the ideal level, so the reasonable annual income of the Ethena protocol is:

Ethena protocol annual revenue = 20*24%*(1–80%*0.5) = $288 million

By comparing the current data, we can see that Ethena Labs is distributing income according to Arthur Hayes' idea: when 100% of USDe is staked, 80% of the protocol income is distributed to sUSDe holders.

Regardless of the calculation method, it indicates that Ethena's annual revenue can easily reach $200 million. Recently, BTC portfolios have begun to be added to the protocol, and the capacity of USDe can easily increase by another $4 billion, and the protocol revenue may increase by more than 1 times (that is, annual revenue will reach $360-560 million)!

Please note that currently holding ENA tokens does not entitle you to protocol income, so the token valuation cannot be determined!

3. Strong reserve fund

All the risk factors disclosed in Ethena's official documents cover almost all the concerns and worries of all players in the market, and Ethena's solution is very simple and crude, building a strong reserve fund. According to official public data, the current size of the fund has reached US$3,200, with a ratio of 1.6% to USDe.

Figure 4 Ethena reserve fund data

Ethena sets out a wide range of uses for the reserve fund in its documentation:

When the USDe price decouples due to market factors (such as insufficient liquidity in the Swap pool), it can use this fund to intervene.

When ETH Perp Swap is at an extremely negative interest rate and the portfolio begins to generate negative arbitrage returns, the fund is used to pay for USDe holders to prevent them from suffering any losses.

If any risk event occurs and causes losses to USDe holders, the fund will compensate them.

Due to exchange restrictions, the collateral portfolio requires additional margin, which is also borne by the fund.

The reserve fund is not the first of its kind in Ethena, but it has calculated and quantified how much revenue will be set aside for the reserve fund, rather than a simple fixed ratio. Ethena has taken into account the extreme situations that may occur in the protocol, so this quantified reserve fund covers all possible risks, further improving the stability of the protocol.

4. Differences between USDe and UST

The "death spiral" incident of LUNA and UST is still fresh in the memory of every cryptocurrency investor. The occurrence of the death spiral is determined by two factors:

In the agreement, UST and collateral are always exchanged at a 1:1 USD value;

Luna is the collateral of UST, and arbitrage trading can depress the value of the collateral.

Once the degree of UST's decoupling is greater than market expectations, market sentiment will panic and everyone will start selling UST. The protocol can be exchanged for LUNA at a 1:1 ratio. In order to mitigate losses, a large number of holders will choose to exchange back to LUNA and then sell them. Therefore, more and more UST is exchanged for LUNA, and then more and more LUNA is sold. Both the price of UST and the price of Luna begin to fall sharply. In this case, the limited arbitrageurs are willing to buy UST, and they will eventually make a profit by selling LUNA. The liquidity of LUNA is exhausted, and the price approaches zero. Naturally, the value support of UST no longer exists.

The collateral of USDe is a Delta-neutral investor portfolio, not a variable-value asset. The value of this portfolio will increase over time, so even if USDe is traded at a discount, the assets held for redemption are market-recognized valuable assets such as ETH.

In the agreement, USDe and collateral are always exchanged at a 1:1 USD value.

The Delta -neutral investment portfolio is the collateral of USDe. Arbitrage transactions cannot affect the value of the collateral (investment portfolio), and its fair value remains unchanged or even increases due to the generation of income.

Therefore, whether arbitrage transactions will suppress the value of the collateral determines whether an algorithmic/protocol stablecoin is a Ponzi scheme!

5. Can USDe be widely adopted (compared to USDT)?

USDe has many advantages and seems to solve all the pain points that have appeared or are facing of all types of stablecoins in the current market. However, there are always two sides to a coin, and its unique mechanism also limits its scale of development and adoption.

There may be large slippage costs during minting and redemption: USDe minting and redemption are not based on the price at the time of user application, but on the value when the hedge portfolio is established or completely closed. When the price of the collateral assets in the portfolio fluctuates rapidly, large slippage is inevitable. The official also highlighted this issue.

Size limit: Since USDe relies on a hedge portfolio as collateral, and the entire crypto derivatives market has an upper limit on OI (total open interest), the issuance scale of USDe is limited by this. Based on the ETH hedge portfolio data, Ethena Labs hopes that the size of the hedge portfolio will not exceed 25% of the total market OI, that is, it cannot exceed 50% of all short positions. The current Ethereum futures OI is $9.4 billion, and Ethena's hedge portfolio has accounted for 21.5%, so the official began to add BTC futures as a new hedge portfolio target.

