Most people come here not to find value investment, but to turn things around. Suddenly one day we see the gods fighting, the market is surrounded by conspiracy theories, and you begin to doubt whether they have taken your money because you have not turned things around. The top predators in the crypto market who are closest to money and directly involved in transactions - market makers, are bound to become the object of market hatred.

This kind of emotion has never ceased regardless of whether it is a bear market or a bull market. For example, DWF Labs, which has invested in 470 projects in 16 months since its debut, should have nothing to do with investing in so many projects, but he said that he had no shortage of money, did not raise funds, and that all the money he invested was earned by himself. Well, this offended a lot of people, such as market makers who absorbed financing. Just like Captain Jack in "Pirates of the Caribbean", he offended everyone in the sea and on the shore, and everyone who saw him wanted to hit him twice.

Cunning, scheming, market manipulation, pump and dump, and reaping the benefits are synonymous with crypto market makers. But before labeling crypto market makers, as a "senior leek" in the industry, as a "senior leek" who can "rationally" analyze, we still have to face up to the important role of market makers in the crypto market, especially in early coin listing projects.

This article explains what market makers are, why the market needs market makers, the DWF incident and its impact on the industry from the perspective of a "senior leek" (God's vision) who can perform "rational" analysis.

I hope this article can be like Captain Jack in the crypto, and anyone who sees it will want to give me a big thumbs up. At the same time, I also welcome experts with God's vision to come and discuss.

1. Market makers are indispensable to the market

Many people have been in the industry for a long time, but they don’t know what market makers are, why there are market makers, and even market makers are regarded as manipulators by some people because some of their actions may be considered to be attempts to influence or manipulate market prices. Just like all sailors think that seeing the "Flying Dutchman" means death.

It should be noted that the "Flying Dutchman" did not create deaths at sea. It had a specific job, which was to transport souls at sea and allow sailors to be reborn.

Similarly, not all market makers are scary. Not all market makers are out to cut you. Market makers also have their own job responsibilities. They play a vital role in market liquidity and capital efficiency. Some tokens without capital flow can become active immediately with the presence of market makers.

Just like the Flying Dutchman, many people cannot see his face. The same is true for market makers, who seem to be hidden in a corner of the crypto world, appearing and disappearing mysteriously, and no one will see them at the first sight. They will appear where projects need funds, where secondary market tokens lack liquidity, and where there is room for profit.

You may be even more confused after reading this. Why do we say market makers one moment and Captain Jack the other? This is a metaphor, which mainly reflects the importance of market makers in the crypto world. They are hidden things in the crypto world. If it weren’t for the institutions pointing it out, we would basically not have discovered them directly.

Let us understand what a market maker is.

1. What is a market maker?

Since the emergence of the concept of finance, there has been the construction of the corresponding financial "market". The most important thing in finance is liquidity, which is the force that keeps the entire financial system running smoothly; the ability to buy and sell assets quickly and efficiently is crucial to traders, investors and the entire market.

Nasdaq has an average of 14 market makers per stock, with a total of about 260 market makers. In addition, in markets that are less liquid than stocks, such as bonds, commodities and foreign exchange, most transactions are conducted through market makers.

Market makers contribute significantly to reducing volatility and transaction costs by providing substantial liquidity, ensuring efficient trade execution, enhancing investor confidence, and enabling smoother market operations.

Market makers in the crypto industry refer to institutions or individuals who help projects provide liquidity and buy and sell quotes in crypto transactions. Their main responsibilities are to provide liquidity and market depth for transactions in one or more crypto markets, and to make profits by taking advantage of market fluctuations and supply and demand differences through algorithms and strategies.

As in traditional markets, clear rules for market making activities are essential for the smooth functioning of the cryptocurrency market. Crypto market makers can not only reduce transaction costs and improve transaction efficiency, but also promote the development and promotion of new projects.

Simply put, market making is to provide bilateral quotes to any given market, providing the market size for both buyers and sellers; without market makers, the market will be relatively illiquid, which will hinder the convenience of transactions.

2. Crypto Market Makers and Traditional Finance

Compared with traditional finance, the market making business in the crypto market is not much different in essence, but there are huge differences in operation mode, technology, risk management and supervision:

First, the scale of market makers in the crypto industry is relatively small;

Secondly, the liquidity of the crypto market is relatively low and the volatility is large, so market makers need to be more cautious in risk management;

In addition, because the trading process in the crypto market is difficult to regulate and there is no strict market maker system to constrain it, the relationship between exchanges, project parties and market makers becomes more complicated.

