Personal record review and future plans:

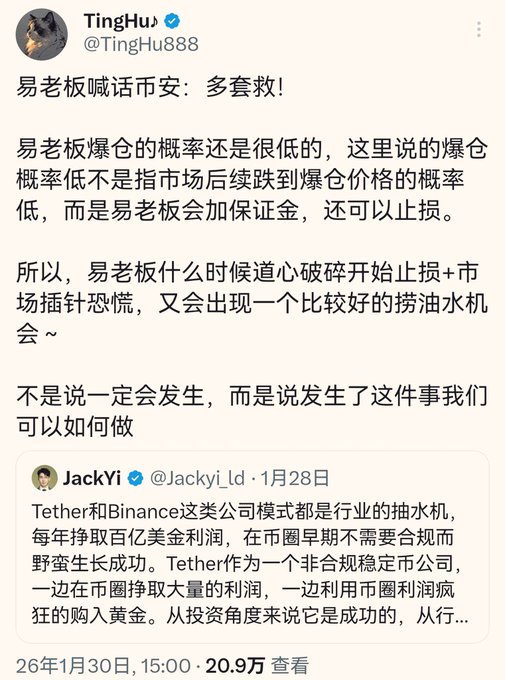

At the beginning of this decline, the price was still relatively high. At that time, Mr. Yi's liquidation price was around 1800. Initially, the view was that the probability of Mr. Yi being liquidated was very low; he would add margin and could also stop loss. Therefore, the plan was to take advantage of his broken resolve and market panic selling to profit from the price drop.

Later, things did indeed unfold according to the script. He added margin and continuously reduced his position through stop-loss orders, leading to a panic sell-off… Unfortunately, I mainly held spot positions and didn't short, so I missed out on this huge profit. Also, I had originally planned to buy Bitcoin at 60,000, and Yi also lowered the liquidation price, but because the drop was too rapid (exceeding expectations), there were very clear signs that it was heading towards liquidating Yi. Once liquidated, the entire market would be dragged down. So, I thought I'd just wait for the liquidation and make a big profit, because this kind of continuous decline followed by liquidation has a high probability of a V-shaped reversal, with substantial gains! But in the end, he stopped just before he could slit Yi's throat; the knife stopped right there, and the "man in black" walked away smiling. Unfortunately, the rapid rebound after the sell-off wasn't the time to monitor the market (without the expectation of a major liquidation, one tends to place orders on the left side; this habit of chasing the sell-off on the right side is more prudent in a bear market), and I regretfully missed the lowest point for short-term buy the dips. By the time it recovered, it had already rebounded by more than ten points, right in a consolidation range.

The plan remains the same: to trade within this range for a period of time, and then, once many people have relaxed or there is a certain probability of a bull market pullback (when people don't believe in the bear market), to leave again and wait for the bottom or the next opportunity to make some money.

twitter.com/TingHu888/status/2...