BlackRock, the world's largest asset manager, is looking to revise its Bitcoin ETF (IBIT), which has been the best-performing among its peers since its launch on January 11.

Bitcoin ETFs continue to attract institutional demand, expanding Bitcoin exposure on Wall Street and extending beyond retail investors.

BlackRock files for Bitcoin ETF amendment

In a filing with the U.S. Securities and Exchange Commission (SEC) on September 16, BlackRock requested that Coinbase, which acts as custodian for the asset manager’s IBIT, process Bitcoin withdrawals within 12 hours.

“Subject to the required minimum balance verification mentioned above, Coinbase Custody will process withdrawals of digital assets from a Custody Account to a public blockchain address within 12 hours of receiving instructions from a Customer or Customer’s authorized representative,” an excerpt from the application reads.

The request comes as investors have raised concerns about Coinbase’s custody practices for Bitcoin ETFs. Specifically, investors want to ensure transparency by requiring Coinbase to provide on-chain proof of Bitcoin purchases for the ETF.

These concerns have arisen as the Bitcoin price has remained stagnant despite the huge inflows into Bitcoin ETFs over the past three months. Some have speculated that Coinbase may be using “paper BTC” or Bitcoin debt instruments for the ETF issuer, which could be contributing to the lackluster price action.

Read more: How to Trade Bitcoin ETFs: A Step-by-Step Approach

Amid concerns, Coinbase CEO Brian Armstrong made a bold attempt to refute fear, uncertainty, and doubt (FUD).

“All ETF creations and burns that we process are ultimately settled on-chain. Institutional clients have the option of trade financing and OTC trading before the trade is settled on-chain. This is standard for all our institutional clients. All funds settle in our prime vault (on-chain) in about a day,” Armstrong wrote .

Retrospectively, Tron founder Justin Sun was the first to question Coinbase’s Bitcoin wrapper, cbBTC, criticizing its lack of evidence and warning that “dark days are ahead for Bitcoin.”

BlackRock’s recent move to revise its Bitcoin ETF is intended to address these concerns. The revisions suggest the asset manager is working to strengthen its operational framework and improve liquidity. ETF analyst Eric Balchunas also downplayed the speculation.

“There are people who understand why these theories exist and want to make the ETF the scapegoat because it’s too far-fetched to think that the original HODLers could be the sellers. But they’re right… All the ETFs and BlackRock have done is rescue the price of Bitcoin multiple times,” Balchunas said .

Coinbase as a potential single point of attack

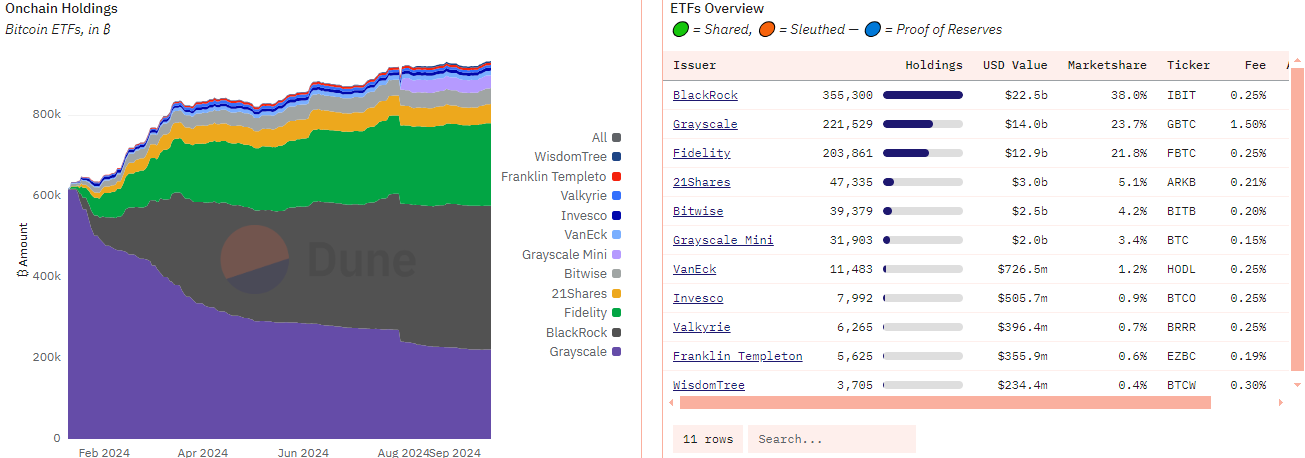

In fact, Bitcoin ETF inflows have been massive since the financial product was launched on January 11. According to Dunn data, BlackRock’s IBIT has over 38% of the market share and manages $22.5 billion in on-chain assets.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Coinbase is a dominant player in the cryptocurrency spot ETF market , providing custody services for eight of the eleven Bitcoin ETFs and eight of the nine Ethereum ETFs. It also provides trade execution and market surveillance services.

Coinbase manages about 90% of the $37 billion in Bitcoin ETF assets, raising concerns about its position as a potential single point of failure. Fox Business reporter Eleanor Terrett and others have recently raised concerns about this influential position.

“It’s a bad sign that almost every crypto ETF issuer has the same custodian for all their BTC and ETH. This makes Coinbase a potential single point of failure, and that’s scary,” Terrett wrote .

Beyond recent concerns about possible debt obligations for investors, threats from North Korean hackers also position Coinbase as a single point of attack if bad actors were to target custodians. Despite these concerns, the platform operates a significant portion of the U.S.-based BTC spot trading market and continues to play a significant role in institutional Bitcoin investment.