The last point is that in terms of technical architecture, the crypto industry needs to have higher technical capabilities to ensure the security of transactions. Market makers use various trading strategies to provide liquidity and make profits. Some of these strategies include statistical arbitrage, order flow trading, and market neutral strategies. These strategies are designed to take advantage of market inefficiencies and spreads.

3. Why do we need market makers?

(1) Providing sufficient liquidity

The main goal of market making is to ensure that there is sufficient liquidity in the market. Liquidity refers to the ability of an asset to be quickly and easily converted into cash without incurring financial losses. High market liquidity mitigates the impact of any trade on transaction costs, minimizes losses, and allows large orders to be executed efficiently without causing significant price fluctuations.

Essentially, market makers help investors buy or sell tokens faster, in larger quantities, and more easily at any given time without causing major disruptions.

For example, an investor who needs to buy 40 tokens immediately can buy 40 tokens immediately at $100 per token in the highly liquid market (Order Book A). However, in the less liquid market (Order Book B), they have two options: 1) buy 10 tokens at $101.2, 5 tokens at $102.6, 10 tokens at $103.1, and 15 tokens at $105.2, for an average price of $103.35; or 2) wait for a longer period of time for the tokens to reach the desired price.

Liquidity is crucial for early-stage coin listing projects. Operations in low-liquidity markets will have an impact on investors’ trading confidence and trading strategies, and may also indirectly lead to the “death” of the project.

(2) Providing market depth and stabilizing currency prices

In the crypto markets, where most assets have low liquidity and lack market depth, even small trades can cause significant price changes.

In the above scenario, right after the investor purchased 40 tokens, the next available price in Order Book B was $105.2, indicating that one trade caused a price movement of approximately 5%. This is especially true during periods of market volatility, when fewer participants can cause significant price swings.

The large amount of liquidity provided by market makers creates a narrow bid-ask spread for the order book. Narrow bid-ask spreads are usually accompanied by solid market depth, which helps stabilize currency prices and alleviate price fluctuations.

Market depth refers to the available number of buy and sell orders at different price levels in the order book at a given moment. Market depth can also measure an asset's ability to absorb large orders without significant price movement.

Market makers play a key role in the market by providing liquidity to bridge this supply-demand gap.

Judging from the market investment invitations released by the exchanges, it is also verified that there are no market makers in the market.

Here are some activities that trading platforms provide for market makers, which indirectly proves that the industry cannot do without market makers:

As can be seen above, the trading platform also provides some services to market makers, including 0% interest loan quota.

Market makers participate in the spot, futures, and options markets, and the threshold is getting higher and higher. Accordingly, trading platforms will also grant different privileges in different participating markets. Generally speaking, trading platforms can give market makers preferential treatment in the following projects:

- Fee discount

- Leveraged Funds

- Deposit and Withdrawal Limit

- API Internal Channel

- Institutional customer accounts/accounting system

For market makers, handling fees are particularly critical, especially in high-frequency trading processes. Of course, in the early stages of a trading platform, it is very likely that some market makers will be paid to make markets, especially for futures and options.

2. Why is DWF always controversial?

1. The environment when DWF Labs was launched

In 2022, FTX exploded, the market collapsed, a series of leading platforms suffered heavy losses, and market makers and lending became the hardest hit areas: Alameda, one of the largest market makers in the cryptocurrency industry, was destroyed in this farce and officially ended on November 10; Genesis, a market maker and lending company under DCG, is also facing the dilemma of insufficient repayment capacity.

The collapse of the top market makers, the destruction of a large amount of capital, and the sharp one-sided market conditions... This caused unprecedented panic among the market makers in the industry. In the aftershocks, market makers tended to shut down, the community and projects faced huge stress tests, and the market liquidity of the crypto industry suffered a sharp decline.

DWF Labs has rapidly risen in such a market environment. The number of investment projects has increased significantly since November 2023. In just 16 months, it has invested in more than 740 projects.

