The answers to these questions will largely be left to Powell's post-meeting press conference.

Fed Chair Powell may reiterate the Fed's independence in the post-meeting press conference and emphasize that policy will be adjusted flexibly based on economic and inflation data. Although inflationary pressures have eased somewhat, some analysts believe that the tax cuts, fiscal stimulus, and tariff measures that the Trump administration may implement will increase upward pressure on inflation, thereby affecting the Fed's policy choices.

Evercore ISI's Global Policy Head Krishna Guha pointed out: "We believe Powell will refuse to make any early judgments on the impact of the election on the economic and interest rate path and will seek stability and calm." Guha added that to maintain the consistent desire of policymakers to be unaffected by political conflicts, Powell "will state that the Fed will take time to study the plans of the new government" and then "refine this assessment as actual policies are formulated and implemented."

The issue of the Fed's balance sheet reduction will also be a focus of market attention, as the Fed has already reduced its holdings of US Treasuries and mortgage-backed securities by about $2 trillion, but is expected to end the balance sheet reduction only in early 2025.

The market generally expects the Fed to cut rates by another 25 basis points in December, and a cumulative 100 basis points by 2025.

Michael Strain, a resident scholar and director of economic policy studies at the American Enterprise Institute, said, the Fed will not reconsider the interest rate path at the meeting ending this week, but will reflect it in the next official forecast to be released in mid-December.

Strain said, "I still think we should be concerned about inflation, and Trump's agenda in 2025 is likely to push up inflation. If the Fed does its job, that will put upward pressure on interest rates."

This will put the Fed in conflict with Trump. "I don't think Trump would want to see upward pressure on interest rates," Strain added. Trump frequently criticized Powell and the Fed and supported low interest rates during his first term from 2017 to 2021.

In view of this, in the context of the Fed's policy adjustment expectations and the positive news for the cryptocurrency market, the ample liquidity environment is expected to drive a broad-based rally in Bitcoin, Ethereum, and Altcoins.

The answers to these questions will largely be left to Powell's post-meeting press conference.

Fed Chair Powell may reiterate the Fed's independence in the post-meeting press conference and emphasize that policy will be adjusted flexibly based on economic and inflation data. Although inflationary pressures have eased somewhat, some analysts believe that the tax cuts, fiscal stimulus, and tariff measures that the Trump administration may implement will increase upward pressure on inflation, thereby affecting the Fed's policy choices.

Evercore ISI's Global Policy Head Krishna Guha pointed out: "We believe Powell will refuse to make any early judgments on the impact of the election on the economic and interest rate path and will seek stability and calm." Guha added that to maintain the consistent desire of policymakers to be unaffected by political conflicts, Powell "will state that the Fed will take time to study the plans of the new government" and then "refine this assessment as actual policies are formulated and implemented."

The issue of the Fed's balance sheet reduction will also be a focus of market attention, as the Fed has already reduced its holdings of US Treasuries and mortgage-backed securities by about $2 trillion, but is expected to end the balance sheet reduction only in early 2025.

The market generally expects the Fed to cut rates by another 25 basis points in December, and a cumulative 100 basis points by 2025.

Michael Strain, a resident scholar and director of economic policy studies at the American Enterprise Institute, said, the Fed will not reconsider the interest rate path at the meeting ending this week, but will reflect it in the next official forecast to be released in mid-December.

Strain said, "I still think we should be concerned about inflation, and Trump's agenda in 2025 is likely to push up inflation. If the Fed does its job, that will put upward pressure on interest rates."

This will put the Fed in conflict with Trump. "I don't think Trump would want to see upward pressure on interest rates," Strain added. Trump frequently criticized Powell and the Fed and supported low interest rates during his first term from 2017 to 2021.

In view of this, in the context of the Fed's policy adjustment expectations and the positive news for the cryptocurrency market, the ample liquidity environment is expected to drive a broad-based rally in Bitcoin, Ethereum, and Altcoins.

