In the past week, TON currency price has witnessed astonishing growth, soaring to a high of 62%, surpassing $ADA and $DOGE in one fell swoop, becoming the ninth largest cryptocurrency in the world by market capitalization. What are the driving factors behind such results? What key developments should we pay attention to in the future?

The Open Network ($TON), built by the world-renowned instant messaging application Telegram, is a completely decentralized first-layer blockchain platform. TON's ambitious goal is to enable users to conduct cryptocurrency transactions without opening any additional applications. This design has been the core of TON's rapid development since its launch in 2022. Until now, ON has been very active in developing its own ecosystem.

I expect that TON will show outstanding performance in the upcoming bull market, and I believe it will become one of the Alpha projects. By deeply understanding TON’s application value and ecosystem development, we can explore the potential factors for its success.

User-level strategies and potential

At the user level, Telegram has an active user base of more than 900 million, which provides TON with a very large potential market. By integrating existing Telegram applications and leveraging various bot (BOT) technologies, TON aims to provide a seamless blockchain interaction experience so that Telegram users can easily transition to the Web3 world. This strategy not only enhances the stickiness of existing users, but also increases their participation in blockchain technology.

In addition, TON’s strategy includes using Telegram as an information dissemination platform to support and promote exchanges among crypto communities and projects. Telegram and Discord platforms have been widely used by many Web3 communities to share information and promote interaction between users. This means that many Web3 users are already familiar with Telegram’s functionality and interface, so acceptance of TON may be higher.

As the TON ecosystem matures and expands, it is expected that the user base will further increase. Especially for those Web2 users who already use Telegram, TON provides an easy way to explore and participate in Web3 activities, which will help further expand TON's market influence and user base. This cross-border integration strategy not only makes Web3 technology more accessible and accessible to ordinary users, but also brings additional growth momentum to TON.

Project function

The integration of the $TON ecosystem with Telegram not only enhances the interactivity of its user base, but also greatly improves the convenience for Web3 users through its bot (BOT) functionality. These bots allow users to participate in primary market transactions and early project development of cryptocurrencies directly within the Telegram application, which is particularly important because many emerging cryptocurrencies, including multiple meme coins such as $BONK, $SLERF, $BOME, They all started their trading careers in the primary market.

Entering the primary market usually requires high technical thresholds and in-depth understanding of the market, which is a challenge for many ordinary investors. However, TON’s robotics technology lowers these barriers, making it easy for ordinary users to participate in these early-stage investments. This not only enhances user engagement, but also expands the activity and inclusiveness of the cryptocurrency ecosystem.

Therefore, it can be seen that the application of Telegram and its Bot (BOT) in the cryptocurrency field not only provides a powerful tool but also provides significant convenience to members of the Web3 community. This integration opens up new avenues for cryptocurrency investment and could be a catalyst for further innovation across the industry.

TON ecological development and innovation strategy

The TON ecosystem is undergoing rapid and far-reaching expansion, demonstrating that the platform is not limited to its original robot (BOT) capabilities. Recently, TON launched its own Launch Pad, which specifically provides opportunities for new projects in the TON ecosystem to be released for the first time, further strengthening its position as an innovation and entrepreneurial incubator.

Even more strikingly, TON recently launched a smartphone called the Universal Phone, priced at only $99. This strategy aims to lower the technical threshold and enable more people to participate in the TON ecosystem at an affordable price. The launch of this mobile phone is not only an innovative breakthrough in the market, but also a big step in popularizing Web3 technology.

In addition, TON Foundation Chairman Steve Yun announced that he will invest US$150 million to stimulate the development of the ecosystem. The funds will be used to incentivize more projects to be built on TON and are expected to move 30% of Telegram users to the Web3 platform by 2028. This ambitious plan highlights TON’s commitment to driving technological innovation and community growth.

Summarizing the above points, I remain extremely optimistic about the future of the TON project. Based on its continued application value creation and positive ecosystem development, I believe TON will be a significant market driver in the upcoming bull cycle. Considering that $TON has never experienced a bull market, future performance will be key, and I expect $TON to become a significant performing cryptocurrency on the market, bringing significant value growth.