DWF Labs has been controversial since its launch in September 2022. Combining some papers and interviews, we can draw the following controversial conclusions:

- The development is too fast. It took only one or two years to complete the journey that old brands such as GSR and Jump have taken in the market for ten years, and they have not yet completely completed the market test period;

- VCs and market makers act as both referees and players at the same time, which is not recognized by their peers in market making;

- Binance’s doubts once again put him at the center of controversy (Binance has clarified the matter and the employee involved was laid off)

2. Capital Markets Do Not Accept DWF Labs

There is also fierce competition and conflict among market makers, especially in a market environment full of changes and uncertainties. DWF Labs was publicly excluded and attacked by its peers. The details are as follows:

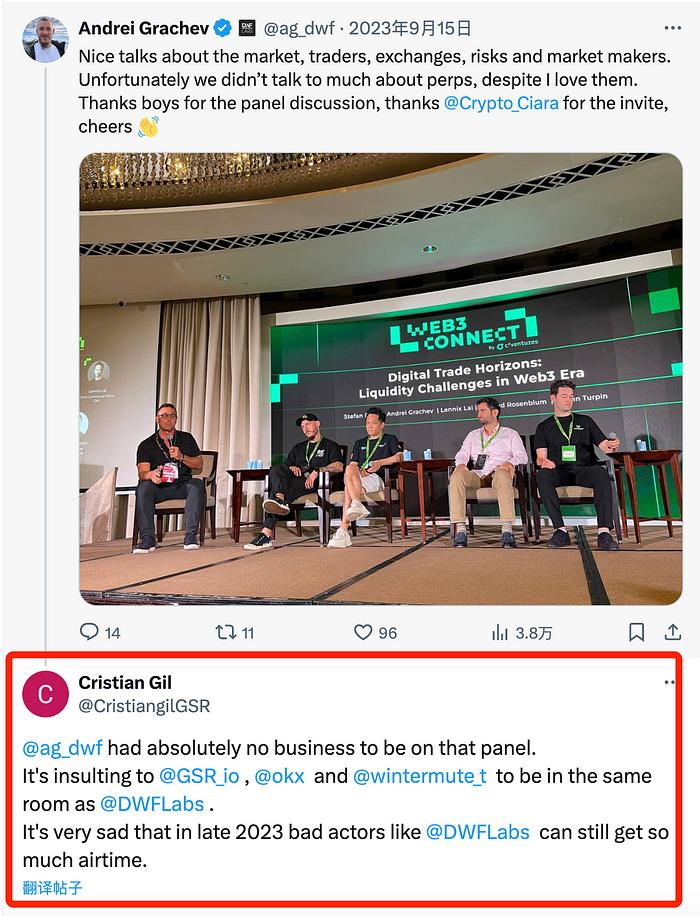

In September 2023, at the "Web3 Connect" forum hosted by C² Ventures during Token 2049, DWF Labs was invited to participate in the discussion with three other market makers, GSR, Wintermute and OKX.

- GSR is an established market maker founded in 2013, focusing on providing cryptocurrency derivatives and liquidity solutions to institutional clients.

- Wintermute is an algorithmic market maker founded in 2017 that focuses on providing liquidity for decentralized finance (DeFi) and Metaverse projects.

- OKX is a leading global cryptocurrency trading platform founded in 2014 that also provides its own market making services.

GSR posted on Twitter that DWF Labs was not qualified to discuss with them because they had no real market-making capabilities and experience, nor real investment capabilities and intentions.

GSR also said that DWF Labs was an insult to them and they would not cooperate with or endorse DWF Labs. Wintermute CEO Evgeny Gaevoy liked GSR's tweet and said they would not cooperate with DWF Labs either. OKX did not make a clear statement.

You see, the fight between gods is also very magical, no martial ethics, just hitting people in the face and exposing their shortcomings. Many people said at the time that if it weren’t for DWF Labs, they would not have known about GSR at all. Uh...

DWF Labs is not accommodating its peers. Andrei Grachev, co-founder of DWF Labs, responded to GSR's accusations on Twitter, calling GSR an "old antique" that has no innovation and progress and only complains on social media. He also said that DWF Labs is better than its peers in technology, trading, business development and other aspects. If the competition is fair, peers will definitely lose. He also mocked GSR's performance and reputation, calling them "incompetent scammers."

Considering what Andrei Grachev, co-founder of DWF Labs, said: " Whether in technology, trading, business development or other aspects, I am better than GSR" , let's break down DWF Labs.

