The price of Ethereum (ETH) is looking for a significant rebound after falling nearly 9% over the past seven days. While the altcoin is building momentum for a potential surge, short positions that expect the price of ETH to continue to fall could come under further pressure.

In this analysis, BeInCrypto looks at the factors that could drive the value of Ethereum higher. It also highlights the implications this could have for traders looking to profit from the price movements of cryptocurrencies.

ETH goes to $3000 'Uptober'... Ethereum Target Recovers, Short Positions Under Pressure

Expecting an uptrend in October, known as “Uptober,” several analysts predicted that ETH could reach $3,000. However, a disappointing start to the month saw Ethereum’s price drop from $2,600 to $2,360, leading to massive liquidations of long positions.

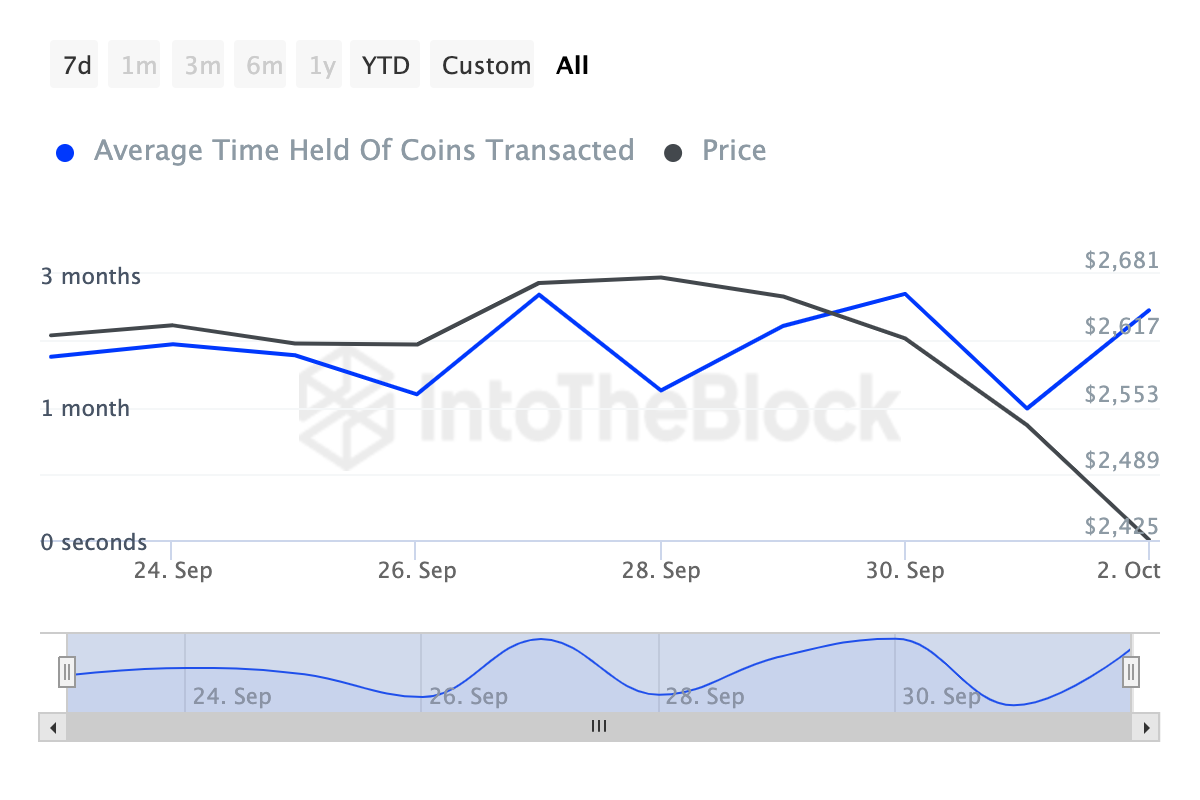

However, recent data suggests that the situation may be changing and short positions may be at risk. One of the key indicators for predicting this is Ethereum’s coin holding time, which measures the length of time a coin is held without being traded or sold.

