Yesterday, Binance launched the 53rd new coin mining project, the liquidity re-pledge protocol Renzo (REZ).

Starting from 8:00 am on April 24th, Beijing time, users can stake BNB and FDUSD in Launchpool to receive REZ rewards. Among them, 85% of the token rewards will go to BNB stakers, and the remaining 15% will be allocated to the FDUSD pool. The mining activity will last for 6 days.

After the Launchpool event, Binance will list Renzo (REZ) and open trading pairs at 20:00 on April 30, Beijing time. REZ will follow the seed tag trading rules.

Received investment from Binance Labs, OKX Ventures, etc.

Renzo is a liquidity re-staking protocol based on the EigenLayer ecosystem, which aims to simplify complex staking mechanisms for end users and achieve rapid cooperation with EigenLayer node operators and Active Verification Services (AVS).

According to the project team, unlike traditional staking, Renzo allows users to obtain higher returns. By introducing the derivative token ezETH, Renzo effectively releases the liquidity of re-staking ETH. Secondly, it uses advanced algorithms to balance returns and risks in real time, thereby automatically making the best configuration choices for users and ensuring a stable and substantial return on investment.

The project said that REZ tokens have dual uses of utility and governance, allowing users to vote on governance proposals on matters related to the Renzo protocol.

According to the encrypted data platform RootData, Binance Labs participated in the investment in Renzo. In January this year, Renzo announced the completion of a $3.2 million seed round of financing, led by Maven11, with participation from OKX Ventures, IOSG Ventures, Figment Capital, SevenX Ventures, etc. OKX Ventures said that this is its first officially announced investment project in the EigenLayer ecosystem.

Project Development

Renzo announced the launch of mainnet in October last year, and in just the third month after its launch, its TVL exceeded $100 million. According to Deflama data, Renzo's TVL is currently $3.3 billion, ranking second in the LRT track.

In January, Renzo launched the Renzo ezPoints program to reward users who contribute to the protocol. One way to earn points is by minting ezETH, which serves as Renzo's liquidity re-staking token. ezETH can automatically earn rewards and ensure liquidity, allowing users to participate in DeFi while retaining re-staking rewards. There is no limit on token deposits in Renzo, which is one of the main factors for its TVL surge.

According to its founder Lucas Kozinski, Renzo's development plan is divided into three phases and will take one to one and a half years:

The first is to increase and distribute liquidity. Currently, Renzo is in this stage, having integrated more than 50 DeFi protocols and launched native re-staking on multiple Layer2s.

The second phase will focus on improving efficiency and solving the gas cost problem on Eigenlayer to increase yield;

The third phase is to enable AVS’s “Slashing” function to build investment portfolios and perform risk management in the next 6 to 12 months.

Currently, Renzo has partnered with companies such as Gauntlet to establish a risk and portfolio construction framework to capture market share and win user trust.

REZ Token Economic Model

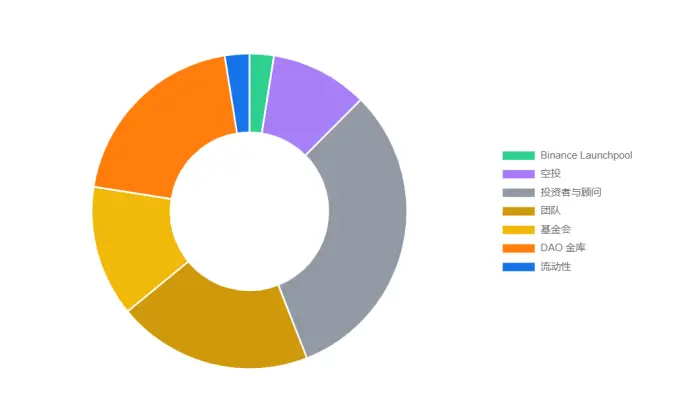

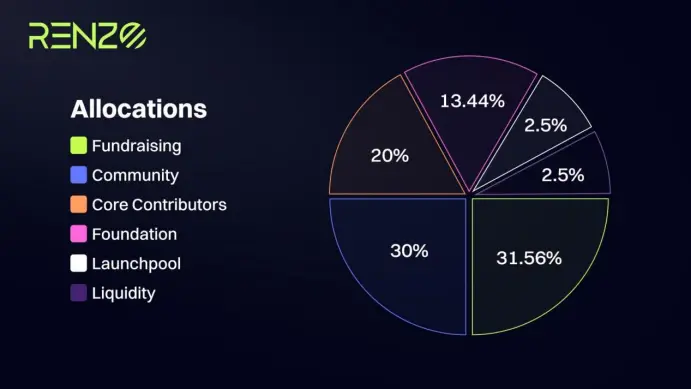

The total supply of EZ will be 10 billion, and the circulating supply at the time of listing will be 1.05 billion, accounting for about 10.50% of the total token supply. The specific distribution mechanism is as follows:

Binance Launchpool will allocate 2.50%;

The airdrop will allocate 10.00%;

Investors and advisors will be allocated 31.56%;

The team will be allocated 20.00%;

The foundation will allocate 13.44%;

The DAO Treasury will be allocated 20.00%;

2.50% will be allocated to the liquidity budget.

