Author:Aaron Elijah Mars

Compiled by: TechFlow

I've been in this industry for four years, invested in over 30 startups, and collaborated with the biggest Web2 and Web3 IPs. However, I've never launched my own token or Non-Fungible Token. It's time to change that (no, I won't be dropping any surprises at the end of the post).

A hot topic this year has been the debate around "Meme coins" versus "utility coins". @MustStopMurad put it well: "Utility tokens are just an upgraded version of Meme coins". It's an interesting perspective, but is it true?

Are Meme coins more fair than venture capital tokens?

I've been involved in a lot of Meme coin projects, but most of the time, the teams have performed terribly. Why is that? What's so hard about launching a token? Well, I'll share my insights into the industry and the Meme coin market.

Honestly, I haven't launched my own token (at least not yet) - my team (around 10 members) and I have been running a token revival project (CTO). I like the CTO idea of reviving a forgotten token. You don't have to take on too much responsibility, you can find an existing brand awareness, you don't need to build a new project from scratch. I think there's a lot of potential in this, there are a lot of really good but overlooked tokens.

We accumulated a lot of tokens for the CTO and started creating content, formulating a strategy to revive the community and try to build a team.

It took off quickly, 100x in a day. It was incredible.

We made a lot of mistakes, and I'll be very candid about that.

The first mistake was that we didn't take any profits. We had an idealistic vision to build a loyal community, with a long-term goal of reaching $10 million. The problem is, if marketing is a money game, then Meme coins are an extremely challenging game.

Those Key Opinion Leaders (KOLs) are not your friends, nor are they reliable. They'll call a token the "new paradigm" and then dump it in 30 minutes. This pump and dump game always ends in a crash.

You'll quickly find it's very similar to traditional advertising, you'll get a Customer Acquisition Cost (CAC) and a Return on Investment (ROI). It's a competitive game, you have to fight your ad networks and users.

In this game, if you don't take profits, you'll get outpaced by your competitors. It's a very brutal way to describe the industry, but it's true. It's either you or them.

When it comes to the community, it's hard to build anything reliable in this market. Attention spans are very short, and if you don't post something new for a day, people will sell at a 90% loss.

Non-Fungible Tokens have a lot of downsides, but they do enable community building. For Meme coins under $10 million, this is very difficult.

Now, I see Meme coins as a testing ground for building utility tokens (and overall skills). You can become the best at content creation (FWOG or using @merv_wtf), the best at community building (Retardio), or the best at collaborating with KOLs. But ultimately, if you succeed, you'll build a real product.

It's also a great way to build a top-tier team, as it's an environment full of challenges and opportunities, with a lot of pressure. I was shocked by the pressure, especially during price rallies. And the potential for depression during price declines.

I'm amazed by the Meme coin and utility coin communities that are able to keep building in this turbulent environment. Honestly, you have to experience it to understand.

We've also seen the limitations of Twitter for crypto projects, but it's unclear if Farcaster can solve this. Ultimately, the best Meme coins are those with existing audiences who can aggregate their influence and resources.

This makes me very excited about social decentralized exchanges and project launch platforms that hold people accountable for their actions and reduce the impact of bad behavior.

I also think there are a lot of opportunities for innovation in this space:

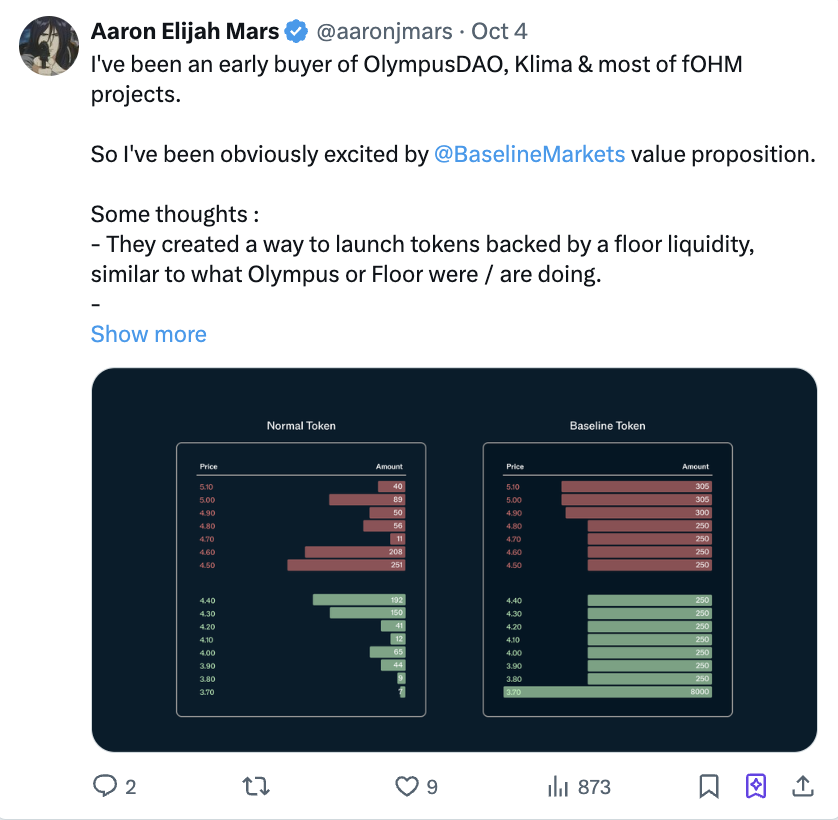

I'm excited about Flaunch / Baseline, and ways to earn yield by providing liquidity for projects and returning market volatility risk to users.

Case studies/papers don't exist. Might have missed some, but couldn't find anything like this (good) article on Meme and how to do a proper launch + community management, we're still far from it.

There's space for new VCs, market makers, and products specifically managing Meme coins. Because it's very similar to startups, your pre-seed buyers face the biggest risk (but they're not locked).

Pumping is really a casino. If you're a serious team, you don't need Pumping, but you'll miss out on a lot of revenue.

I don't know if I'm an asshole trying to formalize/sanitize something that doesn't need it, however, I do genuinely believe this space can be more fun and responsible.

The debate around utility tokens versus Meme coins is unreasonable. I'd rather buy tokens from 16z than be bundled with 10 wallets for $5,000. Until we reduce this risk, we won't truly have fun, because it's a zero-sum game.

I love the vision of Meme, community building has never been more important, and I do believe they'll succeed, but we need better tools to achieve it, and the VC model isn't that bad either, I want to give early users a chance to buy my tokens, but I don't want them to only make 10% in 1 day.

I also think venture capital funds have too much bullshit, they'll never make money and won't create a lasting community, so we might need a hybrid model.

At the end of the day, I think it's just community building, with Meme coins as an attention mechanism. Like Pudgy Penguin. Or Milady.

The best MEME won the internet.

But I also wonder, how useful is community building when you can automate Meme creation: text (@truth_terminal / @luna_virtuals) or visual (@merv_wtf / @luna_virtuals). Is crypto just a framework to transform humans into AI agents through economic incentives?