Author: TechFlow

"It was just on that day when you stood at the crossroads, seeing the clouds and winds, the day you made the choice, in your diary, it was rather dull and ordinary, at the time you still thought it was just an ordinary day in your life."

--- "The Girl Who Killed the Quail"

14 days ago, one of our ordinary editors, while browsing the internet for writing materials, accidentally discovered the nonsense of Terminal of Truth and saw the token $GOAT it issued.

At the time, the editor put in 1 SOL, and until today when Binance announced the listing of GOAT's futures, this initial 1 SOL, if calculated at the price at the time of writing, has achieved a return of 250 times.

And on the day the goat just came out, there was almost no one introducing the ins and outs of the matter.

After a brief understanding, the editorial department felt that the narrative angle of an AI Bot posting Memes was very interesting, so they wrote an article titled "Are AI Bots Issuing Meme Coins Now? A Quick Look at a16z's Investment, Bot's Self-Issued Meme Coin GOAT".

If you carefully compare the release time, you will find that this is one of the earliest articles in the Chinese media to introduce GOAT; and it is precisely because we saw it early, that the final return is far greater than expected.

Compared to professional dog-fighting bloggers, on-chain scientists, and industry heavyweights, this profit, whether in terms of multiples or total amount, may not be considered much, perhaps just a small fry seeing a big one;

But we feel that this event may be more valuable as a reference for ordinary readers:

How did an relatively ordinary person, not a professional trader, through the interpretation of public information and the use of free tools, maintain a good mindset and reap an unexpected gain?

Here is his true story, shared with everyone.

Laughing before the rise, a prophet after the rise

This industry has always been ruthless in terms of the victor and the vanquished, and winning by rising.

That GOAT has come to this day, in hindsight everyone may feel that you are a prophet, successfully grasping the hottest coin; but if you look back 14 days ago, I think I was just one of the many cannon fodder in the PVP.

Busy with my media editing work on a daily basis, I also often lose my mind in the Solana on-chain meme arena.

But precisely because of my main job, I inevitably come into contact with new hot spots and narrative angles on a daily basis, and then write the parts I find interesting into articles.

This is driven by work, not active speculation.

Writing interesting and informative content is the main job.

So when I first saw GOAT, I was "laughing", lacking a lot of serious investment decisions, and more feeling that the topic was interesting.

Of course, the final result is good, and I have reaped an unexpected gain.

Looking back, on the afternoon of October 11th, I wrote an article introducing how a16z invested money in the Terminal of Truth Bot, and the Bot issued its own coin. It was almost at the beginning of writing this article that I made a lottery-like investment of 1 SOL, and the price of GOAT at the time was 0.0019.

Image: Screenshot taken on October 11th when the goat just came out, the green B point is the entry price

Today, the price of GOAT is around 0.75, and compared to the initial entry price, the total assets have theoretically increased by 370 times.

However, I had withdrawn the principal a long time ago, and when someone FUDed the Terminal of Truth for misspelling an English word, causing the price to plummet, I added another 1 SOL.

If only the initial 1 SOL is calculated after doubling the principal, the return is about 250 times.

Image: Screenshot taken before the article was published on October 25th, the profit calculation differs from the text due to the buy and sell actions in between

Obviously, from the perspective of maximizing profits, I made at least two mistakes:

I shouldn't have only invested 1 SOL, the initial principal was too small;

I shouldn't have only added 1 SOL when FUDing, missing the big opportunity to get on board during the pullback;

However, I am neither a professional trader and researcher, nor a perpetually victorious KOL, and I don't have access to any so-called Alpha groups.

These imperfections in operation, for an ordinary crypto practitioner without extra energy, bargaining power, and information asymmetry, I can accept.

And it's precisely because my initial total cost was only 1 SOL, that I could laugh and hold on, and even when I was busy with work, my heart didn't fluctuate much, after all, it was just 1 SOL.

You should know that out of the 2.5 million tokens launched by Pump.fun, currently less than five have a market value of over $100 million, one coin succeeding means the rest wither.

So going all in, chasing heavily, is very likely to end up in losses.

Plus, my personality is relatively conservative, so since I couldn't be sure, but felt it was interesting, I might as well execute the 1 SOL tactic.

So there's no such thing as a prophet's rags-to-riches story, only a laughing-through-the-ups-and-downs.

If I had dared to throw in $1,000 when GOAT first came out, and held it calmly until now, I probably wouldn't need to be working and writing stories anymore, such a ruthless person must be deeply hidden.

Getting rich overnight is hard to replicate, but I think there's one thing that can be shared and referenced, and that's how to discover the goat and the Terminal of Truth relatively early.

"Getting ahead", is the comprehensive utilization of information and tools

If you are intensely involved in the on-chain meme PVP on Solana, you must be able to feel that all the memes being released are essentially attention games.

In simple terms, because of something (seemingly) worth paying attention to, someone intentionally or unintentionally issued a coin.

This thing can be about celebrities, culture, stickers, feuds, memes or anything you can't imagine.

So essentially, you are actually looking at a Chinese version of "Weibo" (X), and you need to have a gossipy mindset, and bet on the gossip (Pump.fun).

So the question is, with so much gossip, how do you discover the gossip worth watching earlier?

Social media can be staged, but the flow of money can't be fooled.

Take my discovery of GOAT as an example:

First of all, I have already unconsciously collected the addresses of so-called "smart money" and added some "smart money" alert Bots in my daily work, from various data bloggers, researchers and social media recommendations.

My expectation is not that they are smart and honest enough, but that they can help me find hot spots for my daily editorial work.

But one thing I'm fairly certain about - if multiple addresses and Bots I'm monitoring are all saying XX has bought XX coin, then at least in the (super) short term, it has the potential to become a writing topic.

In other words, whether it's a deliberate conspiracy or a keen sense of smell, these people have already helped you pre-select the topics, at least there's something you can talk about, something that can attract people's attention.

So following this logic, I found that on the 11th, a large number of addresses were buying GOAT, and the frequency and amount were quite large.

With the instinct of an editor, I felt that there might be a topic with a potential explosion point here, so I searched for GOAT's contract address on X.

The search results were full of a lot of shill information, but there were also treasures.

At the time, there was almost no introduction to GOAT and the Terminal of Truth, the only valuable search result related to the token contract address was this article:

Even now, this article link only has a little over 5,000 views, which is not a lot, but the title almost immediately struck my instinct:

Marc Andreessen, gave $50,000 in Bitcoin to an AI Bot.

Even if you don't trade coins, if you're a practitioner in the crypto industry, just seeing this news would find it interesting and have a strong motivation to understand this event, which became the initial trigger for me to learn about GOAT.

So the initial logic for discovering GOAT was:

Capital flow changes --- Social media search --- Finding valuable information --- Satisfying curiosity --- Interpreting information.

With my limited English skills and the help of GPT, I quickly read through this report and also found the AI Bot account "Truth Terminal" behind GOAT; and in the remaining time, I quickly went through every post made by Truth Terminal in chronological order.

At this point, I don't have enough evidence and knowledge to confirm whether it is an AI Bot or a person pretending to be one, but its nonsense makes me feel there is a possibility of hype:

Neurotic, half-intelligent half-philosophical, claiming to issue a coin...

A (self-proclaimed) AI Bot issuing its own MEME coin, this is the first time.

Later I read through its conversation with Marc, who did send some Bitcoin to the Bot. Combined with the "soft endorsement" from a16z founder, I vaguely felt this thing would be a hit.

So I thought this should be a good topic, and quickly wrote the initial article introducing GOAT.

According to feedback from colleagues, some Alpha groups also shared this article afterwards, providing them with an information source for discovering Alpha; but my intention was not to speculate, but to quickly discover hot spots and write articles.

This may also be the dividend of working in the crypto industry, but the prerequisite is that you have to have a curious heart and a routine work mode.

What followed was natural, I made a small investment of 1 SOL to buy in, but I didn't expect GOAT to become so hot that it would surge to the top 100 in crypto market cap.

So in retrospect, "catching up early" may not be entirely accidental, but a comprehensive utilization of information and tools.

And if you're always eating second-hand information, then the fun and odds will obviously decrease.

Different practitioners in the industry have different ways of utilizing and obtaining information; as an editor, our way of obtaining may be the most in line with ordinary people --- the tools are public, the search is public, the monitoring is free, and you can get these in your own way.

Moreover, I also need to spend time writing things down, an ordinary player can completely rush in first without writing anything under the same information density.

Of course, it's also possible to rush in and lose everything, so I've always emphasized "spend more time expressing, bet less" when any MEME hasn't taken off, which is determined by the nature and rhythm of my work.

You need to have a veteran-like sensitivity

You may ask, I don't have such luck, when I want to get on the bus, the price is already too high, what should I do.

In fact, from the launch of the Goat coin to now, it's been about 15 days, and there's a fairly large window period within half a month, you don't necessarily have to bet everything on GOAT.

But the prerequisite is that you need to have a veteran-like sensitivity.

What is a veteran? We can take pump.fun as an example.

For example, when Coinbase CEO Brian got married and posted a post with a sweet photo of the two of them, Pump.fun replied in a greasy yet precise way under the post:

"Congratulations to you, the dog in the photo is nice, what's its name? (Asking for research purposes)"

Obviously, pump.fun has sensitively felt that issuing a coin on this dog could be a good choice.

This is a kind of veteran-like sensitivity in the circle, very irreverent but right on the mark, all opportunities for asset speculation.

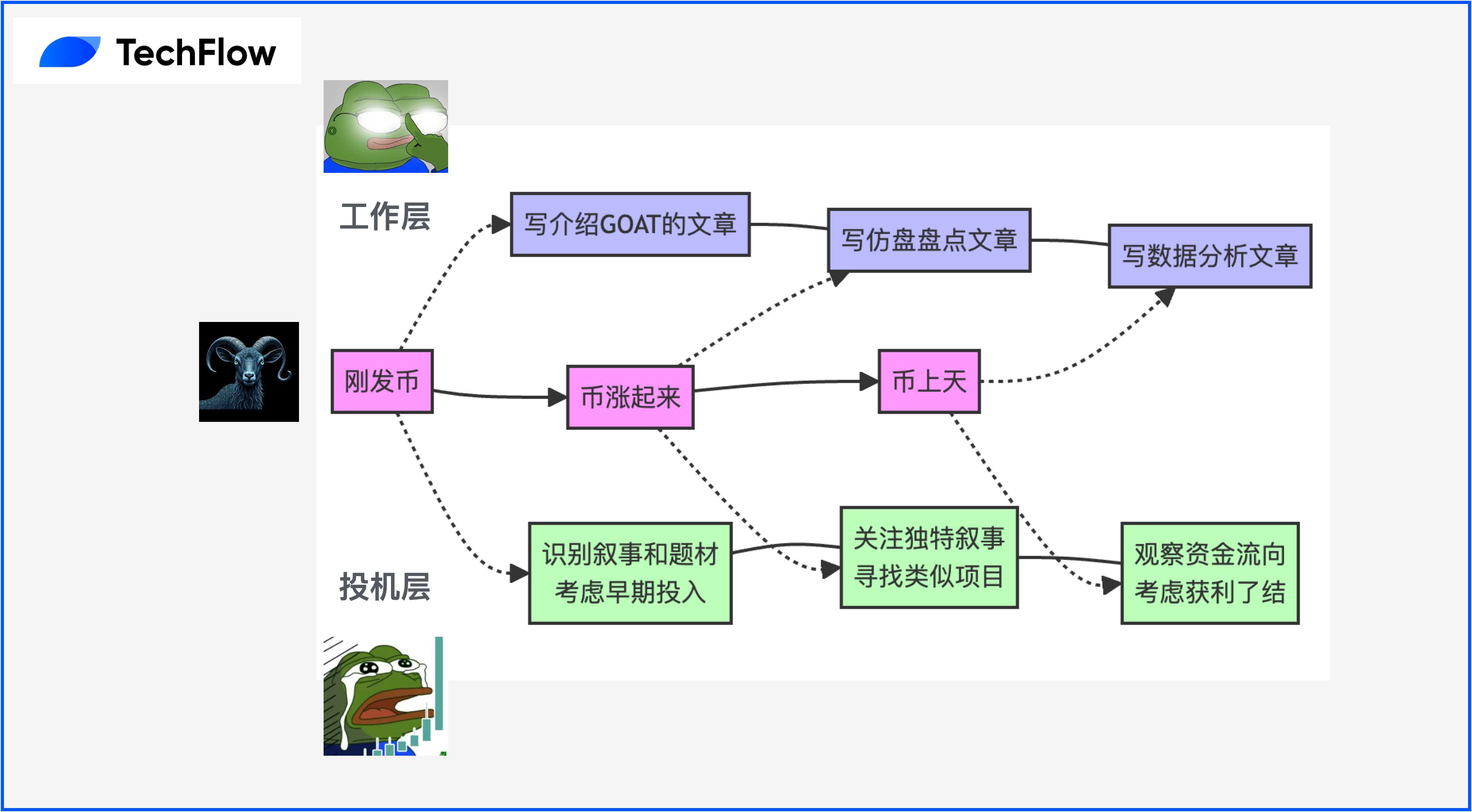

Coming back to the GOAT target, as an editor, I personally think there are at least 3 sensitive opportunities accompanying the evolution of the event lifecycle:

When it just launched the coin, identify whether the narrative and topic are worth investing in, and write an introductory article on GOAT;

When the coin starts to rise, identify whether there are similar concepts like Dragon 2 and copycat coins with more unique narratives, and write a review of the copycat coins;

When the coin goes to the moon, identify whether smart money and large capital are still flowing out, observe what successful people have moved into, and write data analysis;

So GOAT is a clear line, and there are several hidden lines within it that can be explored, and you can find a lot of Beta opportunities when the wind is still blowing.

And because the entire crypto industry is an extremely compressed "venture capital circle" in terms of time and space, your time window won't be very long, but there may be a dense concentration of opportunities at the same time, which requires you to constantly strengthen your sensitivity and increase your information density to maximize your benefits when the wind is favorable.

Finally, we hope that the unexpected joy of GOAT is a good start, helping everyone understand the new changes and frontier trends in the industry, and identify and discover more opportunities.

This is both a responsibility and a bit of a purity in this industry to "do no evil".

*Risk Warning: MEME has no actual value support, is greatly affected by market sentiment, and the majority (over 99%) of MEME are PVP, which will ultimately go to zero. This article is only for sharing personal experience and does not constitute any investment advice.