The Market

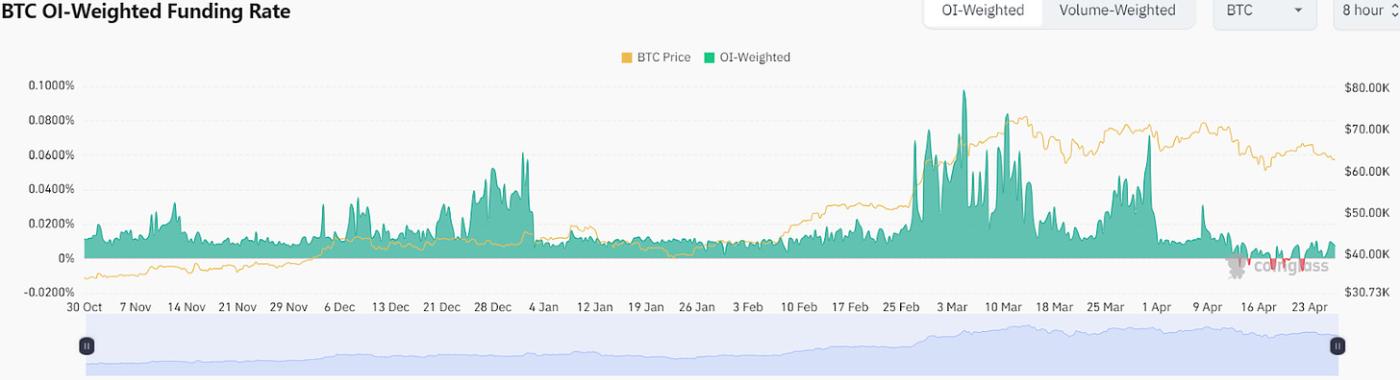

First week after Bitcoin halving, BTC price is at around $63K, down about 15% from the peak level reached in mid-March. The BTC perp funding rate is reset to a low level last seen at the beginning of the year, as the market recalibrates the next direction of the move.

The Bitcoin halving has been a perfect PR moment for a lot of projects developed in the Bitcoin ecosystem. For example, the much-anticipated RUNEs protocol started minting after halving, driving the BTC transaction fees to an ATH, surpassing the level last seen when ordinals were created. However, the newly minted RUNEs haven't matched the price surge of ordinals and BRC20s. In fact, the top 5 RUNEs by marketcap all experienced selloffs since etching. Critics blame RUNE’s initial 13-character name as being too long to be memorable as memes. We think the real issue is that neither BRC20 nor RUNEs can incorporate much utility besides their memic effect. While RUNEs has improved the efficiency of BRC20s, it doesn’t have much more smart contract functionality, and BRC20 still has the first-mover advantage. Furthermore, there are only a handful of market places and wallets that support Bitcoin native assets, most of which are Asia based, such as OKX and Unisat. We’ve heard anecdotally that Western investors often need to navigate Chinese language based forums to find useful information.

Source: OKX RUNEs marketplace

As Bitcoin maxis debate whether we need to build utilities on the bitcoin network at all, we believe Bitcoin L2s and bridges will serve an important function in bringing liquidity and DeFi capability to these emerging Bitcoin native assets, creating utilities for their owners without having to leave the Bitcoin ecosystem. In fact, Multibit has already announced the support of bridging RUNE tokens to BounceBit and Solana.

Merlin Chain, the largest Bitcoin L2 by TVL, also timed its TGE on the halving day. In addition to its Blast-like Merlin Seal program, which attracts more than $1.3B staked assets to earn Merlin tokens, it also gathered close to $1B TVL in the last 30 days. More than half of this TVL is held on Solv Finance’s Bitcoin yield program, thanks to its points farming program. The SolvBTC yield is currently coming from delta neutral trading strategies on BTC, which helps jump start Merlin’s native lending Protocol (Avalon Finance) and DEX (Merlin Swap). The $Merl token has lost 50% since its TGE high, which is not atypical compared to Jupiter’s ~40% drop after the TGE as early investors monetize some profit. The continued growth of Merlin and other Bitcoin ecosystem tokens, to a large extent, depends on the strength of Bitcoin.

On the macro front, the disappointing Q1 GDP print last Friday may not warrant an earlier rate cut, as the inflation remains stubborn. We do not expect the Fed to cut rates in next week’s FOMC meeting, and it will take at least a quarter’s worth of data points on growth and inflation for the Fed to reevaluate this delicate balance. The good news is the Treasury has more money than expected from the April tax payment—$180 billion more than their target, to be precise. This could help with liquidity in the short term as the election date comes close.

Regarding ETF flows, there were small outflows last week. We are not too worried, as the self-direct retail inflow reached its full potential, institutional inflow has not yet materialized. There is encouraging news that Morgan Stanley, one of the largest wealth management platforms, is exploring allowing brokers to recommend BTC spot ETFs. We expect to see more sales-driven inflows as more platforms open up. Furthermore, Hong Kong has approved both spot BTC and ETH ETFs. Although these are not open to most mainland China capital, it opens another important capital market for mass adoption. Crypto is here to stay.

