The US presidential election day has arrived, and the election campaign has entered a white-hot stage. Unlike previous elections, the crypto industry has become one of the focal points in this election. The presidential candidates and the two parties behind them have given unprecedented attention to the crypto field, making the crypto industry no longer able to remain aloof. The election result is likely to have a profound impact on the crypto industry. As presidential analyst Hal Goetsch emphasized in his research report: "From a regulatory perspective, the 2024 election could be one of the most critical moments in the development of cryptocurrencies."

The Rise of Crypto Voters

The Galaxy Digital team conducted an in-depth analysis of the impact of the victory of the two presidential candidates, covering 9 key areas such as the SEC, banking regulation, stablecoin legalization, and Bit mining. The research shows that a Trump victory could bring significant growth opportunities for cryptocurrencies, while the potential negative impact of a Harris victory is relatively limited. This conclusion is highly consistent with the current crypto industry's support tendency.

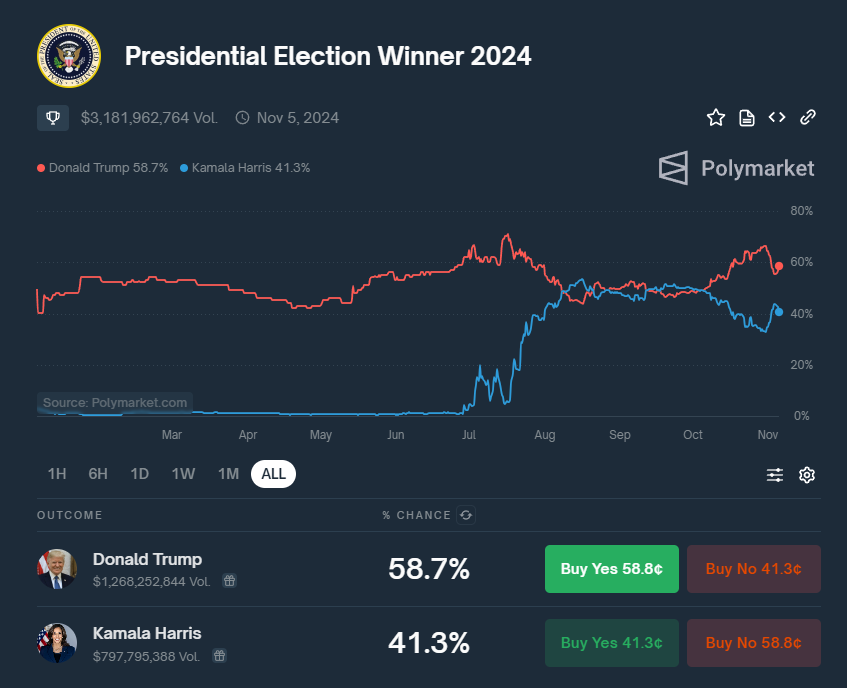

The latest poll data further confirms this trend. A survey by Fairleigh Dickinson University (FDU) shows that 50% of cryptocurrency holders support Trump, and 38% support Harris. In contrast, among non-cryptocurrency holders, Harris leads Trump 53% to 41%. Data from the crypto prediction market Polymarket also reflects a similar trend, with Trump's support rate at 58.7% and Harris at 41.3%.

Grayscale's mid-year poll report revealed the growing importance of cryptocurrencies among voters. Influenced by geopolitics, inflation, and US dollar risks, 47% of voters now want to include cryptocurrencies in their investment portfolios, up from 40% at the end of last year. Notably, 62% of Gen Z and Millennial voters believe that Blockchain technology represents the future of finance. This makes the crypto industry an important battlefield for the two parties to compete for the support of young voters.

The crypto voter group has shown a significant enthusiasm for political participation. Coinbase's research shows that nearly 90% of cryptocurrency holders plan to vote in the upcoming election, which is four times the proportion of ordinary voters. More critically, about 40% of cryptocurrency holders live in swing states, which could make their votes decisive to the election outcome.

Given the strategic importance of crypto voters, the candidates of both parties have to take the cryptocurrency issue seriously. Positioning on crypto policy has become the core battlefield for securing the support of this key voter group.

The Republican Crypto Stance - Light Regulation, Emphasis on Innovation

The Republican Party's advocacy of "small government" makes them prefer to reduce intervention and give the market more freedom, so the Republican Party has a more open attitude towards the crypto industry, and most people have a more relaxed attitude towards the crypto currency industry, and hope to use legislation to constrain the power of the SEC. Trump himself has also shown a very friendly attitude towards the crypto industry.

In the previous term, Trump held a clear opposition to cryptocurrencies, even publicly declaring on the media that "Bit is a scam" and calling for stronger regulation of crypto assets. Before leaving office, he publicly stated that "Bit is a scam and called for stronger regulation of crypto assets", and he also publicly stated that he did not hold any cryptocurrencies. But in 2022, under the Non-Fungible Token (NFT) craze, Trump still issued his own limited edition NFTs, and then released two more series of NFTs in 2023, and in May this year he officially accepted crypto currency donations, and his subsequent series of public statements and actions have earned him the title of "Crypto President", laying the groundwork for his presidential campaign:

- On May 26, Trump publicly declared: To ensure the future of cryptocurrencies and Bit in the United States, if he is ultimately elected, he will pardon Silk Road founder Ross Ulbricht and emphasize support for the right to self-custody.

- On June 12, Reuters reported that several Bit mining company representatives met with Trump at Mar-a-Lago. Trump told the attendees that he loves and understands cryptocurrencies, and added that Bit mining companies help stabilize the energy supply of the grid. He also stated that he will speak up for miners in the White House and hopes that all the remaining Bit will be mined in the United States.

- On July 17, Trump plans to launch his fourth NFT series. In an interview, Trump said his previous series were "very successful", selling out in a single day.

- On July 28, Trump attended the Bit 2024 conference and gave a speech emphasizing "America First", wanting to "ensure America's leadership in crypto, making it the global crypto center." He also stated that "the market cap of Bit may one day exceed that of gold."

- On August 16, Trump's eldest son, Donald Trump Jr., tweeted that he had opened a Telegram channel called "The DeFiant Ones" for his crypto project, with the channel description being the "Official DeFi Channel of Trump".

- On August 22, Trump posted on his social media platform Truth Social that he suggests all remaining Bit should be mined within the United States.

- On September 16, Trump announced that his second son, current Trump Organization Executive Vice President Eric Trump, has officially launched the cryptocurrency project World Liberty Financial. The project aims to "embrace the future of cryptocurrencies" and "abandon outdated big banks", and in the project introduction video, Trump himself stated "let America be the crypto capital".

- On September 23, Trump also discussed cryptocurrencies in an interview with Fox Business, joking: "There are some very, very smart people in the crypto space, and they love our country." Who knows, maybe we can pay off our $35 trillion in debt. Give them a little crypto check... give them a little Bit, and we can pay off our $35 trillion."

- On November 1, Trump tweeted, "I want to wish our great Bit enthusiasts a happy 16th anniversary of the Bit white paper by Satoshi Nakamoto. We will end Harris' war on cryptocurrencies, Bit will be made in America, vote for Trump."

Trump has frequently sent positive signals in the crypto field, obviously aiming to attract crypto voters. It is worth noting that not only Trump himself is like this, but other Republican lawmakers have also actively spoken out in the crypto field, showing support for crypto mining and trading, while opposing excessive government regulation.

For example, Republican Congressman Warren Davidson submitted a rather controversial "Securities and Exchange Commission Stabilization Act", which even proposed the radical move of restructuring the SEC and firing its chairman Gary Gensler.

At the same time, Patrick McHenry, the Republican Congressman who chairs the House Financial Services Committee, is not to be outdone. He wrote to the SEC, severely criticizing the agency for exceeding its statutory authority, believing that its actions are at odds with its mission to protect investors and promote capital development, and pointing out the SEC's obvious hostility to new technologies.

More notably, Senator Cynthia Lummis announced an ambitious plan at the Nashville Bit conference in July - to establish a Bit strategic reserve. According to Lummis' proposal, existing funds from the Federal Reserve and the Treasury Department will be used to purchase 1 million Bit. If this initiative is realized, it will consolidate the United States' position as the world's largest Bit holder, giving it control of 5% of the entire network, a proportion equivalent to the US share of global gold supply.

The Republican Party's crypto-friendly stance has also gained widespread recognition within its own party. On July 8, 2024, a working group of the Republican National Committee (RNC) passed a draft party platform that explicitly pledged to "defend the right to mine Bit and protect the self-custody of digital assets." The draft even stated bluntly that "Republicans will end the Democratic Party's illegal and un-American crackdown on cryptocurrencies and firmly oppose the creation of a central bank digital currency."

Looking at the big picture, Trump and the Republican camp behind him have shown a clear tendency: relaxing regulations, encouraging innovation, and fully capitalizing on the potentially huge economic benefits that cryptocurrencies may bring. This open and inclusive attitude is highly consistent with Trump's policy orientation in the previous term of promoting technological innovation and industrial development, demonstrating the Republican Party's strategic layout in the digital economy era.

Democratic Party - Constructing a Framework, Prudent Regulation

During the Biden administration, the Democratic Party has taken a cautious and conservative stance on cryptocurrencies, focusing on strengthening regulation and risk prevention. Shortly after taking office, the Biden administration tightened the regulatory grip on the cryptocurrency market through agencies such as the Treasury Department and the SEC, introducing a series of regulatory provisions targeting cryptocurrency exchanges and market participants. These measures contributed to the collapse of FTX in 2022 to a certain extent, causing the relationship between the Democratic Party and the crypto industry to plummet for a time. However, with Biden's announcement of his retirement and the approaching election, the Harris team has shown a strong interest in the crypto electorate, representing the Democratic Party in a new way to mend the rift with the crypto industry.

- On August 1, it was reported that the Harris team proactively reached out to the top management of crypto companies such as Coinbase, Circle, and Ripple Labs, aiming to ease the tensions between the Democratic Party and the crypto industry. On August 15, the CEO of Circle publicly confirmed this news and revealed that representatives of the Harris campaign team had participated in previous crypto roundtable discussions.

- On August 8, the U.S. Democratic Party launched the "Crypto for Harris" campaign, an initiative aimed at attracting around 40 million American voters who own digital assets, while also demonstrating the Democratic Party's positive stance on promoting the development of the blockchain and cryptocurrency industry.

- On September 23, Harris publicly expressed her views on cryptocurrencies for the first time. According to a Bloomberg report, Harris stated that if elected president, she would work to promote investment growth in AI and the crypto sector, while focusing regulatory efforts on protecting consumer and investor interests.

- On October 14, Harris further pledged to support the establishment of a cryptocurrency regulatory framework, aiming to provide more investment protection for the 20% of African Americans who own or have owned digital assets.

In addition to Harris, several other prominent Democratic figures have also expressed clear support for cryptocurrencies, including California Governor Gavin Newsom, Illinois Governor J.B. Pritzker, and Robert F. Kennedy Jr. Their statements have won widespread support from the crypto electorate.

Gavin Newsom can be considered one of the most active advocates of blockchain and crypto technology within the Democratic Party. In May 2022, he signed an executive order to develop a licensing framework for crypto companies in California, fully demonstrating his deep understanding and sincere cooperation with the crypto industry. J.B. Pritzker publicly expressed his support for cryptocurrencies on Facebook in 2021, not only welcoming the expansion of crypto ATM company Coinlip in Chicago, but also declaring that "the future of cryptocurrencies is in Illinois." Robert F. Kennedy Jr. even sees cryptocurrencies as a "symbol of freedom and transparency," personally purchasing 21 Bit and buying 3 Bit for each of his children during the campaign, supporting the use of cryptocurrencies as a medium of exchange.

Furthermore, the idea of incorporating Bit into strategic reserves has crossed party lines and become a consensus between the two parties. In the latest episode of the "Unchained Podcast," Democratic Congressman Ro Khanna expressed his support for this idea: "We want to make sure that we can accept Bit as part of the Federal Reserve and as a reserve asset, because not only does it have appreciation potential, but it may also allow the U.S. to set financial standards."

In contrast to the all-out offensive and frequent overtures of the Trump camp, Harris and the Democratic Party's commitments to the crypto electorate appear relatively restrained. However, from the initial cautious attitude to proactive outreach and evaluation of the value of cryptocurrencies, the softening of the Democratic Party's stance has undoubtedly sent positive signals. This transformation has won the support of many heavyweight figures in the crypto industry, including:

- Ron Conway: Founding partner of SV Angel, who has invested in companies like Coinbase and Uniswap. He praised Harris as a staunch supporter of the tech ecosystem and generously donated nearly $450,000 to her campaign.

- Ryan Morrison: Partner at Founders Circle Capital, with a portfolio that includes Robinhood, which provides crypto services, and the digital asset brokerage FalconX.

- Rebecca Kaden: The first female managing partner at Union Square Ventures, a firm that has invested in 24 crypto companies, including industry leaders like Coinbase and Dapper Labs.

- Mark Cuban: A well-known entrepreneur who has invested in 20 blockchain companies, publicly criticized Trump, and has aspirations for Bit to become a "global currency."

It is worth noting that stakeholders of crypto companies with strong domestic demand in the U.S., such as Coinbase, Uniswap, and Robinhood, seem to lean more towards Harris, while meme traders like those represented by Elon Musk, who are fans of Dogecoin, tend to prefer Trump. This subtle difference may foreshadow divergent development trajectories for different crypto industry segments after the election.

Can the Promises be Fulfilled?

As BitMEX's former CEO Arthur Hayes sharply criticized Trump, believing that his "sudden concern for cryptocurrencies" lacks sincerity and is merely an attempt to appease the young, politically active, and newly wealthy crypto community. In fact, until the relevant bills are officially implemented, these crypto declarations may all turn out to be empty promises.

Surveys show that up to 83% of American voters believe that the president has failed to fulfill his campaign promises, to the point where "politicians" have become synonymous with "liars" in American society. However, research by American political scientists has drawn different conclusions: from 1968 to 2004, over a 36-year period, the majority of the promises made by successive presidents were actually fulfilled. Combining various statistics from this period, the average fulfillment rate of presidential promises is as high as 67%, a commendable achievement.

Looking at the attitudes of the two parties, the future development trajectory of the U.S. crypto industry will mainly depend on the tightness of the regulatory grip. Currently, the U.S. Securities and Exchange Commission (SEC) is undoubtedly the heaviest and most persistent cloud hanging over the crypto industry.

SEC: The Core Issue of Regulatory Chaos

Since taking over the SEC in 2021, Gary Gensler has taken a series of harsh regulatory measures against the cryptocurrency industry. He insists that the cryptocurrency market urgently needs much stronger regulation, rather than relying solely on industry self-discipline. Gensler's regulatory focus includes strictly reviewing the ICOs (initial coin offerings) of blockchain startups to ensure that these projects strictly comply with existing securities laws, while emphasizing the protection of investors from potential fraud.

Although the US regulatory system has a system of checks and balances, for emerging industries like encryption, due to the imperfect legal system and the relative lack of judicial precedents, the SEC has considerable discretion. This gives the SEC the ability to have a significant impact on the survival of the entire industry. Currently, the strongest measures that Congress can take are limited to sending letters of protest and proposing the dismissal of the SEC chairman, and this situation is difficult to fundamentally change before the relevant regulatory laws are formally introduced.

Therefore, whether Trump or Harris ultimately wins, the replacement of the SEC chairman has become a common call in the encryption community. Trump has made one of the most explicit commitments in this regard, stating that he will dismiss the current SEC chairman, Gary Gensler, on his first day in office.

At the same time, according to internal sources, sponsors from Wall Street in the Harris camp have privately urged the dismissal of SEC chairman Gary Gensler. These sponsors believe that Gensler has been pushing for the formulation of stricter regulations, which not only hinders the development of the technology industry, but also affects the prospects of other high-profit economic sectors. It appears that this suggestion has had some impact. **According to the Unchained report, the Harris team is seriously considering replacing the current SEC chairman Gary Gensler and seeking a new leader who can reshape the regulatory framework for cryptocurrencies. The two hot candidates currently under review are Chris Brummer from Georgetown University and PCAOB chairman Erica Williams. The backgrounds and positions of these two candidates indicate that they may take a more friendly attitude towards cryptocurrencies than Gensler, and are expected to lead the SEC to develop more flexible regulatory policies.

As the election results are about to be revealed, the promises of the two presidential candidates, whether it is to replace the SEC chairman or to restructure the regulatory framework, will take a considerable amount of time to be verified. The cryptocurrency industry is standing at a crossroads full of unknowns, facing both challenges and opportunities. The only thing that can be certain is that with the gradual standardization of regulations, the fraudulent behavior within the industry will be reduced, the level of trust will be enhanced, and the healthy development of the cryptocurrency industry has already begun.