Author: sterling, founder of Blockchain Capital Source: sterlingcampbell Translation: Shan Ouba, Jinse Finance

Given the hoopla and excitement generated by memecoin casinos and infinite games, it’s easy to dismiss cryptocurrencies as pure speculation. Many view the recent bull run as overtly excessive gambling, financial nihilism, and disinformation. While speculation does drive a great deal of activity, it’s an oversimplification to classify it as a net negative for our industry. Speculation and gambling may belong to the same family, but they are by no means twins.

The casino itself feels far from real. Without a clock, time seems to slow to a crawl. The floors are designed like a maze that is difficult to navigate or leave. You are completely confined to the real world, and you are distracted when jackpots are hit and winners scream and shout (admittedly, this is much more fun than posting Phantom Wallet screenshots). Enjoy yourself, but don't let the hustle and bustle of the casino distract you from the potential of our industry.

Growing up in Las Vegas, I am no stranger to high-stakes gaming. I watched my hometown grow rapidly on the backs of gamblers, paying virtually no state income tax because the casinos covered all expenses. I watched Las Vegas become the fastest-growing city in the U.S., attracting companies like Zappos and Gusto, and becoming something bigger than its nickname of “Sin City.” I have bigger goals for our industry.

It's all speculation

Speculation is not just the domain of high-stakes investors or futurists; the very fabric of modern society is woven into the fabric of speculation.

Philosopher Soren Kierkegaard once said, "Life can only be understood in retrospect, but must be lived looking forward." From the moment we wake up, we are constantly anticipating and preparing for future events. Our morning commute is based on guesses about traffic conditions and arrival times. Our choice of clothing often reflects guesses about the day's weather or social interactions.

In the workplace, project planning and resource allocation are based on speculation about market trends and consumer behavior. Even our social lives are influenced by speculation, as every swipe left or right on a dating app is filled with what could happen. This ongoing process of predicting and adapting to potential futures is so ingrained in our daily lives that we often overlook its pervasive impact.

We are forever dancing with uncertainty, using our ability to speculate to navigate the complexity of modern life and shape our reality. More importantly, uncertainty holds some of the greatest opportunities.

Speculation and innovation

Throughout history, humanity’s greatest technological advances have been accompanied by acts of speculation. Technological advances have been accompanied by dreamers who worked on concepts that seemed impractical or out of reach at the time, concepts that required upfront investments of money and foresight to achieve. For example, the printing press was not an overnight success in the 15th century; people had speculated for decades about the transformative power of movable type and the democratization of knowledge before it. Similarly, the development of the steam engine in the 18th century benefited from earlier speculative investments in coal mining, metallurgy, and engine design. None of this is linear.

Time and again, the most impactful innovations are the result of courageous individuals and organizations willing to take bets on the future, often before the fruits of their labors are realized or after countless failures. In the world of drug development, the story of penicillin illustrates how even occasional failures can lead to revolutionary breakthroughs. Alexander Fleming’s discovery came about after he noticed that mold contamination in one of his petri dishes killed the surrounding bacteria—a “failure” of his initial experiment, which led to one of the most important medical discoveries of the 20th century. It would be foolish to point to any number of failures without acknowledging the role they have played in our greatest successes.

Take the dot-com boom, which wiped out $1.7 trillion in market value from March 2000 to October 2002. One could simply single out Pets.com or any other example from the speculative frenzy that followed, but to do so would miss the point. The dot-com bubble laid the foundation for the modern digital economy, e-commerce, and social media platforms we now take for granted (and it took decades to build). If you take a longer view, the loss of value during that period was a blip.

Cryptocurrency speculation is a good thing

Given that speculation is fundamental to the human experience, and that rampant speculation has fueled innovation and growth for nearly a decade, it would be foolish to reduce the entire cryptocurrency industry to pointless excessive gambling. No one cares about Thomas Edison’s 1,000 failures or whatever unproductive path he ultimately took; there are now 8 billion light bulbs in the world .

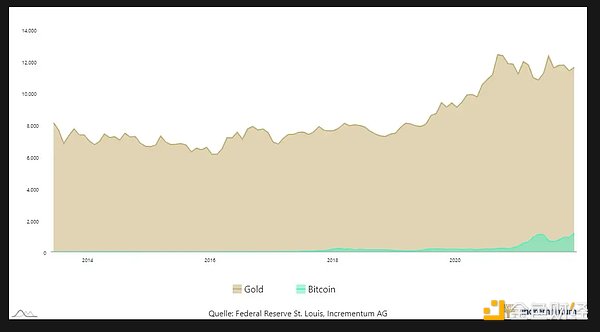

Focusing too much on current failures is a blind spot. The success story for cryptocurrencies has already begun, with Bitcoin valued at over $1.2 trillion and other cryptocurrencies adding another trillion dollars. Given that gold is a $15 trillion asset, it’s easy to zoom out and see that there is still a vast ocean of opportunity in front of us, making any failures or missteps pale in comparison. In fact, the entire cryptocurrency universe outside of Bitcoin could go to zero and we’d still have a massive venture opportunity on our hands (hint: we won’t). Bitcoin has entered the vocabulary of the average person and given its simplicity, immutability, and ubiquity, it will remain the industry’s North Star for the foreseeable future.

To get inspired, you have to try different things, you have to burn money, and you have to fail. The good news is that as Bitcoin becomes more and more popular around the world and demand continues to increase over time (despite many people doing their best to kill the industry), we are moving in the right direction.

