I remember in June 2022, I listened to a cryptocurrency talk on Space in a public restroom somewhere.

The KOLs in Space were discussing where BTC and ETH would fall to. I don't remember the specifics very well, but I do remember someone saying that ETH would fall below 800.

In fact, June 2022 was the lowest point for ETH, not falling below 800. June 2022 was also almost the lowest point for BTC, after which BTC fluctuated at low levels for six months before bottoming out in December 2022.

I had just learned about cryptocurrencies when the crash occurred. The market was still caught up in the illusion of liquidity surrounding NFTs, the metaverse, and GameFi, and the discussions following the crash were extensive.

Six months later, the market was completely stagnant. The young people who had gone all in on Web3 and their DAOs gradually left the market, and a new cycle began.

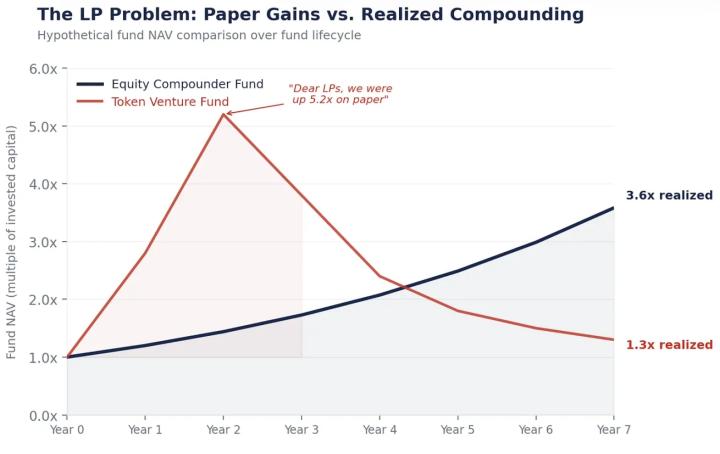

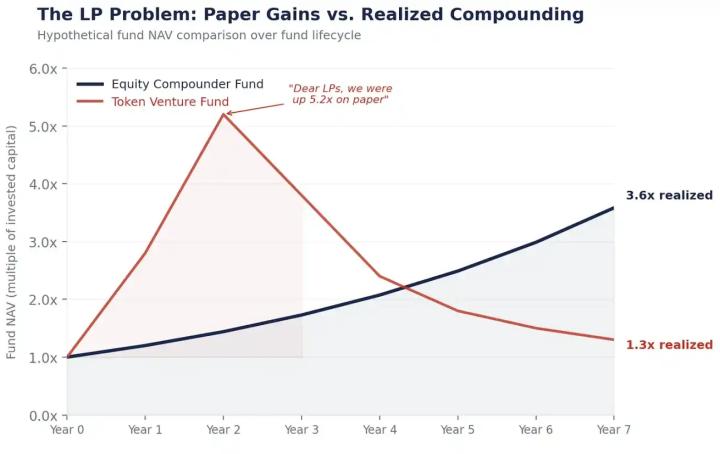

There will always be those who chase high prices and rush in, and there will always be those who have to exit and leave the market. Amidst the ebb and flow of liquidity, the capital market welcomes every young person with dreams, and also welcomes every shrewd and worldly-wise individual.

Is this a cycle of emotions? Yes and no. Emotions are a reflection of prices, and are often only realized after the fact.

In November 2021, the Federal Reserve began tapering, causing panic in risk assets. At the same time, Bitcoin peaked.

In March, May, and June 2022, the Federal Reserve raised interest rates by 25bp, 50bp, and 75bp respectively, and announced in May that QT would be implemented in June. During May and June, the cryptocurrency market experienced a flash crash, with Luna collapsing and Three Arrows Capital going bankrupt.

In July, September, and November 2022, the Federal Reserve raised interest rates by 75 basis points three times in a row, reaching full-speed QT in September. In November, FTX crashed.

In December 2022, the Federal Reserve raised interest rates by 50 basis points, slowing the pace of rate hikes. At the same time, Bitcoin (BTC) bottomed out.

In March 2023, Silicon Valley Bank collapsed, the Federal Reserve slowed its interest rate hikes to 25 basis points, and launched the BTFP. Meanwhile, after a panic sell-off, Bitcoin rose to 30k, and an inscription appeared.

In June 2023, there was a skip rate hike, followed by a 25bp rate increase in July, and then unchanged rates in September and November. Interest rates had peaked, and the market believed the Fed had stopped raising rates. In May, a period of consolidation began; in November, after a 6-9 month correction, BTC rose, and the inscription effect began to create wealth.

By the way, I graduated from LBS in July 2023. When I graduated, everything was quiet; the industry was at its lowest point. There was no commotion, only pure silence. The DAO was gone, but a feast of liquidity was about to begin.

The market is always pricing liquidity at its second derivative (acceleration). When this second derivative is zero, the price will reverse.

As a canary for liquidity beta, BTC has entered the next cycle along with global financial assets.

However, many of the people from back then are no longer here. Zhongdeng has grown old, the young people have become Zhongdeng, and the naive people have become young.

With what feelings do I recall that summer of 2022, the fall of a giant, and the bitter beginning of my new life?

Having weathered the baptism of utter silence, the dissipation of idealism, and the demystification of Web3, adversity is always the best teacher.