Large-scale minting and redemption take a long time: Large-scale USDe minting and redemption means that large-scale hedging portfolios are established or closed. In order to avoid the impact of trading activities on market prices, Ethena needs a lot of time to complete transactions, which will also limit its issuance speed.

USDC and USDT solve the problem of the smooth entry and exit of fiat currency into the cryptocurrency market. The core is to convert fiat currency into cryptocurrency assets, and then participate in a wider range of cryptocurrency transactions; USDe packages cryptocurrency assets into cryptocurrency assets and does not solve the actual problem. This is also determined by its "bond" attribute.

Therefore, the probability of USDe being adopted on a large scale is low, and it cannot compete with USDT.

6. ENA Token Analysis

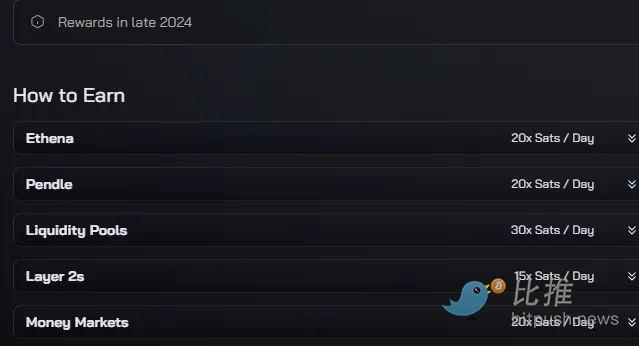

1. “Freebies” and the “most efficient” way to earn freebies

Recently, Ethena's protocol token was issued and started trading on Binance, which has attracted a lot of attention. However, current holders of the token cannot enjoy the protocol income distribution, so it only exists as a governance token. Due to the high market popularity of the project, investors have high expectations for its token, and the price remains high at $1.

Before the token can share the protocol revenue, ENA can only be seen as a "gift" to stimulate the issuance of USDe, and its marketing path is:

Figure 5 ENA stimulates the circulation scale of USDe. Therefore, the best way to participate in Ethena is not to buy tokens, but to mine points.

Figure 6 ENA Points Mining Bonus Method and Bonus Coefficient Table

Among the many points acceleration methods and coefficients provided by the official website, using Pendle is the most cost-effective method. Use USDe to form LP in Pendle, so you can get:

Ethena's Sats points, and enjoy a 20X bonus

Pendle pool transaction fee share (20% of transaction fee)

Pendle Token Rewards

(Pendle’s efficient method can be used in other interest-bearing asset point mining. In fact, Pendle is the biggest beneficiary of point mining.)

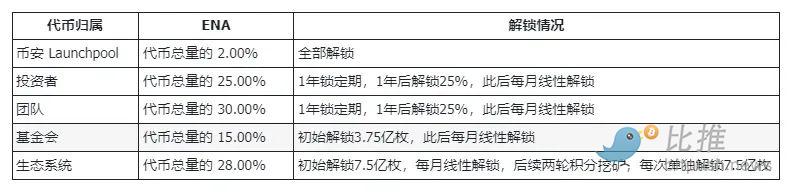

2. ENA Token Circulation Analysis

The circulation curve is shown below:

Figure 8 ENA token circulation release time curve

From the above data, we can see that in the first year, only the point mining activity added a large number of circulating tokens to the market, 1.5 billion, and the foundation unlocked 3.75%, 560 million. In the second year, after the freezing period ends, the team and investors will unlock 2 billion tokens, and then the monthly circulation will increase at the maximum rate.

Price speculation is concentrated from now to the end of the second round of mining. During this period, the token circulation is the smallest and the heat is the highest.

3. ENA Outlook

ENA has value only if Ethena Labs shares protocol revenue with token holders, otherwise it is just a marketing tool for Ethena Labs. Before the revenue sharing proposal is put forward, the value of the token cannot be accurately calculated and the growth prospects cannot be determined.

in conclusion

Currently, point mining is the best way to participate. ENA is less attractive at the current stage, and we need to pay attention to whether the protocol will distribute the income to ENA holders.