In the past two days, many people on Twitter have begun to heatedly discuss whether the SEC will approve the ETH spot ETF.

Many opinions tend to think that it is going to pass! Buy the dips of ETH, ETF reverses BTC, buy the dips of Ethereum assets, and "earn money together".

May is very important. According to current information, the SEC will indeed make approval decisions on multiple ETH spot ETF applications by the end of May, including VanEck, Ark 21 Shares and Hashdex. The earliest specific date is May 23.

Why do people think it can pass this time? Mainly because there have been some "clues" recently that seem worthy of attention.

First of all, Brother Sun has recently entered a phase of "buying, buying, buying". According to the data, since April 1 alone, a single address suspected to be Brother Sun has accumulated 154,570 ETH through Binance withdrawals and on-chain purchases, equivalent to approximately US$490 million, with an average price of US$3,140.

Who is Brother Sun? When did he suffer a loss? The top indicators for escaping the top and buy the dips the bottom.

Therefore, the director @sanyuan2016 speculated: "Brother Sun's indicators are very valuable for reference. This time, he increased his position in ETH again. Is it a signal that ETH's ETF is about to pass? Look at the current ETH/BTC exchange rate, which has also reached a key support level. If ETH takes off, should OP ARB rise?"

However, the opposing view is that Sun Yuchen went to LRT protocol to Airdrop Hunting, and before that, he easily got the wool from ETHFI. According to Dune data, the real-time deposit amount ranking of EigenLayer shows that three Justin Sun addresses, 0x176, 0xdC3, and 0x79ac, currently occupy the second, third, and fourth places on the list respectively. The total amount exceeds 200,000 ETH.

Secondly, well-known analyst Phyrex@Phyrex_Ni also said: "In the early hours of this morning, Grayscale submitted an S-3 application for the Ethererum spot ETF to the SEC. Unlike other companies including BlackRock that need to apply for S-1, Grayscale does not need to submit an S-1 because it has previously registered ETH. In theory, Grayscale's application means that if it is not approved, it is very likely to sue the SEC, unless the SEC has a different reason from the previous rejection of the ETH spot ETF. As for securities, I suggest you stop speculating in cryptocurrencies."

This view roughly means that the ETH spot ETF will replicate the glorious history of the BTC spot ETF.

In fact, there has been a lot of news about the US ETH spot ETF recently. For example, the SEC said that it would postpone the decision on the Grayscale Ethereum Trust's application to convert to an ETF, and Grayscale immediately started working on it and submitted an application called the Ethereum Mini Trust ETF. For another example, after the SEC postponed the decision on the Franklin Spot Ethereum ETF application, the SEC said it would solicit public opinions on the revised proposal for the BlackRock Ethereum Spot ETF.

In short, it was quite lively going back and forth.

In addition, on the 24th, the official website of the Hong Kong Securities and Futures Commission has listed the BTC and ETH spot ETFs of three fund companies, China Asset Management, Bosera and Harvest, and trading will officially start on April 30. This means that Hong Kong has officially approved the ETH spot ETF, and the United States is not far away.

For all these reasons, many people believe that it is only a matter of time before it is approved. KOL, Bitcoin President @chairbtc said: "At the end of May, the Ethereum spot ETF will usher in the next approval. If it is approved, a lot of funds will flow into Ethereum from Web2, and ETH will surely usher in a strong rebound. The probability of approval in May is 80%. Even if it is postponed again in May, the Ethereum spot ETF will definitely be approved this year. It is only a matter of time before it is approved."

In fact, the current Chinese social networks are still speculating on the evidence of the SEC's approval of the ETH spot ETF in May. However, these optimistic views still make crypto investors who follow them excited. And they bet that ETH will gain a good growth in May.

However, as the KOL CriptoNoticias@CriptoNoticias said, the situation of ETH and BTC is not the same: "The main obstacle to the ETH spot ETF is the classification of ETH. The SEC has not officially declared it a security or commodity, as it did for Bitcoin. In order to give the green light to the ETF, the SEC must classify ETH as a commodity."

