November 2024 is destined to be extraordinary, with a combination of factors such as elections, interest rate cuts, and technology sector earnings reports in a single week, which will have a significant impact on the financial market trend. Therefore, everyone must remain highly vigilant this week.

2024 first half: BTC ETF approved; BTC reaches a new all-time high; BTC halving;

2024 second half: The Federal Reserve begins a rate-cutting cycle, the US presidential election

The two major events that will affect the market this week:

Tuesday - US presidential election, whether former President Trump will be re-elected or the first female US president from the Democratic Party will take office, the outcome is about to be revealed

Friday - The Federal Reserve's interest rate decision, expected to cut rates by 25 basis points.

These two events will cause significant turbulence in the cryptocurrency market and will determine the balance of our wallets. Whether it will be left or right, we shall see.

In the coming week, the earnings reports of the technology sector will be released, and the rise of the US stock market is mainly supported by the technology sector. If the technology sector underperforms, it will also affect the market trend.

The battle for the $68,000 BTC support level, the election is tomorrow, November 5th, and the result will be announced on the 6th. The time to buy big or small has come, the price points are still the same, but the trend remains unclear.

First, let's talk about the betting data on the election:

Many people have been looking at the betting data on Polymarket to gauge the US election, but I personally feel that this data is quite subjective, as it is the betting data of non-US users.

If you have to look at betting data, it's better to look at the betting data on US-based betting sites, such as Kalshi and BetOnline, for example. I just saw that the latest data on Kalshi shows over $100 million in bets, with Trump's probability of winning rising by 6% to 53% this morning.

Of course, I personally think that betting data is actually at the bottom of the data chain in observing changes in the election situation, just like the market, it fluctuates with changes in media propaganda, polls, and early voting information, it is a data of market sentiment rather than objective data.

There is also historical experience data that can be referenced, which is that the volatility in the market has been increasing rapidly as the election approaches, and the volatility will remain high for one to two weeks after the election, but once it has been two weeks after the election, the market volatility will quickly decrease, which is a stage of the market transitioning from uncertainty to certainty.

Now let's talk about the impact of the election on cryptocurrencies:

Regardless of who wins, it will not affect the long-term narrative. So let's discuss the short-term:

If Trump loses, the short-term will still see a decline, but the magnitude will not be large, and the outlook for the future remains positive.

The market has already seen a correction in Trump's support rate over the weekend, and this trend can be seen as the market to some extent pre-digesting some of the negative news of Trump's defeat.

If Trump wins: Since there has already been a pullback last weekend, there will not be a large-scale pullback after the election, and it is very likely that new highs will be broken at that time.

If Harris wins: The market will decline in the short term, but the magnitude will not be large, and there is no possibility of falling below $50,000 or $40,000, so don't panic blindly. The Bitcoin behind the election hype has substantial support, and we remain optimistic about the market outlook for next year.

As participants in the financial market, we must remember not to use news expectations to make forecasts:

Whether you are playing defensively or trading based on the market's reaction, remember not to use the news to make forecasts, as the market will react. Emotional risk avoidance or unexpected reversals often occur.

So how do we proceed now? The market trend is either first down then up, or first up then down:

First up: Then based on the target price, which are the several positions given since March, 7.4, 8.1, 8.6, when reaching these positions, it's time to reduce positions.

First down: Then it becomes more painful, deleveraging and washing out positions, we only need to continue adding at the positions where we should be adding.

That's it for the article, if you like it, please give a follow and a like~

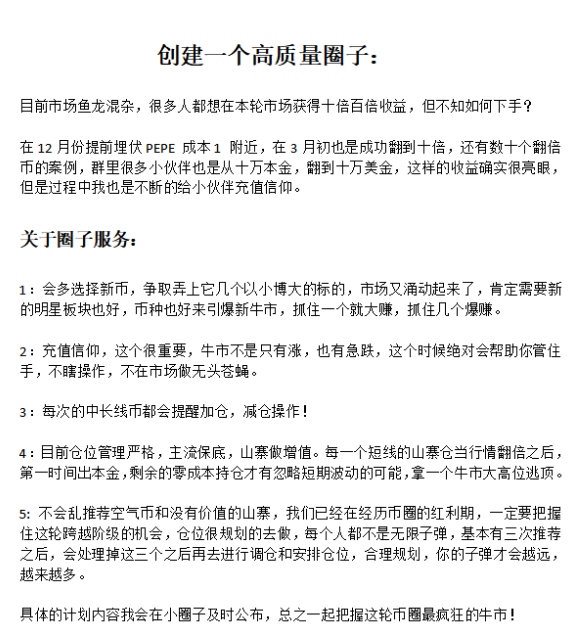

The new discussion group has been set up! We are now preparing to reorganize the discussion group, and as long as the overall market returns to an uptrend, there will be many opportunities for Altcoins to explode. If you want to join the group, feel free to message me, and I will add you to the group!

Creating a password welfare group! (I plan to find some low-cap coins with news catalysts in the near future to help everyone recover their losses, as the Altcoin season is about to arrive, I will help everyone seize the opportunity to double their money on Altcoins! The next password will be announced in the welfare group!!)

Number of members: Temporarily limited to 50 people, mainly spot trading

Additionally, we also have a VIP paid group (spot trading) for those who want to join the VIP group, you are also welcome to contact me to learn more!

Scan the code to join the community!