In today's market volatility, the most attractive guy is $HBAR.

Hedera, the project corresponding to the token, recently announced on its Twitter that Blackrock, one of the world's largest asset management groups, has successfully tokenized its money market fund (MMF) using the Hedera network through the cooperation of Archax, Ownera and HBAR Foundation.

As the news spread, $HBAR started to surge, with its price doubling at one point. As of press time, it has fallen back somewhat, but still has an intraday gain of nearly 60%.

For more information, please visit Weibo Tuantuan Finance here .

BlackRock's determination to enter the RWA market is obvious to all. Last month, the tokenized asset fund BUIDL announced by BlackRock successfully attracted more than US$240 million in funds, which also caused a number of RWA projects such as Ondo Finance to see increases in value.

This time, BlackRock's influence also reached Hedera.

But unlike Ondo, which is an application, Hedera itself is a blockchain. So why did BlackRock choose Hedera to tokenize traditional assets? What are the advantages of the project itself?

Understand the RWA cooperation model

When it comes to RWA, technology is important, but resources may be more important.

Let’s first look at the cooperation between Hedera and BlackRock from the perspective of “tampering with the situation”.

Judging from the official announcement of the project and news from various sources, BlackRock's "money market fund (MMF) tokenization" is not accomplished by Hedera's single blockchain.

In this project, BlackRock worked with Archax (a digital asset exchange), Ownera (an institutional digital asset platform), and the HBAR Foundation. Together, these institutions enabled BlackRock's money market fund to be tokenized on the Hedera platform. The tokenization process involves converting MMF shares into digital tokens that can be traded and circulated on digital asset exchanges.

The cooperation model here can be:

Archax provides a trading platform and custody services, enabling investors to buy and sell MMF tokens.

Ownera provides support to help underwrite tokenized money market funds and ensure compliance of transactions.

The HBAR Foundation serves as an organization supporting the development of the Hedera ecosystem, providing technical and financial support.

Hedera itself is responsible for blockchain accounting, recording all relevant transactions and data. The final effect is:

If an MMF is divided into 1,000 tokens, then buying 1 token does mean that you get one thousandth of the total assets of the MMF. This approach makes the buying and selling of assets more flexible and instant, because transactions can be completed quickly on digital asset exchanges without going through the traditional purchase and redemption process.

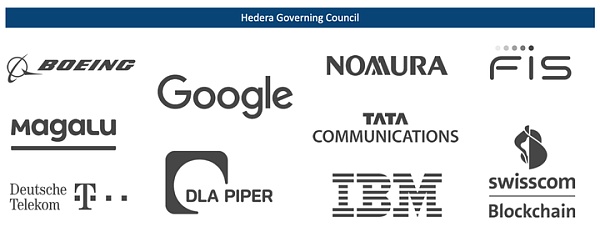

It is worth mentioning that Hedera has a governance committee organization that is responsible for Hedera's strategic planning, updates, network policies and overall management direction. Among them are some of the world's top companies such as Google, IBM, Boeing and Deutsche Telekom. This is obviously more beneficial for Hedera to connect with all parties to obtain resources and seize the situation.

True or false?

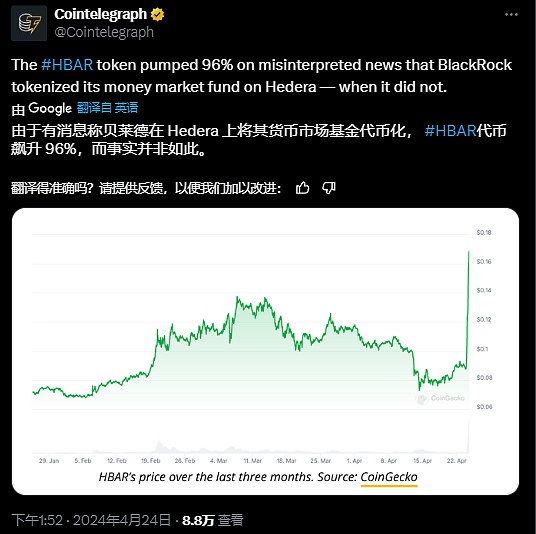

After Hedera officially announced its cooperation with BlackRock, the well-known crypto media Cointelegraph published an article saying that the news that BlackRock would tokenize its money market fund on Hedera was a misunderstanding and it was not the case.

Meanwhile, $HBAR has fallen in response, now down 20% from its high.

At the time of writing, Cointelegraph was still being mocked by netizens in the comment section of the tweet, who believed that its reporting was unprofessional and that it was jumping to conclusions without clarifying the situation when the cooperation had become an established fact.

As of press time, Cointelegraph has confirmed that the tweet has been deleted.

But beyond the truth of the news, we can clearly feel the obvious "news market" effect of crypto tokens. Riding on BlackRock's wind energy, the price has almost doubled, and a false FUD can also cause the price to fall rapidly.

It is not important whether crypto news is true or false, but how long the impact lasts. The market's reaction to the news and its duration are more instructive.

When the "BlackRock RWA" concept has already formed a sector or track, the long-planned emotions need to be ignited by news; and for most crypto players, it is more important to identify the tokens that may benefit in the sector as soon as possible, waiting for the next news to ignite.

Later, I will bring you analysis of leading projects in other tracks. If you are interested, you can click to follow. I will also organize some cutting-edge consulting and project reviews from time to time. Welcome all like-minded people in the crypto to explore together. If you have any questions, you can comment or send a private message. All information platforms are Tuanzi Finance .