Ethereum Exchange Rate Reversal May Become a Major Trend

As the impact of the US election gradually emerges, the cryptocurrency market has risen overall, and the inflow of Ethereum spot ETFs has reached the highest level in six weeks. On November 6th, the total net inflow of nine Ethereum spot ETFs reached $523 million. Although this inflow is still inferior to that of Bitcoin spot ETFs, according to data from Farside Investors, the increase in Ethereum ETF is the highest since September 27th. Among them, the Fidelity Ethereum Fund attracted $269 million in inflows, while the Grayscale Ethereum Trust Fund received $254 million, and the remaining seven Ethereum ETFs had zero capital inflows. It is worth noting that Grayscale's high-fee ETHE fund is still in continuous withdrawal, with its assets under management reduced by $3.1 billion since July, with a total net outflow of $490 million. At the same time, the Ethereum exchange rate has shown a strong rebound, with ETH/BTC quickly rising from the low of 0.0346 in the early morning of November 6th to 0.0376, an increase of nearly 9%. With the inflow of ETF funds, the Ethereum exchange rate is expected to reverse further. Currently, the price increase of Ethereum is in the form of a consolidation within an ascending triangle pattern. Within two days of testing the support of the downtrend line of the triangle, Ethereum price has rebounded by more than 18%. As of the time of writing, the ETH price is maintained above the resistance of the uptrend line of the triangle, further increasing the possibility of a bullish breakout in November. In addition, the closing price of ETH is about $2,680, which is above the 120-day exponential moving average (EMA), further enhancing the bullish sentiment in the market.

From a technical chart perspective, if this breakout is confirmed, the ETH price is expected to rise to $3,600 within 3 months. This trend not only indicates a recovery of market confidence in Ethereum, but also reflects the response of Ethereum ETFs to investment demand. Driven by ample liquidity, the further rebound of Ethereum prices may bring stronger upward momentum to the entire cryptocurrency market.

Currently, the price increase of Ethereum is in the form of a consolidation within an ascending triangle pattern. Within two days of testing the support of the downtrend line of the triangle, Ethereum price has rebounded by more than 18%. As of the time of writing, the ETH price is maintained above the resistance of the uptrend line of the triangle, further increasing the possibility of a bullish breakout in November. In addition, the closing price of ETH is about $2,680, which is above the 120-day exponential moving average (EMA), further enhancing the bullish sentiment in the market.

From a technical chart perspective, if this breakout is confirmed, the ETH price is expected to rise to $3,600 within 3 months. This trend not only indicates a recovery of market confidence in Ethereum, but also reflects the response of Ethereum ETFs to investment demand. Driven by ample liquidity, the further rebound of Ethereum prices may bring stronger upward momentum to the entire cryptocurrency market.

Four Key Tracks: Quality Choices in the Broad-Based Rally

Under the dual drive of loose liquidity and optimistic market sentiment, the projects in the following four tracks are expected to stand out in the broad-based rally.1. Resonance Rebound of Ethereum and DeFi

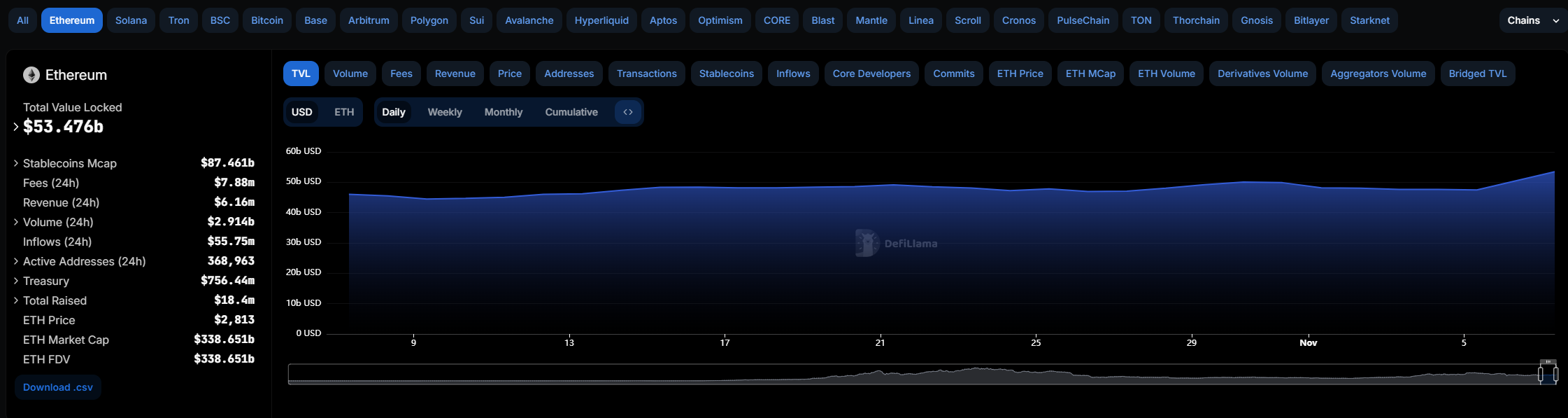

In an environment of loose liquidity, the Ethereum network as the core infrastructure of DeFi will receive significant positive news. Assuming that the Fed's rate cut leads to lower financing costs, this will attract more capital to flow into DeFi, driving the further development of decentralized finance. According to defillama data, the current Ethereum TVL has reached $53.4 billion, an increase of 16% in the past month.

According to defillama data, the current Ethereum TVL has reached $53.4 billion, an increase of 16% in the past month.

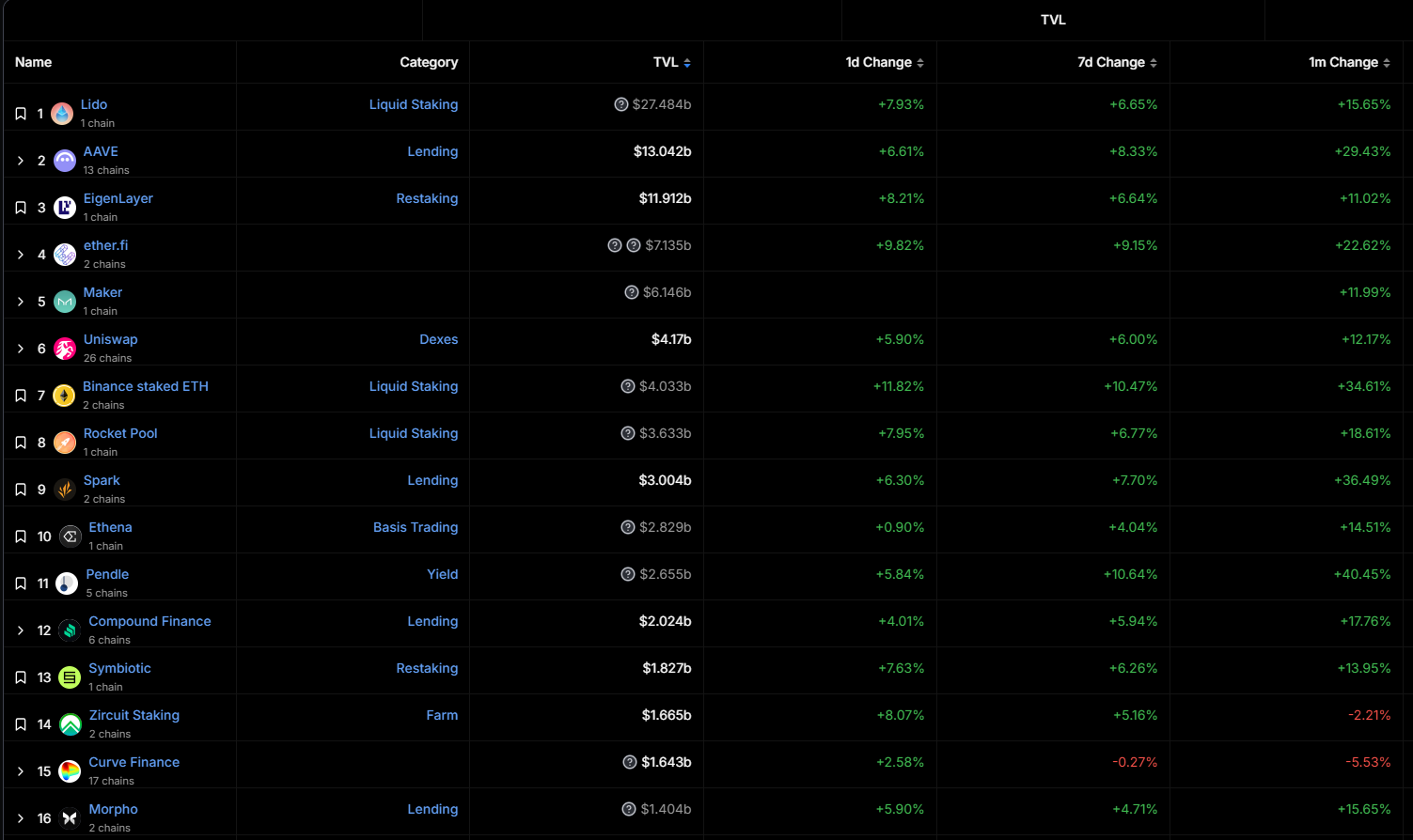

Multiple DeFi protocols have seen growth in the past 7 days.

The following projects are worth watching in the secondary market:

- Uniswap (UNI): Uniswap, with its Automated Market Maker (AMM) model as the core, provides users with decentralized liquidity pools, and is the leader in the DeFi market.

- Aave (AAVE): Aave is a major decentralized lending protocol, providing diverse lending services through its innovative flash loan feature.

- Lido (LDO): Lido allows users to stake Ethereum and receive the liquid staking token stETH, thereby enhancing the security and decentralization of the Ethereum network.

- Ethena (ENA): Ethena Labs is the creator of USDe, a synthetic dollar protocol built on Ethereum. This project addresses the need for a stable, scalable monetary form in the crypto-native space without relying on the traditional banking system.

According to Binance data, in the past 24 hours, ENA has risen over 33%, LDO over 21%, AAVE over 20%, and UNI over 34%.

Multiple DeFi protocols have seen growth in the past 7 days.

The following projects are worth watching in the secondary market:

- Uniswap (UNI): Uniswap, with its Automated Market Maker (AMM) model as the core, provides users with decentralized liquidity pools, and is the leader in the DeFi market.

- Aave (AAVE): Aave is a major decentralized lending protocol, providing diverse lending services through its innovative flash loan feature.

- Lido (LDO): Lido allows users to stake Ethereum and receive the liquid staking token stETH, thereby enhancing the security and decentralization of the Ethereum network.

- Ethena (ENA): Ethena Labs is the creator of USDe, a synthetic dollar protocol built on Ethereum. This project addresses the need for a stable, scalable monetary form in the crypto-native space without relying on the traditional banking system.

According to Binance data, in the past 24 hours, ENA has risen over 33%, LDO over 21%, AAVE over 20%, and UNI over 34%.

2. Reactivation of the Bitcoin Ecosystem Concept

Trump's crypto-friendly policies have further fueled market interest in Bitcoin ecosystem projects. The second-layer solutions and smart contract scalability of the Bitcoin ecosystem have significantly improved, attracting investors' attention to its application prospects. Nowadays, the Bitcoin ecosystem is no longer just a platform for issuing Bitcoin-native assets, but is gradually becoming the main source of liquidity in the crypto market. Currently, numerous projects such as Babylon, Yala, GoatNetwork, Solv, and pStake are constantly emerging in the Bitcoin ecosystem, and some old projects originally belonging to other ecosystems are also accelerating their transition to the Bitcoin ecosystem. In addition, institutional investors such as Polychain are also continuously supporting the emerging projects in the Bitcoin ecosystem. From this perspective, the current Bitcoin ecosystem is showing an unprecedented vitality. The development of the Bitcoin ecosystem has clearly gone through two stages: the early stage mainly focused on the issuance of Bitcoin-native assets.The current stage is more focused on the spillover of Bitcoin's intrinsic value. The changes brought about by this evolution are also clearly reflected in the current "cold inside, hot outside" situation. In other words, Bitcoin is gradually transforming from a relatively closed value storage role to a "gold mine" that can release liquidity for other crypto ecosystems.

In discussing Babylon's project to create a stable income stream for Bit and Yala's project to develop a Bit stable coin, the industry generally recognizes a view: Although Bit occupies 60% of the crypto market capitalization, most of the assets are still hoarded and "dead assets" that cannot provide the much-needed liquidity for the market. The methods to obtain liquidity are either to rely on the external environment (such as the Fed's interest rate cuts or the outflow of funds from the global market), or to activate the potential resources internally. And Bit is the best source of internal liquidity. By enhancing the practical value of Bit and guiding its liquidity to other ecosystems, the Bit ecosystem will no longer be just a tool for value storage.

If the Bit ecosystem can release 10% of Bit's liquidity, this will be a "timely rain" for the DeFi projects of other ecosystems. Therefore, many project parties and investors are also gradually changing their thinking, from focusing on the issuance of Bit native assets to how to introduce Bit's liquidity into other ecosystems. This also explains why previous DeFi projects developed in other ecosystems (such as Solv and pStake) have flocked to the Bit ecosystem, and why the Ethereum L2 project Metis will incubate Goat Network to layout the Bit L2. These projects are all competing to seize the entry point of Bit liquidity release, in order to take over this part of the new market vitality.

Therefore, the narrative of Bit L2 is no longer limited to expanding services for Bit, but is focused on extending Bit's liquidity to other ecosystems while preserving Bit's consensus. This trend has prompted other public chain ecosystems to also reverse-assist the development of Bit's L2, such as the participation of Metis, EOS and other public chains.

3. Innovative Concept Assets Combining with AI

With the rapid development of AI technology, its combination with blockchain is becoming an emerging trend in the crypto market. The integration of AI and blockchain not only can improve efficiency, but also brings unprecedented innovation opportunities for data privacy protection, decentralized governance and intelligent applications. In an environment of ample liquidity, AI-combined crypto asset projects are increasingly attracting the attention of investors. Based on their functions and application scenarios, AI+blockchain projects can be roughly divided into the following categories:

Decentralized Data Marketplace

The decentralized data marketplace is one of the core applications of AI+blockchain, which realizes the sharing and trading of data in a decentralized manner. AI models require a large amount of data for training, and blockchain can provide a secure and transparent market for these data, enabling secure and efficient data exchange between data providers and consumers. This type of project provides rich data sources for AI models, while protecting data privacy and reducing the risks of traditional centralized data markets.

- Fetch.ai (FET): Fetch.ai provides the infrastructure for a decentralized data marketplace, allowing various devices to communicate and trade data through intelligent agents. This distributed learning model allows AI systems to continuously acquire new data and improve their intelligence.

- The Graph(GRT): Worldcoin is a digital identity protocol aimed at supporting the AI era. WLD is a native utility token with governance attributes.

- Bittensor(TAO): Bittensor is a C2C machine learning protocol that incentivizes participants to train and operate machine learning models in a distributed manner.

AI Model and Computing Resource Sharing Platform

The decentralized sharing platform of AI models and computing resources provides AI developers and users with higher efficiency and cost-effectiveness. Blockchain acts as a trusted distributed ledger in this field, ensuring that the sharing of AI models and computing resources is not interfered by centralized institutions, while providing a reliable reward mechanism to encourage participants to share resources.

- io.net (IO): io.net is a decentralized artificial intelligence computing and cloud platform. By aggregating GPU supply from underutilized resources, io.net creates a network that allows machine learning (ML) startups to obtain nearly unlimited computing power at a fraction of the cost of traditional cloud.

- Grass(Grass): Grass is a decentralized data layer built for artificial intelligence, which allows users to share Internet bandwidth and obtain verifiable network data through a distributed network.

Decentralized Data Privacy Protection and Identity Authentication

Data privacy and identity protection are important issues in AI applications. Through the distributed encryption characteristics of blockchain, AI+blockchain projects can achieve secure data privacy protection and identity authentication. Users can autonomously manage data authorization on the blockchain, avoiding the abuse of personal privacy by centralized platforms. This type of project is particularly suitable for AI applications that require a large amount of sensitive data, such as the medical and financial fields.

- Worldcoin (WLD): Worldcoin is a digital identity protocol aimed at supporting the AI era. WLD is a native utility token with governance attributes.

Intelligent Automated Trading and Prediction Market

The combination of AI and blockchain can also be applied to intelligent trading and prediction markets, using the transparency of blockchain to improve the credibility of prediction and trading, while utilizing AI algorithms for data analysis and market forecasting. This combination can bring significant advantages in financial and other highly volatile markets.

- Numerai (NMR): Numerai uses a decentralized prediction market combined with AI technology for trading forecasts, attracting data scientists from around the world to continuously optimize trading models through a competition mode. Blockchain ensures the transparency of the prediction market and the fairness of rewards.

- dYdX (DYDX): As a decentralized financial derivatives platform, dYdX uses AI for automated trading strategies, combining on-chain data for real-time analysis, further improving the effectiveness of trading strategies and the accuracy of market forecasting.

These AI+blockchain projects are driving the development of decentralized technology in different ways, bringing innovation and diversified application scenarios to the crypto market. With the ample liquidity environment driving more capital inflows, these projects may achieve more widespread applications in the fields of data sharing, computing resource sharing, privacy protection, and intelligent trading in the future.

4. The Rise of RWA (Real World Assets) Leaders

On-chain real-world assets (RWA) are becoming an important development direction for blockchain applications. By tokenizing traditional financial assets (such as treasury bonds, real estate and bonds) and introducing them into the blockchain network, RWA projects have significantly improved the liquidity and transparency of traditional assets, opening up a convenient investment channel for global investors. If the Trump administration continues to promote a friendly regulatory environment for cryptocurrencies, RWA in this field is expected to occupy an important position in the application of blockchain technology.

Assuming Trump supports the crypto market, the growth potential of RWA will be further released, mainly reflected in the following aspects:

Promote Friendly Regulation and Facilitate Compliant Asset Tokenization

If Trump pushes for crypto-friendly policies, he may simplify or relax the regulatory requirements for asset tokenization, making it easier for RWA projects to obtain legal compliance. This will provide a more stable policy foundation for the tokenization of treasury bonds, real estate and other financial assets, allowing investors to feel more at ease in purchasing and trading these assets on-chain.

Especially in the current global market environment, the Trump administration may be more inclined to promote the development of the US crypto industry, thereby enhancing its competitiveness in the global digital finance field. In this context, RWA projects will benefit from the relaxation of regulations and policy support, allowing the tokenized assets to enter the market in a more legal and secure manner, attracting more institutional and retail investors' attention.

Activate the traditional asset market and improve asset liquidity

If the Trump administration pushes for economic stimulus policies and market-oriented reform measures, the RWA project can fully utilize this policy background to bring a large number of traditional financial assets into the blockchain. Through on-chain trading and circulation, RWA can not only improve the liquidity of assets, but also significantly reduce the intermediary fees in the traditional financial system. For example, the tokenization of US Treasury bills can allow more investors to obtain liquidity at a lower cost, without being limited by the complex procedures of the traditional trading market.

In addition, if Trump's policies increase the fiscal deficit, the government may rely more on market financing to stimulate the economy, which will drive more demand for the issuance of Treasury bills. RWA can meet this demand on the chain, bringing more sovereign assets (such as US Treasuries) into the blockchain trading platform, making it convenient for global investors to trade and obtain returns at any time.

Under this policy background, RWA projects such as Ondo Finance will be able to attract more investors.

Ondo Finance: Focuses on the tokenization of traditional financial assets, especially Treasury bills, and is committed to providing users with lower-threshold investment channels.

MakerDAO: By introducing RWA as collateral for the decentralized stablecoin DAI, it not only injects stable assets into the DeFi ecosystem, but also further improves the liquidity of on-chain assets.

PENDLE: Pendle is a yield trading protocol that divides income-generating assets into principal and yield components, allowing users to earn periodic or on-demand yields. PENDLE is a utility token used for liquidity incentives, governance, and fee value accumulation.

Summary

Against the backdrop of market volatility after the election and the Federal Reserve's potential interest rate cuts, the cryptocurrency market is ushering in a positive investment environment. If the Federal Reserve cuts interest rates by 25 basis points, the increase in liquidity may bring the possibility of a general rise in Bit, Altcoin, and Ethereum. In this context, the resonance rebound of Ethereum and DeFi, the functional expansion of the Bit ecosystem, the innovation of AI-combined assets, and the leading projects of RWA will become the focus of investors' attention. Accompanied by the inflow of Ethereum ETF funds and the reversal signal of the ETH exchange rate, the upward momentum of the cryptocurrency market in the future is worth looking forward to.