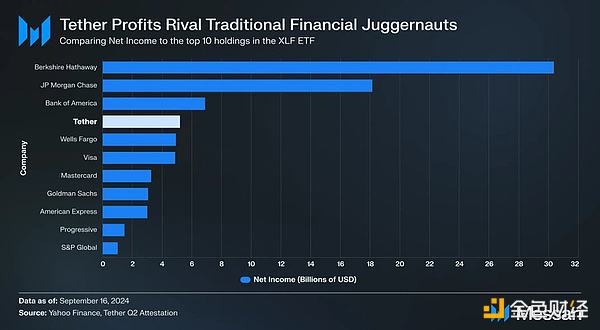

Tether’s record-breaking profitability last quarter has put it among the giants of tradfi. But its massive profit of $5.2 billion has also made it a target for new competitors looking to get a piece of the action.

In this article, we take a deep dive into the rapidly evolving world of stablecoins, both in the centralized and decentralized realms.

Stablecoin Overview

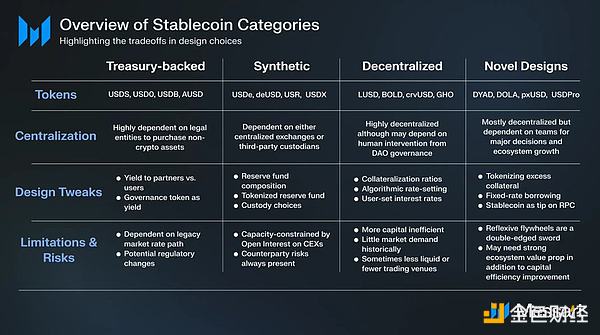

We will make the following vertical segmentations:

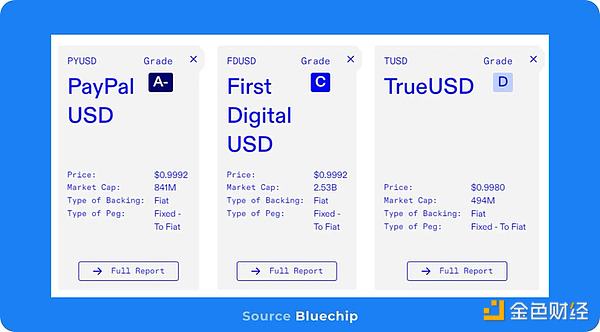

PYUSD

Centralized stablecoins often lack transparency and tend to only see high trading volumes when there are clear incentives. PYUSD is one of the few centralized stablecoins with a market cap of $1 billion that has gained trust.

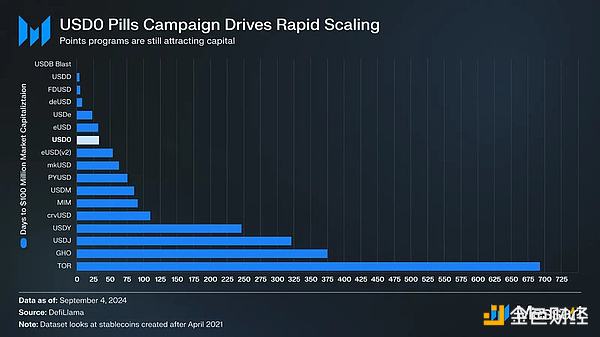

USD0

More decentralized treasury-backed stablecoins like USD0 have grown rapidly through airdrop incentives and partnership integrations with DeFi platforms like Morpho. USD0 has reached this mark very quickly with a market cap of around $250 million.

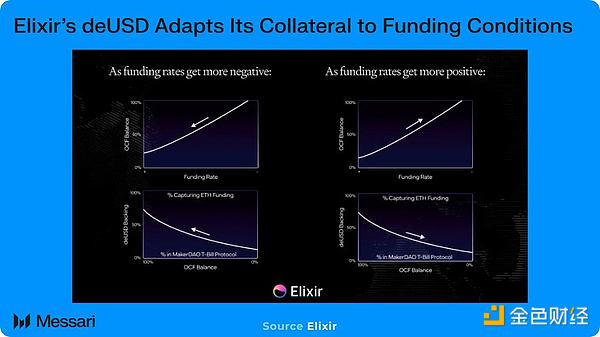

Elixir’s deUSD

Synthetic stablecoins like USDe use “long spot + short futures positions” to maintain their pegs. USDe lost market share as the basis was compressed. But new protocols like Elixir aim to improve on the Ethena model by adjusting its collateral backing.

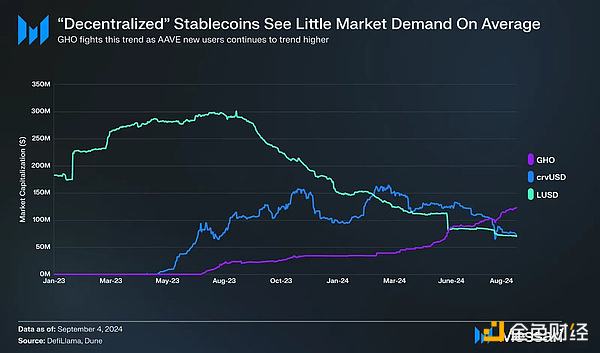

GHO

Stablecoins that focus on maximizing decentralization and minimizing human intervention have not shown much demand. GHO may be an exception as it takes advantage of the continued growth of active users on AAVE.

DYAD

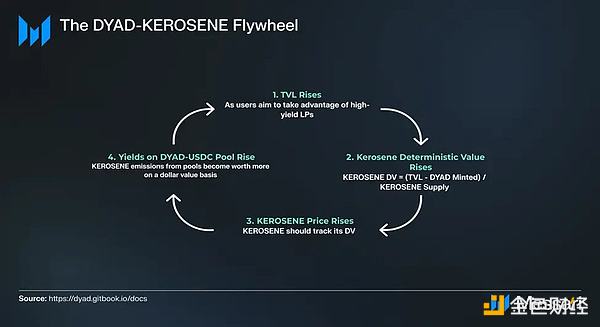

Innovative designs often attempt to implement some mechanism to improve upon typical mortgage debt.

Position mode. DYAD is one such stablecoin, and its goal is to utilize excess collateral in the system through another token called KEROSENE. KEROSENE allows users to mint more DYAD by pledging their own exogenous assets. Moreover, the more KEROSENE an NFT (NOTE) holder has, the more they will earn from the liquidity pool.

Each of these categories of new stablecoins competes with each other on yield, accessibility, liquidity, stability, and capital efficiency. New designs or tweaks to old ones involve a variety of trade-offs:

New stablecoins enter the market every week, and the stablecoin landscape is constantly evolving.