TradFi Update

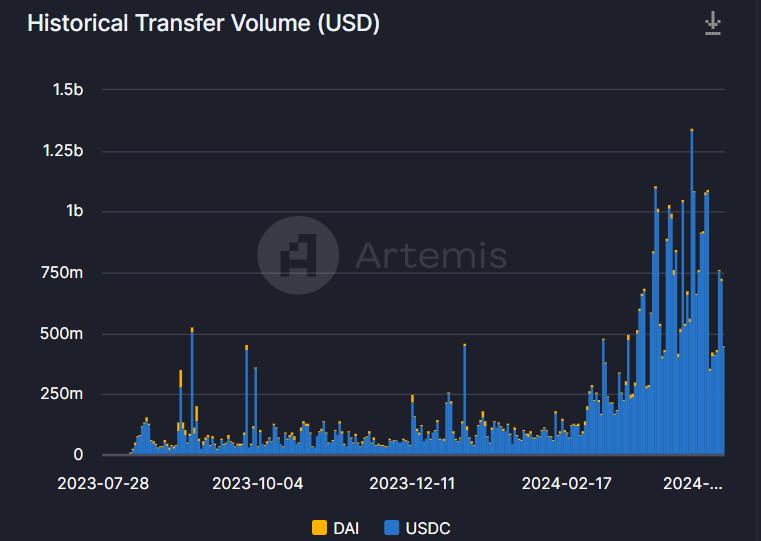

Stripe is finally supporting crypto payment, after 6 years of bumpy inroads into crypto. It currently only supports USDC on Solana, Ethereum and Polygon chains. The CEO demoed the payment interface at a Solana event, which looks well integrated into the existing payment workflow. Instead of entering your credit card number, users just need to log into a crypto wallet. We think Solana will disproportionately benefit from this integration because of its fast and cheap transactions. Since Circle enables secure bridging of USDC between Ethereum and Solana, the real world payment use case may bring more USDC onto Solana, further supporting its ecosystem growth.

DeFi Update

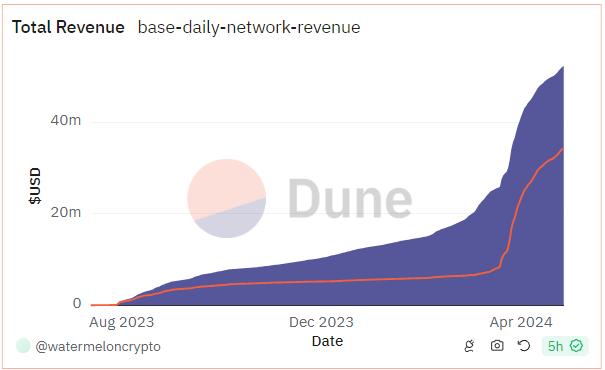

We wrote about the growth of the Base ecosystem in the recent CoinDesk L/S Newsletter. Once the blockchain speed and cost is practical to support essential applications, we believe the real competition will be in user acquisition and retention, which Base has a great advantage over other chains due to its access to 110M Coinbase users. Coinbase is also making a great effort to provide frictionless onboarding to Base through its smart wallet and magic spend features. A few charts worth highlighting to show Base’s growth momentum:

Capital is flowing to Base as the USDC balance on Base has risen to the second largest, only next to Ethereum

Builders are building on Base with Base contract deployment ranked as the top one among all chains covered by Token Terminal.

Strong user growth and revenue

Coinbase will report its Q2 earnings next week. In their Q4 shareholder letter, Coinbase mentioned Base’s TVL at $600M; it is now at $1.8B, with 3X growth in a mere three-month period. Coinbase’s Net Income for 2023 is $95M, Base’s total revenue YTD is already $52M, representing a significant portion of Coinbase’s total income. Additionally, with spot trading volume doubling in Q1 and the custody revenue from spot ETFs, we believe Coinbase is poised to report a strong Q1 next week, beating street estimates.

Top 100 MCAP Winners

Bonk (+36.10%)

Hedera (+23.09%)

Pepe (+21.87%)

Near Protocol (+20.27%)

KuCoin Token(+8.72%)

Top 100 MCAP Losers

Ethena (-25.09%)

Nervos Network (-21.64%)

Ronin (-17.64%)

ORDI (-17.37%)

Jupiter (-14.83%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.

About the Author

Kelly is Portfolio Manager and Head of Research at Decentral Park Capital. Investing across sectors with a thesis driven, deep research approach.

Prior to this, Kelly has led research and product efforts at CoinDesk Indices and Fidelity Digital Asset Management. Kelly has been a TradFi investor for 15 years before joining the crypto space.

You can follow Kelly on Twitter and LinkedIn for more frequent analysis and updates.