Disclaimer: The contents of this report reflect the opinions of the author and are provided for informational purposes only. It is not written with the intent to recommend the purchase or sale of tokens or the use of protocols. Nothing contained in this report is investment advice and should not be construed as such.

1.Introduction

1.1. The Importance of Community

The community within a cryptocurrency project is not merely a collection of users or investors, but it has established itself as a critical factor in determining the success or failure of a project. Blockchain technology and projects based on it are centered around decentralized governance. Thus, underscoring the significance of the community's involvement cannot be overstated.

Decentralized governance means that the community, including the management team, collaboratively makes decisions about the tokenomics, project roadmaps, development priorities, and other matters concerning the future of the project. Neglecting the community or failing to operate a project transparently can often lead to skepticism and create uncertainties. This, in turn, can foster FUD (Fear, Uncertainty, Doubt), undermining the fundamental value of the project.

Notably, Do Kwon, the founder of Luna, once ignored numerous critiques raised by the Luna community regarding the LUNA-UST mechanism, famously tweeting that he does not "debate the poor." His dismissive response to questions about how to secure $300 million in reserves for the 20% interest offered by the Anchor Protocol also exacerbated fears of a bank run. The consequences of disregarding such valid concerns were tremendous.

The participation and feedback of the community play a vital role in steering a project in a direction that aligns with market demands and expectations. When project teams actively communicate with their communities and foster engagement, the transparency and trustworthiness of the project can be enhanced. Moreover, community members act as voluntary promoters and supporters, extensively publicizing the value and potential of the project and significantly contributing to the expansion of its user base. The recent trend among newly launched projects to essentially allocate a portion of airdrop to the community stems from an understanding of these effects, aiming to quickly incorporate the community into the project.

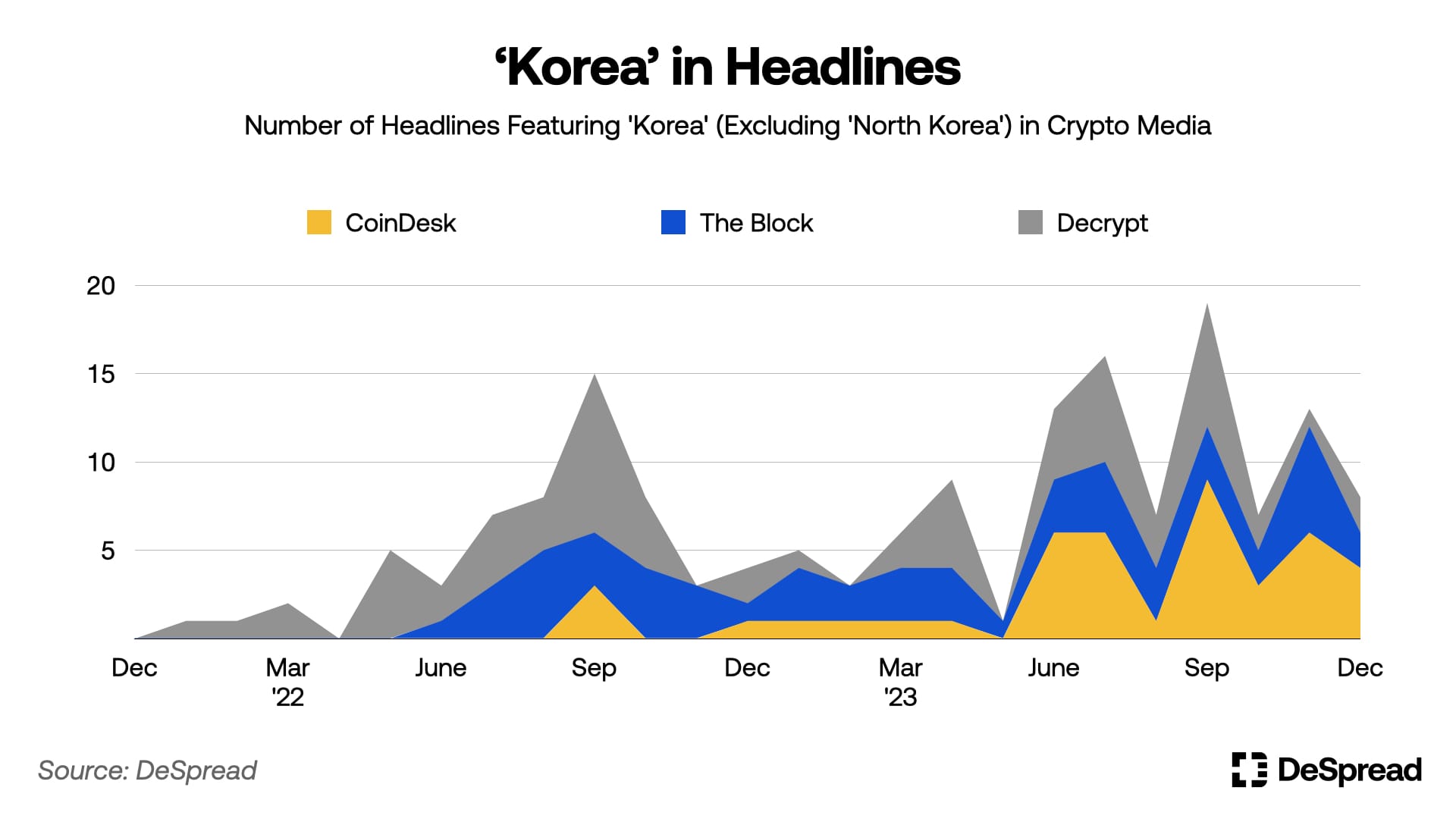

The stature and interest in Korea within the cryptocurrency industry are on an upward trend. An analysis of the mentions of "Korea" in major international media headlines, excluding North Korea, indicates a growing global interest in the South Korean crypto market. The peak in the charts for the latter half of 2022 was primarily due to articles related to Do Kwon, but from the second half of 2023, there has been an increase in articles covering government regulations and the overall Korean market. This trend highlights the rising global attention towards market trends and policies in Korea.

As covered in the previous report (DI - 01: Centralized Exchanges in Korea), Korean exchanges are ranked high in global trading volumes. Notably, as seen in the charts, Upbit recorded the second-largest spot market trading volume worldwide in 2023, following Binance.

Korean exchanges predominantly trade altcoins rather than Bitcoin or Ethereum, and their influence on major altcoins with relatively large market capitalizations is significant. For instance, on August 5, 2023, 90% of the global trading volume for Stacks (STX), a Bitcoin layer 2 project, occurred on Korean exchanges. Similarly, on January 4, 2023, 60% of the global trading volume for the token of Blur, the largest Ethereum NFT marketplace, was also on Korean exchanges. Such data underscores the importance of the Korean market and its impact on the global stage.

Understanding community trends in specific markets is crucial to grasping what characteristics those markets possess. This report begins from such perspective and is written with the intention of providing an in-depth analysis of the Korean crypto community. The focus is mainly on understanding the types of communities in the Korean crypto market in 2023, the topics they were interested in, and further, the correlation between these interests and market trends.

2. Korean Crypto Community Platforms

2.1. Telegram

Telegram, a leading messaging app with approximately 800 million monthly active users (MAU) globally, is the most actively used platform by the on-chain crypto community in Korea. Beyond mere messaging, Telegram offers features such as large group chats, notification messages, and bots, which support not only personal communication but also the operation of many communities.

There are various channels on Telegram related to crypto, including those for airdrops, exchange announcements, DeFi news, trading signals, and research, with at least 500 channels currently targeting the Korean audience.

Many projects operate official Telegram channels and chat rooms, allowing for the timely dissemination of the latest information and updates and facilitating communication among community members. Telegram supports multiple languages and is used worldwide, making it easy to communicate with the global community. Its ease of forwarding and quoting messages between channels makes it effective for information dissemination.

2.2. KakaoTalk Open Chat

KakaoTalk, the most widely used messaging app in Korea, boasted 48 million MAU by the end of 2023, making it the top mobile app among all users in Korea. Considering the population of South Korea was approximately 51.32 million at the end of the year, it is reasonable to suggest that almost every Korean uses KakaoTalk. The app is used across all age groups, which enhances its accessibility, and the crypto community utilizes KakaoTalk's open chat for communication. Open chat is a service on KakaoTalk that allows random users to create and engage in conversations based on shared interests.

Crypto-related open chat rooms are typically formed around regular crypto investors and specific crypto holder groups, with a majority appearing to be investors in cryptocurrencies listed on centralized exchanges. Discussions in these general crypto chat rooms often revolve around pricing and market analysis. KakaoTalk's crypto community is characterized by its accessibility, attracting a more diverse range of participants compared to Telegram. However, the proportion of users who engage in on-chain services is lower than on Telegram.

KakaoTalk open chat rooms have a limitation of 1,500 participants and lack features like message forwarding, making it less efficient for information sharing between chat rooms. The functionality of bots is also limited, and creating sub-channels within chat rooms is not possible. Additionally, with few international users, it tends to spread overseas news less efficiently.

These technical limitations and user characteristics mean that the KakaoTalk crypto community generally lacks the quality and expertise of information compared to Telegram, presenting several challenges in community management.

2.3. Coinpan

Coinpan is one of the largest cryptocurrency community websites in Korea. By the end of 2023, it boasted an MAU of 5.3 million, according to SimilarWeb. This surpasses the MAU of Bithumb, Korea's second-largest exchange by trading volume, which was approximately 4.7 million in December 2023. On March 27, 2023 alone, the number of posts on the free board reached 8,636, making it one of the most active communities in Korea.

Coinpan primarily hosts posts related to investment gains and losses, news, and investment rationale. Discussions often center around coins listed on centralized exchanges like Upbit and Bithumb, with many posts encouraging investment in specific coins. Profit and loss posts usually share screenshots from these exchanges, and profits from futures trading on international exchanges also frequently appear.

Coinpan users can see crypto prices from various exchanges, including Bithumb, Upbit, Coinone, Coinbit, Korbit, and Binance. They can also check for the Korean premium and volume information. However, some boards and features may require login or a certain level of community participation, which could act as an entry barrier.

2.4. DCInside

DCInside, often referred to as Korea's Reddit, is one of the most famous online community sites in Korea, known for its wild and free discussion culture based on anonymity. The site consists of various boards called 'gallery,' where users can engage in topics of interest.

Several cryptocurrency-related galleries exist on DCInside, such as the Bitcoin gallery, Altcoin gallery, NFT gallery, and cryptocurrency gallery. These galleries mainly focus on sharing information and discussing investments related to coins listed on Korean centralized exchanges like Upbit and Bithumb.

The communities here tend to be highly speculative, with discussions often dominated by subjective opinions and short-term trading strategies rather than objective information. Discussions on on-chain technologies or the long-term value of projects are relatively rare, with a focus instead on short-term profits driven by rapid price fluctuations.

While the quality of information in these galleries may be lacking, they serve as useful portals for understanding the interests and investment tendencies of Korean crypto investors.

2.5. X (formerly Twitter)

X, formerly known as Twitter, has established itself as one of the most widely used platforms by the global crypto community. Industry stakeholders primarily use Twitter for communication and information sharing.

However, the activity level of the crypto community on Twitter in Korea is somewhat lower compared to the global scale. The number of crypto-related Twitter users and tweet volumes in Korea are significantly lower than in Japan, possibly due to the platform's low popularity in Korea.

Though the absolute numbers are relatively low, the Korean crypto Twitter community includes various users interested in specific projects, chart analysts, fundamental investors, speculators, analysts, memecoin enthusiasts, and experts in DeFi and NFTs. Particularly, it is active among investors focused on fundamentals and research.

In Korea, Twitter is generally slower in timeliness compared to Telegram, where the fastest news delivery and most active discussions occur. However, Twitter tends to have a higher proportion of users engaged in on-chain activities compared to other communities.

2.6. Discord

Originally a platform for gamers, Discord has become widely used in the crypto community. Its key feature is community organization based on servers. Each project or organization can create its own server, and users can join servers that interest them to engage with the community.

In the crypto sector, Discord is primarily used for community formation centered around specific projects. Many projects operate their own Discord servers, sharing information about project updates, development progress, airdrops, and governance votes. Communication and discussion among community members are also actively facilitated.

However, discussions on Discord tend to be project-specific, with less emphasis on general investment information or market trends. This is partly due to the platform's project-centric nature and its structural characteristics, which make information sharing across servers challenging.

Discord offers various features such as voice chat, screen sharing, role assignment, and bot integration, making it a useful tool for community management. It is particularly popular among developers for integrating with GitHub to receive code updates and for technical discussions.

However, Discord engagement in Korea is somewhat limited compared to global levels. This is because the platform is still unfamiliar to Korean users, and language barriers make it difficult for them to participate in global communities. Also, the presence of locally preferred messaging platforms like Telegram and KakaoTalk makes Discord less frequently used in Korea.

2.7. Naver Cafe

Naver, as the largest portal site in Korea, hosts a popular community service known as Naver Cafe. It is one of the oldest and most widely used community platforms in the country, and it has been adopted by the crypto community as well. Within Naver Cafe, crypto communities primarily focus on altcoins listed on Korean centralized exchanges, sharing price chart analyses and investment information. This trend reflects the investors' preference for short-term gains and their interest in highly volatile altcoins.