A decrease in holding time indicates that more holders are selling their assets, which is usually a bearish signal. This activity often foreshadows downward price pressure, which indicates that confidence in holding the coin is weakening.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

However, in this case, the coin holding time increased by 58% during Ethereum’s recent price decline. This increase is a bullish indicator for ETH, suggesting that long-term holders are building or maintaining their positions despite the price decline.

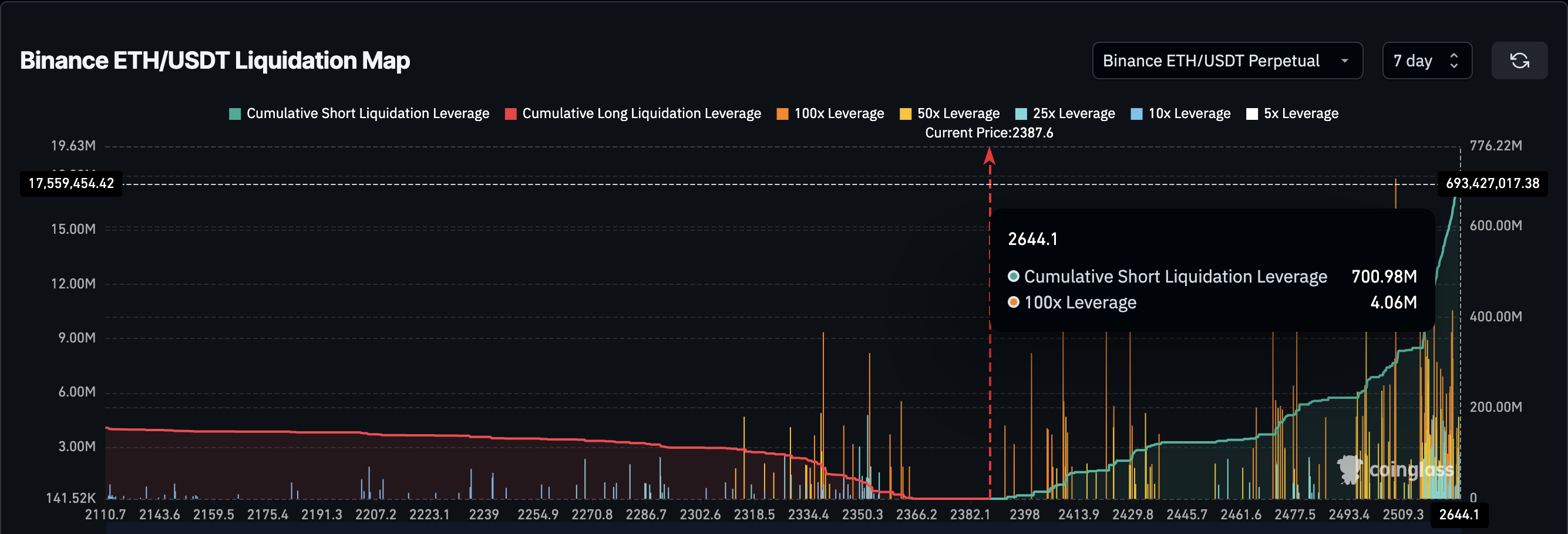

This action could be crucial for the cryptocurrency to recover and erase some of its recent losses. If this trend continues, the price of ETH could rise to $2,600. According to Coinglass, a cryptocurrency derivatives data platform, a rise to $2,644 could result in over $700 million in short liquidations.

If this development is confirmed, a short squeeze could also occur. A short squeeze is a phenomenon where when the price of a cryptocurrency rises significantly, traders who bet on a decline liquidate their positions.

ETH Price Prediction: $2690 Possible if Buying Pressure Strengthens

Despite the ETH decline, the bulls still seem to be defending the price. If this continues, it may not be long before ETH bounces back and resumes its uptrend.

However, significant buying pressure is needed for this prediction to come true. As you can see on the daily chart below, if the uptrend holds, the price of Ethereum could rise to $2450.

If buying pressure strengthens, the altcoin’s value could rise to $2690. In that scenario, Ethereum could push its price up to $3202 without saying goodbye to the bull market.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

On the other hand, a break below the section trend line could invalidate this prediction. In that scenario, the price of ETH could fall below $2300 and even to $2295.