The Dynamo DeFi newsletter covers trends, on-chain analysis and tools in crypto each week. Be sure to also check out my YouTube for more regular content.

Upgrade to the premium newsletter for access to premium articles, videos, and a Discord group.

The Perpetuals DEX Built for Traders

RabbitX is the fastest, and fastest growing, perpetuals DEX in DeFi. With 20x leverage, no gas fees, deep orderbook liquidity, and a truly professional trading experience. Check out the best mobile app in crypto and Back The Bunny.

Trade now: https://app.rabbitx.io/trade

Sponsored

📈Trends and Narratives

Bitcoin Halving and the Runes Takeover

This week Merlin Chain, a Bitcoin Layer 2 protocol, reached the 10th largest TVL of any chain. The chain has seen over 2,000% TVL growth in a month while having only a few protocols, compared to the hundreds on many EVM chains.

Nearly half of this TVL comes from Solv Finance, an uncollateralized lending protocol earning native token yields using trading strategies. Currently, Solv is offering over 8% APY for those willing to stake their BTC. NOTE: Staking redemptions are not available until June, but that’s not stopping nearly 15,000 investors from staking on Solv.

Happy Halving

The Bitcoin halving has cut block rewards to 3.125BTC. While there are fewer rewards per block mined, Bitcoin fees in the days after the halving are off the charts:

To emphasize the massive jump post-halving, here are the last 7 days in Bitcoin fees:

A significant portion of this jump is due to the launch of Runes, a new protocol and improved token standard over BRC-20 tokens. If you haven’t noticed Runes plastered all over your timeline for the last few weeks, here’s a helpful explanation of what they are and why they’re important:

How to Capitalize

Dive into Runes and the Bitcoin ecosystem. I suspect this narrative has not peaked yet, and there are still many opportunities to capture upside as many market participants won’t learn about these new protocols and primitives until after much of the gains are made.

Watch for new protocols on both Merlin and Stacks (both are Bitcoin Layer 2 protocols with burgeoning ecosystems). MERL and STX tokens should accrue value as the ecosystems grow as well.

I’ll have more later this week with a dedicated email about Stacks and its ecosystem.

🔢On-Chain Analysis

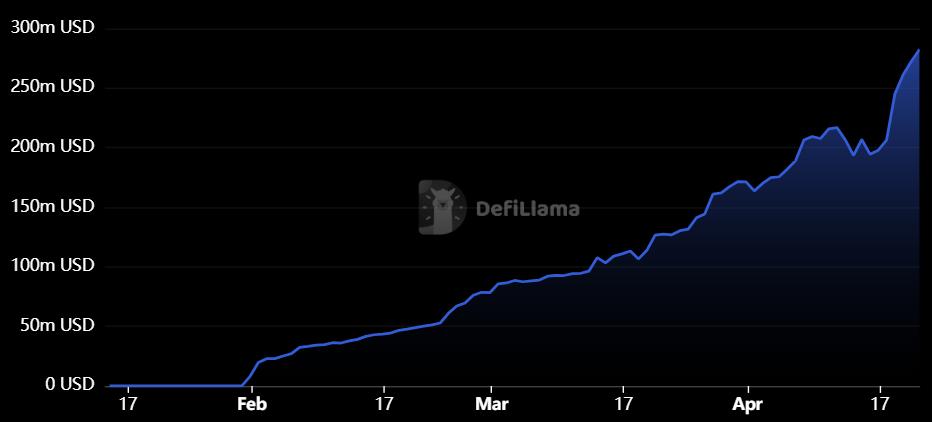

Mode Network TVL Surges Amidst Points Program

Mode, a fast-growing Layer 2, accelerated its growth this week, with TVL surging over 30%. Mode stands out, not for its tech, but for its economic incentives.

Mode has an ongoing points program to allocate airdrop rewards towards people that:

Deposit funds into Mode

Use tokens like mBTC, ezETH, and weETH in Mode DeFi

Engage with the Mode ecosystem

While Mode is still relatively early as an ecosystem, its strong performance against much well-funded chains like Base is a strong signal.

