Author:Poopman

Compiled by: TechFlow

Another RWA stablecoin backed by treasury bonds? Ugh, how boring.

Whenever I mention @usualmoney to my friends, they always react this way.

Nowadays, many stablecoins choose to use treasury bonds as collateral, as their yields are relatively attractive and the risks are relatively low. For example:

Tether holds $81 billion in treasury bonds.

MakerDAO / Sky has heavily invested in treasury bonds and earned substantial yields from them (sorry, I can't recall the exact numbers).

There are even more RWA participants, such as Ondo, Hashnote, Blackrock, and Franklin, who have joined this competition. However, to be honest, the operating models of most treasury bond stablecoins are quite similar.

KYC-verified institutions can directly mint stablecoins by depositing real treasury bonds into a designated fund. The Token issuer then collaborates with the fund manager to issue the corresponding amount of stablecoins.

The yields may vary slightly, as these treasury bonds have different maturity dates, but the differences are not significant, typically ranging from 4% to 6%.

So, is there a way to achieve higher yields and make it more interesting?

(This is not a promotion or in-depth analysis, just a few thoughts on the Usual token economics, and all the content in the article is my personal opinion, not investment advice.)

Issues?

A simple and effective way to increase yields is to issue more governance tokens to attract more deposits and total locked value (TVL).

However, these tokens often lack real utility and tend to be heavily sold off upon launch due to high inflation. In many cases, they are merely tools for users and investors to exit, or the tokens are not closely tied to the actual revenue generated by the product.

In many cases, the revenue flows directly to the product itself, rather than the governance tokens. For example, sDAI earns DAI, not $MKR.

Those tokens that do have a connection often adopt the ve3.3 model to kickstart a positive flywheel effect (kudos to @AerodromeFi, @CurveFinance, @pendle_fi), and if the flywheel gets going, they can grow rapidly in a bull market. However, when the flywheel stops, the dilution effect can cause trouble.

A new approach is to enhance the utility of the token or reposition it as an L2 token, like @EthenaNetwork / @unichain. But this strategy is usually only effective for large enterprises 🤣.

$Usual has chosen a different approach, by allocating 100% of the protocol revenue to the governance token, making it "fundamentally backed by real dollars".

At the same time, they have introduced some PVP elements (such as early vs. late, staking vs. unstaking) to control inflation and issuance, making it more interesting.

However, you may be disappointed to learn that $usual is not the high-yield product you might have imagined, but rather a more interesting and secure (SAFU) product compared to its competitors.

To help you understand better, let's take a look at the user flow.

$Usual

$Usual Token Economics and User Flow

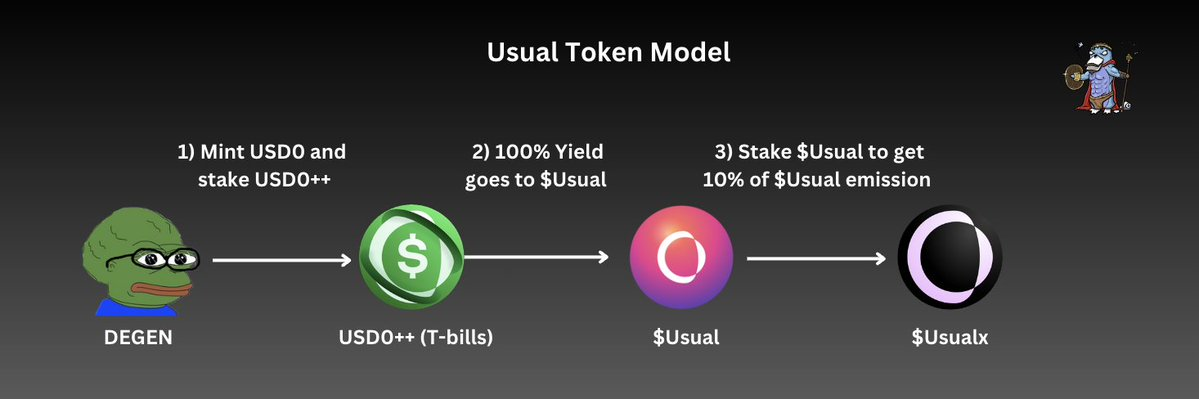

Usual money token economics

First, as a user, I can mint USD0. If I don't want to provide liquidity or participate in other yield farming, I can stake my USD0 into $USD0++.