3. About DWF Labs

1. DWF Labs Prequel: The Founder’s Rise

The co-founder and public image agent of DWF Labs is Grachev. Although Grachev is Russian and his main business was in Europe in the early stage, he has deep roots in Huobi (now HTX) and OKX, and has a wide network of contacts in Asia. Therefore, we can see that among the hundreds of projects invested by DWF Labs, there are many Asian projects. This has a lot to do with Grachev’s early work as an incubator. At the same time, it also explains why DWF Labs is both an investment institution and a market maker.

DWF was not popular 23 years ago, and its parent company Digital Wave Finance was also very low-key in Europe and the United States. It really became popular when Grachev founded DWF Labs in Singapore in September 2022. After FTX and its affiliated company Alameda closed in November, the market was in a period of confusion, and small and medium-sized WEB3 projects continued to increase liquidity with funds. DWF Labs was like a savior at that time, bringing hope to many potential projects.

The article does not end here. This article is a WEB3 intensive article that will analyze the ins and outs of the period, so let’s take a look at how Grachev, co-founder of DWF Labs, drives the prosperity of the global primary and secondary markets.

According to the timeline, Grachev's hairline history and the opportunities of DWF Labs.

(1) Origin of DWF Labs - Operation of Huobi Russia

- Born in Uzbekistan, Grachev studied organizational management at Orenburg State University and then worked as an oil trader for two years. In 2016, he entered the cryptocurrency space by running a small mining farm and doing some personal trading.

- In 2018, at the age of 30, Grachev became the CEO of Huobi Russia and devoted his efforts to preparing for the launch of Huobi Russia, a local exchange officially authorized by Huobi Global (now known as HTX) through its cloud program.

- There is no difficulty in preparing Huobi Russia. After obtaining authorization, it is enough to recruit technical personnel to build the platform. What bothers Grachev is that if Huobi Russia is launched, what will happen if there is no liquidity? Without liquidity, there is no income.

- At this time, Grachev learned that a small high-frequency trading (HFT) company in Switzerland was looking for an exchange with low interest rates, and Grachev realized that this would have a significant impact on its trading profitability.

- Huobi Russia only has the right to use its brand, software and trading liquidity, while the listing of tokens and adjustment of customer transaction fees still require the authorization of the headquarters Huobi Global Station. Grachev spent 2 months convincing the exchange to allow him to offer preferential rates to the Swiss HFT company, so that it can obtain Huobi's liquidity cheaply through Russian agents.

- On December 8, 2018, when Huobi Russia was officially launched, the trading volume had reached $10 million, and the next day, the figure rose to $22 million. At this time, Grachev, the marketing master incarnation, began to promote Huobi Russia.

The company, called HFT, made Grachev famous, attracting attention and scrutiny from the entire cryptocurrency community. He later became a behemoth that influenced more than 400 projects and mobilized hundreds of millions of dollars. The company would later be called DWF Labs, and this is its origin story.

(2) Digital Wave Finance was established

Three days after Huobi Russia officially launched, HFT established a company in Switzerland named Digital Wave Finance, which mainly engages in market making and proprietary trading.

The high-frequency trading company was founded on December 11, 2018 and is run by brothers Marco and Remo Schweizer and Michael Rendchen. All three are traders who have worked closely with market-making company IMC Trading and are proficient in automated trading strategies. Their goal is to apply these types of strategies to cryptocurrencies.

At this time, Grachev did not join Digital Wave Finance. The three early co-founders of Digital Wave Finance seemed to be very low-key and rarely appeared in public, so not many people paid attention to Digital Wave Finance in the early days.

Digital Wave Finance targets spot and futures trading. By the end of 2020, Digital Wave Finance has achieved initial success and accumulated $50 million in capital in the early stage.

(3) Grachev after de-Huobi

During his time at Huobi Russia, Grachev met Zac Zou, regional marketing director at cryptocurrency exchange OKEx (now known as OKX).

Before Huobi Russia shut down, Grachev founded a Latvian entity called Vroom and launched a website called VRM Trade. One of the main strategies of the website is to incubate other trading companies and discover talents.

VRM Trade has a very big blueprint. It wants to become the most influential unicorn crypto group by investing in the next crypto unicorn company, and its core circle will form a "decentralized Wall Street". The plan is to increase its valuation to $100 million by 2021, and its core goal is to become "the most influential company that attracts all talents and "rules" the crypto world."

This may also be the reason why DWF Labs acted as an incubator after Grachev became the co-founder of DWF Labs.

During the period of 2020–2012, Grachev was most closely associated with Digital Wave Finance. Due to Grachev’s connections in China, he helped Digital Wave Finance integrate with other exchanges and obtain corresponding low fees. Through the joint venture, the high-frequency trading company was responsible for the token trading of major exchanges, while Grachev was responsible for the interaction with the exchanges and the token trading of other smaller exchanges.

Digital Wave Finance is now operating on more exchanges and at a higher level across the board. It has a VIP 7 rating on Bitfinex and OKEx, and has negative maker fees on at least 7 exchanges.

This level brings huge benefits. For example, DWF's market maker fee for placing orders on Binance is -0.002%, and the market maker fee for acquiring orders is 0.0157%. Such low fees allow market makers to provide a steady stream of liquidity to the exchange.

(4) DWF Labs was established

The VRM Trade brand was abandoned in June 2022, and Grachev set up a Singapore entity for DWF Labs, which will take on the responsibility of being the public face of Digital Wave Finance.

Grachev, Schweizers and Rendchen were the original shareholders.

In September, DWF Labs was officially launched, which means the birth of a positive company. Due to the personality of the founder, DWF Labs has its own internet celebrity traffic and radiates brilliance wherever it goes.

(5) Growth of DWF Labs

In January 2023, Zou (formerly of OKEx), Heng Yu Lee and Ng (formerly of Gemini) also became shareholders of DWF Labs’ Singapore entity.

Ng is a co-founder of OpenEden, which has its funds managed by a registered fund management company regulated by the Monetary Authority of Singapore and is working with Standard Chartered Bank’s cryptocurrency unit Zodia Custary. Darley Labs, the investment arm of Darley Technologies, is also an investor in OpenEden, according to its website.

In February 2023, Sylvain Barbezange, then head of over-the-counter trading at Darley Technologies, moved to Digital Wave Finance as head of institutions.

From the talent structure of DWF Labs, we can see that although DWF Labs is a new company, its co-founders are all high-end talents with rich experience in the crypto circle. This makes it easy for the incubation department of DWF Labs to discover better potential projects, which is also the confidence of DWF Labs to do well as a VC.

The company is launching a first-of-its-kind incubation program for cryptocurrency companies and plans to create what Grachev called a compliant market for over-the-counter trading of cryptocurrencies.

With financial backing from Digital Wave Finance, and the connections built along the way, DWF Labs has what it takes to become a major force in the cryptocurrency space in the near future.

2. DWF Labs Investment Return Rate

DWF Labs believes that the turbulent market is the best time to enter the investment field, so after the FTX explosion in 2022, when the market was sluggish, DWF Labs quickly expanded in the primary and secondary markets and entered hundreds of projects. This step really worked, and they have accumulated enough funds from the profits to invest in projects.

DWF Labs stated on its official website that "regardless of market conditions, DWF Labs invests in an average of 5 projects per month." As a company whose main business is market making and high-frequency trading, let's take a look at its performance.

In terms of market-making currencies, DWF Labs mainly targets East Asian projects and various new and old sentiment-themed targets. Currently, 140 tokens belonging to DWF Labs narratives can be collected, with a total market value of 64,026,720,062.54. The average price fluctuation of DWF Labs narrative tokens in the past 7 days was 9.1%. The best performing tokens during this period were MRST, ORT, and JASMY.

Data platform Cryptorank shows that from September last year to now, DWF Labs' comprehensive ROI on primary market investment has reached 3.54%, with an investment range of US$3-10 million. It mainly invests in Ethereum ecology, DEX, Metaverse, games and privacy tracks, and is ranked 2nd among investment banks.

- Among them, there was one stock with a 50-fold increase, two with a 25-fold increase, three with a 10-fold increase, and most of them ended with a 5-fold return.

- The project with the highest increase is Fetch.ai;

The above yields do not seem to be outstanding, that is because the data platform is dynamic. When a project declines, the comprehensive income is diluted, and many projects have completed the entire market cycle or are in an adjustment period.

If we click on any project, we can see the historical growth rate. For example, Fetch.ai’s one-year growth rate reached 807.3%, which shows that DWF Labs has its own set of investment targets.

