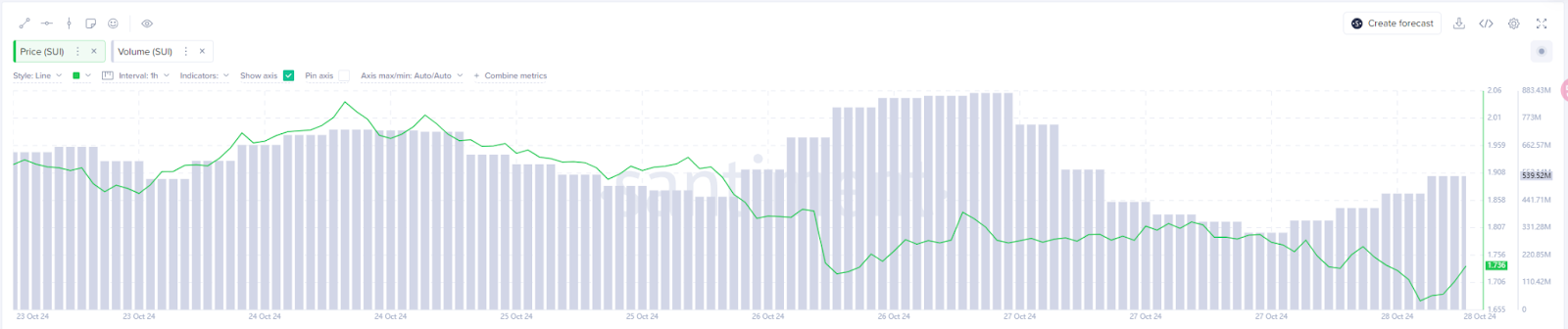

Recently, the rapid development of the Sui ecosystem has invigorated the entire market.On-chain data shows that the daily capital inflow to Sui has increased significantly, even surpassing that of established public chains like Ethereum (ETH) and Avalanche (AVAX), quickly attracting the attention of investors. However, just as the Sui ecosystem is shining, the price of the SUI token has fallen 6% in just 24 hours, retreating from a high of $2.25 to $1.68, with the apparent strength masking short-term price volatility.What market logic is hidden behind this anomaly? Is it a short-term correction or a signal of potential? Below, we will analyze Sui's opportunities and potential from four dimensions: the current state of the ecosystem, user structure, competitor comparison, and future trends, to comprehensively explore whether Sui can become an undeniable rising star in the public chain market.

Previous report:SUI Leads the Crypto Market: DeFi Ecosystem Explodes, Grayscale Trust Boosts, Can the Price Soar Further?