When I stake my USD0, my $USD0++ will receive 90% of the $Usual rewards, which are $USUAL, not USD0 or USDC. The $Usual issuance rate depends on the amount of $USD0++ minted and the yield from the treasury bonds.

100% of the treasury bond yields earned by USD0++ will go into the protocol treasury, and the $Usual tokens are responsible for managing the treasury.

To get the remaining 10% $Usual rewards, I can stake my $Usual into $Usualx. Each time new $Usual is minted, this 10% will be automatically distributed to the stakers. Additionally, $Usualx holders have the right to participate in voting and other governance decisions, such as adjusting the issuance rate.

Throughout the user flow, we can see that the governance token ($Usual) actually receives all the earnings of the RWA product itself, while the stablecoin holders and stakers are incentivized through the yield-supported rewards.

Since Usual is an RWA product, it is difficult to achieve extremely high annual percentage yields (APY) or annual percentage rates (APR), as the yields are closely tied to the actual interest rates and the supply of USD0++.

More details will be introduced in the following paragraphs.

Token Utility Overview:

The token represents the full earnings of the protocol revenue.

By staking, you can receive 10% of the total $Usual issuance and have voting rights to influence the issuance direction.

Participate in governance decisions on treasury management (such as reinvestment).

(Future option) Burn $Usual to early unstake LST USD0++.

Interesting Issuance Mechanism

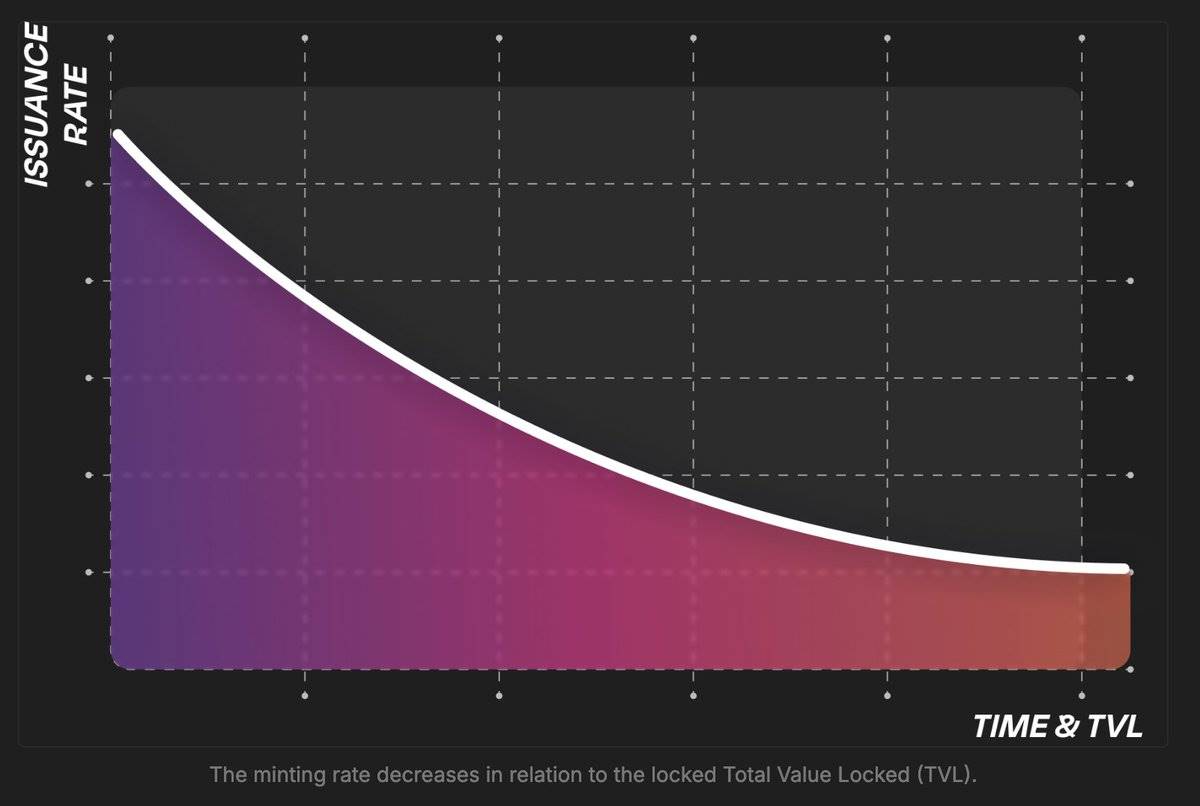

The $Usual issuance is dynamically adjusted based on the supply, which means:

When the TVL grows, the $Usual issuance will decrease.