While Naver Cafe is highly accessible and familiar, it has some shortcomings in terms of the reliability of the information. The platform frequently features successful investment history and coin recommendations, many of which lack objective evidence and are often speculative. Additionally, Naver Cafe has limitations in integrating with the global community. Most discussions within the cafe are conducted in Korean, and there is relatively little discussion about international projects or global trends. However, interest in on-chain activities such as DeFi, NFTs, airdrops, and liquidity staking has been growing recently, and activities related to these topics are on the rise within the cafe.

We have examined the characteristics of major Korean crypto communities formed across various platforms. Each platform has its own unique features in terms of user numbers, interests, and discussion culture. In the next section, based on this background knowledge, we will conduct an in-depth analysis of the topics that received significant attention in the Korean crypto community during 2023, and how these interests have impacted the market.

3. 2023 Korean Community Trends

3.1. Google Trends

Google Trends is a service provided by Google, the world's largest search engine, that allows users to see how frequently a particular term is searched for in a specific region over a given period. In Google Trends, the search volume is expressed as interest where the peak search volume during the selected period is set to 100, allowing for a comparison of relative changes. By utilizing Google Trends to analyze keywords, we can determine the topics of interest among Korean investors and users and compare these interests with those in other major countries.

3.1.1. Stock vs. Coin

- Korea's love for cryptocurrencies

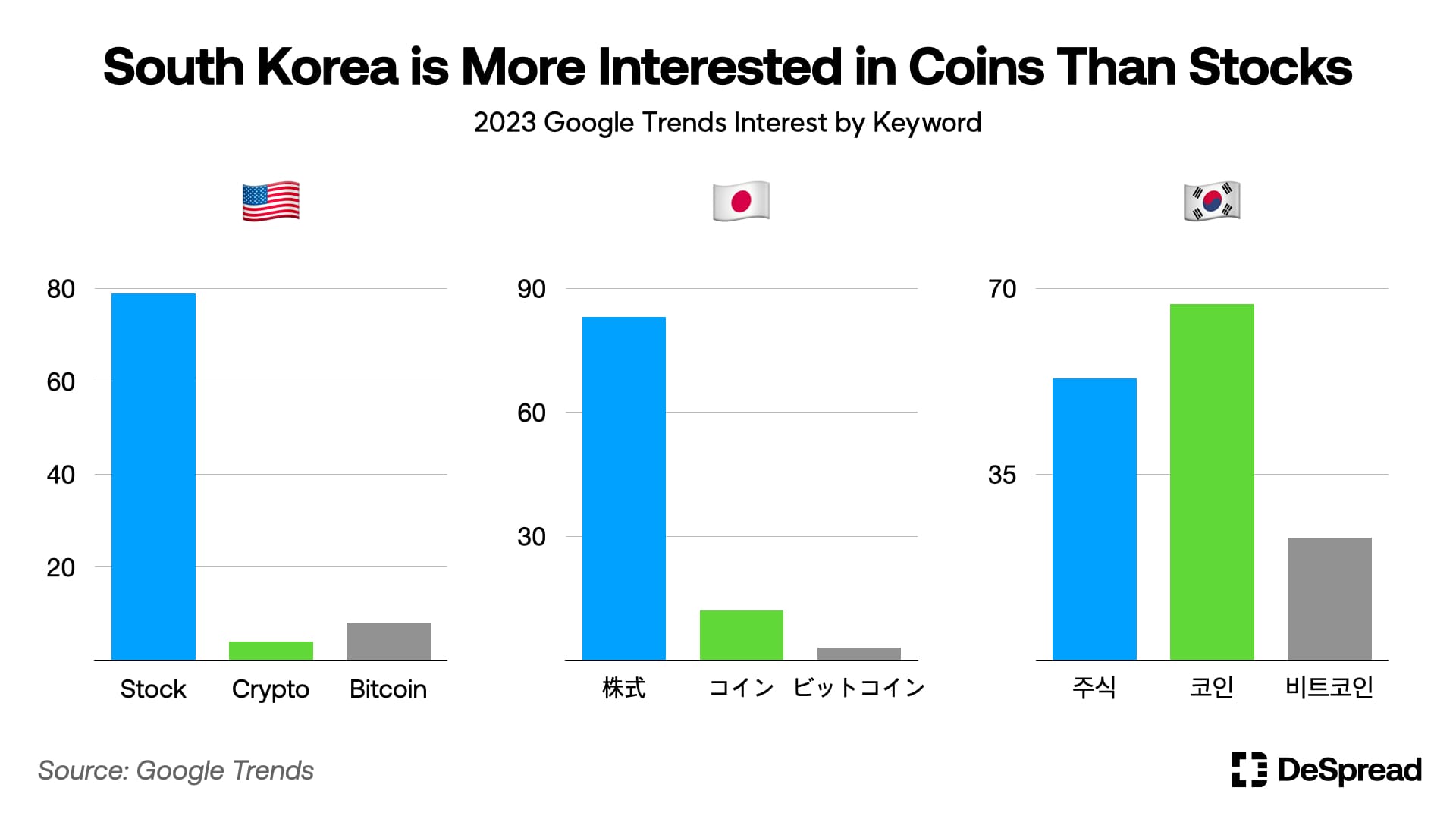

- When comparing the search volumes for "stocks" and "coins" between the United States, Japan, and Korea, Korea exhibited a significantly higher interest in cryptocurrencies compared to the other nations. In the United States, the search volume for stocks was about 20 times higher than that for cryptocurrencies, while in Japan, stocks had approximately 7 times the search volume of coins. In contrast, in Korea, the search volume for coins was about 25% higher than for stocks.

- This difference in interest is also reflected in the actual number of investors. In 2022, the number of Korean stock investors holding at least one share was about 14.41 million, representing 28% of the population. In contrast, the estimated number of cryptocurrency investors, based on accounts eligible for trading, was about 6.27 million, accounting for 12% of the population. This shows a considerable level of engagement with cryptocurrencies. Meanwhile, as of December 2022, the number of registered accounts on centralized exchanges in Japan was about 6.3 million, which represents only 5% of the population, indicating a relatively lower rate of cryptocurrency adoption.

- Comparison between Korea and Japan

- In Japan, interest in cryptocurrencies is somewhat lower compared to stocks, which is also reflected in trading volumes. For example, if we compare the trading volumes from May last year of the top five exchanges in Japan with Upbit, Korea's leading exchange, there is a significant difference: the Japanese exchanges had a trading volume of $4 billion, while Upbit had $27 billion.

- According to CoinGecko, the trading volume in Japanese exchanges is predominantly focused on Bitcoin and Ethereum, which contrasts with Korea's strong focus on altcoins. Despite this difference in trading preferences, the number of registered accounts on cryptocurrency exchanges in Japan is continuously increasing, indicating potential market growth. This growth is noted by the Japan Virtual and Crypto assets Exchange Association (JVCEA), suggesting that while the current market engagement may be lower compared to Korea, there is a potential within Japanese crypto market.

3.1.2. Comparison of Interest in Representative Exchanges by Country

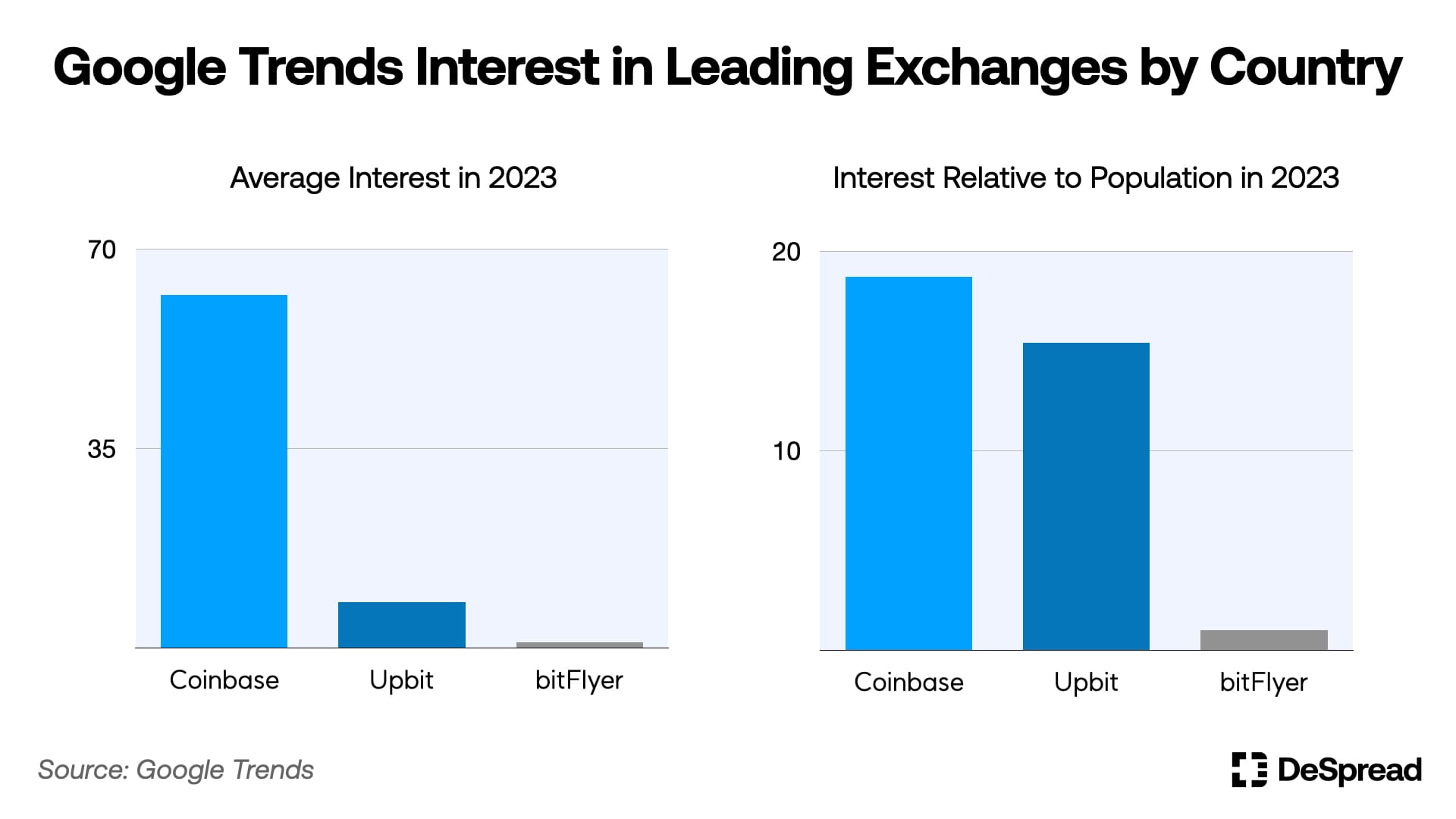

- The role of exchanges: Centralized exchanges are indispensable components of the blockchain and cryptocurrency industry. They serve as gateways to on-chain activities and are the most accessible venues for investment. For this analysis, we've selected Coinbase for the United States, Upbit for Korea, and bitFlyer for Japan, to evaluate the interest levels each country has in cryptocurrencies and their centralized exchanges.

- High interest relative to population in Korea: Analysis of search volume data reveals that although Coinbase commands an overwhelming level of absolute interest globally, when adjusted for population, Upbit and Coinbase exhibit similar levels of interest. This indicates a high rate of cryptocurrency exchange usage in Korea, suggesting a robust engagement with the crypto market among Koreans. On the other hand, Japan's bitFlyer shows both very low absolute search volumes and interest relative to population, which indicates that the usage of crypto exchanges in Japan is relatively less active compared to Korea and the United States.