Price Decline Behind High Inflows: A Signal of Market Unease

1. The Contradictory Phenomenon of Capital Inflows

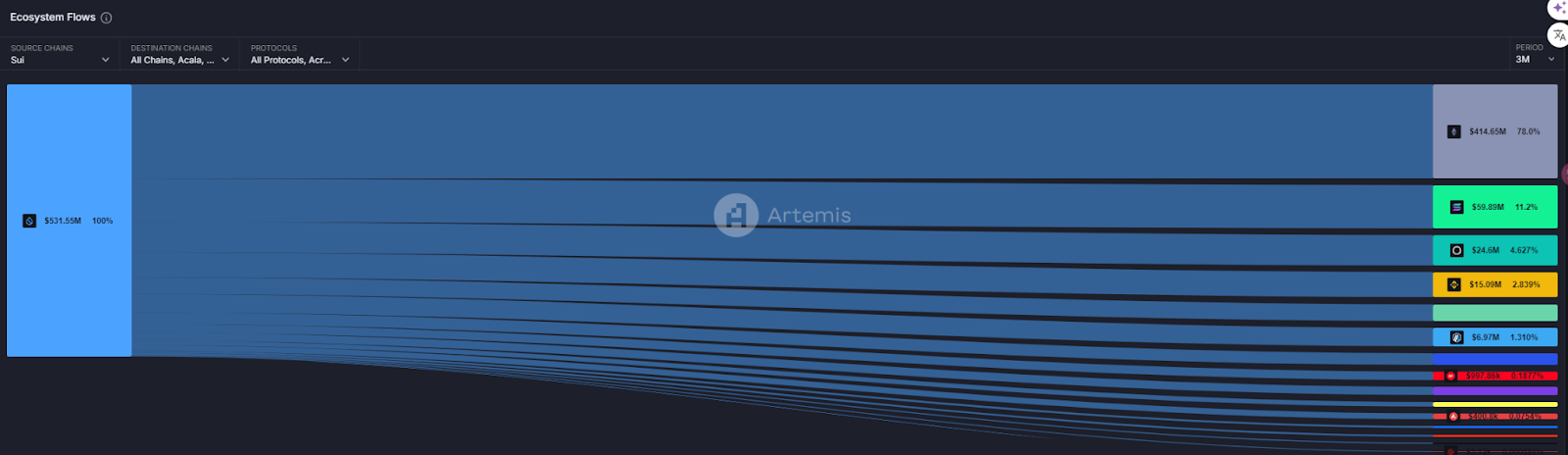

On the surface, the large capital inflows to Sui seem to be an extremely bullish signal.According to Artemis data, within the past three months, SUI's net capital inflows rank third, surpassing Ethereum (ETH), Avalanche (AVAX), and Fantom (FTM).This is one of the on-chain indicators supporting the narrative of a price reversal for SUI. Additionally, Sui has provided a timeline for resolving its staking distribution issues, which may also lead to a price trend reversal.

In Sui's network capital inflows, Ethereum accounts for as high as 78%. This trend indicates that Ethereum users' attention to the Sui ecosystem is constantly increasing, reflecting that investors tend to transfer their funds to Sui when seeking more efficient and low-cost on-chain experiences. In comparison, Solana's capital inflow share in Sui is 11.2%.

This phenomenon on the one hand shows Sui's attractiveness to the high-frequency trading and low-cost user groups, and on the other hand also means that these capital inflows are most likely not long-term positioning, but rather "opportunistic" short-term capital. Especially driven by the DeFi market and liquidity mining returns, these funds are more inclined to short-term arbitrage.

In other words, while high inflows look good, once the market sentiment changes, the selling pressure may be more intense than expected. The current contradictory relationship between price declines and inflow increases has already revealed a sense of unease in the market: can the influx of bottom-fishing capital and short-term arbitrage capital truly support Sui's medium and long-term value?

2. The "Time Bomb" of Selling Pressure and Unlocking Mechanisms

It is worth noting that Sui's token economic design has also brought hidden worries to the market. On November 1st, Sui will unlock 64.19 million tokens, accounting for 2.32% of the total circulating supply, which will undoubtedly become a major test for the market. In the past period, the market has been very sensitive to token unlocking, which is often seen as an important precursor to price corrections. This means that in the short term, if selling pressure emerges, the SUI price may further explore the bottom. If the price breaks through the key support of $1.45, market expectations may become more negative, triggering more selling behavior.

The Current State of the Sui Ecosystem: The Absence of Meme Ecology and the "Double-Edged Sword" of SocialFi and GameFi

In the current crypto market, the popularity of the Meme ecosystem is undoubtedly an important driver of on-chain activity. Taking Solana as an example, the Meme ecosystem has already formed a widespread discussion atmosphere on the chain, becoming a core pillar of community interaction and user traffic. However, the Meme sector in the Sui ecosystem is noticeably weaker, and there are even short-term arbitrage and user stickiness risks in the SocialFi and GameFi areas. We will delve into these issues from three aspects: the "double-edged sword" of SocialFi and GameFi users, the absence of Meme ecology, and the short-term arbitrage risks of liquidity pools.