When the TVL decreases, the $Usual issuance will increase.

Question:

So, poopman, are you saying that Usual doesn't encourage deposits when the TVL is high?

Answer:

No, not at all. When the TVL is higher, Usual can actually earn more from the increased treasury bond yields. Therefore, the value of $Usual should be higher as the treasury grows.

Conversely, when the TVL is lower, the $Usual issuance will increase, as the treasury earnings decrease, and they need to pay more compensation. The higher issuance helps Usual attract more TVL to the platform.

Additionally, to prevent excessive inflation of $Usual:

The issuance rate will be adjusted based on the interest rates.

A maximum issuance threshold has been set (decided by the DAO).

This is because Usual wants to ensure the token growth rate does not exceed the treasury growth rate, to maintain the value of $Usual, while aligning with the principle of "project growth = token value growth". Of course, the DAO can make adjustments as needed.

For Early and Late Participants:

In this model, early participants benefit the most, as they obtain the most $Usual at a higher price when the TVL is high.

For later participants, while they receive fewer tokens, they don't suffer any real loss apart from opportunity cost, as they still earn the yields.

In simple terms, $Usual is a token that represents the earnings generated by Usual.

$Usual has introduced some fun elements through the introduction of PVP, where users can earn 10% of the $Usual issuance of other participants by staking, and early participants can receive more rewards from later participants.

