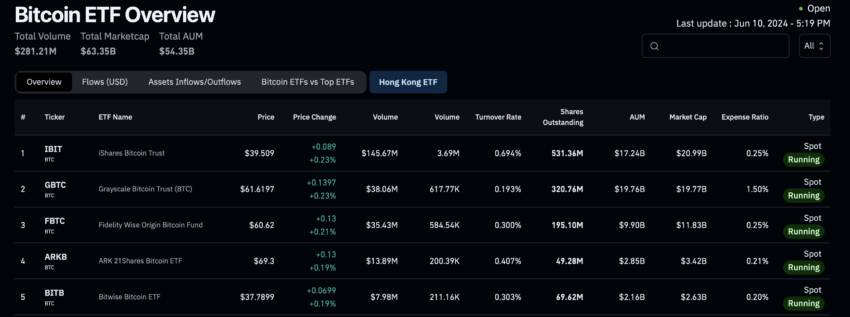

Cryptocurrency investments continue to see increasing capital inflows thanks to the approval of a Bitcoin spot exchange-traded fund (ETF) in January.

Bitcoin recorded $1.97 billion in inflows last week, while Ethereum recorded positive inflows of $69 million.

Cryptocurrency investment exceeded $2 billion last week

Cryptocurrency investment inflows accumulated to $4.3 billion over five weeks. Last week, Bitcoin led the way with $1.97 billion, followed by Ethereum with $69 million, with a positive flow of $2 billion .

“Ethereum also had a big week, with $69 million in inflows, the highest since March,” BTC veteran Kyle Chassé said in a Monday post .

Bitcoin saw inflows for the 19th consecutive day, driven by increased interest from institutional and individual traders. ETFs currently hold 5% of all Bitcoin, with 34 ETFs controlling over 1,000,000 BTC. Last week, 11 ETFs approved by the U.S. Securities and Exchange Commission (SEC) purchased 25,729 BTC. This is almost eight times more than the 3,150 BTC mined during the same period.

Read more: How to Trade Bitcoin ETF: A Step-by-Step Approach

US Bitcoin ETFs currently hold nearly 5% of all BTC. As of Monday, spot funds held a total of 1,043,775 BTC, according to CoinClass. There are currently 19.71 million BTC in circulation, worth $1.36 trillion at the current Bitcoin price, and are expected to reach the final cap of 21 million BTC over the next century.

Despite investors' moves to invest in Bitcoin through ETFs, the Bitcoin price has not recovered from the all-time high of $73,777 hit on March 14. Experts believe this is due to large-scale short selling by hedge funds .

“Why is the price of Bitcoin suppressed while ETFs are building stacks like crazy? Because hedge funds are shorting Bitcoin at all-time highs,” noted prominent trader Quinten.

Hedge funds have historically shorted BTC as part of a trading strategy that involves selling futures contracts to profit from expected price declines. Sina Ji, co-founder of BTC-focused 21st Capital, pointed out that hedge funds taking BTC short positions could be a sign that they are interested in carry trade strategies . This involves buying an asset while simultaneously selling futures to take advantage of the price difference between the spot and futures markets.

Read more: Bitcoin (BTC) price prediction for 2024/2025/2030

The typical scenario is a short squeeze. This happens when the price of Bitcoin starts to rise, forcing those with short positions to buy back BTC at a higher price to cover their positions. This increased buying pressure will push the Bitcoin price higher, causing more short sellers to exit their positions, adding to the upward price momentum.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some content is an AI-translated version of the English version of BeInCrypto articles.