Venture Capital funding in the cryptocurrency industry has seen a notable recovery this year, with investors pumping more than $4 billion into startups. In particular, four areas have seen the strongest increase in investment activity including: Ethereum reStaking, DePIN (decentralized physical infrastructure network), Bitcoin ecosystem, and RWA (real -world assets).

Ethereum reStaking is a relatively new field, having grown significantly this year thanks to pioneering protocol EigenLayer.

EigenLayer facilitates the reStaking of Ethereum (ETH) and Liquid Staking Tokens (LST) with validators in other blockchain networks, allowing users to earn additional rewards. In less than a year, the protocol has amassed assets worth nearly $15 billion. EigenLayer's success has spurred the launch of several EigenLayer-based Liquid reStaking platforms and raised total assets of more than $9 billion.

All three leading EigenLayer-based Ethereum Liquid reStaking protocols, Ether.Fi, Renzo, and Puffer Finance, have had successful Capital rounds this year.

In February, Ether.Fi raised $27 million co-led by Bullish and CoinFund. Puffer Finance followed up with an $18 million Series A round in April, co-led by Brevan Howard Digital and Electric Capital , bringing its valuation to $200 million. Meanwhile, Renzo raised $3.2 million in seed funding led by Maven11 in January, valuing the project at $25 million at the time.

Recently, both Puffer and Renzo received additional funding from Binance Labs .

Second, DePIN projects are also gaining attention, especially projects operating on the Solana chain . Some DePIN projects like Io.net; peaq; IoTeX; Natix and SendingNetwork have both raised Capital in recent months. For example, Io.net reached a $1 billion Token valuation in March. DePIN projects leverage blockchain technology to decentralize their physical hardware infrastructure and incentivize users to use Token to network expansion. As of April this year, about 70 projects have raised about $192 million across the DePIN and DeAI (decentralized artificial intelligence) categories.

The Bitcoin ecosystem is also rapidly expanding, with startups building on the network seeing increased investment activity. So far in 2024, there have been more transactions related to the Bitcoin ecosystem than in 2023 total – 81 transactions in Q1 2024 compared to 77 transactions in 2023.

.png)

Last but not least, the RWA Tokenize category is also becoming very popular, with a number of new startups including Securitize, Centrifuge and Backed all securing funding in recent years. recent month. More than 25 RWA-related startups have raised a total of $80 million this year as of April.

VIC Crypto compiled

Related news:

Grayscale's Bitcoin ETF recorded positive cash flow for the first time when it collected $63 million

Grayscale's Bitcoin ETF recorded positive cash flow for the first time when it collected $63 million

Bitcoin recovered strongly, liquidating more than $150 million in Short positions

Bitcoin recovered strongly, liquidating more than $150 million in Short positions

Stablecoin volume on Ethereum broke records in April

Stablecoin volume on Ethereum broke records in April

BTC-e's past $9 billion money laundering scheme has unraveled

BTC-e's past $9 billion money laundering scheme has unraveled

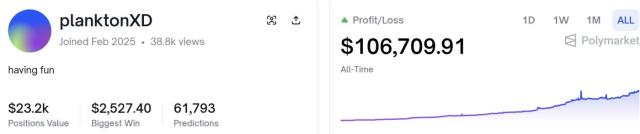

Will the FED cut interest rates? Predictions from traders and Wall Street

Will the FED cut interest rates? Predictions from traders and Wall Street