Author:Crypto Radahn

Compiled by: TechFlow

Cryptocurrencies have been evolving for over a decade. During this time, each bull market has brought new hot topics.

The hot topic in 2017 was ICO, while in 2021 it was DeFi, GameFi and Non-Fungible Token. So, what new trend might the 2024 bull market bring? One potential hot topic is Memecoins.

Why Memecoins?

Memecoins have almost no practical use or added value in the crypto space. They are rife with scams and do not solve any real problems. So, why are they so popular now? The short answer is:

Memecoins are community-driven. Investors now tend to trust Memecoins communities more than utility tokens that may be backed by VCs and potentially dumped on retail.

Using low-cost Layer 1 (L1) like Solana and Layer 2 (L2) chains like Arbitrum, the transaction costs are almost zero.

Celebrity endorsements and Memes can better attract audiences, thus driving the increasing popularity of Memecoins.

So, now you understand why Meme coins are a current area worth paying attention to. But how do we judge which Meme coins are of high quality and which are low quality (or even outright scams)? To help you understand, we've summarized a few simple steps to filter out potential coins.

Step 1 — Strong Community and Fan Base

A strong community and fan base can boost the survival chances of Meme coins. To assess this, you can look at the following:

Whether there is a large and active community on X (Twitter), Telegram and Discord.

Whether the project team is active in the comments and actively interacting with the community.

Whether a unique identity has been formed around a Meme (e.g., the frog for $PEPE or the dog for $DOGE).

Step 2 — Token Distribution

To effectively check this, you can use the free version of Bubblemaps: enter the Meme coin you're interested in and the blockchain it's on. Then, check the distribution of its Tokens. If the bubble chart shows many colors, clusters, and huge bubbles, it means that many Tokens are held by a few entities, which could mean a lot of dumping.

Overall, look for Token distributions that are evenly distributed (deep bubble colors) and not clustered (bubbles not connected).

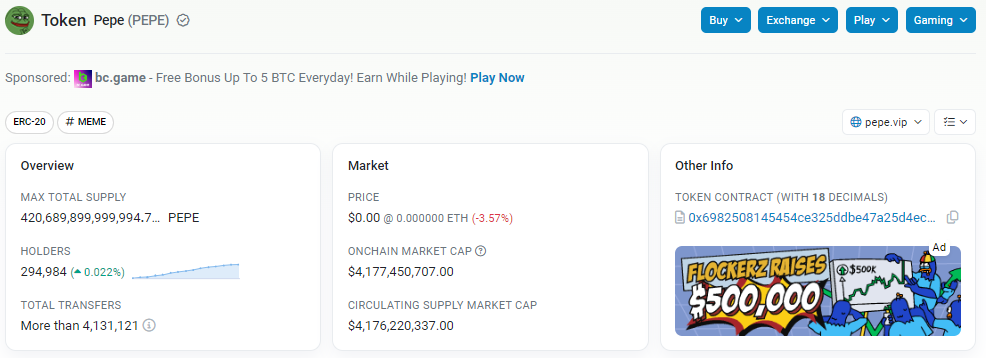

Step 3 — Token Holders

Potential Memecoins will see a gradual increase in the number of Token holders over time. You can look for an upward trend in the number of holders by checking block explorers like Etherscan. Here's an example for $PEPE:

Source:Etherscan

Step 4 — Trading Volume and Liquidity

Look for Memecoins with large trading volume and strong liquidity, especially those with a market capitalization of over $100 million. In short, focus on the following metrics:

Trading volume should be over 8%-10% of the market cap.

Liquidity should be over 2%-4% of the market cap.

You can find this information on DexScreener.

Step 5 — Historical Performance

Memecoins that have experienced around 80% crashes may only perform well if:

Major holders have not dumped.

The community provides support.

The number of holders continues to increase.

Conclusion

There you have it, a guide on how to pick the strongest Memecoins in the market. However, be sure to exercise caution before fully committing.

Disclaimer

The information provided by Altcoin Buzz is for educational, entertainment and reference purposes only and does not constitute financial advice. Any information or strategy is based on the author/reviewer's risk tolerance, which may differ from yours. We are not responsible for any direct or indirect investment losses caused by using the information provided. Bit and other cryptocurrencies are high-risk investments, so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.