Sui's star continues to rise, gaining real traction that has drawn more attention to the chain, as well as its twin flame, Aptos.

Both descendants of Facebook’s shuttered Diem blockchain project – Sui and Aptos have raised $300M and $350M, respectively, to build ultra-scalable blockchains capable of handling tens to hundreds of thousands of transactions per second. To do this, they have repurposed Diem’s technology, particularly its security-focused language, Move, which prevents common hacks like double-spending or reentrancy attacks. With the alt-L1 trade being a consistent trend in the past two cycles and both native tokens showing strong recent price action, it's valuable to compare these two networks focused on scalability and security to see exactly what they bring to the table.

In this article, we’ll compare Sui and Aptos, including their technical architecture, tokenomic structure, ecosystem, and usage trends, to see where their differences lie, where one may hold an edge, and the overall challenges both face.

Ecosystems and Usage

These networks hold different ambitions, and you can see differences in their ecosystems and usage. As expected, DeFi currently reigns supreme across the Diem descendants as the most used application, driving the majority of activity, though each chain also boasts unique applications tied into real-world use cases.

Since June, daily active addresses on Sui have fluctuated between ~350K and ~1.4M, settling around ~500K and rising above 1M this month, according to Artemis. Aptos has seen daily active addresses hover around ~150K, with occasional spikes up to ~400K and ~1.2M.

BanklessDavid C

BanklessDavid C

- Sui currently holds ~$800M in TVL, breaking through its previous high of ~$750M. Most of this value is held between three lending protocols — NAVI Protocol, Scallop, and Suilend, which has grown rapidly on the back of an airdrop campaign.

BanklessDavid C

BanklessDavid C

- On the other hand, Aptos TVL sits at ~$470M, a little below its ~$480M peak, but with a more diverse set of applications holding the top spots on the chain. Aries Market, a trading and yield venue, leads, followed by liquid staking protocol Amnis and DeFi hub Thala, which brings a stablecoin, DEX, and liquid staking service. DEX trading volumes between the chains remain close, ranging between ~$20-$50M the past month.

Interestingly, both networks also have hardware plays on them: the JamboPhone on Aptos and the SuiPlay0X1 on Sui.

- The JamboPhone, developed with Web3 infrastructure company Jambo, is an affordable smartphone aimed at expanding general crypto access in Africa, Southeast Asia, and Latin America, connecting users to the Aptos ecosystem.

- The SuiPlay0X1 is a blockchain-powered handheld gaming device built by Mysten Labs that will support games from platforms like Steam and Epic Games, as well as Sui-native games. Sui aims to make gaming a standout feature with its object-centric architecture uniquely equipped to allow in-game NFT composability and boast partnerships with large Korean gaming developers like Netmarble, NHN, and NCSoft. It will be interesting to see if they can succeed where so many have failed.

Technical Variations

While both use Move, Sui and Aptos employ different variations tailored to their needs that are incompatible with each other.

- Sui adopts an object-centric approach for its Move variation, organizing all resources like tokens into unique "objects" that hold ownership, transaction history, and defining details. This setup enables just one ledger update when a transaction is processed, as just the state of the single object is updated, rather than the state of all accounts transferring ownership, streamlining the overall chain’s data management to increase its potential for scalability.

- Aptos, like Diem, uses the traditional account-centric model, as most blockchains do, updating both sender and recipient accounts during transactions, which may be more familiar to developers. Unlike Sui’s new Move variation, Aptos has sought to improve the original version, refining it by lowering latency and increasing transaction throughput.

To ensure that these systems run smoothly, both Sui and Aptos use a Move prover tool. The tool checks everything before data or transactions are added, catching issues early during testing.

Consensus Methods and Performance

Beyond Move, Aptos and Sui’s consensus methods shape transaction performance and scalability, influencing how efficiently each network processes transactions.

- Aptos builds on Diem with its AptosBFT consensus system, which was originally developed for the Facebook project. This system helps validators quickly agree on transactions, finalizing most in under a second, while automatically replacing unresponsive validators to maintain efficiency, regardless of the amount of capital they have staked.