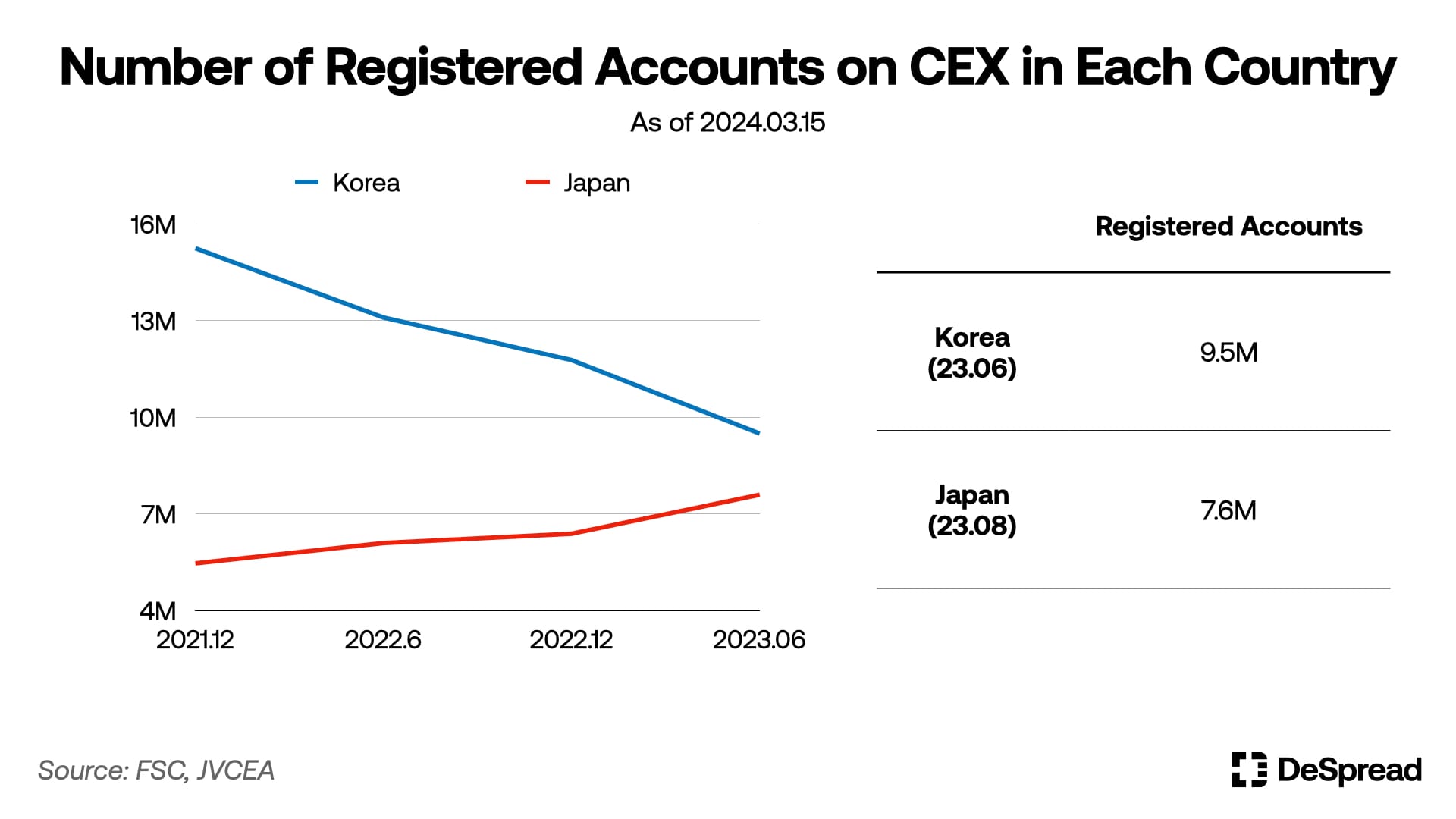

- Characteristics of each country's crypto environment: The U.S. crypto trading environment heavily revolves around global exchanges such as Coinbase. Coinbase targets a global user base and had completed KYC for approximately 110 million users by the end of 2022, a number exceeding the total population of South Korea. As of the first half of 2023, there were 9.5 million registered accounts on centralized exchanges in Korea, with about 6 million of those being active traders. In contrast, as of August 2023, Japan had only 7.6 million registered accounts on centralized exchanges. Compared to Korea, this number shows a lower user rate relative to its population.

3.1.3. Centralized Exchanges vs. On-chain Keyword Comparison

- Benchmark for on-chain interest: Compared to using centralized exchanges, participating in on-chain activities typically involves a higher entry barrier. By analyzing the search volumes for keywords associated with representative exchanges and on-chain related keywords, we can indirectly gauge the level of interest in on-chain activities among countries.

- Interest in on-chain trading: As an indirect indicator of interest in on-chain trading, we selected Uniswap, a leading decentralized exchange (DEX), for comparative analysis with each country's prominent centralized exchanges. The results show that interest in on-chain trading, relative to interest in centralized exchanges, is ranked in order from the United States, Japan, and then Korea. Particularly in Korea, while cryptocurrency investment activities are vigorous, the relative interest in on-chain activities appears lower. In Japan, interest in Uniswap is comparatively high, but this may be accentuated by the notably low interest in bitFlyer, suggesting that the higher relative interest in Uniswap may be more due to the lack of interest in their centralized counterpart rather than a genuine high engagement with decentralized trading platforms.

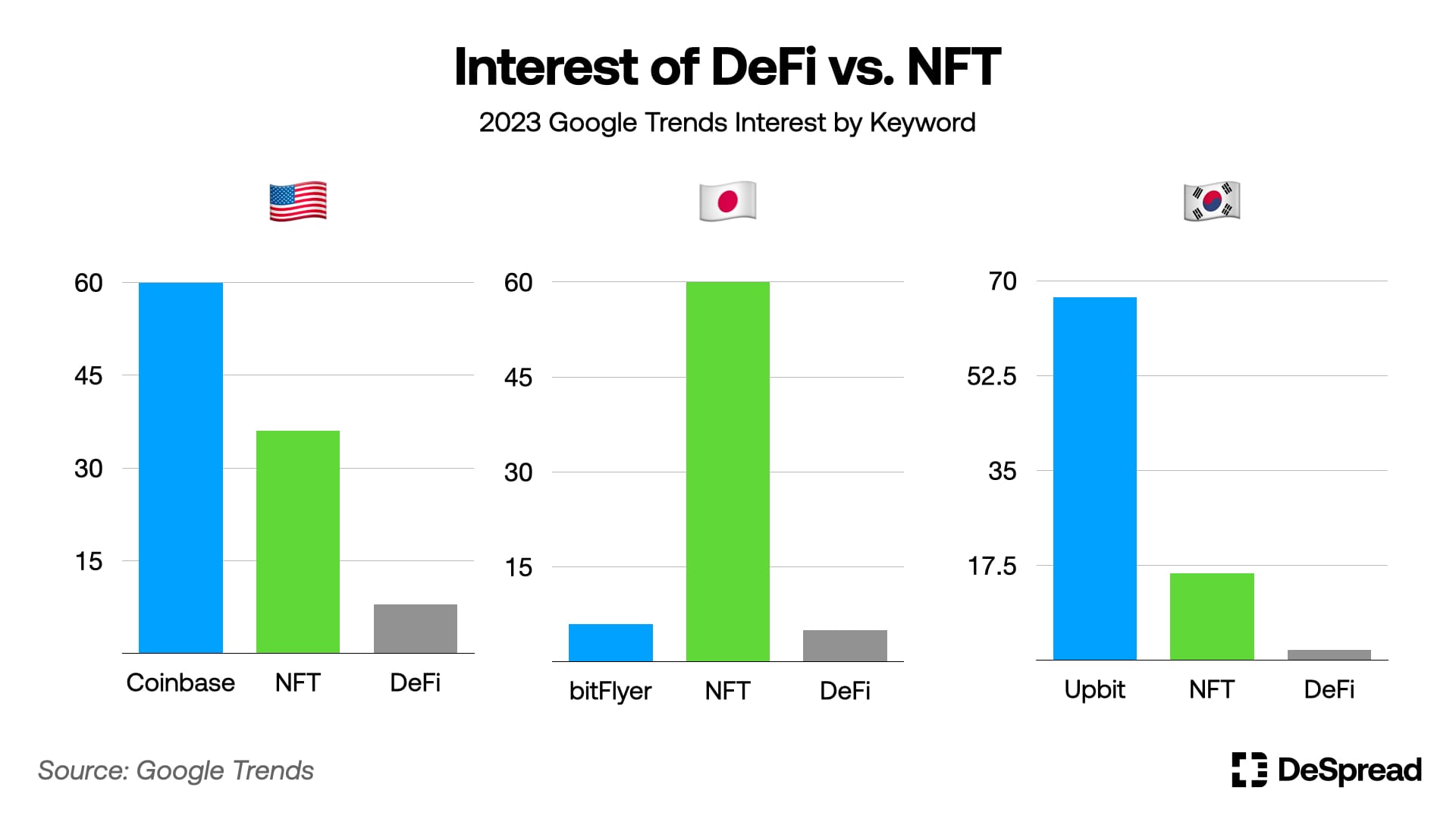

- NFT and DeFi: In both the United States and Korea, the interest in NFTs surpasses that in DeFi. This trend can likely be attributed to the easier comprehensibility and higher accessibility of NFTs, as well as their frequent use in promotional airdrops, which make them more appealing to the general public. In Japan, interest in NFTs is notably higher than in centralized exchanges, suggesting a relatively more vibrant NFT market.

- Developer proportion and on-chain interest: According to Electric Capital, while 28% of global crypto developers are based in North America, only 11% are in the East Asia & Pacific region, which includes Korea. Although specific data for Korea was not disclosed, it appears that the proportion of protocol developers in Korea is very low compared to its trading volume. This indicates a stronger focus on trading through centralized exchanges rather than on developing on-chain technologies within Korea.

In summary, Korea shows high interest in crypto investments and trading but relatively lower interest in on-chain activities such as NFTs and DeFi. On the other hand, the United States exhibits a high interest in on-chain activities, and Japan displays a particularly strong interest in the NFT market.

3.2. Telegram Crypto Community

An analysis was conducted on 110 active Korean-language crypto announcement channels on Telegram. Channels that primarily focused on corporate announcements or news headlines were excluded from this study to concentrate on those that foster community interaction and engagement. We'll take a look at what channels Korean crypto investors on Telegram were paying attention to, what topics they were interested in, and what sentiment they expressed.

3.2.1. Acitivty Analysis

The chart above shows the price of Bitcoin in 2023 and the number of messages per month on 110 Korean crypto community channels.

- BTC price and community activity: There is a clear trend where increases in BTC prices align with heightened activity in the community channels. This was particularly evident from October to December 2023, when a sharp rise in BTC prices led to a significant uptick in message volume. This suggests that price rallies stimulate investor interest and participation, leading to more vibrant discussions and information sharing.

- Channel activity in bear market: During August and September 2023, when BTC prices showed a decline, there was a corresponding drop in the number of messages in the channels. This pattern indicates that bear markets tend to dampen investor enthusiasm, resulting in decreased community interaction.

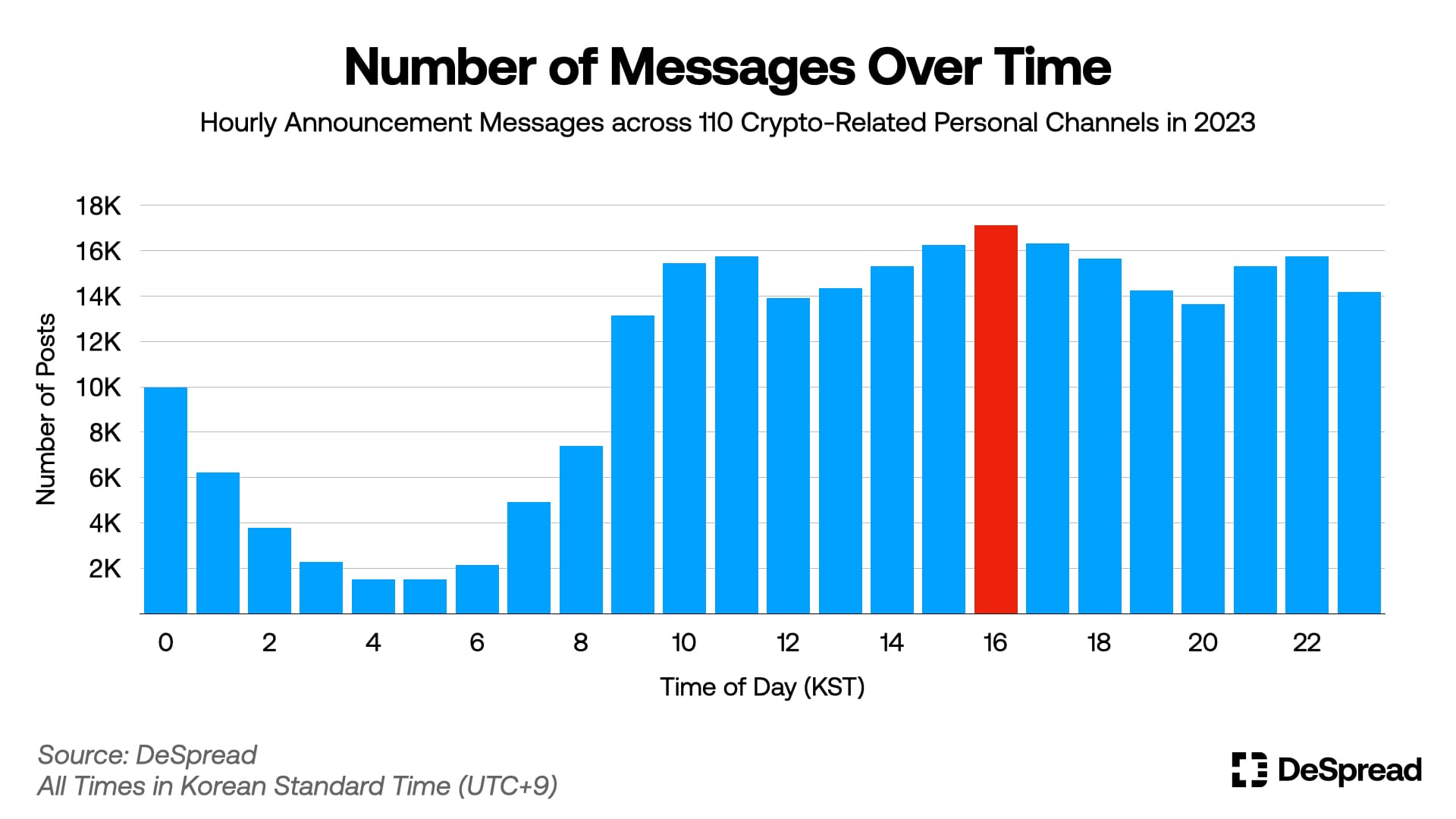

- Most active time period: An hourly analysis of message volumes revealed that community activity was most vibrant between 4 PM and 5 PM KST. The activity starts to increase around 9 AM, maintaining a high level until about 11 PM, with the period from 2 PM to 6 PM being particularly active peaking at 4 PM. While the least amount of activity occurred from 2 AM to 6 AM KST.

