What does a textbook #Bitcoin dip in a bull market look like?

I provided this thread to @_checkonchain subscribers at $57.5k, not because I wanted to pick the bottom, or thought it couldn't go lower.

Instead, I shared my own personal logic behind why I stacked sats myself.

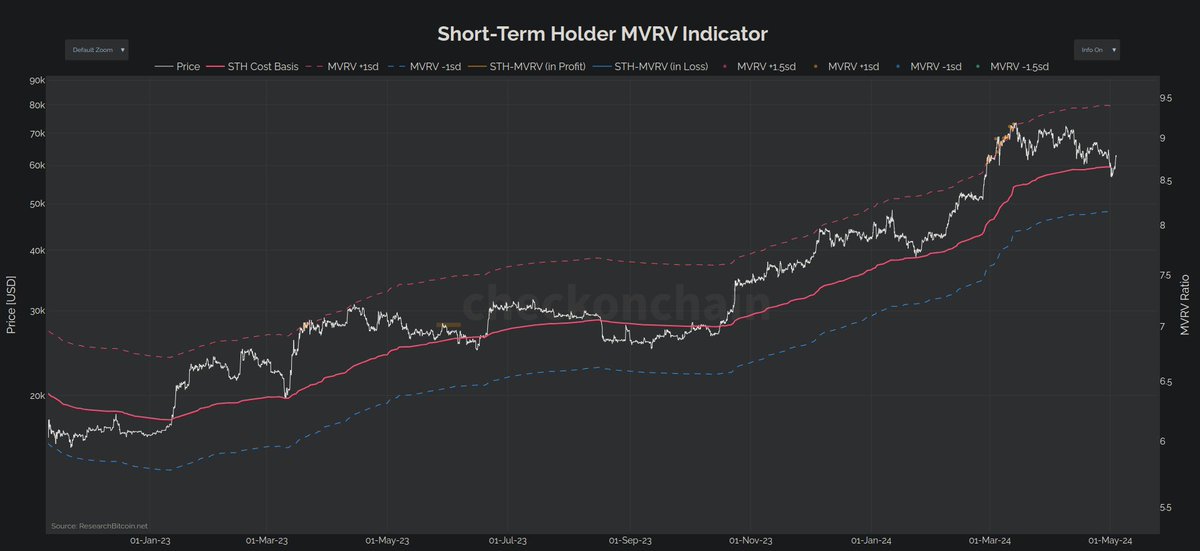

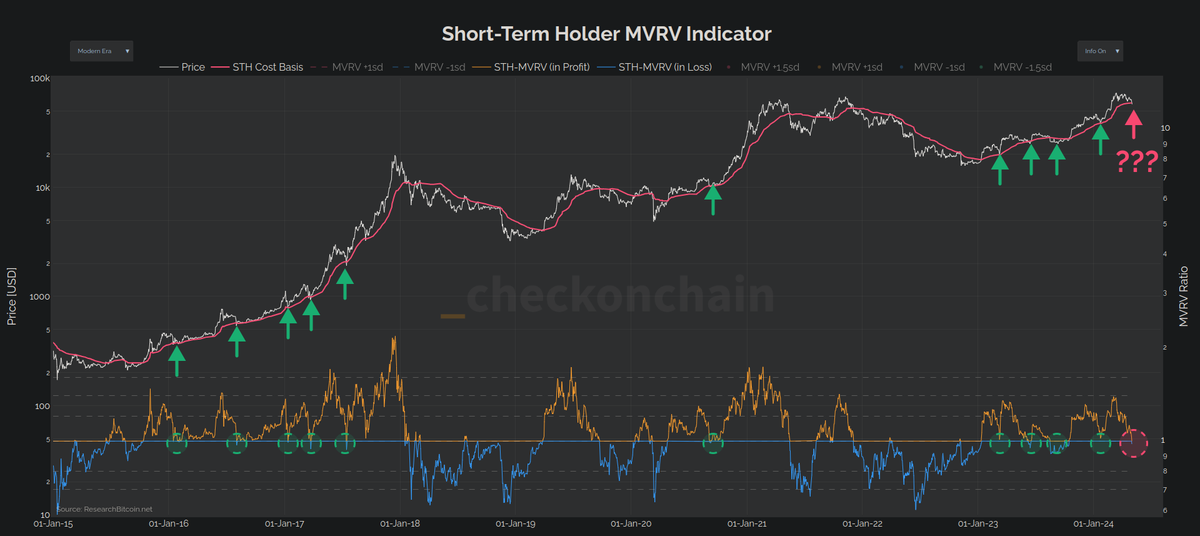

Firstly, price revisited and traded below the STH cost basis at $59.5k. This was a level we flagged in our first post about risks of 'Top Heavy' markets

However, if you believe, as we do, that #Bitcoin is in a bull market, that's exactly where you'd expect support to be found!

I'm a HODLer, and I like buying #Bitcoin.

However I also like buying it at a discount, and less so at a premium.