You might be thinking, “ Okay, Sterling, but how does buying Smoking Chicken Fish contribute to the overall value proposition of cryptocurrency?” or “ Hey, Sterling, isn’t Solana just a memecoin? How can it be so valuable? ” or “ Sterling, my wife told me that the youthful exuberance she fell in love with disappeared a few years ago, can you help me? ”

First, part of the appeal of cryptocurrency is that it is tied to infinite games, and in the internet-first synchronous community, this will likely never change. These speculative games have always received the most attention, and Bitcoin's main appeal has always revolved around its ability to redistribute wealth to anyone willing to believe in its long-term value proposition. This is a feature, not a bug.

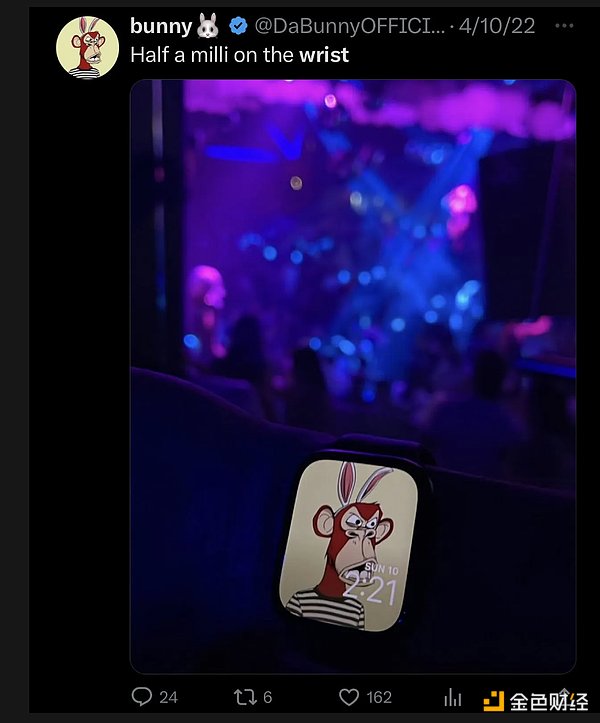

This speculative behavior extends to every crypto cycle. Last cycle, we saw NFTs take the world by storm as people explored all the different ways that verifiable behavior and ownership could be valuable. The bottleneck for innovation was ultimately infrastructure, as gas fees kept many early adopters away and the friction of the onboarding process brought tears to my parents’ eyes. Unviable infrastructure ultimately dealt a huge blow to the industry, as nascent business models incentivized rugpulls and few developers were able to deliver on the grand vision that NFTs offered. Sure, there were scams, but there were also many serious attempts to exploit the technology, and the story of verifiable fans is far from over.

But I hope this is the end of these people's fate

Memecoin is not only a better form of speculation due to wider distribution, cheaper prices, and a more understandable value proposition, but it has also tested the infrastructure improvements of cryptocurrency over the past few years, with all systems running fairly smoothly.

Considering that the biggest hesitation for many institutions in using the technology is its unreliability or lack of Lindy features, the seamless activity we are seeing across many ecosystems is a necessary step to understanding how powerful our pipeline is. Likewise, early adopters who are not afraid to emulate $15,000 and lose it in various ways are extremely valuable pioneers as we develop solutions for ordinary people.

The advent of stablecoins has had a profound impact on DeFi, but it has also had its own penicillin moment, with people in emerging markets able to use dollar-denominated savings accounts, avoid predatory fees for cross-border payments and remittances, and access global markets. The global remittance market is worth $740 billion; these are huge opportunities with clear paths to victory.

For Yellow Card, the most popular exchange in Africa with hundreds of millions of dollars in monthly trading volume, its users do not buy memecoin, but mainly exchange naira and dinar for more stable USDC or USDT. This behavior extends to Southeast Asia and Latin America, where inflation and hyperinflation have limited the use of traditional US dollars.

Payments are providing businesses with a similar respite from a financial system that has strangled small businesses. Companies like Blackbird have largely abstracted the “crypto” part of the business, and restaurants around the world are choosing to use them because they help save on transaction costs and lower CAC for diners seeking rewards. TYB, on the other hand, is rethinking loyalty with the opportunity to reward consumers for engagement beyond spending. These companies are seeing meaningful upticks in conversion, spend, and retention compared to traditional companies, and for the first time we are starting to see true adoption in the crypto track that extends beyond the typical “crypto” user. Networks become incredibly valuable once they succeed, and the winners who experiment in these verticals will reap huge success.

Prediction markets use speculation to better incentivize truthfulness in polls, and companies like Polymarket have begun to achieve mainstream success, with nearly $500 million in trading volume this month alone. Drift also recently added prediction markets on Solana, and we’ll soon see embedded Blinks everywhere people are arguing on the internet.

The road to tokenization will be paved with categories that may seem silly at first glance when you realize that it could mean everything, from carbon credits to ETFs, from whiskey to recipes to cattle. That being said, we have already taken a major step towards this mission as Securitize has partnered with Blackrock to launch BUIDL, bringing its first tokenized fund to market. Even BCAP’s early funds are tokenized because something has to be tried, the game has to be played (sorry, but I refuse to use the word “arena”).

Outside the Casino

The user base that is usually online for a long time is prone to emotional fluctuations, and the sensational media is waiting for the next opportunity to expose the craziness of our industry, so I don't blame people for becoming depressed or nihilistic when seeing the recent activity. The nature of cryptocurrency subverts the existing financial system; you should feel that the world is collapsing around you, and absurdism is usually inseparable from you. The good news is that you can also play an important role in the solution. A lot of ideas are being tried, and many of them are destined to fail. This is it.

Cryptocurrency casinos may seem like a fever dream of pixel punks and dog-themed tokens, but behind the meme-fuelled craziness lies real transformative potential. So whether you’re here for the tech, the earnings, or because your wife’s boyfriend told you Bitcoin is going to hit 100k, all we need is an aha moment.