The general pattern of Telegram crypto channel activity closely mirrors typical workday patterns in Korea. Interestingly, the steady activity continues after 6 PM. The fact that the community remains active after 3:30pm, when the stock market closes, can be seen as a reflection of the 24-hour global nature of the crypto market.

3.2.2. 2023 Trend Keyword Analysis

Throughout 2023, an analysis of the most frequently mentioned keywords across 110 personal cryptocurrency Telegram channels in Korea was conducted. The results showed that the most commonly mentioned keywords were "Bitcoin," "NFT," "Airdrop," and "Ethereum." Notably, while Google Trends indicated that interest in NFTs was lower in Korea compared to other countries, the keyword ranked highly in the Telegram channels. This discrepancy suggests that many projects utilized free NFT airdrops as a marketing strategy.

Investors showed significant interest in free offerings, and the prevalence of active on-chain users on Telegram contributed to this trend. The analysis also explored which keywords dominated the Korean community discourse each month:

January - Macroeconomic uncertainty

The focus was on macroeconomic uncertainties, highlighted by keywords related to the “Year-end settlements”, "CPI," "FOMC," and "Interest rates." These topics were prominent due to the overarching downturn in the crypto market, fueled by concerns about interest rate hikes and a potential economic recession.

February & March - Airdrop & USDC depegging

These months were marked by the "Silvergate" and "SVB" bankruptcy events in Feburary and the "USDC” depegging in March. Despite the overall market sentiment being bearish, February saw significant interest in the Blur token airdrop from the NFT marketplace Blur, and March featured the Ethereum layer 2 project "Arbitrum" airdrop, which reinvigorated market activity. Blur's airdrop helped it emerge as a formidable competitor to the established OpenSea, while Arbitrum's airdrop encouraged increased engagement with dApps within the Arbitrum ecosystem. Furthermore, the keyword "ZK Sync" also ranked high during this period, indicating heightened anticipation for upcoming airdrops related to this project.

April - Memecoin boom & SUI

In April, fueled by the memecoin mania represented by "Pepe (PEPE)," speculative sentiment surged as Pepe’s price skyrocketed over 80 times within just three days, swiftly becoming the center of attention. Additionally, the launch of the next-generation Layer 1 blockchain "Sui," developed by former Meta employees, garnered significant interest within the crypto community. South Korea's top five exchanges listed Sui in their KRW markets simultaneously for the first time.

May - BRC-20 token standard & Regulatory issues

In May, the Bitcoin network's 'BRC-20' token standard attracted considerable attention. Utilizing the Ordinals protocol, BRC-20 operates by embedding information onto Bitcoin similarly to NFTs, differing notably from the ERC-20 standard. While it presents some inconveniences, such as needing new inscriptions for token transfers and off-chain indexing for balance tracking, it has been perceived as a promising expansion within the Bitcoin ecosystem.

Additionally, the political realm heated up with the "Kim Nam-guk incident," involving allegations of substantial cryptocurrency holdings and trading by the lawmaker during committee meetings, further compounded by his participation in drafting a bill to postpone crypto taxation, leading to conflict of interest accusations. This resulted in the enactment of an amendment to the Public Service Ethics Act, requiring public officials to declare the type and amount of cryptocurrencies they own, effective from December 14, 2023.

June - Consecutive bankruptcy of CeFi platforms

In June, the Korean crypto industry was rocked by the consecutive bankruptcies of major domestic CeFi platforms "Haru Invest" and "Delio." These platforms, which had attracted investors with high interest rates, faced liquidity crises due to opaque fund management and poor partner selection, leading to a sudden halt in withdrawals. Investigations revealed that Haru Invest suffered significant losses from the FTX collapse, which in turn caused a cascading crisis for Delio. The estimated damage amounts to approximately 103 billion KRW, and both companies are currently undergoing corporate rehabilitation procedures.

This incident starkly highlighted the transparency issues and poor risk management practices within CeFi platforms, significantly damaging industry-wide trust. Notably, Delio, which had even obtained a license from the Financial Services Commission, underscored the limitations of achieving trust through regulatory entry alone. Consequently, this crisis has prompted a re-evaluation of the advantages and disadvantages of CeFi and DeFi within the community. DeFi, with its on-chain transparent fund management, is now being viewed as a viable alternative.

July - Ripple’s partial victory against the SEC, Worldcoin launch, Japanese market

July was marked by Ripple's partial victory in its lawsuit against the SEC, where the New York District Court ruled that sales to general investors were not a violation of securities laws. This significant legal precedent influenced the discourse on the nature of cryptocurrencies as securities, boosting Ripple’s price and its prominence within the Korean community, which holds a substantial amount of Ripple.

Additionally, the launch of "Worldcoin," supported by OpenAI's CEO Sam Altman, captured global attention with its unique structure using iris recognition to distribute cryptocurrency, raising concerns about privacy and the distinction between humans and AI. Worldcoin was listed on major exchanges worldwide, including Bithumb, Korbit, and Coinone in South Korea.

The keyword "Japan" also frequently surfaced, especially in July, during the 'WebX Tokyo,' Japan's largest blockchain conference, accompanied by discussions of Japan's crypto-friendly government policies.

August - Curve hacking, Sei mainnet launch, Anticipation for Bitcoin spot ETF approval

In August, the crypto community was deeply shaken by the 'CRV' hacking incident. A vulnerability in the decentralized exchange 'Curve Finance' led to the loss of over $50 million. The situation was particularly alarming because the founder of Curve had taken out loans using CRV as collateral across several DeFi protocols. This raised concerns about potential cascading liquidations if the price of CRV continued to fall. Fortunately, CRV's price eventually recovered, averting the worst-case scenario, though the incident undeniably damaged trust in the platform.

Another major topic of interest was the listing of 'SEI.' With its mainnet launch, SEI was simultaneously listed on South Korea's top five exchanges, generating significant excitement. SEI also secured listings on major international exchanges such as Coinbase and Binance, establishing its global presence. The project was praised for its investor-friendly tokenomics, including a 25% airdrop of its total supply to the community.

Additionally, August marked a growing anticipation within the Korean community for the approval of a Bitcoin spot ETF. The submission of applications by major financial institutions like BlackRock and Fidelity fueled expectations that institutional interest and participation in the crypto market were becoming more mainstream. However, the SEC's decision to postpone the approval once again brought a sense of caution and concern among the community members.

September - KBW & Friend.tech

In September, the Korean crypto community was abuzz with the largest blockchain event in the country, 'Korea Blockchain Week (KBW) 2023.' Held in Seoul from September 4 to 9, the event attracted significant attention. Notable figures such as Ethereum co-founder Vitalik Buterin, Circle CEO Jeremy Allaire, and Maelstrom Fund CIO Arthur Hayes attended, engaging in deep discussions on various aspects of blockchain technology. Numerous Korean blockchain projects also participated, sharing their visions and achievements with the broader community.

Another major highlight of September was 'Friend.tech.' Launched on August 10, Friend.tech saw its Total Value Locked (TVL) skyrocket from $5 million to $50 million within just a month, nearly a tenfold increase. The anticipation of future airdrops and the involvement of key opinion leaders (KOLs) in the Korean community using the service generated substantial excitement and discussion.

October - $MEME & $SPURS

In October, the crypto community was buzzing with news about the launch of the $MEME token by Memeland, an NFT project created by the popular community '9GAG.' Meme Land had already garnered significant attention through its issuance of NFTs such as Captains and Potatoz. The announcement of the $MEME token launch and the initiation of a farming event intensified this interest. Even non-NFT holders could earn points through simple social missions, which were expected to influence the subsequent distribution of $MEME tokens, drawing substantial attention from the community. Additionally, the fan token SPURS, associated with Tottenham Hotspur where Son Heung-min plays, was introduced and listed on exchange launchpads, attracting significant attention.

November - Celestia mainnet launch & Airdrop

In November, the launch of the modular blockchain 'Celestia (TIA)' mainnet captured significant attention within the crypto ecosystem. Celestia was simultaneously listed on major global exchanges, including Bithumb, Coinone, and Korbit in South Korea, highlighting its prominence and generating substantial interest. Prior to the mainnet launch, Celestia conducted a large-scale airdrop targeting Cosmos users and others who met specific criteria, which drew considerable interest from investors. Users who frequently interacted with the network received an average of over 300 TIA tokens, with the initial trading price hovering around 3,000 KRW.

December - Fusionist Bianance launchpool & WEMIX relisting

In December, the Web3 game 'Fusionist' gained significant attention as it was unveiled as the 40th Binance Launchpool project. Upon listing, Fusionist's price soared above $10, delivering substantial profits to the investors.

Additionally, there was notable news regarding the relisting of WEMIX on KRW markets. Previously delisted due to discrepancies between the reported and actual circulating supply submitted to the Digital Asset eXchange Alliance (DAXA) by WEMIX, the token faced scrutiny. However, in December, WEMIX was relisted on Coinone, Gopax, Korbit, and Bithumb, making it available on four of the five major DAXA exchanges, excluding Upbit. While the relisting suggests that some issues with WEMIX's circulating supply have been resolved, transparency regarding circulating supply remains a significant concern for Korean investors.

3.2.3. Primary Information Source

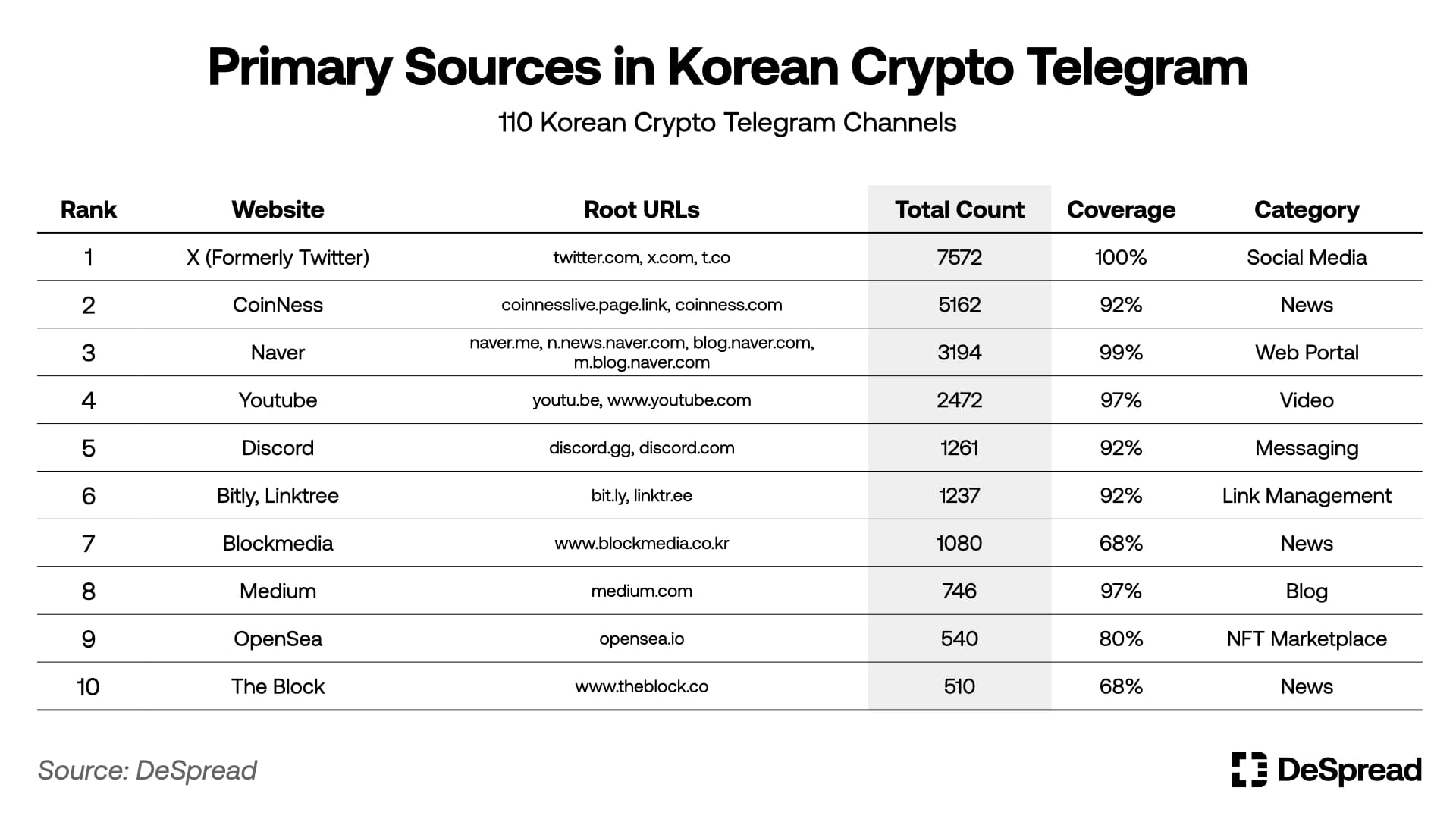

To analyze the information sources and their influence on the Korean crypto community, data from 110 crypto-related personal Telegram channels were collected throughout 2023. By aggregating the citations from each channel, the top 10 platforms were identified based on their usage frequency.