🚜Farm of the Week

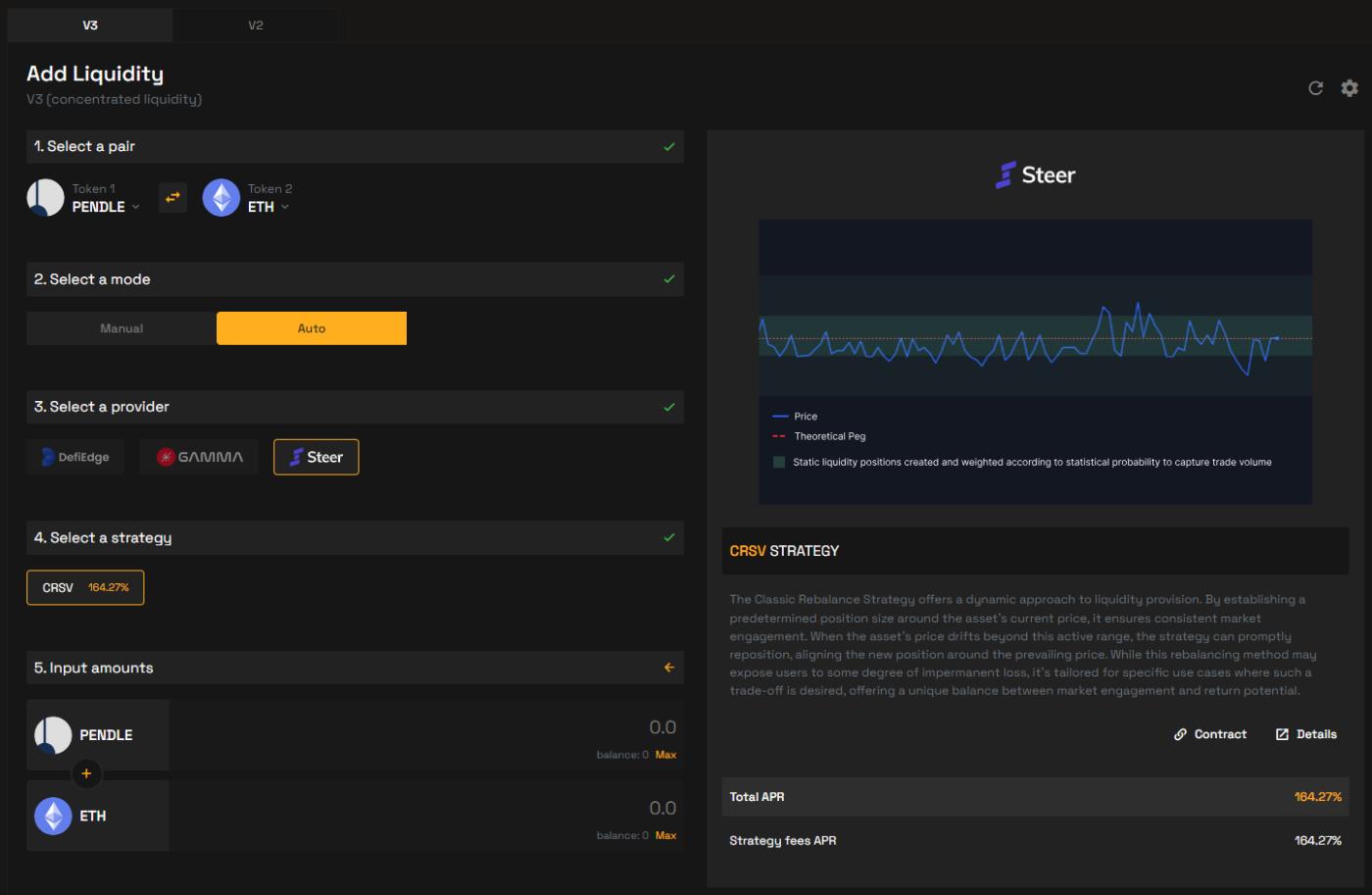

PENDLE-WETH on Camelot V3

This strategy is available on the Arbitrum network, and Camelot is Arbitrum’s leading native DEX with over $100M in TVL.

How it Works

Pendle has established itself as one of the top yield protocols, and the token has performed very well in the last 12 months. If you hold PENDLE or ETH, this strategy could be for you.

Simply select ‘Auto’ (or Manual if you like to set your own parameters and ranges) and select your favorite provider. Steer’s CRSV strategy auto-rebalances, has plenty of TVL, and currently offers ~165% APY.

Risks

Here are the farm’s details on DefiLlama - while the TVL is considered safe with over $2M in TVL, I wouldn’t personally feel confident strategy if the TVL fell below $1M.

🛠️Tool Spotlight

Track Crypto Events with Layergg

Layergg tracks crypto events, past and present.

Most of their content is on their X page; however, they also have an active Telegram channel. Their monthly calendars are definitely worth a read to keep up-to-date on the coming month’s events.

⚡Learn about DeFi with Dynamo DeFi Pro

The premium version of Dynamo DeFi gives you deeper insights and teaches you how to research yourself.

For $11/month (less than lunch in most countries), premium subscribers get:

⚡Discord to discuss on-chain data and trades. Learn more here.

⚡Community calls & AMAs in Discord. 3X per month I’m holding community calls and AMAs in the Dynamo DeFi Discord.

⚡Exclusive newsletters & on-chain data indicators. Actionable insights about which tokens have strong fundamentals. Plus special in-depth reports.

⚡Pre-recorded videos. These will be longer in-depth videos where I show my research process. View past videos here.

⚡Monthly group calls. Each month, I’ll conduct a group video call to discuss the market, latest crypto trends, and more. Premium subscribers can access calls here.

📅Key Events This Week

Macro Events

📊 Tesla earnings - April 23rd

📊 Meta earnings - April 24th

📊 Microsoft earnings - April 25th

📊 Google earnings - April 25th

Token Unlocks

🔓 CTSI (0.65%) - April 23rd

🔓 BICO (1.92%) - April 23rd

🔓 DAO (5.98%) - April 24th

🔓 AVAX (8.79%) - April 24th

🔓 YGG (3.49%) - April 24th

🔓 AXL (0.83%) - April 27th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 AxonDAO token launch on Arbitrum - April 24th (Source)

🚀 Entangle mainnet launch - April 24th (Source)

🚀 Forgotten playland game release - April 25th (Source)

🚀 MetaX chain mainnet launch - April 27th (Source)

🚀 Stacks Nakamoto Upgrade - April 15th-29th (Source)

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi