Author: Robert Greenfield IV Source: medium Translation: Shan Ouba, Jinse Finance

Selling pressure is the dark enemy of all asset holders.

While VC funds and dishonest influencers often lead the way in this regard, supply shock stocks, miners, and a growing number of institutional investors have now become the dominant force in fear, uncertainty, and doubt (FUD), commanding billions of dollars in net flows.

However, native selling pressure is a function of the token economics (Tokenomics) of each network and protocol - mechanisms encoded into every burn, minting, and annualized revenue distribution function to incentivize stakeholders while avoiding economic inflation and preventing the price of the system's native token from plummeting.

In this brief, we will analyze the local selling pressure embedded in the Bitcoin, Ethereum, and Solana economies. Okay, without further ado, let’s get started.

Bitcoin

The supply of Bitcoin is capped at 21 million, with a pre-set issuance schedule. Every time a new block is generated (on average, every 10 minutes), miners receive an additional block reward, which increases the supply of coins. Every 210,000 blocks (approximately four years), this fixed block reward is cut in half, an event known as a halving. The block reward for Bitcoin at its creation in 2009 was ₿50.

Zero block rewards and a fixed supply cap will not be reached until 2140, but with each halving, inflation will continue to decrease and block rewards will be halved. However, until the supply cap is reached, Bitcoin will remain an inflationary asset. At the current block reward, ₿164,000 (~$10.3 billion) will be minted each year.

Currently, the main local selling pressure on Bitcoin comes from the following sources:

Miner income (from transaction fees and block rewards)

Market shocks to supply (creditor payments, government expropriation)

Miner selling pressure

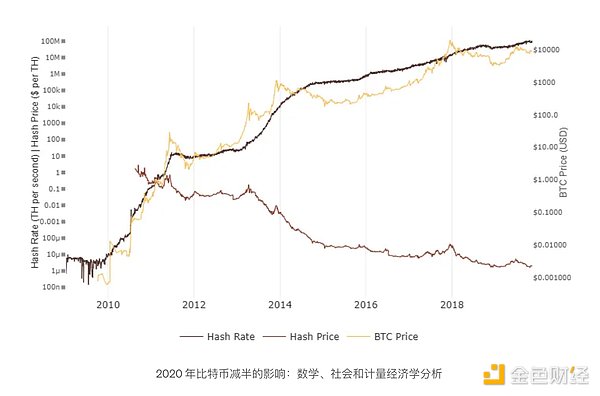

Due to the high operating costs and competitive nature of Bitcoin mining, as well as the need for publicly traded mining companies to report quarterly earnings and maintain stock prices, miners are often forced to sell their mined Bitcoin to realize a profit. This creates a constant selling pressure on Bitcoin. The high costs of mining, including financing facilities and ongoing operating expenses (such as electricity, taxes, and personnel costs), force miners to periodically sell a portion of their mined Bitcoin. On top of that, even as block rewards decrease, the total Bitcoin mining power (i.e., hash rate) has historically increased, further reducing profitability per unit of hash power.

Since the Bitcoin halving in April 2024, miner revenue (i.e. potential selling pressure) has averaged $218 million per week, compared to a high of $489 million before the halving in April 2024. However, during the same period, the network's hash rate growth has stagnated, indicating that miners' profit margins have been significantly compressed.

At current Bitcoin prices and hardware costs, it appears that expanding mining capacity has become unprofitable. Profitability compression means that miners may need to sell a larger percentage of Bitcoin to cover operating costs, which are primarily denominated in fiat currencies.

Market shock x supply

In the cryptocurrency space, a "supply shock" is when a large amount of a particular cryptocurrency suddenly enters the market due to an unexpected event. This supply surge often significantly changes market dynamics, often leading to a sharp drop in the price of that cryptocurrency. Such events can be triggered by the following factors:

Massive sell-off : When a large holder (such as a whale or institution) decides to liquidate a large number of holdings.

Token unlocking : When a large number of previously locked or vested tokens enter circulation, increasing the circulating supply.

Regulatory changes or hacking attacks : Regulatory crackdowns, exchange hacks, or other unexpected events could lead to panic selling and rapid liquidation of assets.

This rapid increase in supply, without a corresponding increase in demand, would create a "shock" in the market, destabilizing prices and potentially leading to broader market volatility.

For Bitcoin, market supply shocks usually stem from the collapse of centralized Bitcoin liquidity platforms such as exchanges, market makers, and lending platforms. Unlike other cryptocurrencies, Bitcoin has no token unlocking schedule or smart contracts that can be exploited on its network.

Creditor repayment (temporary risk)

During the Bitcoin halving cycle in 2024, market shock supply is currently limited to the $10 billion (168,000 BTC) in Bitcoin repayments from the Mt. Gox and Genesis bankruptcies. There are concerns that these creditors may choose to sell their Bitcoin holdings after receiving full compensation, causing market turmoil, especially if a recession caused by the recent decline in interest rates triggers a sell-off.

Government seizures and sales

Bitcoins confiscated by governments from illegal websites, often on the Dark Web, also add to the market-impacting supply.

For example, in February 2024, German authorities seized 50,000 Bitcoins, worth approximately $2.1 billion, from the former operator of the piracy website Movie2k.to. The cryptocurrencies were voluntarily handed over by the suspects in the case as part of an investigation into the illegal commercial exploitation of copyrighted works and money laundering. The confiscation was part of a joint investigation by the Dresden Public Prosecutor's Office, the Saxony State Criminal Police, and other agencies.

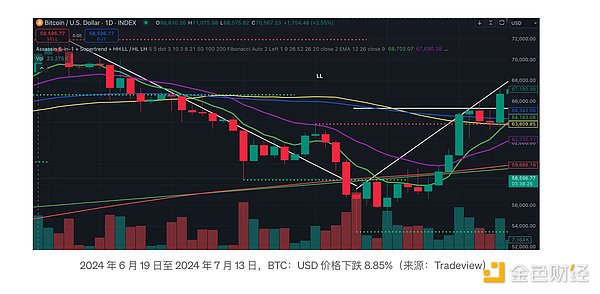

After confiscating Bitcoin, the Saxony government dumped it on the market, causing Bitcoin to rise against the US dollar (BTC)

) price fell by 16.89%. However, on the last day of the sell-off, the price rebounded and the final decline narrowed to 8.85%.

Bitcoin held by governments

The market shock to supply is not limited to the German state of Saxony. As of 2024, several governments around the world hold large amounts of Bitcoin, primarily acquired through confiscations related to criminal activity:

United States : The U.S. government is the world’s largest Bitcoin holder, holding approximately 203,129 BTC, valued at approximately $11.98 billion. These Bitcoins were primarily obtained through confiscations related to cases such as the Silk Road Dark Web market.

China : China holds about 190,000 Bitcoins, worth about $11.02 billion. Most of these Bitcoins came from the PlusToken Ponzi scheme, one of the largest cryptocurrency scams in history.

United Kingdom : The United Kingdom holds approximately 61,000 Bitcoins, valued at approximately $3.53 billion. These Bitcoins were confiscated from various financial crimes, including major money laundering operations.

El Salvador : As the first country to adopt Bitcoin as legal tender, El Salvador holds about 5,800 Bitcoins, worth about $400 million. These holdings are part of the country's financial strategy, including a plan to "buy 1 Bitcoin per day."

Ukraine : Ukraine holds approximately 46,351 Bitcoins, a combination of assets confiscated by police and donations received during the war.

Bitcoin ETF Outflows (Theoretical)

2024 introduces a new Bitcoin price correlation: Bitcoin ETF net flows. As cryptocurrencies are gradually incorporated into structured products, global investment macro trends will increasingly co-determine prices with an asset’s token economics and its network/protocol performance KPIs.

Ethereum

Ethereum started out as a proof-of-work (PoW) network, but later switched to proof-of-stake (PoS) to better improve transaction throughput and reduce hardware requirements that had led to the network becoming more centralized.

Ethereum is doubly inflationary and uses the following three dynamic supply mechanisms to bootstrap its token economics:

Issuance : Ethereum is issued based on the total staked value. Specifically, the total issuance is proportional to the square root of the number of validators.

Transaction fee burning : Ethereum burns a portion of the ETH used to pay transaction fees from the circulating supply.