The results are presented above, where 'Coverage' indicates the proportion of the 110 channels that referenced a particular source at least once during the year. For instance, if all channels cited a specific platform at least once, that platform's coverage would be 100%.

- Influence of X: An analysis of 110 Korean crypto Telegram personal channels revealed that X (formerly Twitter) is the most frequently cited source of information. X was referenced 7,572 times, approximately 1.4 times more than CoinNess, which ranked second. This predominance is likely due to nearly all Web3 projects operating official X accounts, making it a common source of information. Additionally, X is the most widely used platform by global crypto users. In terms of coverage, X achieved 100%, indicating its significant influence within the Korean crypto community.

- Korean Media: Among Korean platforms, CoinNess, Naver, and Blockmedia were the most frequently cited sources of information on Telegram. CoinNess led the Korean platforms with 5,162 references and 92% coverage. Coinness primarily offers short foreign news articles translated and uploaded in real-time, allowing users to quickly grasp the latest trends and issues, making it a frequently shared source on Telegram. Naver, Korea's leading portal site, recorded 3,194 references and 99% coverage. As a platform with extensive news services and numerous blog postings, Naver has established itself as a crucial source of information within the Korean crypto community. Blockmedia, a specialized Korean blockchain media outlet, was cited 1,080 times with a 68% coverage rate. Blockmedia's articles often cover trends in both domestic and international traditional financial markets, cryptocurrency market trends, major projects and corporate news, and regulatory issues. However, compared to CoinNess, Blockmedia is slower with updates, and its content frequently includes traditional financial market topics, resulting in relatively lower coverage.

3.2.4. Channel Forward Rank

The chart illustrates the top 10 most forwarded channels among 110 Telegram channels. "Forwarding," similar to reposting on X, means sharing a message from one channel to another, serving as an indicator of a channel's influence and popularity.

The most forwarded channel was ‘코인같이투자 (WeCryptoTogether),’ with an impressive 168,765 forwards. This number is about 34% higher than the second-ranked channel, ‘취미생활방 (enjoymyhobby),’ which had 125,919 forwards. ‘WeCryptoTogether’ boasts approximately 33,000 subscribers, making it one of the largest Korean crypto Telegram channels. It offers various project information and analysis. Half of the top 10 channels have over 10,000 subscribers, indicating that channels with a larger subscriber base tend to be forwarded more frequently.

3.2.5. Average Forward Rank

In addition to examining the most forwarded channels, it is also insightful to analyze the rankings based on the average forwards per message. This metric provides another indicator of a channel's message quality and influence.

The channel ‘유트로의 크립토 서바이벌 (jutrobedzielepsze)’ ranked first in average forwards per message, with an impressive 57.5 forwards per message. This is about 57% higher than the second-ranked channel, ‘ICOROOTS,’ which averaged 36.6 forwards per message. Interestingly, despite its high average forwards, ‘jutrobedzielepsze’ ranks only 8th in terms of subscriber count among the listed channels. This suggests that the effectiveness of message dissemination is influenced more by the quality of individual messages than by the number of subscribers.

3.2.6. Message View Rank

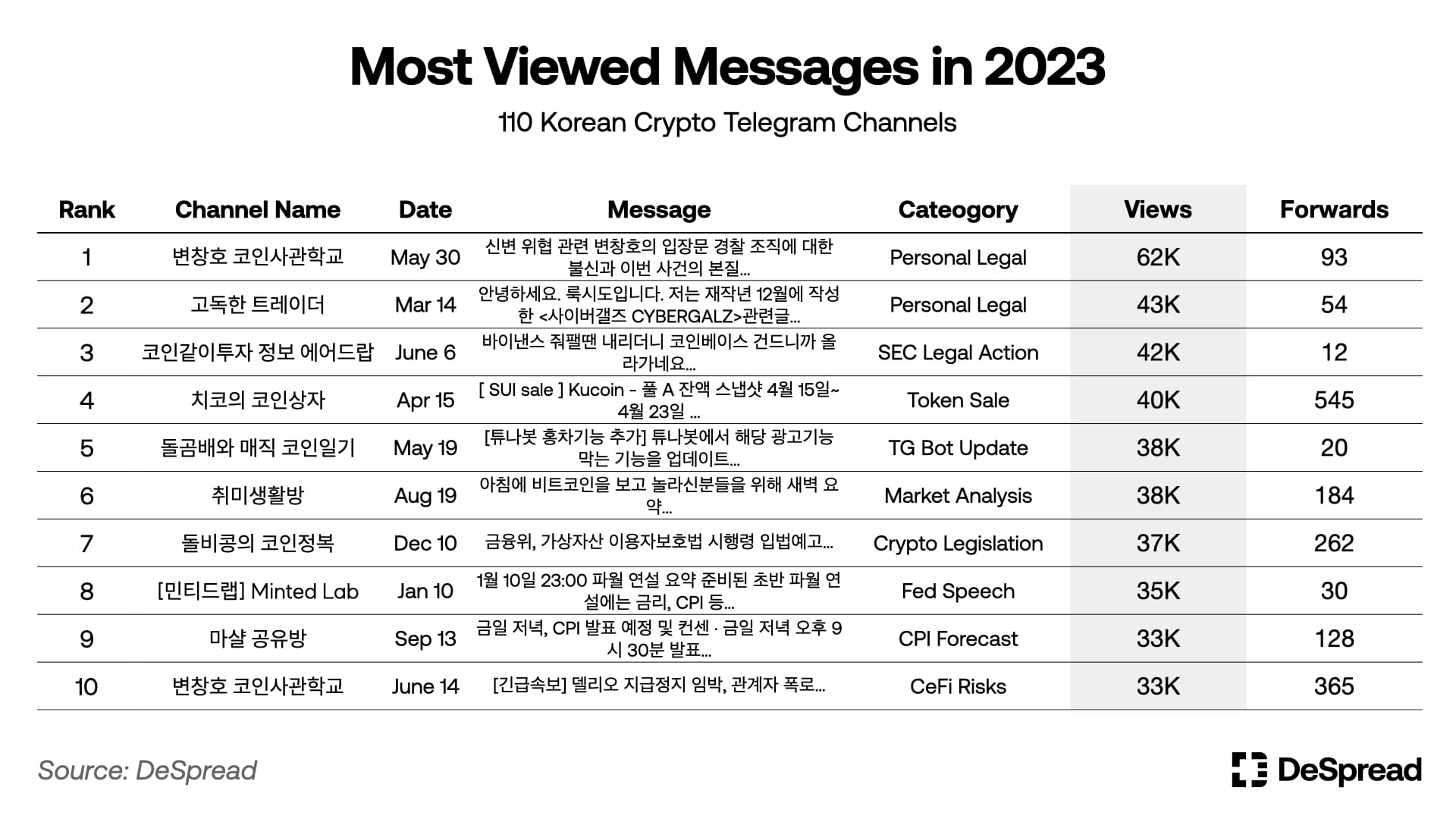

Throughout 2023, three main topics emerged as the most viewed in the Korean crypto Telegram community.

First, there was a significant focus on legal and regulatory concerns, such as data breaches, money laundering, and financial crimes. These topics dominated the top spots, reflecting the community's anxiety about industry uncertainties and risks.

Second, information about new investment opportunities, particularly token sales, garnered substantial attention. For instance, information regarding the SUI token sale ranked fourth in views, indicating that Korean investors are highly responsive to new projects and potential profit opportunities.

Third, consistent interest was shown in macroeconomic indicators like the Consumer Price Index (CPI). This indicates that investors are keen on monitoring broader economic trends to predict crypto market movements.

While personal events and issues related to specific projects attracted high viewership, they did not see as many forwards. Conversely, information about investment opportunities, such as the SUI token sale, was both highly viewed and frequently forwarded, highlighting active information sharing on practical investment opportunities.

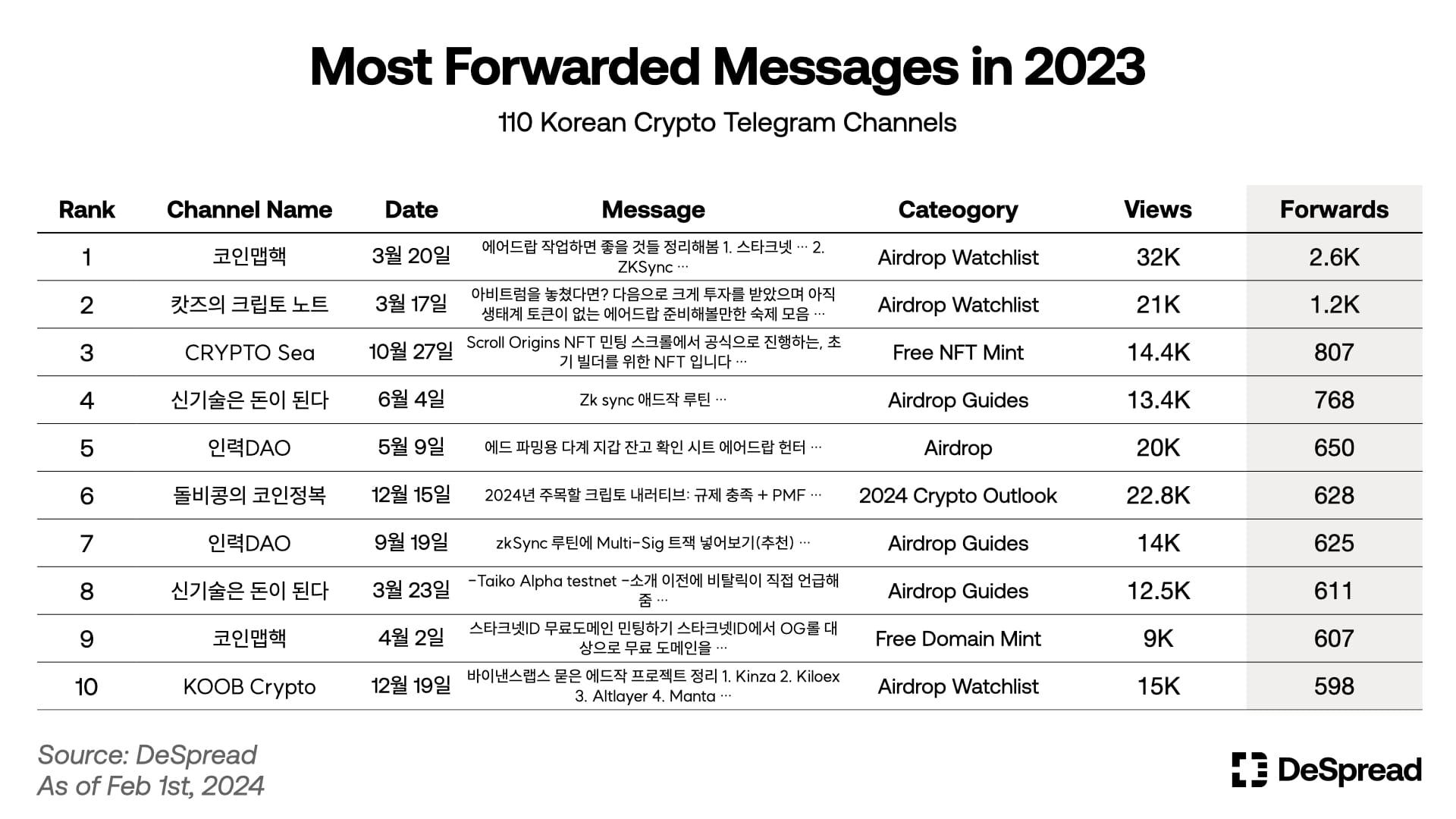

3.2.7. Message Forward Rank

In 2023, the most forwarded messages within the Korean crypto Telegram community predominantly focused on airdrop information. The top forwarded message, posted on March 20th in the '코인맵핵 (centurywhale)' channel, was titled "Summary of Good Airdrop Tasks." This post, which detailed how to participate in airdrops from promising projects like StarkNet, zkSync, and LayerZero, was forwarded over 2,600 times. This high forwarding rate indicates significant interest among investors in airdrops.

Messages ranking from second to tenth also mainly discussed airdrops or opportunities for free NFT minting, underscoring the community's keen interest in obtaining assets without direct investment. Notably, airdrop information about next-generation projects like zkSync, StarkNet, and Scroll appeared frequently among the top messages. Additionally, a noteworthy message was posted on December 19th in the 'KOOB Crypto' channel, titled "Summary of Airdrop Projects Funded by Binance Labs." Despite being relatively recent, it made it into the top ten most forwarded messages, demonstrating the community's continued interest in projects backed by major exchanges.

Overall, the analysis reveals that the most actively shared information in 2023 was practical and directly related to airdrops. This trend highlights the investors' sensitivity to new profit opportunities and a particular interest in next-generation promising projects.