(III) DWF Labs’ recent investment direction

DWF Labs has always insisted on selecting 5 tokens for investment every month. At the beginning of June, DWF Labs set its sights on Memecoin, a mass-produced "counterattack" track.

DWF Labs has entered the Meme track in a high-profile manner. Co-founder Andrei Grachev officially announced that he will invest more funds in Meme projects: $LADYS and $FLOKI have been clearly invested, and three other projects are in communication.

On June 4, DWF Labs purchased $FLOKI, and the token broke through its all-time high of $0.000343 on June 5, an increase of 45%.

On June 3, DWF Labs invested $5 million in $LADYS.

After DWF Labs invested in $LADYS, the market performance did not react as much as $FLOKI, with a 4.16% increase in the past 7 days. I wonder if this is an opportunity.

So let's analyze it:

4. About $LADYS

The Milady project was launched on May 5, 2023. It is a project related to the Milady NFT series, and its token is called $LADYS. All PEPE token and Milady Maker NFT holders can claim $LADYS.

As stated by the official website:

$LADYS is a meme coin with no intrinsic value or return expectations. This token is not associated with Charlotte Fang or her creation Milady Maker in any way. It is simply a tribute to a meme that we all love and identify with. This project has no formal team or roadmap and exists purely for entertainment purposes.

(1) About Tokens

- Project Name: Milady

- Token Name: Milady Meme Coin ($LADYS)

- Market value: $217,114,922.00

- Market capitalization ranking: 301

- Fully diluted market cap: $217,114,922.00

(2) Token Distribution

$LADYS focuses on:

- Centralized exchanges: 57.96%

- Large holders: 22.29%

- Moderate holders: 6.95%

- Project/Smart Contract: 4.75%

(3) $LADYS bullish indicator

- Narrative: LADYS belongs to the Meme narrative. The Meme sector has a total of 614 normally operating tokens with a total current market value of 68,346,212,796.40. The average increase in the sector's tokens in the past 7 days has increased by 3.1%.

- The 7-day increase of $LADYS is -2.39%, which indicates that the price of $LADYS is weak recently. This also means that the market has not yet fully realized its potential value. $LADYS may have other advantages or untapped potential that can serve as a catalyst for future growth.

- From the perspective of funding rate: $LADYS currently has a funding rate of 0.06% on Bybit (futures), which means there are more long positions, indicating a bullish sentiment in the market as they are willing to pay a 0.06% fee to airdrop traders. The total open interest is currently worth $18,763,223.56, and the trading volume in the past 24 hours is $11,190,797.76.

(4) Neutral indicators

- BOLL indicator: Currently, the price of $LADYS is between the middle line and the upper line, indicating that the recent performance is relatively strong. The middle line may serve as support and the upper line may be a short-term target.

- RSI: The current RSI is 54.89, indicating that the market condition is neutral, with no obvious overbought or oversold signals.

This is basically the end of this long article. DWF Labs is a controversial emerging market maker. It operates with its own unique "venture capital + market making + incubation" model, which was unimaginable among previous market makers, so it is currently quite controversial.

DWF Labs is like Captain Jack Sparrow in "Pirates of the Caribbean". He never follows the rules and offends most people on the sea and on the shore. Everyone wants to scold him. But he can't stand the fact that others are really capable, so he has a large number of "brainless fans".

According to the written explanation, DWF Labs is an industry catfish. The controversy over DWF will not stop, and it will intensify in the foreseeable future. Some people think that DWF Labs is an innovative pioneer in the Crypto industry, while others think that they are harvesters and creators of market instability.

No matter what it is like, as a member of the industry, we are here to turn things around and should not be led astray. I always believe that things that most people cannot understand have greater opportunities.

DWF Labs gave us a clear signal in early June, and there are 3 projects under negotiation. According to industry inertia, when it is officially announced, it is the time for it to sneak into the market, so if you want to follow and buy, you have to do a good job of on-chain tracking, and wait for the official announcement to make money.

references:

https://www.prestolabs.io/research/market-making-predatory-or-essential

https://news.marsshare.cc/20231222113456020809.html

https://foresightnews.pro/article/detail/43411

https://www.wikibit.com/zh-cn/202310292534493947.html

https://www.chaincatcher.com/article/2123653

https://medium.com/hindsight-series/dwf-ventures-investment-thesis-2023-c08486bcc0d0