Despite the growing optimism about the potential of Ethereum (ETH) this month, this cryptocurrency may struggle to reach the $3,000 mark. This prediction goes against investors' expectations, especially after the euphoria of "Uptober" last month.

From an on-chain and technical perspective, this analysis highlights three key obstacles that could prevent Ethereum's price from breaking through the $3,000 barrier, potentially keeping it below this critical threshold in the short term.

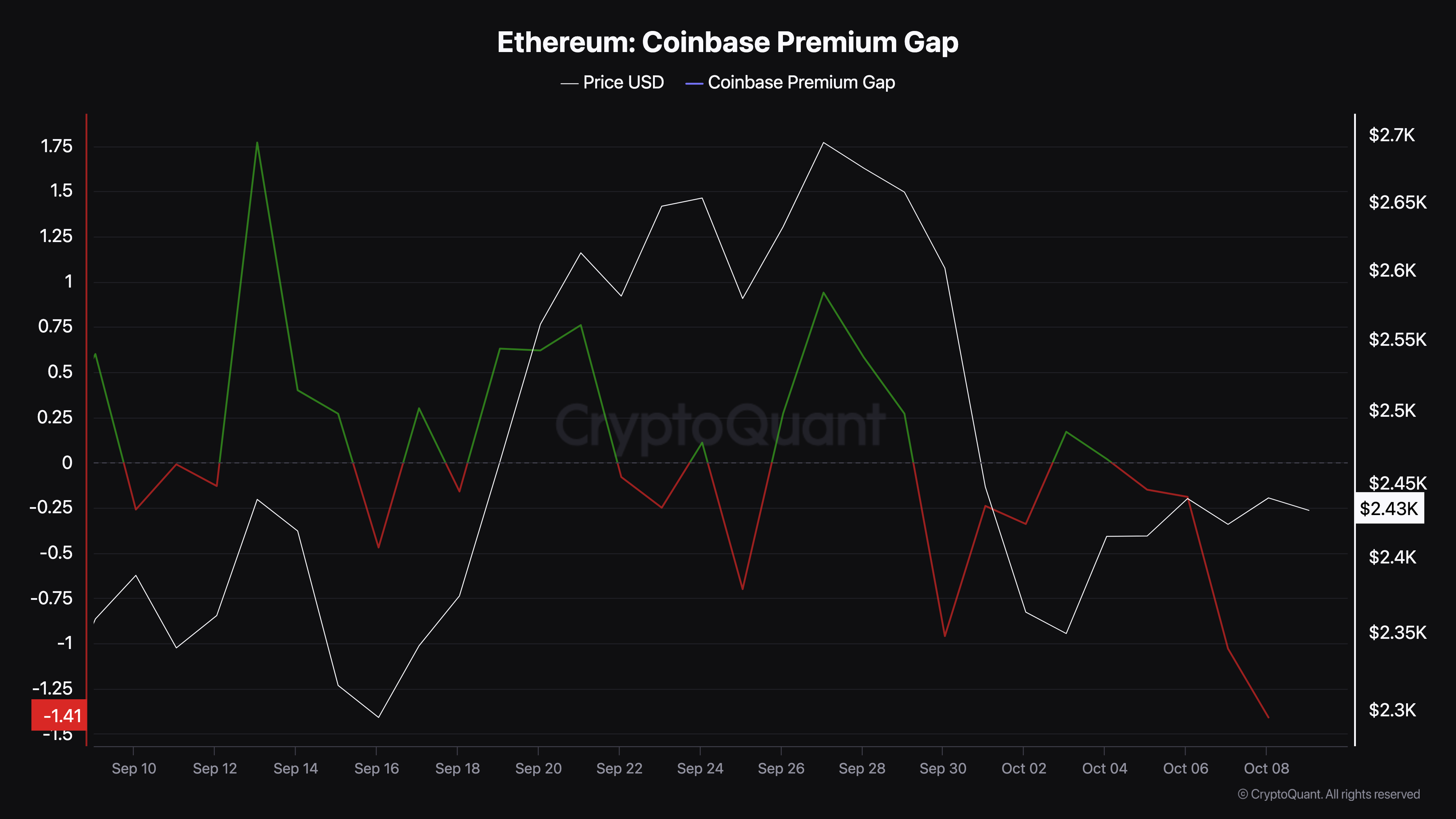

Ethereum Coinbase Premium Gap Decreasing

One indicator supporting this hypothesis is the Ethereum Coinbase premium gap, which tracks the activity of US investors. A high Coinbase premium gap indicates buying pressure from investors in that country.

Conversely, a low value suggests increasing selling pressure. On September 27th, the premium gap was 0.94, which coincided with ETH's price rising to $2,694.

However, at the time of writing, this figure has dropped to -1.41, indicating that market participants are refraining from purchasing ETH. With most being sellers, this suggests this cryptocurrency may not experience a significant upswing soon.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

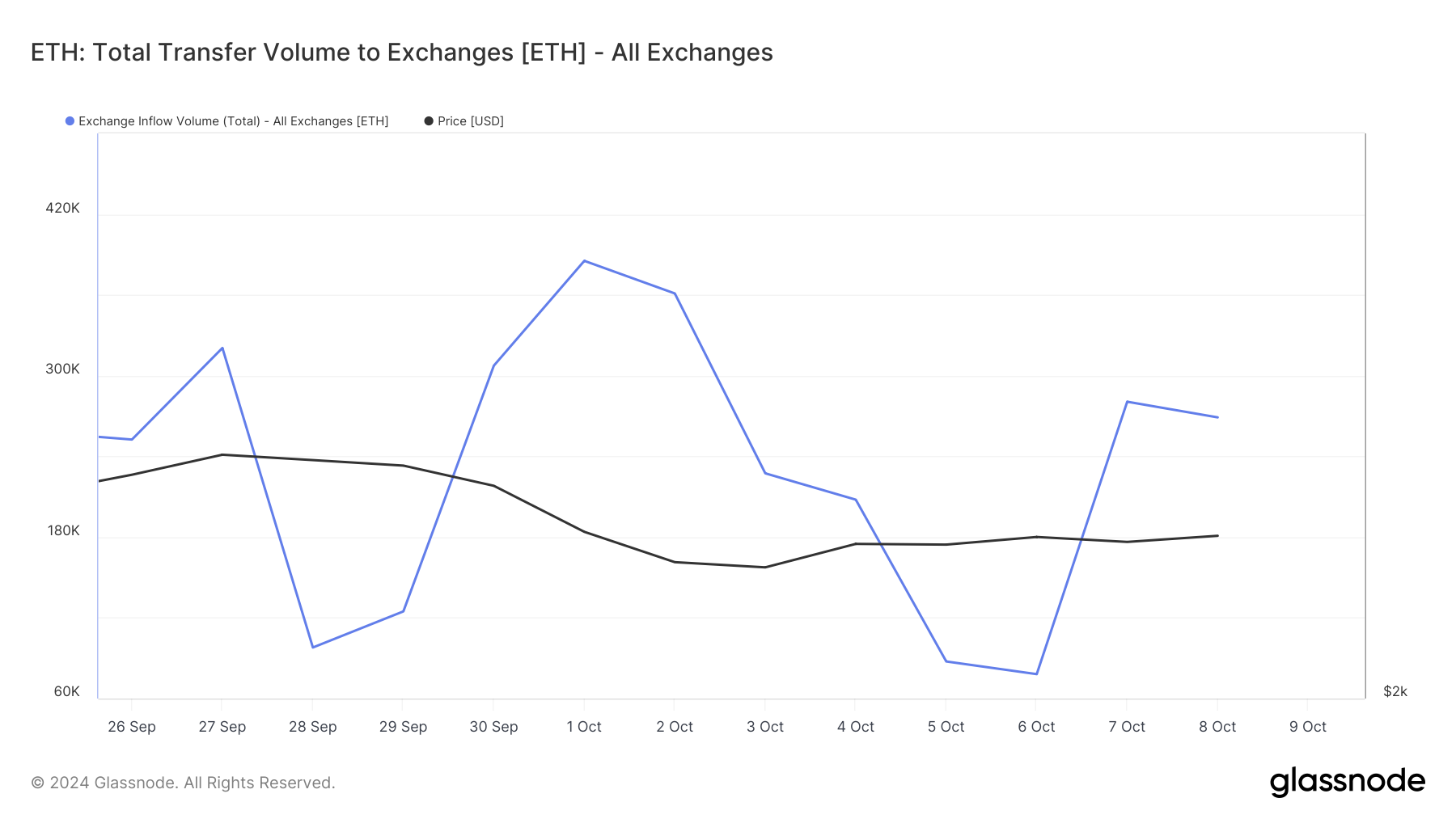

Additionally, data from Glassnode shows a sharp increase in the amount of ETH flowing into exchanges. On October 6th, the total exchange inflow was 78,127 ETH, but this has now tripled to 268,956 ETH in just 5 days.

This increase suggests that some holders are losing confidence in Ethereum's short-term outlook and are selling before further price declines. This indicates that a broader range of ETH holders, beyond just US investors, are disposing of altcoins. If this trend continues, Ethereum's price could face significant downward pressure.

ETH Price Forecast: Bearish Outlook

Based on the 4-hour chart, Ethereum is currently trading at $2,468 and has been moving within an ascending triangle pattern since July. While this pattern can result in either an upward or downward breakout, the chart suggests a higher likelihood of ETH falling below the triangle.

Considering Ethereum's current weakness, this cryptocurrency may drop to $2,208 rather than surpassing $2,600. However, if buying pressure increases, this outlook could be reversed.

Read more: How to Invest in Ethereum ETFs?

For this to happen, demand for ETH is needed not only in the US but also in various regions. In that case, Ethereum's first target could be $2,709, with the potential to then surpass $3,000.