Today, a "hot" MEME project on the Base chain was launched. It raised 4,000+ ETH in the early stage, and has many followers on Twitter. In addition, there was "enthusiastic" interaction from OKX Web3 wallet and others. As a result, everyone condemned it as soon as it went online.

An investor said that no one makes money except the project owner. This project is FOMO.

"Scam project. Shameless. Cuts harder than Machi."

What is this?

What is FOMO?

FOMO is a MEME coin of the Base chain. The name is very catchy and its self-positioning is also wonderful: Father Of Meme.

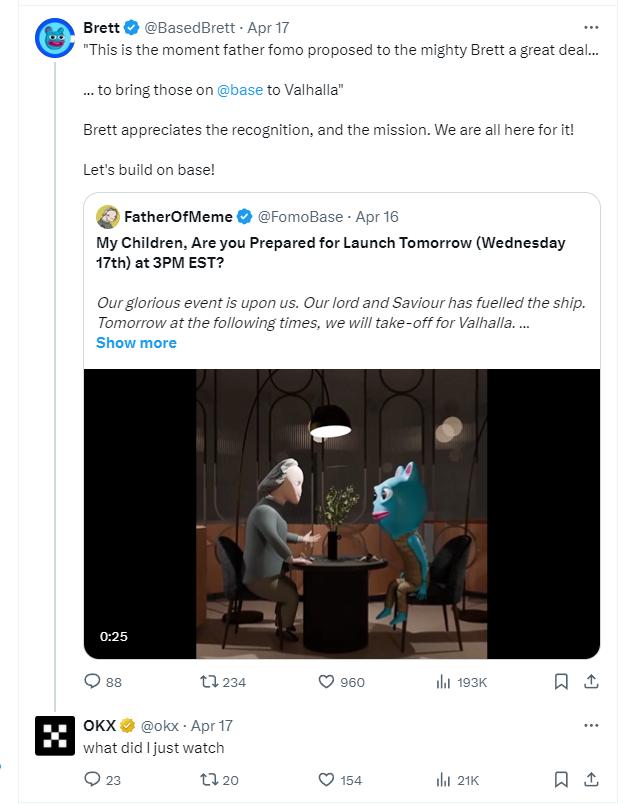

The first post on FOMO's official Twitter account was on March 29. The following posts can only be described as very exciting, with many magical videos interacting with well-known MEME coins, such as shib, floki, Pepe, bome, etc. As the father of MEME, the content is naturally to take the members of the MEME family with him.

In short, people who are familiar with the current crypto industry can easily draw a conclusion: MEME is a relatively powerful coin. The project owner is very good at content operation.

Looking only at Twitter data, reading and interaction are also pretty good.

On April 10, the project started pre-sale. Standard "money financing" with a minimum of 0.05 ETH and a maximum of 8 ETH.

It took only 14 minutes for the financing channel to be closed. The project owner issued a message: Everyone please stop sending money.

How much money was raised? The project owner said it was about 15 million US dollars. (There are 4224 ETH on the Base chain alone)

After the financing was completed, the project team continued to release interactive videos with the popular MEME coin, giving people the feeling that this is going to be a big undertaking.

The token was launched in the early morning of April 18. Investors thought they would make money.

As a result, the result was a failure.

Why is FOMO so popular?

Before talking about how it failed, it is necessary to say a few words. Judging from Twitter, this project has received a lot of attention from KOLs. Even now, we can still see that many top KOLs in the crypto are paying attention to it.

In addition, the official Twitter account of OKX web3 wallet has been actively interacting with MEME coin, and OKX Web3 wallet is currently conducting Base chain MEME coin trading activities. FOMO is also one of the officially listed tokens.

The Twitter posts are high-quality, the project concept is interesting, it is tied to the popular Base chain of MEME, and there are interactions between KOLs and well-known exchange wallets. All signs indicate that FOMO is worth playing.

What’s Wrong with FOMO?