Further, Aptos uses a parallel execution engine to process multiple transactions simultaneously, enhancing speed and scalability. According to Artemis, due to this architecture, Aptos has been able to occasionally process ~326M transactions in one day, though data varies, with the chain’s average sitting closer to ~1M. In early September, it also announced a new upcoming consensus system called RAPTR, which aims to provide even higher throughput.

The end game of consensus is here!

— Alexander Spiegelman (@SashaSpiegelman) September 5, 2024

Today, I am excited to announce Raptr, the ultimate BFT protocol.

With all the experience we developed over the years, building DAG BFT systems, Raptr combines the main DAG techniques to unlock high TP while presorving our optimal theoretical… pic.twitter.com/rdKkEtUVnw

- Sui takes a different approach by splitting transaction handling into two parts: Narwhal for organizing transactions and Bullshark for processing them in order. This division enables more efficient transaction sharing and validation on Sui. Further, the chain is gradually replacing Bullshark with Mysticeti, a new consensus protocol designed to reduce transaction latency. However, these results are based on internal testing, and real-world performance could vary as Mysticeti is implemented and optimized.

Unlike Aptos, Sui’s model allows its validators to process individual transactions in parallel without waiting for blocks to fill up. This means that different transactions can be handled simultaneously, which enables theoretically uncapped scalability. As a result, Sui has averaged ~3-4M transactions per day since August, though data again varies across sources.