3.2.8. Bitcoin Sentiment Analysis

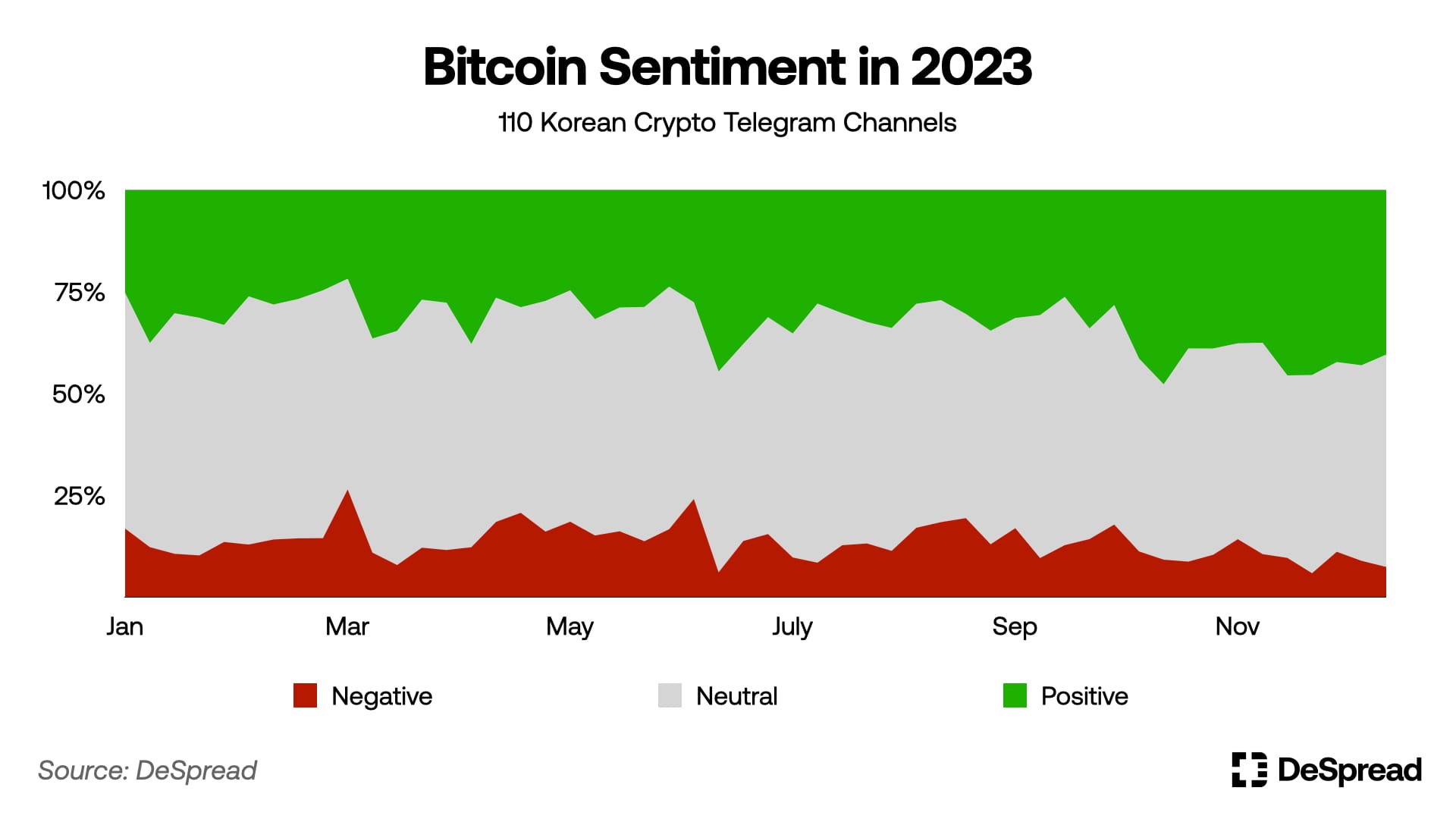

Using OpenAI's GPT-4 model, a sentiment analysis was conducted on messages containing the keywords 'Bitcoin' and 'BTC' within the Korean crypto Telegram community throughout 2023. The prompt was designed to categorize messages as positive, negative, or neutral based on their sentiment towards Bitcoin, while also determining their relevance and categorizing the content. Marketing and promotional messages were excluded from the analysis, resulting in a total of 22,878 messages being classified.

A significant increase in positive sentiment was noted in June. This was closely linked to a rise in Bitcoin prices during that period. Comparing Bitcoin price charts with sentiment trends revealed that positive sentiment typically expanded during price upswings, while negative sentiment grew during downturns.

However, the sentiment generally lagged behind price movements rather than leading them. This suggests that investors' sentiments were reactive, shifting in response to price changes. Also, there was a noticeable increase in positive sentiment towards the latter half of the year. This trend can be attributed to growing anticipation of Bitcoin ETF approvals towards the end of the year, which bolstered investor optimism.

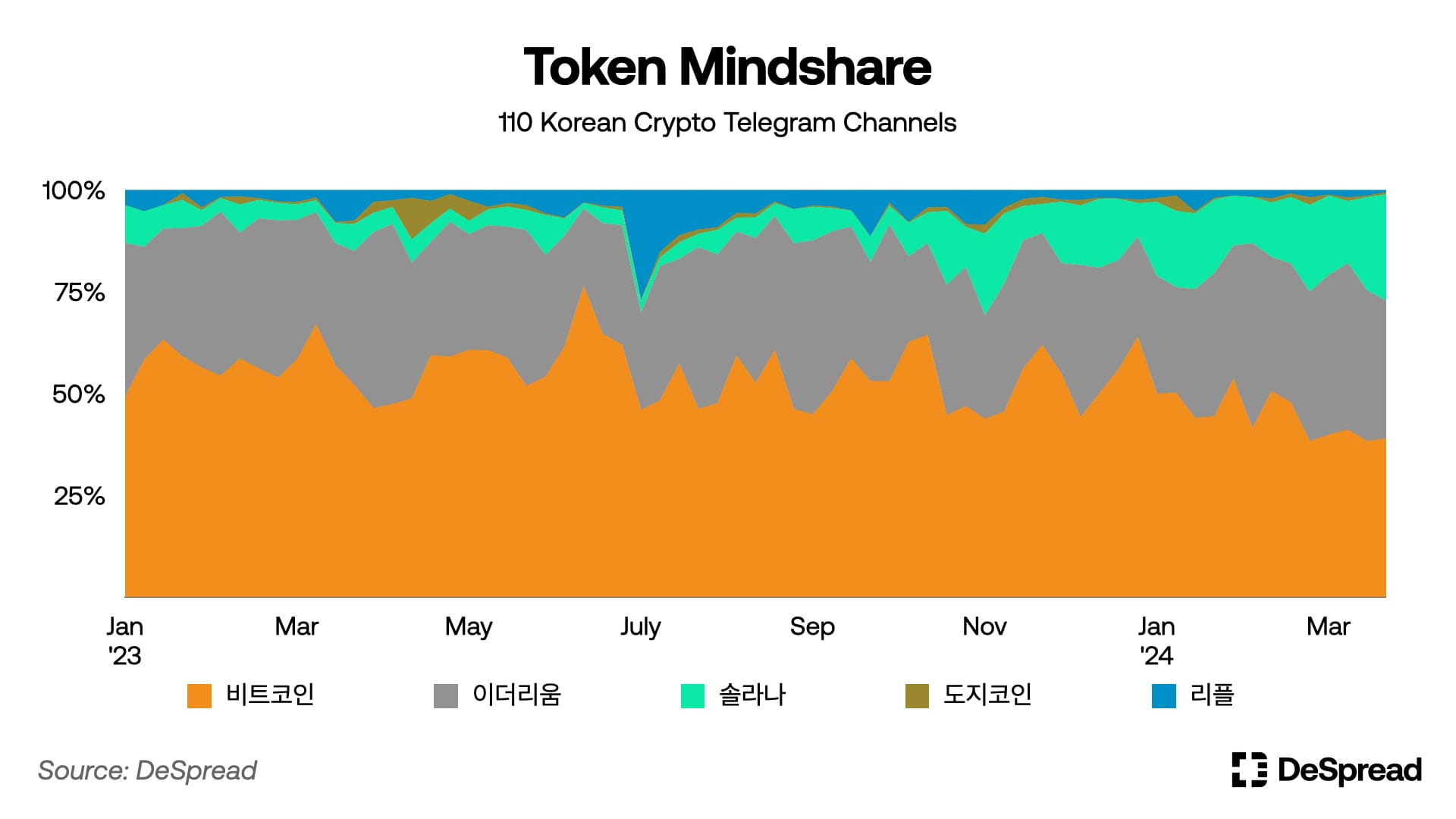

3.2.9. Token Mindshare

This analysis aims to determine the proportion of discussions within the community focused on specific tokens, referred to as "Token Mindshare." A higher mindshare percentage indicates greater community interest in a particular token.

The analysis reveals that Bitcoin (BTC) and Ethereum (ETH) consistently maintained high mindshare percentages throughout the analyzed period. This steady interest underscores their status as cornerstone assets in the crypto market, continuing to capture investor attention.

From July 2023 onwards, Solana (SOL) experienced a significant rise in mindshare. By spring 2024, Solana's mindshare nearly matched that of Ethereum. This surge in interest can be attributed to several factors such as the rapid expansion of the Solana ecosystem, the launch of various projects, the anticipation of airdrops, and the explosive popularity of the Solana memecoin ecosystem.

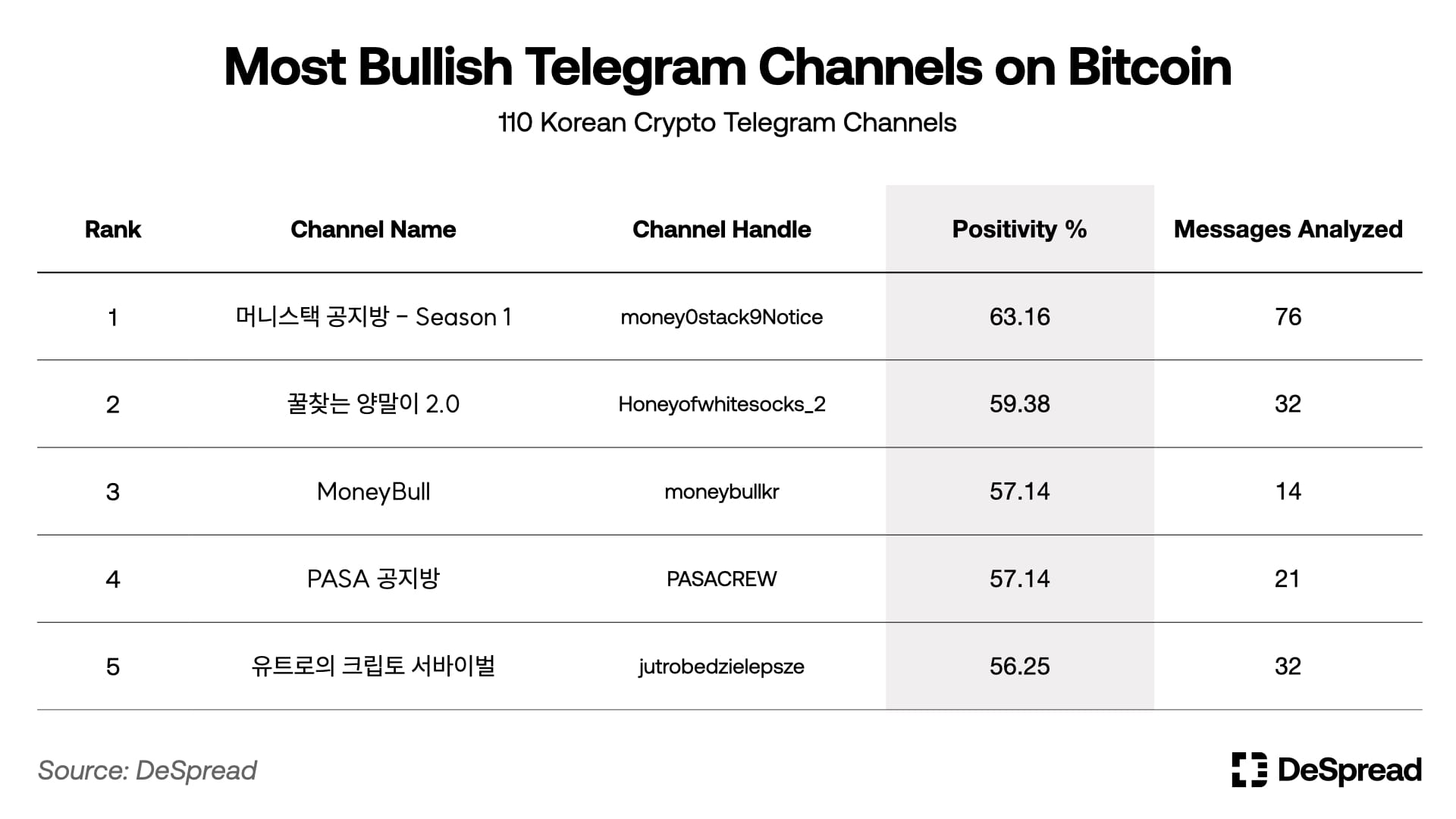

3.2.10. Most Bullish Channels for Bitcoin

By analyzing 110 personal Telegram channels with the GPT-4 model over 2023, we were able to identify the channels that sent the most positive messages about Bitcoin.