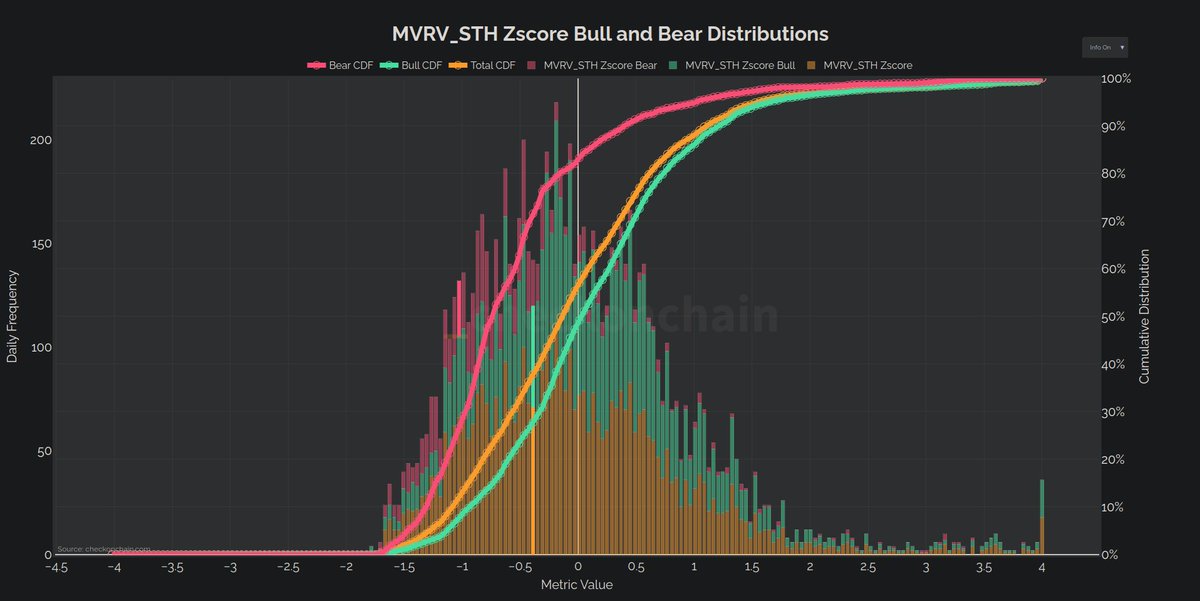

On a statistical basis, that dip brought us much closer to the 200D moving average, and statistically speaking, $BTC was no longer expensive for a bull market.

You also want to see a little bit of pain and fear. We know the ETF holders capitulated ~$700M, and we could see a hefty sum of $BTC fall into loss.

That said, dips are scary for a reason, they shake people out.

If we were going to bounce, it would probably look like this!

Naturally, plenty of folks bought high and then sold low.

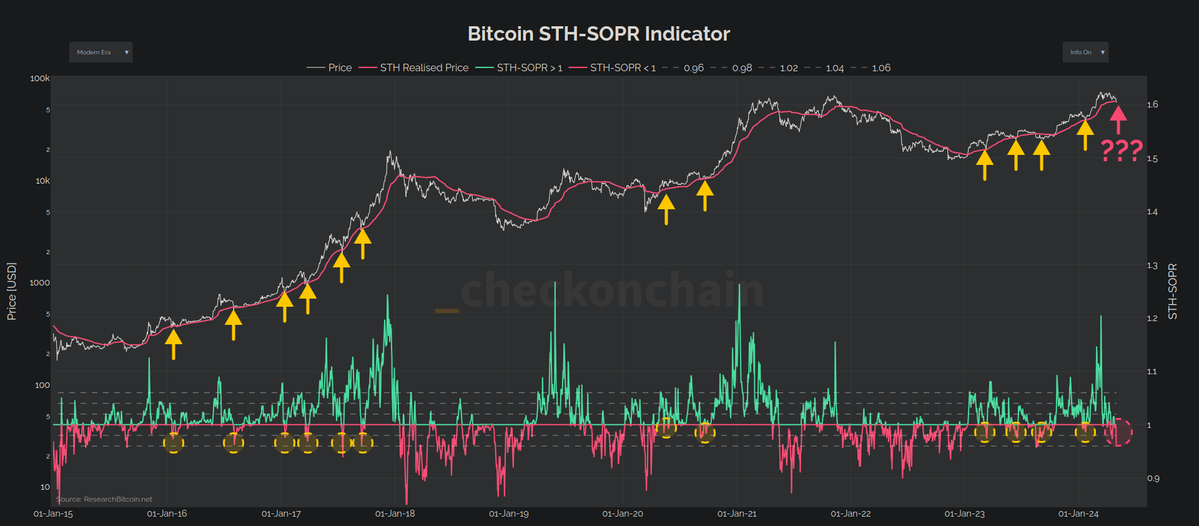

STH-SOPR is one of my all time favourite indicators, and it printed an absolutely beautiful undercut of 1.0.

It shows me when the top buyers specifically started to capitulate out.

I like taking the other side of that.

For a final dollop of cream on the cake, we also saw the #Bitcoin futures market cool down in a very healthy way.

This didn't look like a margin call, so my concern about a massive, sharp, angry deleveraging was minimal.

Overall, this describes a bull market dip where I step in.

I shared a video post in the original newsletter where I show how I assign simple probabilities and frameworks to these metrics.

They are simple frameworks that any #Bitcoin HODLer can use to improve their DCA hit rate, and feel more confident about their decisions.

The post received very positive reviews, as it was coming from Check the HODLer first, vs Check the analysts second.

Thank you to every @_checkonchain subscriber, you're the best, and you have made my year already.

It's a joy creating content for you.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content