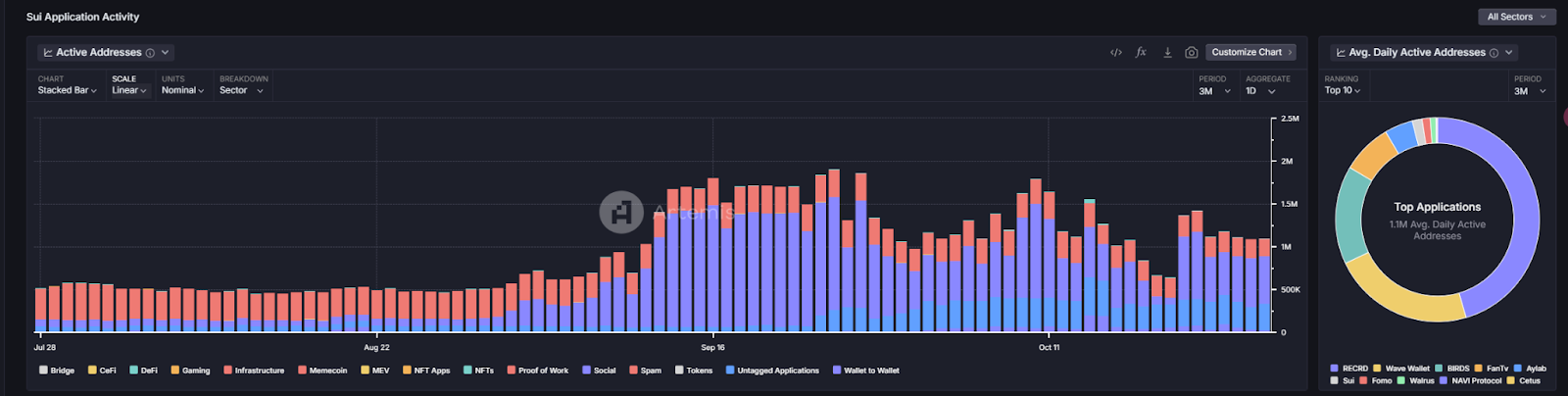

1. The "Double-Edged Sword" of SocialFi and GameFi Users

According to the data, over 60% of the active users on the Sui chain are concentrated in the SocialFi and GameFi sectors, becoming the main source of traffic in the ecosystem. Among them, the SocialFi project RECRD, with its advertising revenue sharing model, has attracted a large number of short video creators, with a daily active user count of up to 370,000, driving on-chain activity. The GameFi project SuiBirds has also attracted 120,000 daily active users through its innovative gameplay, showing the rapid growth in this sector.

However, this high concentration of users in the SocialFi and GameFi sectors is not entirely positive. The activity of SocialFi users depends on advertising revenue sharing, and advertising revenue is essentially affected by the investment of advertisers and the user conversion rate. When the advertising ROI fails to meet the expectations of advertisers, advertising revenue will quickly decrease, thereby affecting the activity of users on the platform. In the long run, this model lacks stability and has a high risk of user churn.

The bubble characteristics are more pronounced in the GameFi sector. Many users have flocked to the liquidity pools to participate in in-game income activities due to the high returns, but this type of short-term capital is easily affected by market sentiment. Once the returns of the liquidity pools cannot be sustained or decline, users may quickly withdraw their funds, causing severe fluctuations in the on-chain capital flow. For Sui, how to explore more stable application scenarios beyond SocialFi and GameFi is a pain point that must be addressed in the process of ecosystem growth.

2. Lack of Meme Ecology: A Weak Link in Market Narrative

Currently, there are only a few Meme projects on the Sui chain with a certain market scale, with HIPPO being the only one with a market capitalization close to $100 million. This situation is in stark contrast to Solana, where the number of Meme projects on the chain is numerous, with higher market capitalizations and active interactions, successfully attracting a large number of users and community attention.This is not only due to the difference in market demand, but also the choice of the founding team in terms of market narrative. The founders of Solana frequently participate in Meme topics, especially being active on social platforms like Twitter, which has directly promoted the development of the Meme ecosystem on the Solana chain. In contrast, the Sui team has adopted a low-key and pragmatic style, rarely participating in Meme-related topics, resulting in a lack of market attention on its Meme ecosystem.

From a market perspective, the Meme ecosystem is not only a means to attract users, but also an important support for the activity of the crypto community. For Sui, the lack of a Meme ecosystem means that it lacks sufficient appeal among the current popular user groups, and the growth of its on-chain ecosystem may be limited as a result. In the short term, this difference may not show a significant disadvantage, but as the Meme narrative continues to ferment, Sui's ecosystem expansion may face the risk of insufficient traffic.

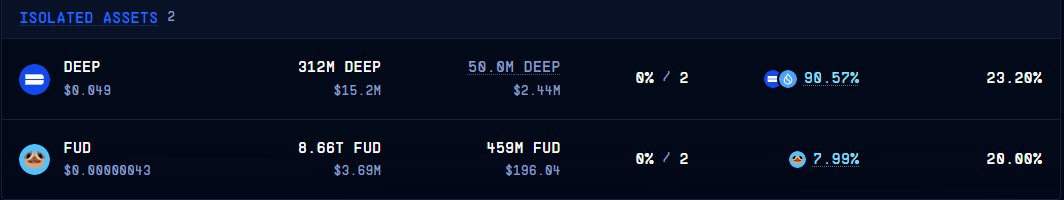

3. The Risk of Short-term Arbitrage Capital: The Challenge of High-yield Liquidity Pools

The current liquidity pools (such as Cetus, Deep, and Kriya) on the Sui chain offer extremely high annualized yields, with the Kriya liquidity pool reaching as high as 7398%, far exceeding many on-chain platforms, attracting a large influx of short-term arbitrage capital. However, high risk comes with high returns. While the high-yield model of liquidity pools can drive on-chain activity in the short term, this model is extremely unstable and tends to form a bubble in the long run.

When market sentiment is high, a large amount of short-term arbitrage capital rushes in, leading to an increase in on-chain activity. However, once market sentiment declines or the returns of the liquidity pools fail to meet expectations, the short-term arbitrage capital will quickly withdraw, causing significant fluctuations in on-chain capital. For Sui, relying on this high-yield liquidity pool-based ecosystem model is difficult to maintain stable user activity in the long run, and may even lead to market turmoil due to the large-scale withdrawal of capital.

