Written by Yangz, Techub News

Behind the "constant changes" in the token economy, does Renzo really pay attention to the community's opinions, or is he worried that users will not buy into it after the ezETH depegging?

On April 23, Binance released a research report revealing the token economics of Renzo, the Ethereum re-staking protocol. The next day, Renzo announced that it would open the first quarter airdrop application on May 2, distributing 5% of the total token supply. Today, Renzo said that it listened to "community opinions" and decided to update the token application timeline, token economics, and airdrop qualifications. Among them, the total community token allocation increased from 30% to 32%, and the total airdrop allocation increased from 10% to 12% (the total supply in the first quarter increased from 5% to 7%, and the additional 2% was borne by liquidity and the foundation), and the application date was changed to 19:00 on April 30. In addition, the minimum qualification for each wallet airdrop is 360 ezPoints, and most airdrop addresses can be fully unlocked after TGE. Wallets with more than 500,000 ezPoints will unlock 50% at TGE, and the remainder will be unlocked linearly within 3 months.

As a highly anticipated project in the Ethereum re-staking ecosystem, why did Renzo change its mind overnight? The reason is probably closely related to yesterday's ezETH depegging and the community's dissatisfaction with the airdrop allocation.

ezETH depegging

First, ezETH fell to $688 yesterday. On the one hand, some people took advantage of this to get something for free. For example, the whale address starting with 0xaa1 bought 2,499 ezETH with only 2,400 ETH during the decoupling period, making a net profit of 99 ETH. On the other hand, this incident also caused huge losses to users who conducted leveraged transactions on platforms such as Gearbox and Morpho Labs that used ezETH as collateral. According to Instadapp analyst @DeFi_Made_Here , Gearbox lost 50% of its ezETH TVL due to this decoupling, and also owed a debt that will be repaid by the reserve. Morpho users also faced huge losses, with liquidation amounts in the 6-7 digits.