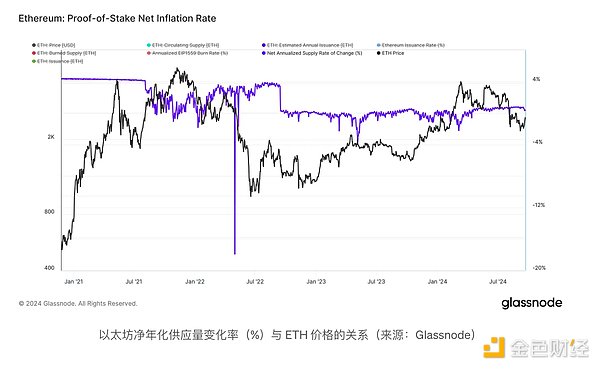

As of this writing, Ethereum has approximately 1.66M validators, with a total issuance of 23,300 ETH per week, resulting in an annualized inflation rate of 0.295%. The annualized yield (APY) earned by staking ETH as a validator or through liquidity staking is 2.8%.

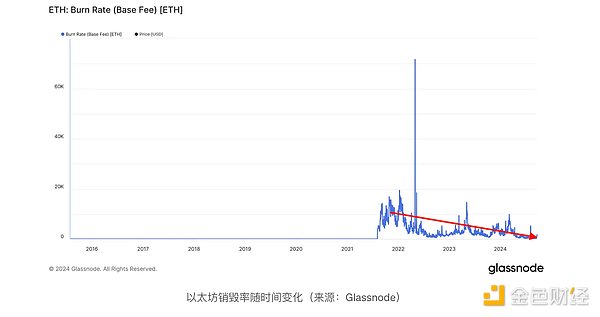

Ethereum's BASE_REWARD_FACTOR controls network inflation. As L2 Rollup usage increases, Ethereum's transaction density and destruction rate have been steadily declining since 2021, leading to higher inflation.

If transaction density continues to decline as users opt for lower L2 transaction fees, validator profitability and total ETH staked will inevitably decline with it unless the BASE_REWARD_FACTOR factor is increased. However, doing so would also increase inflation. Ethereum may need to refocus on better scaling transaction costs on L1, or redefine the relationship between rollups and the base layer to increase the proportion of ETH staked and/or the amount of ETH burned.

Another factor that influences Ethereum supply and demand dynamics, albeit indirectly, is staking. About 29% of the total ETH supply is staked and continues to grow. Staking is a large source of net supply for Ethereum and has been widely popularized and simplified through liquid staking protocol such as Lido and Rocketpool, which allow users to stake without setting up their own validators and receive a percentage of validator rewards through APY.

Solana

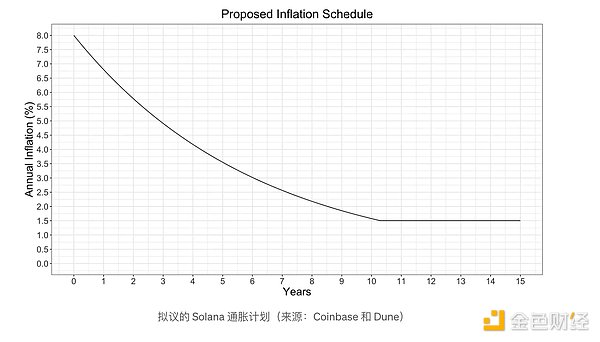

Solana has been a PoS network from the beginning and has a fixed total inflation schedule that does not change based on the number of validators. Currently, Solana’s inflation rate is 5.1% and will continue to decrease by 15% per year until it reaches a terminal inflation rate of 1.5% in approximately 2031.

Solana destroyed 50% of base and priority fees, while Ethereum destroyed 100% of base fees. However, Solana’s destruction rate was much lower, only offsetting 6% of YTD issuance (1.1M SOL destroyed, while 18.2M SOL issued). Most of Solana’s inflation comes from its fixed issuance schedule, which adds 528K SOL ($84M) per week — more than ETH’s $46M, but less than BTC’s $198M.

Solana’s staking rate has remained stable, remaining above 60% since September 2021, peaking at 72% in October 2023, and stabilizing at 68% in March 2024. A higher staking rate compared to ETH means that more staking rewards may be sold.

in conclusion

Token inflation affects flows differently depending on factors like issuance costs (mining vs. staking) and variability (burn rate). PoW chains like Bitcoin face higher selling pressure from miners to cover costs, while PoS stakers can keep more of their earnings. PoS inflation rate also depends on changes in the staking rate. To fully understand issuance-driven flows, both metrics need to be considered. For example, while staking acts as a liquidity absorber for ETH, this is not currently the case for SOL.