Tokenomic Models

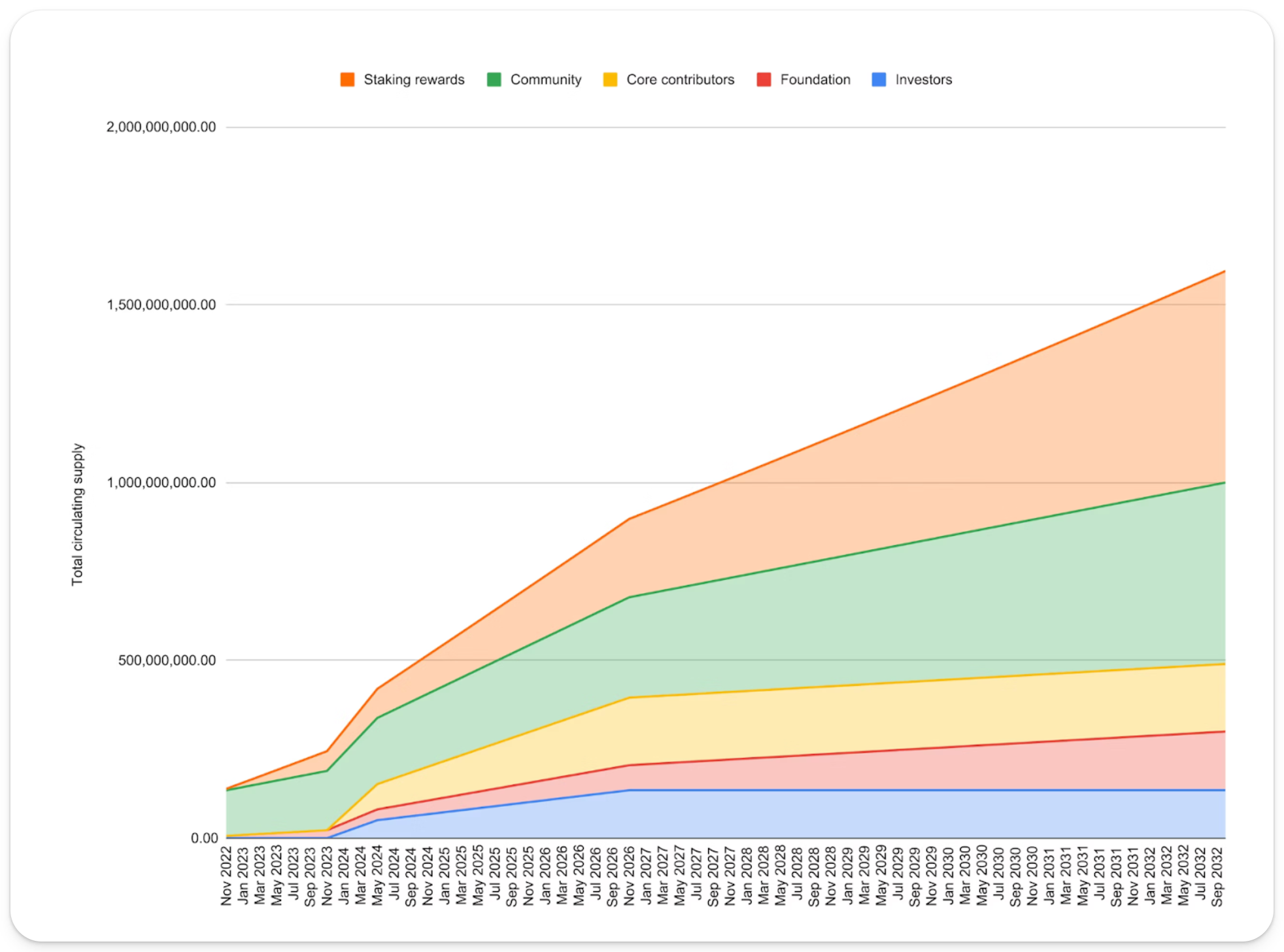

Like their technology, Sui and Aptos have fundamental similarities in their tokenomics but manage supply differently and are in different unlock stages.

- APT has an uncapped supply with a 7% annual inflation that will decrease over time. The token is used for staking (as Aptos is Proof-of-Stake), transaction fees, and governance. APT has a built-in deflationary mechanism as all transaction fees are burned, intending to balance its inflation rate, which will also decrease over time. APT currently has ~45% of its supply in circulation, with a market cap of ~$3B and a fully diluted market cap of ~$6.7B.

- By comparison, SUI has a capped supply of 10B and an annual inflation rate of ~3%. Like Aptos, SUI can be staked to earn rewards (as a Proof-of-Stake network) and is used for transaction fees and governance. However, Sui does not burn transaction fees, lacking Aptos’ concrete deflationary mechanism. It has a quasi-permanent deflationary effect through its storage fund for onchain data, though this is only a temporary pressure. Currently, Sui has only 27% of its tokens in circulation, giving it a ~$3.3B market cap and a ~$12.5B fully diluted market cap.

Challenges and Risks

Despite their innovations in scalability and security, Sui and Aptos face challenges due to Move's complexity, the EVM's dominance, and market competition.

While Move has security advantages, it is harder to learn than Solidity (used for the EVM), slowing the chains' growth. Even if developers are familiar with Rust, which Move is based on, they may find the transition to Move difficult, and onboarding top talent from other ecosystems could prove challenging. While anecdotally, some developers have reported that learning Move can take just several weeks (if you already know Rust), the smaller developer community and fewer libraries available compared to more established languages will likely slow adoption. Despite this, both Sui and Aptos are gaining developers, with Sui doing so at a faster pace, ranking in the top 10 ecosystems for monthly active developers, according to Electric Capital.

That being said, Move is also less battle-tested than Solidity. As Sui and Aptos' TVL grows, they could attract hackers, exposing untested vulnerabilities that could undermine the language’s value proposition.

Beyond Move's complexity, Sui and Aptos must compete with the EVM-dominated market, as well as the SVM, both of which have well-established developer communities, applications, and user bases, making it difficult for newer chains to gain traction. Additionally, new L2s have continued to embrace alternative virtual machines. The aptly named Movement is a highly anticipated Move-based EVM L2, which could theoretically bring the best of Move to an EVM environment, providing developers access to the language’s benefits in a familiar setting and with the largest total addressable market.

Takeaways

While Sui leads in TVL and daily active users, ultimately, both Sui and Aptos are in a race to secure a foothold in DeFi and have a large chasm to overcome to compete with Ethereum and Solana, especially if other blockchains like Movement can bring Move’s benefits to a more familiar environment.

They both push scalability and security, but differing consensus, programming models, and tokenomics highlight distinct paths to growth. It’s still early, and the success of both depends on sustaining developer engagement, capturing user interest, and maintaining ecosystem growth.