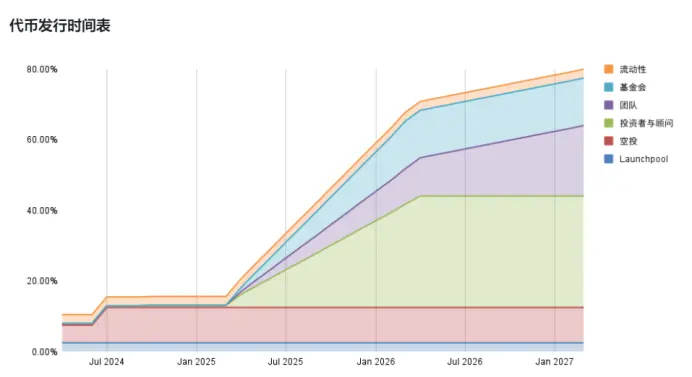

According to the chart, judging from the token unlocking progress, during the initial circulation stage, the circulation ratio of REZ tokens will remain at a relatively low level in the past year. The token supply will mainly consist of Binance Launchpool and airdrop shares, and by the end of the first quarter of next year, the circulation supply of REZ tokens will enter an accelerated stage.

The economic model is controversial

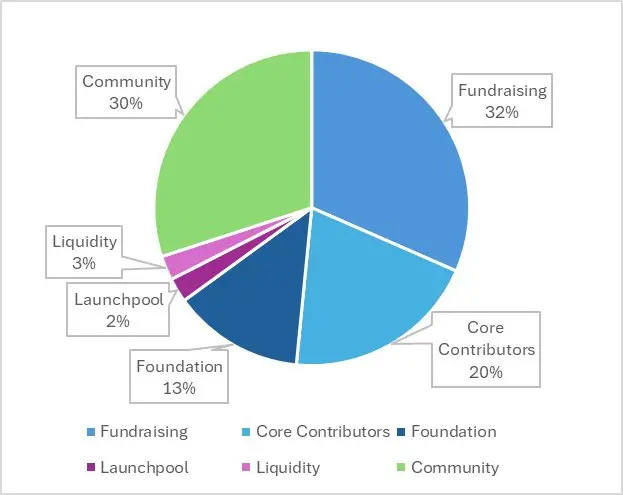

As the economic model of the REZ token was made public, questioning voices began to emerge in the crypto community, among which the way the economic model was presented in charts became the focus of controversy.

Some investors pointed out that the economic model allocated a large number of tokens to investors and the team. The project was accused of hiding this fact by designing a misleading pie chart. In the pie chart, the "half" marked at the bottom actually occupies 62%, but the two parts that only account for 2.5% are visually magnified to about 20%. Some investors even released a pie chart that they thought was more accurate for comparison.

In addition, some investors also expressed doubts about the "decentralization of the protocol" claimed by the project party.

They sarcastically said that it was ridiculous for the project to promote decentralization while only airdropping 5% of the token supply. They further pointed out that up to 70% of the token supply was still in the hands of insiders, which showed that the so-called decentralization was not achieved at all.

As the controversy within the community escalates, Renzo announced today that it will open the first quarter airdrop claim event on May 2, distributing 5% of the total token supply. It should be noted that Renzo's first quarter incentive event will end on April 26, and users who sell their ezETH holdings before then may lose their airdrop eligibility. Users can claim REZ on May 2 through the official claim website.

It is understood that Renzo will linearly distribute 500 million REZ (5% of the total) based on the ezPoints accumulated by users. 50% of the tokens of the top 5% addresses will be unlocked immediately at TGE, and the rest will be gradually released over the next 6 months. In addition, 2% of the 5% airdrop in the first quarter (ie 0.1% of the total token supply) has been allocated to NFT communities such as Milady Maker and SchizoPosters. The second quarter reward event will start immediately on April 26, 2024.

In addition, Renzo also stated that the airdrop qualification depends on the ezPoints at the time of the snapshot, and has nothing to do with the ezETH balance at the time of the snapshot (regardless of whether it is sold); users whose Pendle YT expires before the snapshot are eligible for airdrops as long as the score meets the minimum standard; NFT airdrops will be calculated based on the number of NFTs, not the number of wallets.