Matters of concern: Analysis of TON market and circulation issues

Despite optimism about the future development of $TON, especially in the upcoming bull cycle, there are still some key questions and considerations that investors should pay close attention to.

First, $TON currently has a market cap of approximately $23 billion, while its fully diluted market cap (FDV) is a whopping $34 billion. This means that the $TON coins circulating in the market only account for about 68% of the total issuance, and about 32% of the coins have not yet been circulated. When these uncirculated tokens are unlocked in the future, they may have a significant impact on the market, including potential price pressure.

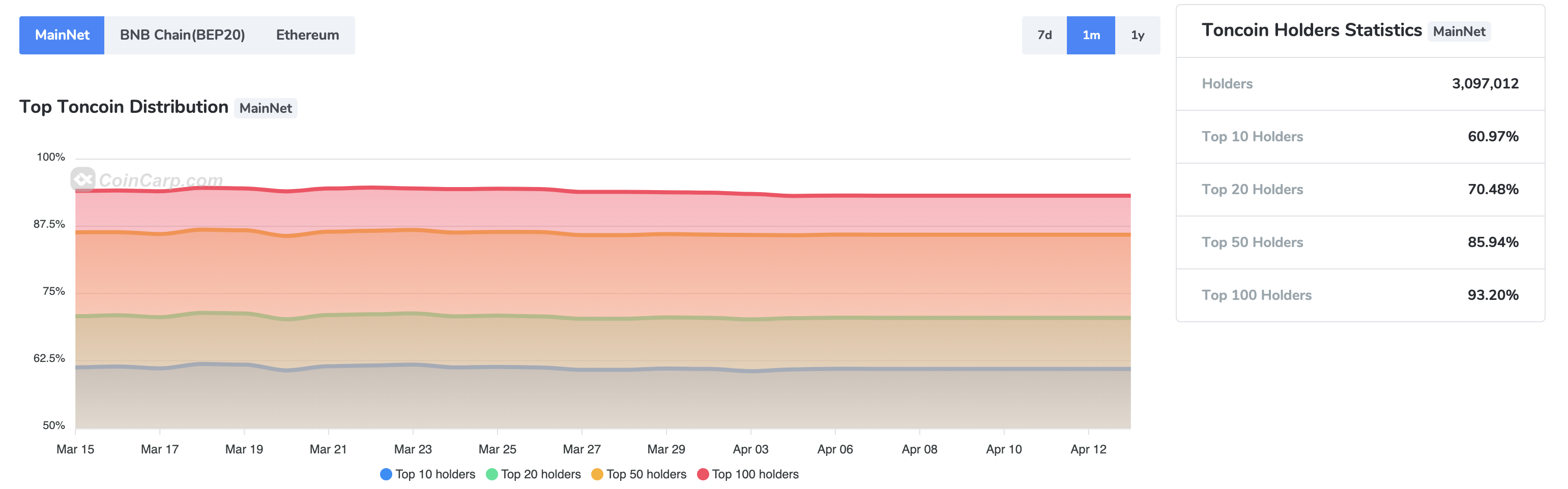

Secondly, the holding distribution issue of $TON has attracted widespread market attention. Currently, the top 100 wallets hold up to 93.2% of $TON tokens. This high degree of concentration may lead to market manipulation and price control behavior, increasing investment risks. This centralized holding model appears more extreme than other cryptocurrencies.

In comparison, Solana has always been considered one of the most centralized tokens. Compared to $TON, the first 100 wallets of $SOL only hold $21.95%. When we compare, we can find that $TON tokens It's very centralized. This centralized situation not only poses a threat to the price stability of $TON, but may also affect the fairness and transparency of the entire ecosystem. When a small group of holders controls the vast majority of the supply, their market decisions can have a huge impact on the price of the currency, which can lead to disadvantageous situations for other investors.

In short, although TON's innovation and integration strategies provide huge market potential, these circulation and distribution issues are risk factors that investors must carefully evaluate before considering investment.