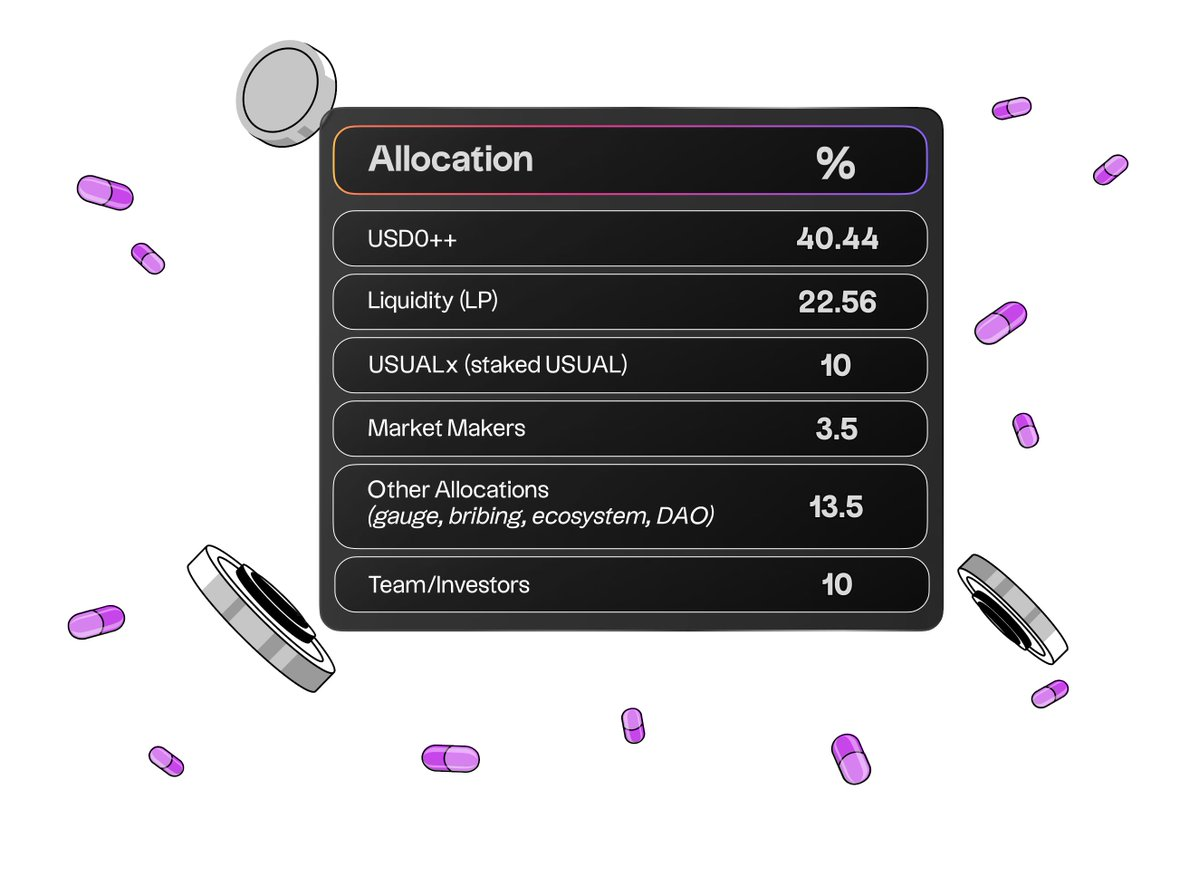

Token Distribution:

$Usual distribution is community-centric:

73% of the tokens are for the public and liquidity provision

13.5% is allocated to MM / team and investors

13.5% is for DAO / buybacks / voting, etc.

It's great to see this DeFi design putting the community first. The team has done a great job.

What are the issues to be aware of?

$Usual tokens are quite interesting, with significant and meaningful value, especially emphasizing inflation control. However, Usual and users may need to be aware of some risks.

Liquidity issues and de-pegging risks of USD0++

Currently, there is over $320 million in USD0 staked in USD0++, while the Curve liquidity for USD0 is only around $29 million. In other words, less than 10% of the USD0++ available in the market is available for exit, and asset imbalance in the pool during large-scale exits could lead to de-pegging. Although this ratio is not too bad (worst-case only 2-3% liquidity), this is a risk we must consider when entering the TGE window, as short-term investors may choose to exit.

Yield competitiveness in bull markets

It may sound a bit naive, but during bull markets, attractive yields typically come from the crypto assets themselves (such as ETH, SOL, etc.), not from stable real-world assets like Treasuries.

In comparison, I expect stablecoins like sUSDe to earn handsome returns in a rising market, attracting more TVL than Usual, as their yields can reach 20-40% or higher. In this case, if there are no new products to enhance the yield of USD0, Usual's growth may stagnate.

Nevertheless, I believe around 80% of the DeFi community understands the risks that USDe holders need to bear. As a "pessimistic stablecoin", Usual can provide a better and more resilient choice for those seeking stability.

DAO issues: low participation rate

Low participation rates have always been a common problem in DAOs. Since Usual is DAO-centric, ensuring sufficient and effective participation is crucial. Here are some thoughts:

Delegation may be a solution, but DAO decisions are not always optimal. Collective wisdom is often used to support the construction of DAOs, but based on the results of the Arbitrum DAO, not everyone has the understanding or vision to build a meaningful future for the project.

Most participants are self-oriented and tend to only vote for matters that benefit themselves. This can lead to monopolization or uneven reward distribution issues.

Therefore, handing over too much decision-making power to the DAO also carries risks, which may ultimately lead to undesirable outcomes.

Conclusion:

The token economic model is robust and interesting. Governance tokens do have real value as they are supported by revenue.

$Usual stakers can earn 10% of all minted as a reward, incentivizing users to stake. This model injects fresh vitality into the RWA stablecoin space, and I believe this is the right approach.

Excellent performance in controlling inflation. The minting is strictly limited by the available supply of USD0++ and real-world interest rates, ensuring that inflation does not dilute the value of $Usual.

However, the downside is that one cannot expect extremely high annual yields, which may be a disadvantage compared to other products in a bull market.

Liquidity issues. Currently, the liquidity of USD0 against USD0++ on Curve is less than 10%. This may pose a risk to liquidity providers during the TGE window, especially in the event of large-scale exits.

However, I believe most holders are willing to hold long-term.