Written by Distilled

Compiled by: TechFlow

Introduction

Over the past two years, I have been following the Altcoin market with all my heart. However, there has always been a question in the market: the long-awaited "alt season" similar to 2021 has not yet appeared.

Here, I’ll explain why and offer suggestions for optimizing your Altcoin strategy.

Let’s first define “Alt Season”. Definition: When Altcoin outperform Bitcoin ($BTC) and prices surge across the board.

This is a period of great Altcoin boom and euphoria is building in the market. Think of it like a rising tide lifting all boats.

That’s what a strong Altcoin season can do, boosting almost every sector. What’s the driving force? The massive amount of liquidity that’s flooding into the market.

Tracking liquidity flows

Historically, there have been two main sources of this liquidity:

New inflows from retail investors, flowing in through centralized exchanges

Liquidity flowing out of Bitcoin on CEXs to Altcoin

Liquidity then slides down the market cap ladder and further along the risk curve. OGs are so familiar with this dynamic that they often refer to it as “the road to alt season.”

The Lalapalooza Effect

The path to the 2021 Altcoin season was clearly visible, but now it is gone. I think the reasons are multifaceted and are the result of a combination of several factors.

Individually, each variable is not enough to make a big difference, but when combined and pointing in the same direction, the effect is huge. Famous investor Charlie Munger describes this effect as the Lalapalooza effect.

So what is the cause of the combined effect here? I see several and will try to explain them.

1. Too many projects

The market is full of liquidity, but it is overwhelmed by the extreme saturation of projects. Imagine there are more ships in the ocean than waves.

Only certain areas like artificial intelligence (AI) or the SOL ecosystem have really felt the wave of “copycat season”.

What was once a rising tide that lifted all boats has become a selective, rotating game that's akin to the PvP nature of "The Hunger Games."

2. Token Dilution: The Hidden Handbrake

Token dilution, especially from token unlocks, is hampering a 2021-style Altcoin season.

This often overlooked factor absorbs a large amount of organic capital inflows. No matter how good the technology is, if supply exceeds demand, it will be difficult for prices to rise.

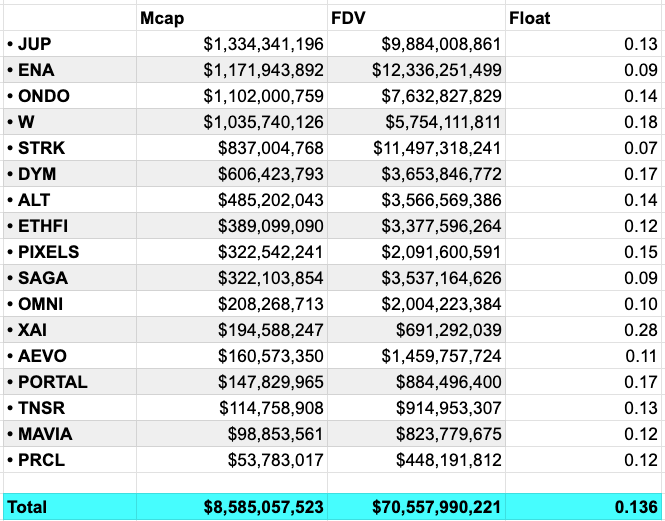

An investor recently sampled the launches of major projects so far in 2024. The average circulation of these projects is about 14%, and the funds waiting to be unlocked have reached $70 billion.

What happens when a market combines oversaturation with excess supply? The answer: conditions for the cottage season become difficult.

3. The Double-Edged Sword of Adoption

The increase in TradFi adoption has been a mixed blessing. On one hand, it has increased the credibility of cryptocurrencies, and on the other hand, it has brought more talent to the crypto space.

More talent might seem beneficial, but it actually increases market efficiency. If more smart people turn to crypto, it will be harder to find an edge.

4. Bitcoin ETF: A new dynamic

The approval of a Bitcoin ETF is a game changer for Altcoin. Before the ETF, the main channel for acquiring Bitcoin was through centralized exchanges.

This is good news for Altcoin, as investors can easily switch from Bitcoin to try Altcoin.

This time, the people buying Bitcoin are different.

Those who buy Bitcoin through an ETF face a more complicated path to enter the Altcoin market.

5. The perfect storm: the Covid-19 effect

Why is 2021 such a remarkable year for Altcoin? A lot of it has to do with the unique circumstances.

With the lockdown in place, the flow of money and the time people spend interacting online are both particularly high.

This creates the perfect conditions for cryptocurrencies to attract retail investors, and given the rarity of such conditions, it is reasonable to view 2021 as an outlier.

Everyone is still “drunk” on the 2021 highs; but the alt season of this bull run seems out of reach.

in conclusion

Review this article

The Altcoin market has gone from a general upsurge to a rotation game.

With more smart people in the market, it takes more effort to find an edge.

Project saturation, and a massive oversupply of tokens, is draining liquidity.

The traditional path for Altcoin season has been broken, largely due to Bitcoin ETFs.

Practical advice

That’s a lot to cover in this post, so let’s make it actionable:

Focus on fully diluted valuation (FDV) and saturation rate.

Keep an eye on ETF developments and sectors with heavy institutional participation, such as RWA. These may have different and potentially more favorable opportunities over the next few years.

With the market flooded with Altcoin, don’t just look at the USD value. Compare Altcoin valuations to Bitcoin ($BTC). There’s no point holding an asset with higher risk and lower returns. Assessing Altcoin performance relative to Bitcoin can provide a clearer indicator of strength.

Work hard on your strengths. It’s not just about growing assets, it’s also about enhancing your knowledge, skills, and network.

There are many opportunities in the cryptocurrency market, but they require more effort and new perspectives. The market changes rapidly and success will favor those who can adapt quickly.