But, it flipped over.

Where did the car crash?

Let’s first look at the token data.

According to dextools.io, the liquidity is only $700,000. The market value is $13 million. As for the price, you can see the trend in the above picture.

what happened?

Twitter account E@0xEdwin999 roughly explained it, let's take a look. The following content comes from E.

How does FOMO do evil? At the beginning, only 10E was added to the pool, and then 300E was snatched by itself, permanently locking the pool, but the project itself received 4000E, saying that it would buy back and add to the pool in succession. So far, the buyback is less than 50E.

Do you think that’s the end? Wrong. He opened the market at a price that would make pre-sales profitable, but he set a 30% sales tax, which amounted to more than 1 million. Do you think that’s the end? Wrong.

The tokens obtained by sniping are to be burned, but he chose to randomly distribute these coins to 600 addresses, and each address received a different number of coins, which means that it is extremely difficult for us to find out whether the wallet that shipped the coins is a pre-sale or a project party.

Logically speaking, the K-line of such a hot project should not go this way, and the opening buying volume is very strong, but why is it heading for zero? Are retail investors cutting their losses? The reason is simple. Some people can ship without considering the cost. So I found this wallet and traced back the source of the tokens. I found that his coins not only came from the sniping of the opening project party, but also from the disperse token. This means that the project party gave free tokens to its own mouse warehouse wallet by giving coins to the pre-sale. This also explains why he released a form on tg for people who received fewer tokens to fill in. Distributing tokens is an extremely simple thing. It can be simply distributed in proportion according to the amount. Why did less coins appear? There is only one reason. In order to ensure that the distribution of tokens conforms to the token economics, the project party stole coins from retail investors.

Since there is a repurchase expectation, someone will definitely buy after the first repurchase. The increase in the band repurchase, naive traders think that the project party did not think of this. First of all, the source of the amount used by the project party for repurchase is the proceeds from the above-mentioned operation, plus the 7.2E repurchased by the tax wallet. Why is it 7.2? Why not 7.21? I don’t know. First, the market is smashed, and then a small repurchase is made with the wallet that smashed the market, creating the illusion that it will rebound and retail investors are bottom buy the dips. If you buy according to the K-line reversal trend, then congratulations, you are trapped. What’s more terrible is that the project party has collected 166E to 0x7B50760f1785eF5A282bA13bC8dc00bfA9B027E3, and started to repurchase 3.4E per transaction, an average of once every 3-5 minutes, and repurchased five times. Does this operation make you feel like you are going to take off? 166E is going to be bought in? If you think so and chase it in, then congratulations, you are trapped again.

After repurchasing 10E, the project party transferred the money away.

Why can a pre-sale of On-Chain meme get replies from Gemini and Official Twitter? Official Twitter even replied twice. Doesn’t the official know how much this will mislead retail investors? Gemini is currently being sued for funding problems, maybe it was recharged, what about OKX? Is there something unspeakable? I have always been a loyal user of OKX, but this incident really disappointed me. I didn’t lose a lot of money on this plate, because I thought that the pre-sale market would not make any money at the end, but thinking of the two replies from Official Twitter, I chose to buy the dips some at the bottom, but ended up leaving the market with a stop loss. I believe I am not the only one who thinks this way.

A complete scam

From the current situation, this project is a complete scam.

But everyone was fooled.

The project party's operations within just a few hours after issuing the currency were classic, deceiving retail investors.

At present, in the words of investors, the project party's on-chain operations are naked and clear, without any obvious concealment, and they don't care what the community thinks at all.

Is it possible for the price of this kind of project to rise again? Many people would think so. A friend who paid money for FOMO in the early stage said: I sold it, and I couldn’t beat the project party at all.

At present, the activity content of OKX Web3 wallet has not been deleted, and some players may still try to invest.

MEME coins are risky and investment needs to be cautious. There may also be pitfalls in interactions between KOLs and institutions.