As the last week of September begins, financial markets will be focusing on several economic events in the United States. However, only a few events will directly or indirectly impact the portfolios and investment strategies of cryptocurrency investors.

Bitcoin (BTC) had a good start to the week in the Asian session earlier this week, with prices well above $63,000.

Manufacturing and Services PMI

The Business Research Council is scheduled to release data on Monday on the purchasing managers’ index (PMI) for manufacturing and services, which will shed light on the health of these sectors.

With the previous reading of 55.7 and the mid-term forecast at 55.4, a PMI above 50 could signal expansion in the manufacturing and service sectors. This could be positive for riskier assets like Bitcoin, especially if the report points to economic growth.

Consumer Confidence and Consumer Sentiment

The consumer confidence report, due out Tuesday, September 24, will be closely followed by the consumer sentiment report, which follows Friday. The two surveys come from different sources, but they measure how optimistic or pessimistic consumers are about the future of the economy.

Both reports reflect consumers’ financial outlook, business conditions and perceptions of the labor market over the next six months. In essence, they provide a snapshot of how people feel about the economy today and in the near future.

Optimism is growing among consumers as inflation eases in the United States. This positive change is largely due to expectations that inflation will continue to decline through the end of the year.

If these reports show increased confidence and sentiment, it could suggest that consumers are more willing to spend. This improved outlook could have a ripple effect, benefiting speculative assets like Bitcoin.

2nd quarter GDP

The second-quarter gross domestic product (GDP) report, due out Thursday, is one of the key economic indicators of the week. It is the second revision to the initial report in July, which showed a 2.8% increase for the quarter.

Increased domestic spending has been the main driver of GDP growth. Increased consumer spending often boosts the economy and inflation, strengthening the US dollar. Conversely, a slowdown in spending can reduce this effect.

A strong GDP report could boost confidence among U.S. citizens in the stability of the economy. This positive sentiment could also benefit the price of Bitcoin, which many investors see as an alternative investment or hedge.

Federal Reserve Announcements : Jerome Powell and Michelle Bowman

Federal Reserve Chairman Jerome Powell is scheduled to deliver his opening remarks on Thursday, and the market is eagerly awaiting his remarks after the latest inflation data and the 50-point rate cut by the Federal Open Market Committee . Powell’s remarks could have a major impact on market sentiment.

In addition to Powell’s speech, several other Federal Reserve officials are scheduled to speak throughout the week. Crypto traders will likely be closely monitoring these comments, especially after last week’s unexpected rate cut. In particular, Federal Reserve Governor Michelle Bowman is scheduled to speak on Tuesday and Thursday.

“The Committee’s large policy action could be interpreted as a premature victory declaration for the price stability mandate. A calmer move toward a more neutral policy stance would ensure further progress toward lowering inflation toward our 2 percent objective,” Bowman said in a statement Friday .

By expressing disagreement with recent policy decisions, Bowman becomes the first Fed governor with a dissenting view since 2005. Because of her unique position, Bowman’s upcoming comments will be closely watched by investors as she seeks to clarify concerns about the pace of rate cuts.

Core PCE inflation

The personal consumption expenditures (PCE) price index, due out Friday, is one of the key economic indicators this week. The core PCE, which excludes volatile categories such as food and energy, is one of the key data points the Federal Reserve uses to assess inflation trends and guide future monetary policy decisions.

Analysts forecast that core PCE will rise 0.2% for the month and 2.7% for the year, while overall inflation is expected to slow to 2.3%.

If the August PCE inflation rate comes out lower than expected, there could be a greater chance of further rate cuts, which could be a positive for Bitcoin. Lower interest rates tend to encourage lending, which increases liquidity in financial markets.

Read more: How to Protect Yourself Against Inflation Using Cryptocurrencies

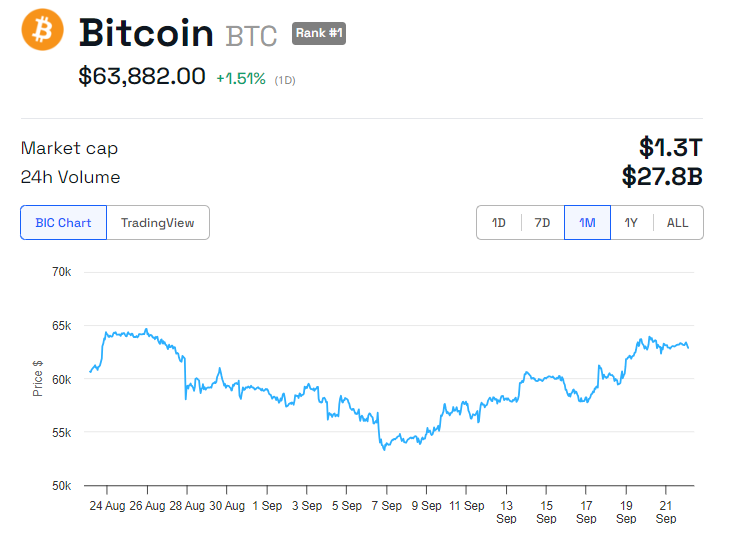

The environment of lower interest rates and more liquidity is generally positive for Bitcoin. According to BeInCrypto data, Bitcoin is currently trading at $63,882, up 1.51% since the start of Monday’s session.