The Ethereum community is increasingly concerned about the issue of concentration of power in a certain group of projects in the ecosystem. This is demonstrated by the dominance of a few validators in validating transactions and securing the network. And the birth of reStaking is expected to solve this problem. So what is reStaking and how does it work to get so much attention? Let's find out with Coinmoi in the article below.

1. What is reStaking ?

reStaking is an emerging investment strategy in the cryptocurrency sector, especially in the Ethereum ecosystem. Accordingly, reStaking is the process of re-staking (Stake) or reusing staked Token to increase security and continue to receive profits. This idea was initially introduced by the EigenLayer project and has since become an important part of the cryptocurrency ecosystem.

In reStaking, users can choose to re- Stake Liquid Staking Token to participate in security and receive rewards from the services the middleware provides. This process helps increase profits for participants and also provides additional security and decentralization to the network.

reStaking can be simply understood as using part or all of the reward received from participating in Stake to further bet on the same or other nodes on different networks. However, reStaking brings many benefits, but you also need to pay attention to the risks related to Smart Contracts and fraud on the part of validators.

2. How reStaking works

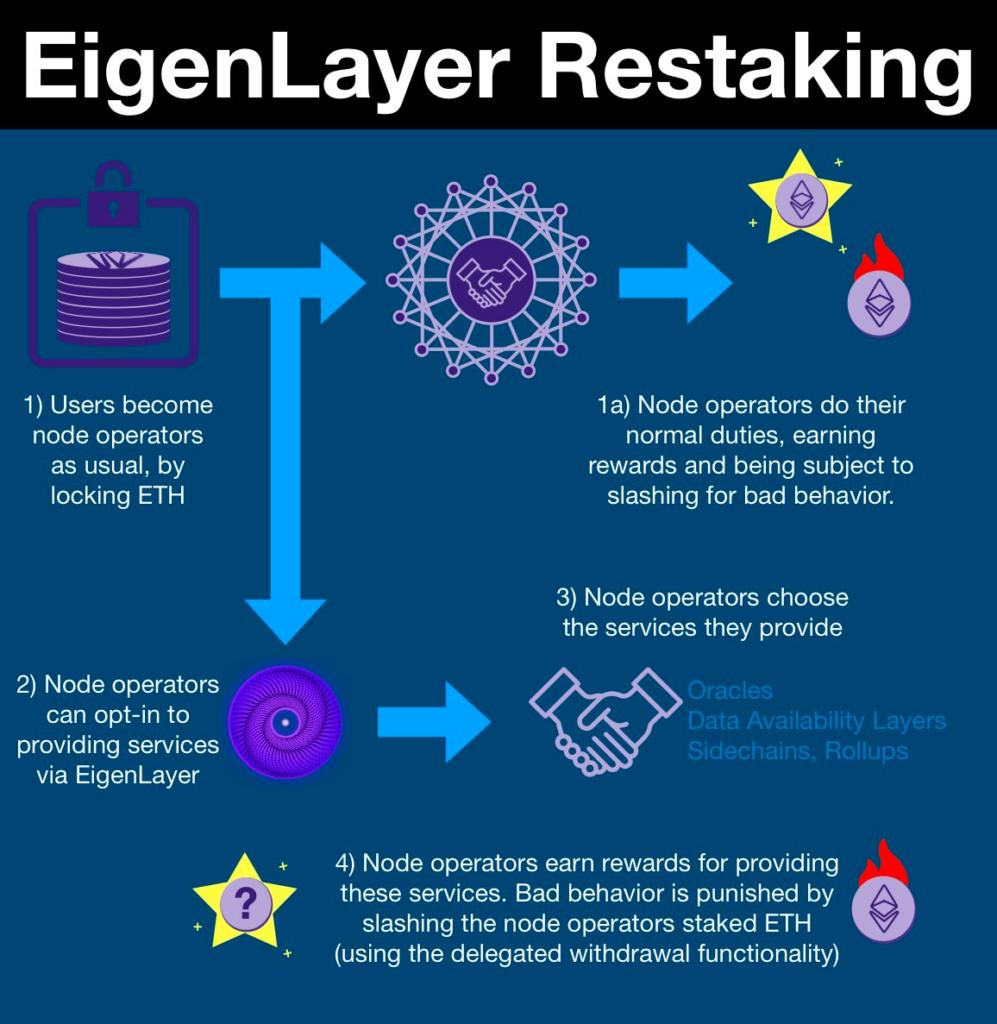

reStaking is an important mechanism in the cryptocurrency space, used to reuse and enhance the value of crypto assets such as ETH. In the case of EigenLayer, a leading project in the field, reStaking is done by reusing Stake ETH to secure Active Authenticated Services (AVS).

