The crypto market started the second half of the year on Monday in a rising pattern.

The latest data on U.S. manufacturing activity showed that the U.S. manufacturing PMI fell further into contraction territory in June, hitting a four-month low, which boosted investors' hopes that the Federal Reserve may cut interest rates in September as the economy appears to be showing signs of weakness. Investors are still awaiting the June employment report due on Friday, which would provide more support for a rate cut if it shows signs of further cooling in the labor market.

Bitcoin (BTC) rebounded above the $63,000 support level in the early trading and has been hovering around the $6.3 level.

For more information, please visit Weibo Tuantuan Finance here .

Most of the top 200 Altcoin by market cap followed Bitcoin higher.

LayerZero (LZO) had the largest gain, up 15.1% and trading at $3.83, followed by Bonk (BONK) up 14.1% and Ethereum Name Service (ENS) up 11.7%. Arkham (ARKM) had the largest loss, down 8.7%, while Convex Finance (CVX) fell 7.1% and ionet (IO) fell 4.4%.

The current overall market value of cryptocurrencies is $2.32 trillion, with Bitcoin accounting for 53.5% of the market share.

As for U.S. stocks, as of the close of the day, the S&P index, Dow Jones index and Nasdaq index all closed higher, up 0.27%, 0.13% and 0.83% respectively.

Bitcoin price may be near or have already bottomed

Data shows that Bitcoin’s premium index on Coinbase has fallen to its lowest level since the FTX crash. Similar values in November 2022 and August 2023 were accompanied by prices about to bottom and then rebound.

It’s always darkest before the dawn, and the last time the Coinbase premium was this low was a few months before the massive rally from October 2023 to March 2024.

The indicator remained negative for a long time in June and most of May, mirroring the market downturn in August and September last year. On Friday, the indicator fell to nearly -0.19, the lowest value since the crypto exchage FTX crash in November 2022.

The negative values in early November 2022 coincided with BTC’s bear market low below $16,000, before prices surged to nearly $25,000 in February. That’s an increase of more than 50%.

The August 2023 premium nadir occurred a few weeks before Bitcoin hit a local bottom around $25,000. BTC has since been range-bound, with prices doubling before hitting a new all-time high from October to January, driven by expectations for a U.S. Bitcoin ETF.

At least recently, the Coinbase premium has become a reliable, confirmatory and even forward-looking indicator of overall market trends, highlighting the importance of the US market in determining market price formation. There are signs that the next 6 to 12 months will be exciting, but also turbulent.

Given that several upcoming catalysts are centered around the U.S. market—such as ETF flows, U.S. monetary policy, and the presidential election—expect this trend to continue.

Will there be another market crash in the short term?

Despite the rebound, Bitcoin failed to maintain the positive tone it set at the beginning of the year, with specific factors further creating headwinds for the digital asset's price in recent weeks, ending the first half of the year on a downturn.

BTC also decoupled from the U.S. stock market in June as long-term holders resumed selling while excess supply took its toll on the market.

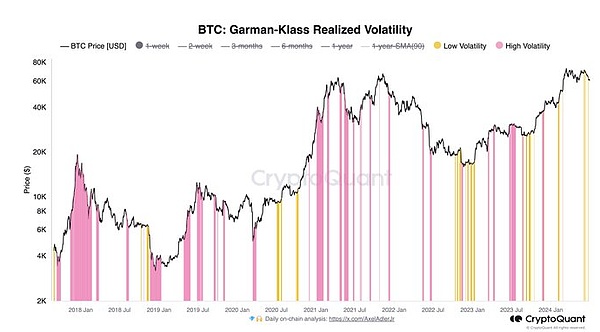

The policy environment has led to a drop in volatility, which has affected Bitcoin prices. BTC has struggled to maintain its upward momentum, decoupling from the U.S. stock market, and long-term Bitcoin holders who paused selling in early May have returned. Although reduced selling by mining companies indicates some stabilization in the market, continued cashing out by long-term holders means the near-term outlook is fragile.

At the same time, excess supply continues to weigh on the market, with potential selling pressure from Mt. Gox potentially dumping Bitcoin.

There is only short-term selling pressure, but the long-term outlook is still bright.

The Federal Reserve's preferred inflation measure, the personal consumption expenditures index, was unchanged in May, suggesting that inflation is now just above the Fed's 2% target.

This could push for a rate cut in September, with the case for such action supported by the third estimate of U.S. GDP for the first quarter, which showed that the economy remains on weak footing despite a small upward revision. In addition, consumer confidence is declining due to high mortgage rates and limited supply, and a low percentage of consumers plan to buy a home, hoping that a rate cut will come soon.

If long-term holders continue to take profits at current levels, which we believe is unlikely over the longer term, it could put downward pressure on Bitcoin prices in the short term, potentially extending the current decline and impacting the bull case in the medium term.

While Bitcoin’s sideways price action over the past four months has been extremely boring, periods of less market volatility are when whale do the most accumulation, and Bitcoin is still in a bull cycle.

Later, I will bring you analysis of leading projects in other tracks. If you are interested, you can click to follow. I will also organize some cutting-edge consulting and project reviews from time to time. Welcome all like-minded people in the crypto to explore together. If you have any questions, you can comment or private TTZS6308. All information platforms are Tuanzi Finance .

I plan to accept five more one-on-one classes at the end, but I won’t accept any more. To be honest, I can’t handle too many. After all, my energy is limited.

Currently, there are basically no good opportunities for retail investors to get on board BTC. The focus is to lay out high-quality copycats in the later stage and strive to achieve an overall return of no less than 10 times this year.