The top channel, '머니스택 공지방 (money0stack9Notice),' had 63% of its Bitcoin-related messages conveying positive sentiment. This channel also posted 76 messages about Bitcoin, making it the most prolific in sharing Bitcoin-related information and opinions among the top channels. '머니스택 공지방' is known for promptly delivering professional and in-depth information about Bitcoin and the Bitcoin Layer 2 ecosystem, Stacks. The channel actively covers new developments and favorable news related to Bitcoin, maintaining an objective and balanced perspective. As of the analysis, it had around 3,700 subscribers.

It's noteworthy that the high proportion of positive messages did not equate to unconditional buy recommendations. The channel focused on delivering objective information, discussing the development of the Bitcoin ecosystem, and exploring the technical aspects of Bitcoin. This balanced approach contributed to its reputation and subscriber count.

3.3. X (Twitter)

Twitter has become one of the most important communication platforms in the global crypto community, where many projects and influencers share the latest information and engage in active discussions. However, in Korea, Twitter usage is significantly lower compared to other countries, and this trend is evident within the crypto community as well.

While the exact number of Twitter users is not publicly available, DataReportal's report indicates that as of April 2023, Korea had approximately 9.8 million Twitter users. This is significantly less compared to 95.4 million users in the United States and 67.5 million users in Japan.

When analyzing the number of tweets containing Bitcoin-related keywords by language over time, the disparity becomes clear. For example, during the same period, Japan averaged around 17,000 Bitcoin-related tweets, whereas Korea averaged only about 1,700 tweets. Even when considering the number of Twitter users, the per capita volume of Bitcoin tweets in Korea is relatively low.

3.4. DCInside

DCInside is a prominent online community platform in Korea, consisting of various topic-specific boards known as 'Gallery.' An analysis was conducted on the posts within the 'Bitcoin’ gallery over 2023, the most frequented cryptocurrency-related gallery on the platform.

3.4.1. Activity

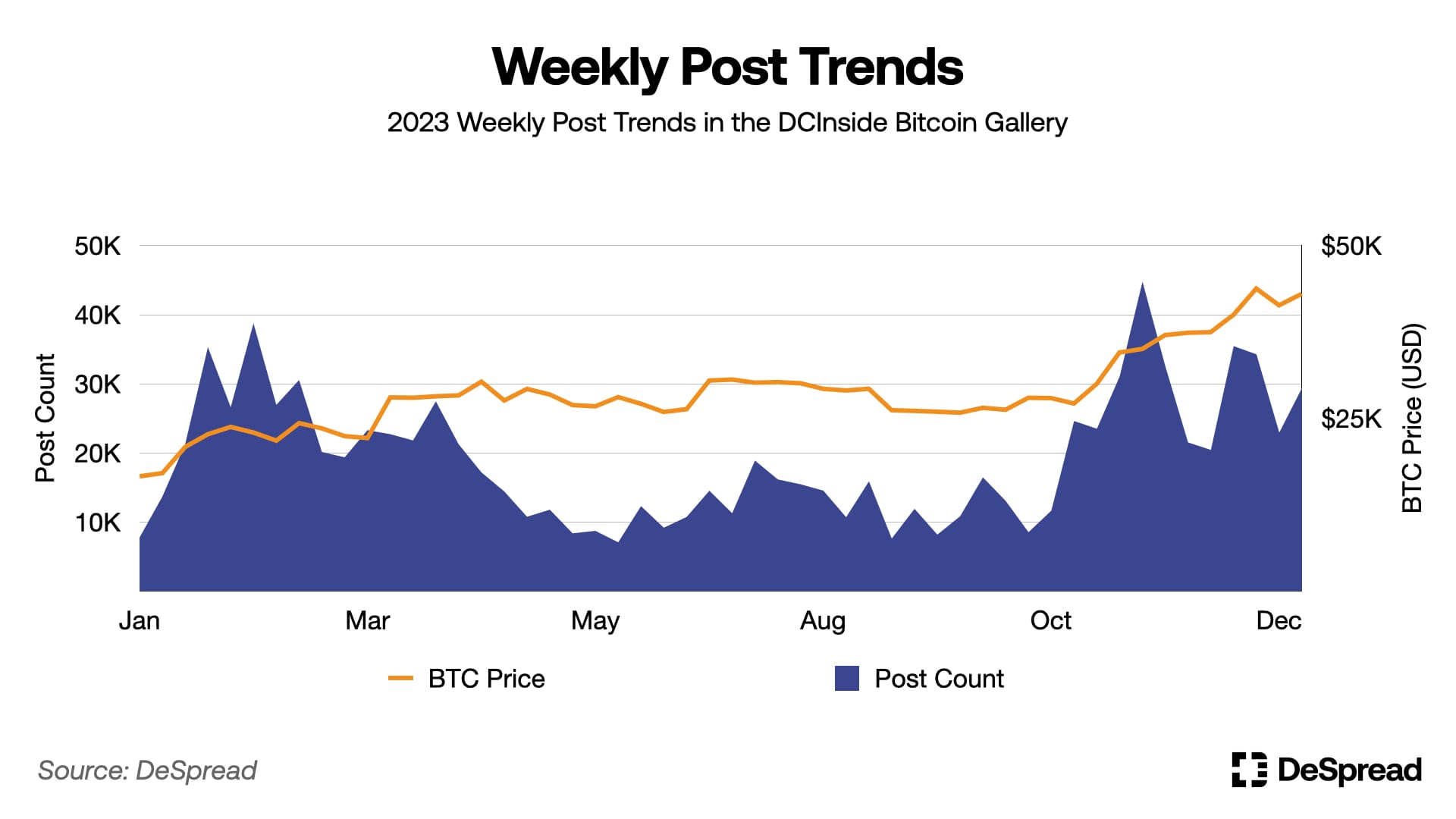

An analysis of the weekly posts in the DCInside Bitcoin Gallery in 2023 revealed a correlation between the gallery's activity and BTC price movements. Similar to trends observed on Telegram, the gallery's activity tended to increase during periods of rising BTC prices. In late October, when BTC prices surged sharply, the weekly post count reached a peak of approximately 45,000 in early November. This surge in activity suggests that DCInside Bitcoin Gallery users were actively sharing information and engaging in discussions in response to market movements. On the other hand, during periods of stagnant BTC prices, the gallery saw a noticeable decline in activity. This indicates that a subdued market environment led to reduced investor engagement and fewer posts.

3.4.2. Bitcoin Gallery TOP Keywords

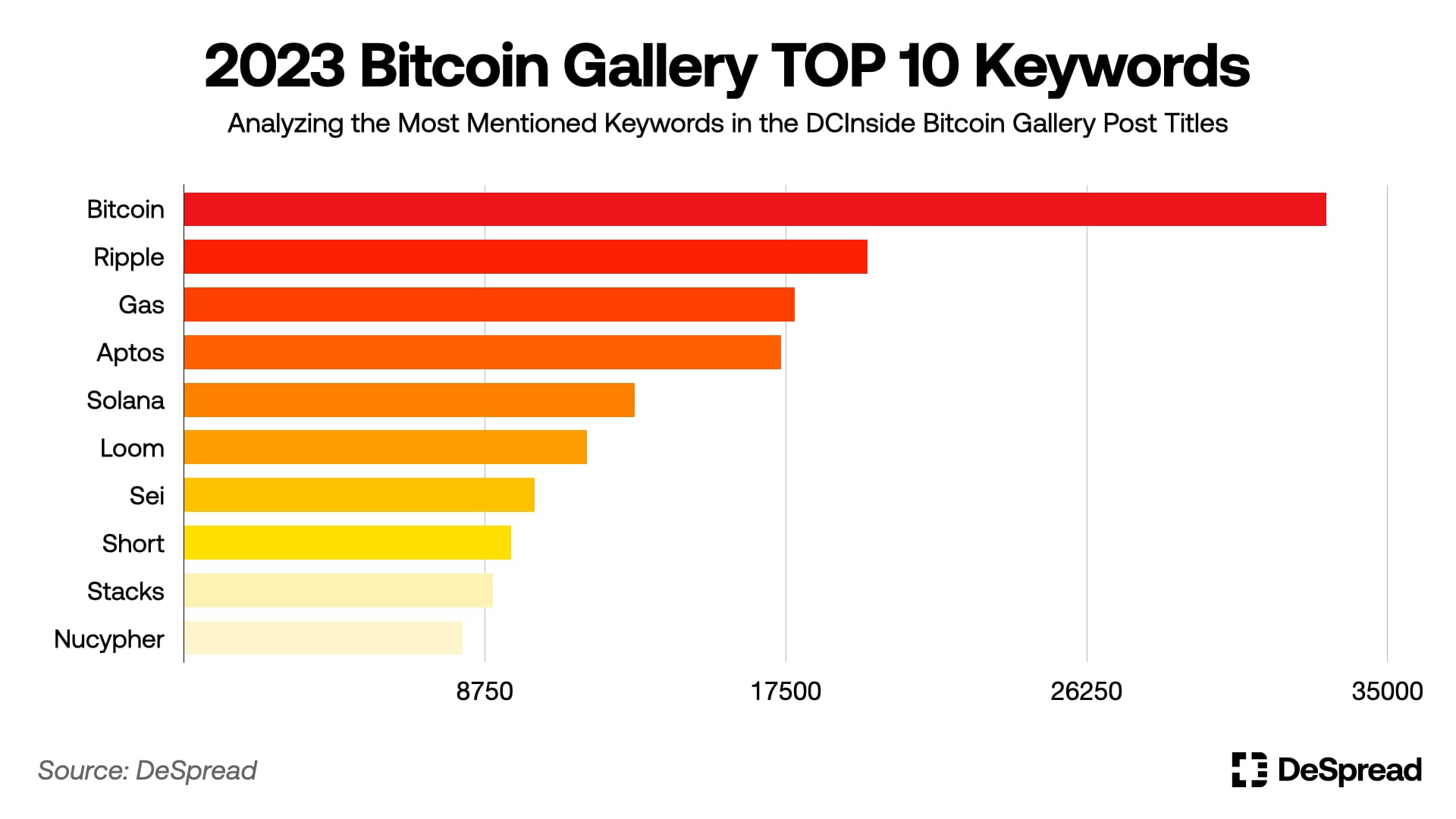

In 2023, an analysis of the most frequently mentioned keywords in the titles of posts within the DCInside Bitcoin Gallery revealed that "Bitcoin" overwhelmingly ranked first. This indicates that Bitcoin remains the core cryptocurrency attracting the most attention from investors in the crypto market. Positions from second to tenth were predominantly occupied by altcoins listed on major domestic exchanges. Notably, Ripple (XRP) was the second most mentioned, and GAS ranked third. The significant attention on GAS can be attributed to its extraordinary performance, where it surged over 10 times within a month before plummeting by 75% in just three days.

The only non-coin term to appear in the top ranks was "short," reflecting a high level of interest among DCInside investors in short-selling. This suggests that the community has a strong speculative character, with many participants looking for short-term profits.

Overall, the 2023 data from the DCInside Bitcoin Gallery shows consistent interest in Bitcoin, alongside active investments in altcoins aimed at short-term gains. The prevalence of the term "short" underscores the speculative nature of the community.