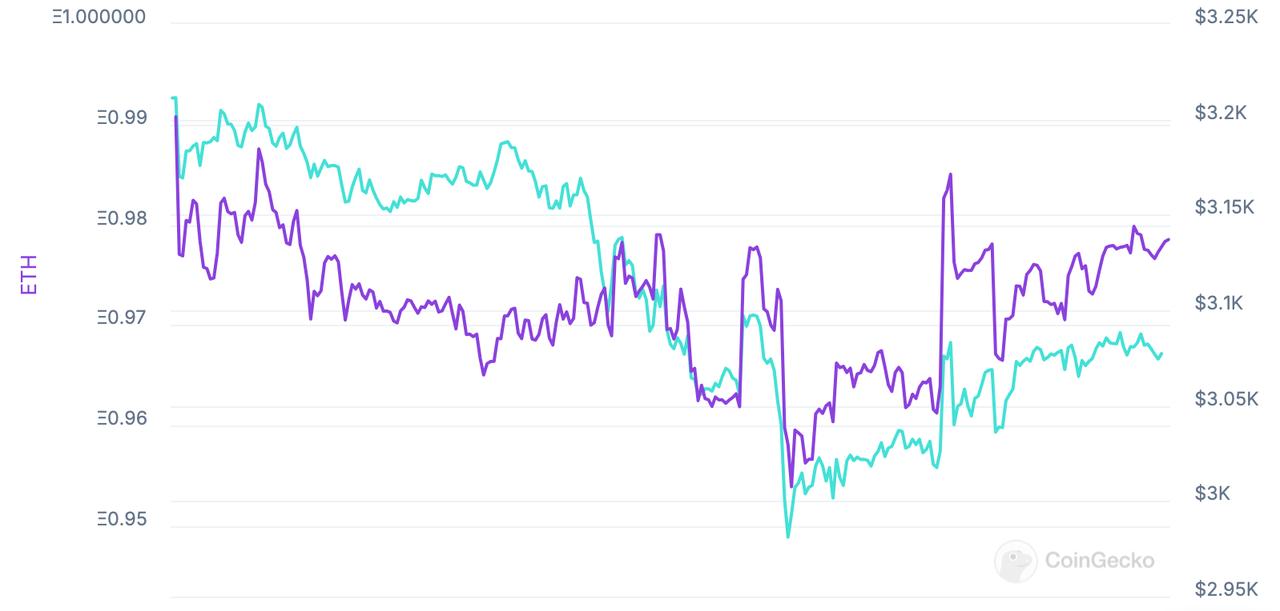

Although Coingecko data shows that ezETH has basically recovered its peg, it is still trading at a lower price than ETH, indicating that users do not have 100% confidence in Renzo’s LRT.

Unreasonable token allocation and low-level errors

Secondly, the community’s own dissatisfaction with Renzo’s initial token distribution plan has “accumulated into a disease” since it announced the plan. KOL @0xCaptainLevi on friend.tech complained: “Renzo’s airdrop is a joke.” Levi said that Renzo’s entire business is based on depositors, but only gives users 5% of the tokens, half of which are vested, and the actual airdrop is only 2.5%. More specifically, 250,000 users who deposited $3.5 billion in ETH and locked up for 6 months can only get 2.5% of the airdrop, which is the same as the share allocated to Binance’s Launchpool, which lasts for 7 days. Moreover, if users sell ezETH before May 2, all points will not count. Looking back at the team and investors, they can get up to 65% of the token allocation. To make matters worse, the token generation event (TGE) was scheduled before the airdrop could be claimed, that is, REZ could be traded on Binance before the airdrop participants received the tokens.

Levi directly called out Renzo officials and posted the following ironic token distribution chart, "We users put real capital at risk to make you what you are today, but instead of rewarding your loyal community, you did everything you could to harm them and played word games, thinking no one would find out." Teng Yan, a former analyst at Delphi Digital, also responded in the comments, saying, "I have to agree that providing 5% of the funds to the community in the Web3 protocol is very stingy."

In addition, as the second largest LRT platform with a TVL of more than 3.3 billion US dollars, the token distribution pie chart in Renzo's first announcement made a low-level mistake, which was shocking. Among them, the two 2.5% shares were drawn to be almost the same as 20%. It should have accounted for "half", but the total share was 62%. For this reason, many users criticized and even ridiculed this misleading presentation, believing that this was an attempt by the project to "beautify" its own poor token distribution through design. However, Renzo backfired.

Wider impact on LRT

Apart from Renzo itself, this incident also has a wider impact on the LRT track. Protocols like Puffer and Kelp that have not yet launched tokens may need to reconsider their strategies around airdrops and token economics to prevent similar incidents from happening. In addition, people also need to re-evaluate their confidence in the re-staking ecosystem.

In response to this incident, DeFi researcher Ignas tweeted to express his concerns. Ignas said, "The first lesson we learned is that holding LRT is not risk-free, and secondly, the situation of LRT may get worse."

Ignas analyzed that Eigenlayer has just been launched on the mainnet, but there are two key upgrades that will bring greater risks to re-staking/LRT, including slashing and permissionless AVS (if any). If there is a problem with AVS, the slashing event may reduce the user's ETH balance re-staked on Eigenlayer, for example, by 5%. Then, if the user re-stakes directly on Eigenlayer, he will only lose 5%. But for LRT, even a 5% slashing event may cause greater damage to LRT's peg, because it may cause panic and cause a large outflow of LRT due to low liquidity. Although it can be restored to the peg price after the slashing, the liquidation may be very cruel for a period of time. As more and more AVS are launched, the risk of slashing will also increase.

Eigenlayer will initially use pooled security, where all AVS share a stake of $1 billion, so the cost of attacking a protocol is $1 billion, similar to a military alliance. But if a protocol is attacked, all AVS will be affected. "I'm not sure if Eigenlayer really allows permissionless AVS, but if it does, the risk coverage of each AVS will increase," said Ignas. "Now everything is just FUD, because slashing will not derail Eigenlayer, but low liquidity and LRT, which is widely accepted as collateral, will cause undue damage."