The price of Ethereum (ETH) has struggled to maintain its strength in recent weeks. A series of weak developments have left the altcoin stuck at the $2,300 level.

Despite attempts to push higher, selling pressure is weighing heavily on ETH, making the path to $3,000 uncertain.

Holders prepare to sell ETH

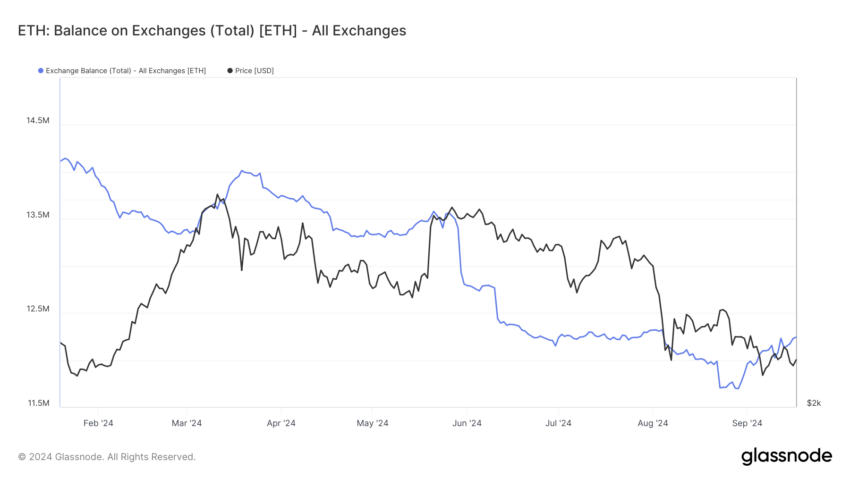

The Ethereum price has experienced the most selling pressure in the past six months. In the past two weeks alone, investors have moved over 255,869 ETH, worth over $596 million, onto exchanges. This surge in selling pressure is similar to the strong profit-taking observed in March, creating a difficult environment for the Ethereum price recovery.

This selling indicates that confidence among investors is weakening, further hindering Ethereum from gaining any upside momentum. With market sentiment still bearish, Ethereum’s ability to recover to previous highs could be challenged.

Also, Ethereum’s macro trend is closely tied to its correlation with Bitcoin. Historically, ETH prices tend to fall when its correlation with Bitcoin weakens. Currently, the correlation between ETH and BTC has fallen to 0.54.

Read more: How to invest in Ethereum ETFs?

The low correlation with Bitcoin could increase volatility for Ethereum, making it more vulnerable to price drops. While the market waits for clearer signals, this weak correlation adds more uncertainty to ETH’s short-term price movements.

Ethereum Price Prediction: Bearish is More Likely

As of 11:00 PM on the 19th, the price of Ethereum is at $2,429, breaking through the major resistance level of $2,344 and rising. Given the ongoing selling and the weakened market conditions, it seems difficult to rise to $3,000 in the near future.

If selling pressure continues, ETH is more likely to fall to $2170. A drop below this support is unlikely, but the risk remains.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

If the overall market sentiment turns bullish, Ethereum could gain momentum again and rally to $2681. A break above this level would invalidate the bearish outlook and open up a further upside to the $2930 barrier, potentially allowing ETH to reach $3000.