3.4.3. Monthly Top Keywords in 2023

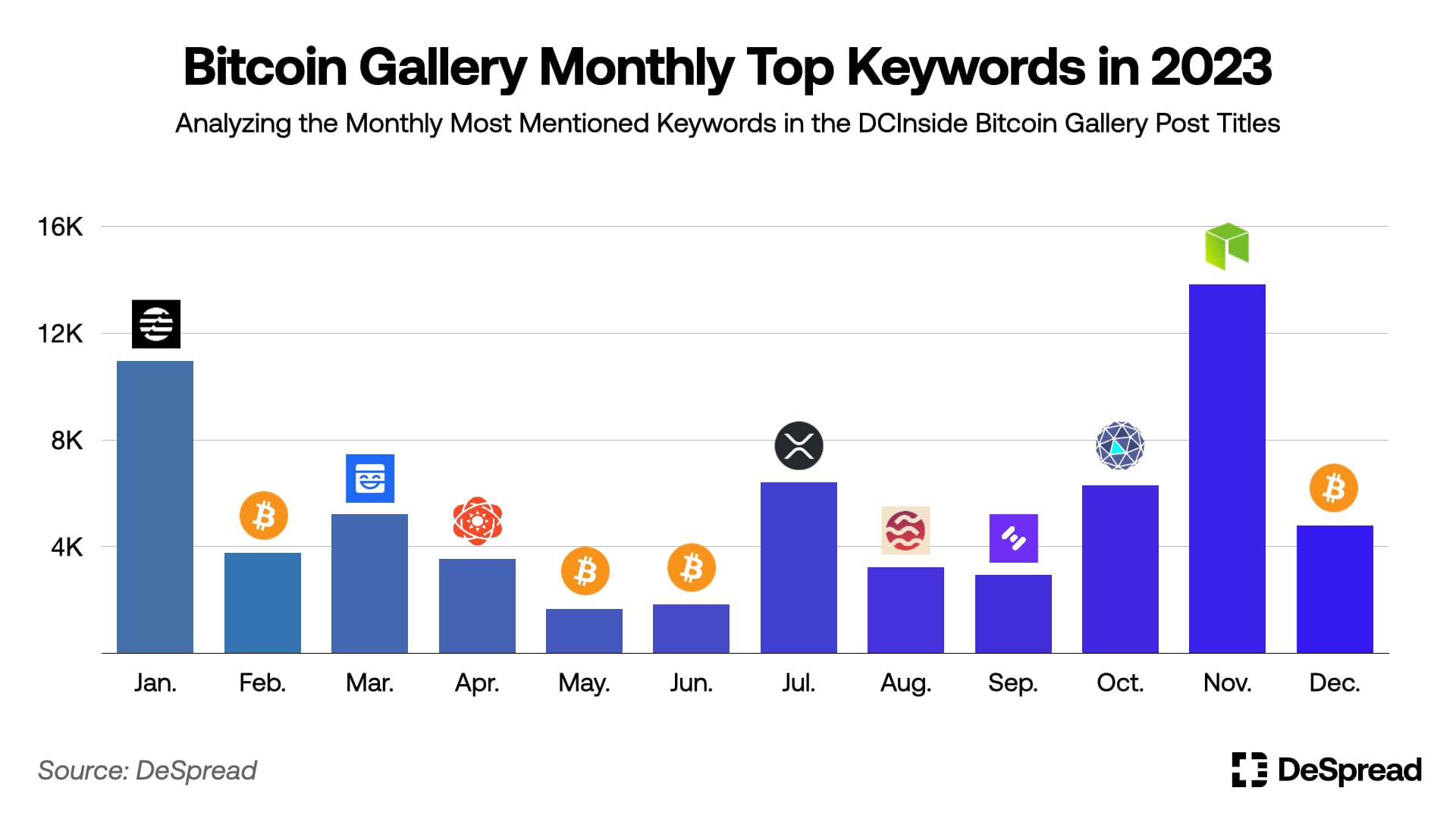

The chart above shows an analysis of the most frequently mentioned keywords in the titles of DCInside Bitcoin Gallery posts for each month of 2023. In January, the most mentioned keyword was 'Aptos (APTOS),' as its price surged over fivefold within the month. This rapid increase garnered significant attention from the community. In July, 'Ripple (XRP)' was the dominant keyword. This surge in mentions was due to the news of Ripple's legal victory against the SEC, which spurred expectations of a price increase for XRP. In November, the keyword 'GAS' topped the mentions. GAS experienced an unprecedented tenfold increase in price without any apparent reason, followed by a dramatic 75% drop in just three days, illustrating a classic pump-and-dump scenario.

The monthly changes in keywords indicate that DCInside investors are highly reactive to short-term market volatility, focusing heavily on coins listed on major domestic CEXs. However, this focus on short-term profits means there is less discussion about long-term value or technological innovations. This trend aligns with the earlier observation regarding the popularity of speculative keywords like 'short,' emphasizing the community's speculative nature.

3.5. Naver Cafe

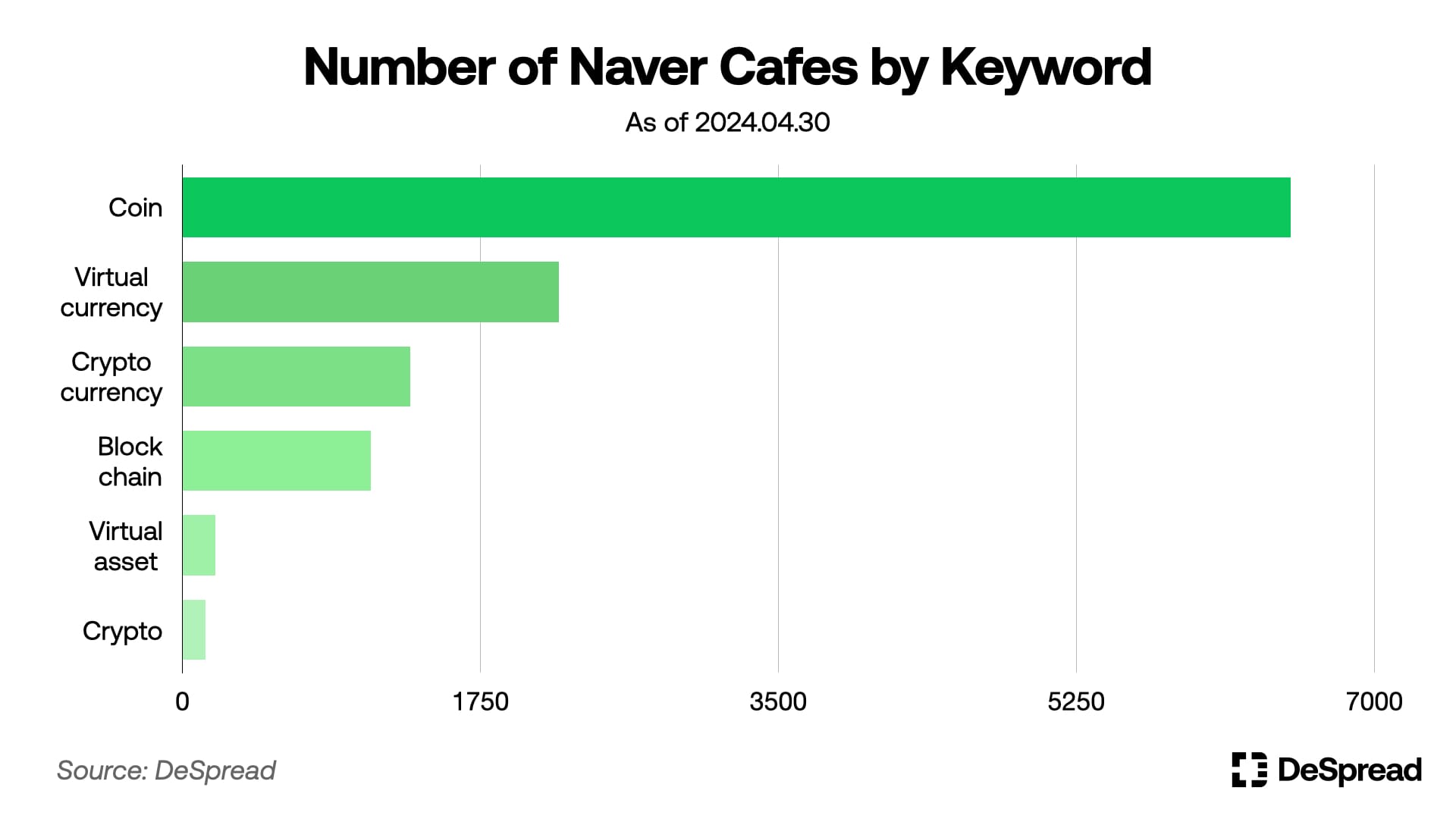

The chart above shows the number of cafes by keyword: the top six words that are used interchangeably with "cryptocurrency" and the number of cafes associated with them. Coin or cryptocurrency appears to be the most popular word.

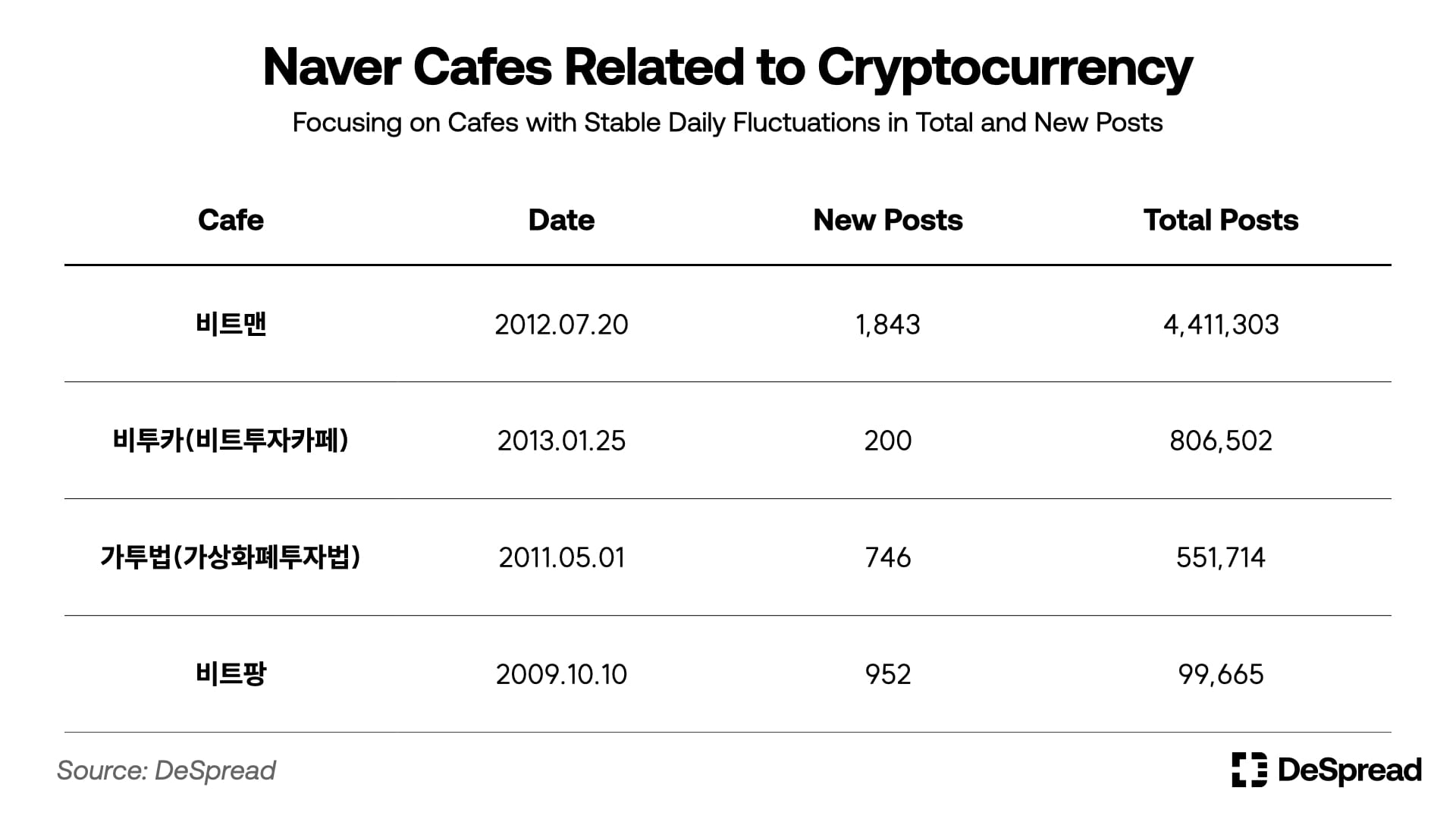

To understand the characteristics of Naver Cafe communities focused on crypto assets, representative cafes were selected based on data collected from late February to April 2024. The selection criteria involved searching for six keywords synonymous with crypto assets and choosing cafes ranked by Naver’s algorithm, specifically those with stable daily fluctuations in new posts. The analysis confirmed that discussions within these cafes are predominantly centered around the prices of virtual assets.

There is a notably higher interest in altcoins compared to Bitcoin, with community members frequently engaging in chart analysis and asking questions related to altcoin prices and trends. Additionally, the number of new posts in these cafes is closely related to price movements. Increased activity within these communities often coincides with price rises, indicating a strong correlation between cafe activity and market trends.

4. Conclusion

So far, we've analyzed the characteristics of the Korean crypto community across various platforms and the key trends for 2023. Our in-depth analysis reveals that Korea holds a significant position in the global crypto market. Upbit, Korea's largest exchange, boasts the second-largest spot trading volume worldwide, and Koreans show more interest in cryptocurrencies than in stocks.

Given the importance and potential of the Korean market, it is natural for many global Web3 projects to consider entering Korea. However, successful market entry requires a deep understanding of the local community's characteristics and needs.

The Korean crypto community exhibits unique traits and trends. Messaging app-based communities, such as those on Telegram and KakaoTalk, are highly active, and there is a strong speculative tendency, with a keen sensitivity to short-term price movements. Conversely, Twitter usage is relatively low, and interest in on-chain activities such as NFTs and DeFi is lower compared to other countries.

Considering these characteristics, global projects aiming to establish themselves in Korea need tailored marketing strategies and community management know-how that align with local investor expectations. Applying global standards directly may not be effective; instead, a customized approach reflecting local sentiments and needs is essential.

Especially, securing the trust of local investors is crucial in the initial stages of community formation. This can be facilitated by employing native language-speaking professionals for community management. Additionally, consistent and persuasive messaging about the technology and vision of the project is vital to shift the focus from speculative activities to an understanding of the intrinsic value and growth potential of the project.

We hope this report broadens the understanding of the Korean crypto community and provides meaningful insights for Web3 companies to develop effective market strategies for Korea. Ongoing timely data analysis and in-depth research are essential to closely monitor the rapidly changing trends in the crypto market. Understanding the unique characteristics and trends of the Korean community will be crucial in this effort.

<References>

- 한경코리아마켓, '충격과 공포의 시장'…주식 투자 외면하는 日 개미들. 2022

- 더인베스트, 카카오 4Q.23 컨퍼런스콜 내용 및 질의응답, 2024