The Bitcoin (BTC) market is currently experiencing uncertainty as dormant coins are being recirculated, leading to sluggish market demand. On-chain data has revealed that a significant amount of BTC that has been held for a long time is now being recirculated.

This is usually positive for the value of the coins, but with low demand, it can put additional downward pressure on the price of Bitcoin.

Old Bitcoins are returning to the market

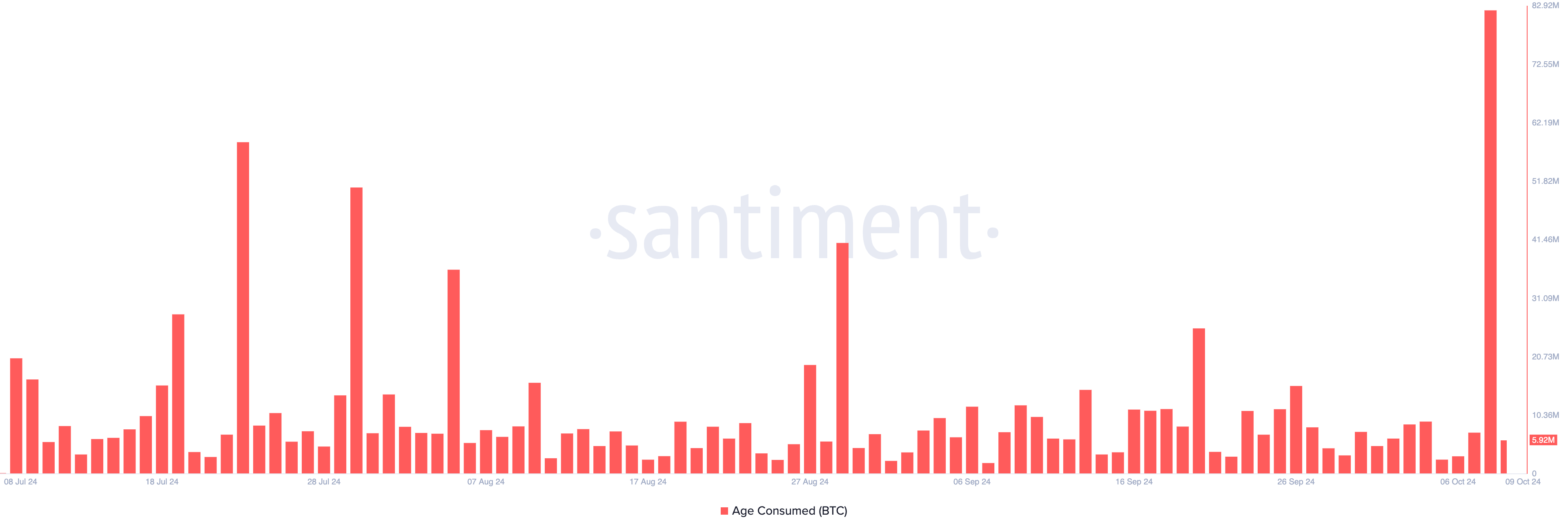

Lookonchain, an on-chain data analysis company, mentioned in a post on its own X that major Bitcoin whales have withdrawn 250 BTC from Binance after a 6-month dormancy. This whale activity coincided with a spike in Bitcoin's age consumed metric, which tracks the movement of long-held coins. On that day, the metric surged by 1026%, reaching an all-time high of 82.1 million in the past 90 days.

This surge is significant when long-term holders rarely move their coins. Their movements often suggest a change in market trends. Historically, when dormant BTC is recirculated, it is seen as a positive indicator for future price movements, suggesting the resumption of activity by strategic long-term holders.

Read more: What Happened in the Last Bitcoin Halving? 2024 Prediction

However, for this positive scenario to materialize, the movement of dormant coins needs to coincide with strong market demand. If previously inactive coins are recirculated during periods of weak demand, it can increase selling pressure and drive down the price of Bitcoin, which is what we are currently seeing in the market.

The declining Bitcoin Chaikin Money Flow (CMF) highlights this weak demand. The CMF, which tracks the flow of capital in and out of the market, is currently at -0.13, below the zero line. This suggests that liquidity is draining, and more traders are selling Bitcoin, adding to the downward pressure.

BTC Price Prediction: The Market Needs New Demand

The current surge in BTC supply can lead to a price decline if demand is unable to absorb it. The Fibonacci retracement tool reading for BTC indicates that selling pressure could push the coin price below $60,000, testing support at $58,464.

If the bulls fail to defend this level, Bitcoin's price could drop to $54,847.

Read more: Bitcoin Halving History: Everything You Need to Know

However, if the coins experience new demand, the recirculating dormant coins could be absorbed by buyers, which could push the price higher and invalidate the downside outlook mentioned above. In this scenario, Bitcoin's price could reach $68,474.