Crypto.com has filed a lawsuit against the U.S. Securities and Exchange Commission (SEC) after receiving a Wealth Notice, indicating the possibility of future prosecution. The SEC intends to treat most cryptocurrency transactions as securities transactions, which would significantly increase regulation of the industry.

Crypto.com is not the first company to proactively file a lawsuit on this issue, but there is no clear conclusion yet.

Crypto.com CEO: “We Will Sue the SEC First”

The case began on the morning of October 8, when the SEC sent Crypto.com a Wealth Notice . A Wealth Notice is a procedure used by the SEC to notify a company that it has completed its investigation and is about to file charges . In response, Crypto.com CEO Chris Marzalek announced that they would be suing the SEC first .

“Our company’s unprecedented action against the federal agency is a legitimate response to the SEC’s enforcement-driven regulatory actions that have harmed more than 50 million U.S. cryptocurrency holders. The SEC’s unauthorized intrusion and illegal regulation of cryptocurrencies must stop,” Marzalek said.

Read more: What does it mean when you receive a wellness notice from the SEC?

Crypto.com’s official statement was direct and aggressive, claiming that the SEC’s improper attacks were part of operating a legitimate exchange, and adding that the regulator’s actions against the industry left Crypto.com with “no other choice.” It even said the indictment ran counter to the growing bipartisan pro-crypto consensus within the government.

In short, Marzalek and Crypto.com claim that the SEC’s impending lawsuit is completely unjustified. They claim that the SEC is attempting to treat almost all cryptocurrency asset transactions as securities transactions, except for Bitcoin and Ethereum . The company has even filed petitions with the SEC and CFTC requesting explicit confirmation that some of its crypto assets are actually commodities.

SEC's War on Exchanges

This preemptive strike mirrors a similar move by ConsenSys in April, when it filed a lawsuit against the SEC over the same concerns about securities trading in response to the imminent threat of prosecution. That suit was dismissed in late September , leaving these questions unsatisfactory.

In essence, Marzalek may have a point when he describes the lawsuit as “an action to protect the future of cryptocurrencies.” Commodity regulation is looser than securities, which is a big reason why Bitcoin and Ethereum are considered commodities. But if all other assets are held to a higher standard, it would have dramatic implications for the entire industry.

Read more: What is the Howey Test and How Does It Affect Cryptocurrencies?

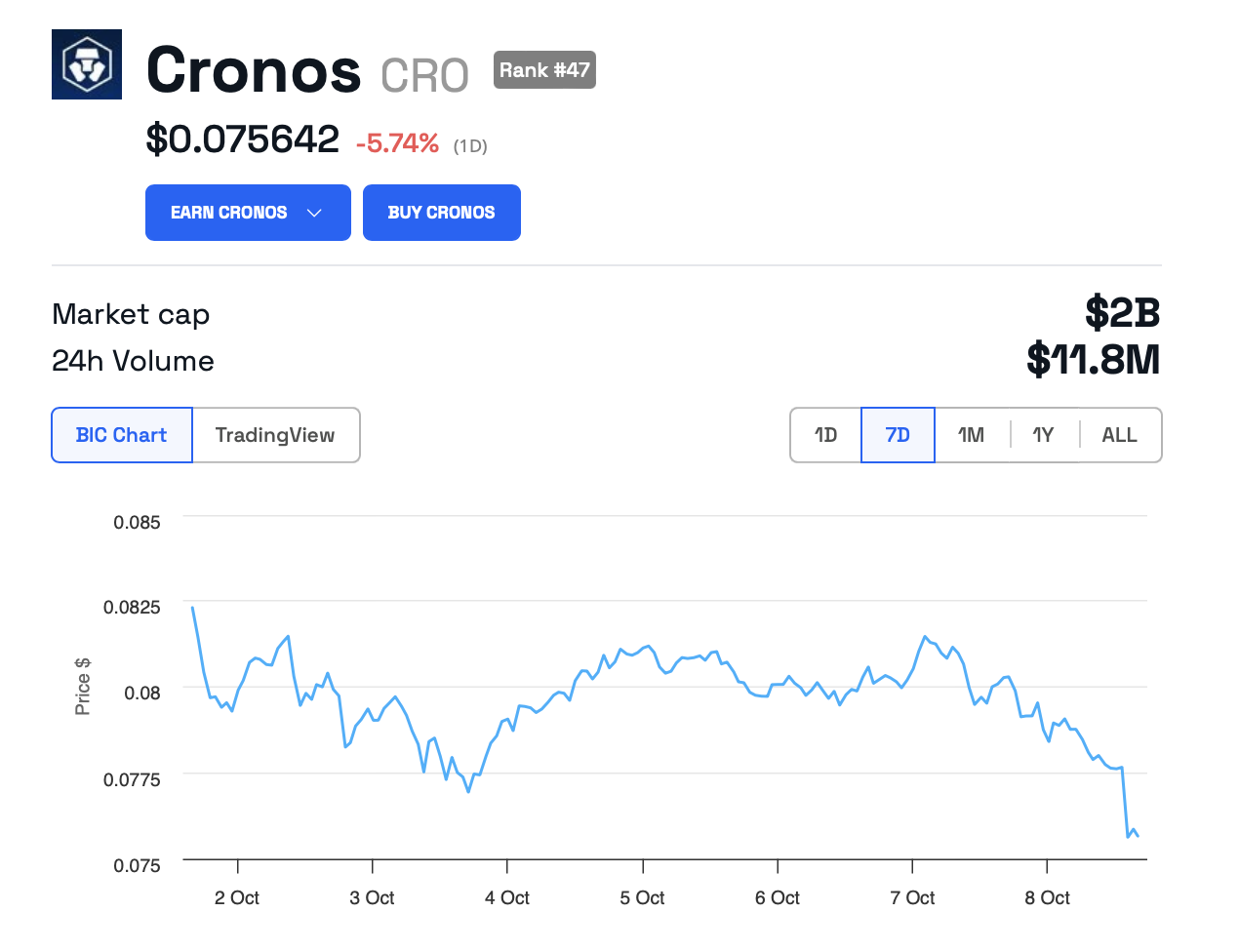

This legal battle is currently in its very early stages. Since the announcement, the price of Kronos (CRO), the native token built on Crypto.com’s blockchain , has fallen. Beyond this slight decline, the proceedings remain unclear. Marzalek and his team will pursue this case as much as possible, and hopefully clarify the legal position of all exchanges.