Competitor Comparison: Sui vs. Aptos - The "Technology and Ecosystem Battle"

1. Technical Architecture: The Tradeoff between Latency and Consensus Mechanism

From the perspective of underlying technology, the architectures of Sui and Aptos both adopt the design philosophy of high performance and low latency. To optimize the user experience, Sui has gradually adopted the Mysticeti consensus engine to replace the previous Narwhal architecture, thereby improving the transaction completion time. However, compared to Aptos, Sui's transaction latency is still slightly higher and may face network congestion pressure as the market capacity increases.

Aptos, based on its innovative block structure design, is outstanding in terms of TPS (transactions per second) and response latency, and has more advantages in scenarios such as DeFi and high-frequency trading. This makes Aptos' user experience superior to Sui's to a certain extent, attracting more users with higher requirements for low latency and high efficiency. From the current situation, Aptos is gradually catching up with Sui in terms of user growth speed and ecosystem expansion, which undoubtedly puts Sui under considerable competitive pressure.

2. User Engagement: How Long Can Sui Maintain Its "Leading" Position?

Data shows that Sui is ahead of Aptos in indicators such as TVL (Total Value Locked), daily active addresses, and daily transaction volume. Currently, Sui's TVL has reached $1 billion, which is significantly higher than Aptos' $790 million, indicating that user participation and transaction frequency are more active on the Sui chain. However, Aptos' rapid development speed is worth noting. In the past three months, Aptos has shown significant growth in the NFT and GameFi sectors, demonstrating its increasing attractiveness to users.

For Sui, this competition means that it needs to continuously improve the user experience and maintain market attention. Although the current leading advantage exists, if it fails to further improve user stickiness and ecosystem depth, Aptos' rapid rise may gradually cause Sui to lose competitiveness in the market.

SUI Future Trends: Technical Analysis of Charts and Investment Opportunities

1. Chart Support Levels and Key Technical Indicators

From the perspective of technical charts, the price trend of SUI still has significant support and resistance lines. According to the current trend, the price of SUI is above the 99-day exponential moving average (EMA99), which is around the $1.45 level. This level has recently become an important support and has played a key role in price pullbacks. EMA99 is a commonly used moving average for observing long-term trends, and if SUI can stabilize above this line, it will strengthen the market's long-term bullish confidence.

In addition, the price of SUI has been fluctuating above the 0.618 Fibonacci retracement level, which is around $1.63. This indicates that this price level has a certain support in the short term. The Fibonacci retracement line is a common tool used by investors to judge the support and rebound positions of price pullbacks. If the price of SUI is effectively supported above this level, the bullish force may drive the price to rise further in the upcoming market rebound.

2. Risks and Opportunities of Technical Indicators

The change in trading volume is another important indicator.According to Santiment data, the trading volume has increased by 12.2% in the last 24 hours, but the price has fallen, which usually indicates that the market selling pressure is relatively large. If the trading volume continues to rise but the price fails to rebound, it may mean that the market selling force is strong, and further pressure may be exerted in the short term. However, if the price stabilizes and the trading volume decreases, it may indicate that the market selling pressure has eased, creating conditions for a price rebound.

In addition, the trends of technical indicators such as RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) are also worth watching. If the RSI bounces back from below 30, or the MACD generates a golden cross at low levels, it may be a signal of a short-term rebound.

Currently, the strong resistance level above the SUI price is at $2.36. If the SUI price can effectively break through and stabilize above this level, it will form a clear bullish signal, indicating that the market may start a new round of upward trend. If this resistance level cannot be effectively broken through, the price may continue to fluctuate in the range of $1.63 to $2.36 in the short term, forming a consolidation trend.

If the bullish force is unable to support the SUI price to remain above $1.63, then the support at $1.45 below will become the key defense line. Once it breaks through, it may trigger further sell-offs, testing the lower support in the $1.3 area. The support situation in this area will be the key to determining whether the market is entering further corrections.

Conclusion: The Potential and Challenges of Sui

Overall, the Sui ecosystem has demonstrated its innovation in blockchain technology and application scenarios, especially in the exploration of emerging fields such as SocialFi and GameFi, gradually becoming an undeniable force. However, facing the rapid catch-up of competitor Aptos, the selling pressure brought by token unlocking, and the market fluctuations of short-term arbitrage capital, Sui still needs to further optimize its ecosystem expansion and user stability in order to break away from the shadow of bubbles and speculation, and truly become an innovative benchmark in the public chain field.