When users Stake ETH to EigenLayer to retake, this amount of ETH will be used to provide security for AVS. At the same time, middleware such as Oracle, Layer 2 and Rollups will pay service fees to AVS, this fee will be Chia between EigenLayer and restaker.

In recent times, reStaking protocols have become very popular, with TVL values increasing significantly. reStaking not only helps increase profits, but also provides the opportunity to reuse Stake Capital for other security activities, while creating a safe and growing ecosystem for the cryptocurrency community.

3. Popular reStaking methods

According to EigenLayer – the leading project in this field – there are a total of 4 reStaking methods:

3.1 Native reStaking

- Target audience: Solo Staker – people who operate their own hardware & software or rent servers in the cloud & operate the software themselves to authenticate the Ethereum blockchain.

- Action: Validator can retake Stake ETH by redirecting withdrawal information to EigenLayer's contract.

- Model: Similar to receiving rewards through direct Staking in Ethereum.

3.2 reStaking LSD

- Target audience: Liquid Staking Protocol users.

- Action: Validator can retake Lido or Rocket Pool 's ETH Stake liquid Token by redirecting withdrawal information to EigenLayer's contract.

- Features: This way of receiving rewards is related to DeFi activities.

3.3 reStaking ETH LP

- Subject: Join the DeFi market.

- Operation: Validator can retake the number of LP Token linked to the ETH pair.

- Model: Earn rewards in the DeFi market.

3.4 reStaking LSD LP

- Subject: Join the DeFi market.

- Operation: Validator can retake the number of LP Token linked to the Liquid Staking pair (For example: Curve's stETH- ETH LP Token).

- Model: Earn rewards on Layer 1 blockchain then go to DeFi market.

4. Advantages and disadvantages of reStaking

4.1. Advantage

reStaking brings many important benefits to both users and the blockchain network:

- Unlock LSD Token and LP Token asset liquidation : reStaking allows users to further leverage LSD or LP Token assets to Stake into Validators, thereby increasing flexibility for liquidation assets in the DeFi market.

- Increase profits : By Stake assets on two different networks, users can receive double profits. In addition, after Stake assets in the second network, investors can still use representative assets to Mint stablecoins and continue to participate in the DeFi market to earn other profits.

- Increased network security using reStaking : Accepting more assets increases the value of the network, thereby making it harder to attack and a place of trust for dApps, protocols and platforms other.

- Anti-dumping : reStaking creates more applicability for the original Token , helping to avoid dumping and minimizing damage to the project and investors.

- Increased security for the original network : Attractive profits from reStaking increase the incentive for original asset holders to Stake. This makes the root network more secure and decentralized, while also increasing its trust.

4.2. Defect

Although reStaking brings many benefits, investors also need to note some of the following potential risks:

- Risk of asset loss: If Node commits fraud or cyber attack, your assets may be stolen or fined, resulting in permanent partial or total loss of assets. In addition, if the system experiences a technical error or is attacked , user assets may also be threatened.

- Smart Contract Risk: Errors in Smart Contract can lead to assets being locked or lost. Additionally, if the network is attacked, your assets could be stolen or lost.

- Asset bubble risk: Using Wrap Token or new Token can cause asset values to increase virtually, not reflecting the actual value. Additionally, pledging the assets represented by the Mint Stablecoin may leave the underlying asset vulnerable to liquidation when the market value declines.

- New ecosystem risks : The emerging DeFi market has many potential fraud risks, especially poor quality projects. Token value can fluctuate widely due to low liquidation and lack of information.

5. Some reStaking projects

5.1 EigenLayer

- A pioneering project in the field of reStaking, attracting almost all TVLs of the reStaking market today.

- Supports a variety of authentication networks and services, including Ethereum, Solana, Near, Polkadot, etc.

- Large and growing community, supported by reputable investment funds such as Polychain Capital, Coinbase Ventures, etc.

5.2 Frax Finance

- DeFi project famous for its USDX value adjustment algorithm, integrating reStaking into their ecosystem.

- Allows users to Stake FXS ( Frax 's native Token ) to receive Staking rewards and trading fees.

- Supports many networks such as Ethereum, Polygon, Avalanche, etc

5.3 Lido

- Market leading Liquid Staking protocol, supports Stake ETH, SOL, DOT, etc.

- Integrating reStaking into Lido Staked ETH (stETH), allowing users to Stake stETH to receive additional rewards.

- Supports many networks such as Ethereum, Polygon, Solana, etc

6. Summary

Launched at the end of 2022, reStaking is currently one of the hottest trends in the market. This proves that reStaking is not just a short-lived trend but can contribute a lot to DeFi's growing ecosystem.

Above is the most basic information about reStaking, hopefully you have had the most basic view of this technology.

Follow CoinMoi to update the hottest issues of the crypto market Please!!!

Article What is reStaking ? Learn about the new trend on Ethereum that appeared first on CoinMoi .