Previously, there was an article on the Followin platform, in which many opinions believed that it was unrealistic to pass the bill in May. The original text is as follows:

《Bankless: Can the Ethereum Spot ETF be approved? 》

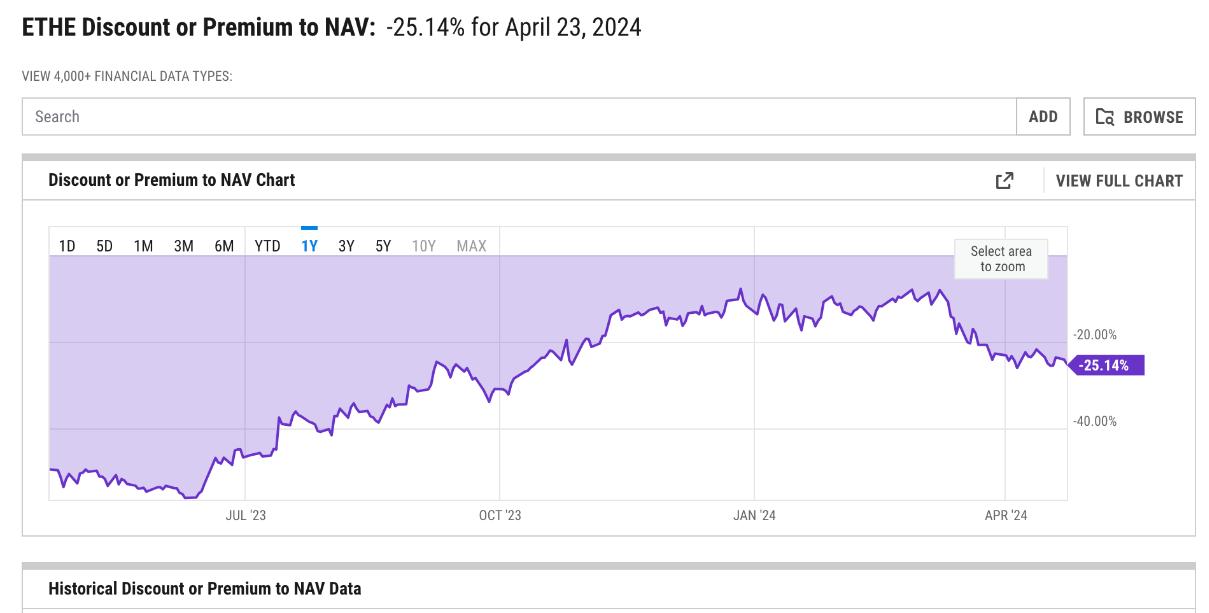

In fact, there is an interesting indicator, which is the discount rate of Grayscale's ETH Trust. As can be seen from the figure below, this discount rate has not only not increased recently, but has fallen instead.

Image source: https://ycharts.com/companies/ETHE/discount_or_premium_to_nav

This shows to some extent that at least the funds are not optimistic about Grayscale's Ethereum spot ETF. There are only a few days left in May. If there is any gossip, the well-informed Wall Street tycoons will have to "start performing".

But, is this a bad thing?

Recently, aura Shin@laurashin, a well-known crypto journalist and KOL, wrote: “Should you sell your ether before the SEC is expected to reject the spot ether ETF on May 23?”

In her opinion, the market has long expected that the SEC would refuse to approve the application, and the market has already digested this negative impact. The official statement of the SEC's rejection may be a "neutral event" rather than a major negative impact.

Recently, Standard Chartered Bank stated in a report that the spot Ethereum ETF is unlikely to be approved by US regulators in May. At the same time, they reiterated that the price target for Bitcoin by the end of the year is $150,000 and the target for Ethereum is $8,000.

An interesting point may be that the current mainstream view does not support the approval of the ETH spot ETF in May, but this does not affect everyone's belief that ETH will have a good market performance in May.

They say: Optimism is not a bad thing, because we are in a bull market...