Source: The Wall Street Journal

Compiled by: Bitpush News Mary Liu

On Tuesday evening, Republican Senate candidate Bernie Moreno was celebrating at the La Centre banquet center in the Cleveland suburbs when he received calls from several other cryptocurrency executives, including Brian Armstrong and Brad Garlinghouse.

Just minutes earlier, Bernie Moreno had defeated three-term Democratic Senator Sherrod Brown, who is the chairman of the Senate Banking Committee and one of Congress' biggest critics of cryptocurrencies, by a stunning margin.

Bernie Moreno has won another key seat for the Republicans in their bid to regain control of the Senate, and cryptocurrency executives have been calling to congratulate Moreno.

This is also a devastating blow for Brown, who is one of the few remaining Democrats in Congress, and the state was once a stronghold for moderate Democrats.

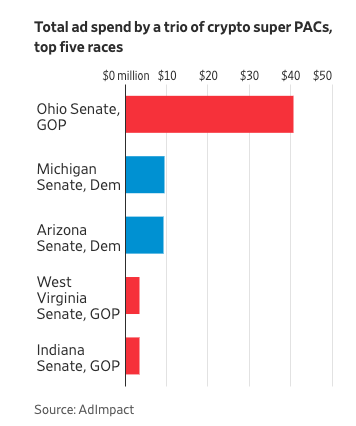

The cryptocurrency industry has become one of the biggest spenders in the election cycle, donating $170 million to three super PACs to elect friendly lawmakers, such as the former blockchain entrepreneur and car dealer Bernie Moreno, who ran for the Ohio Senate.

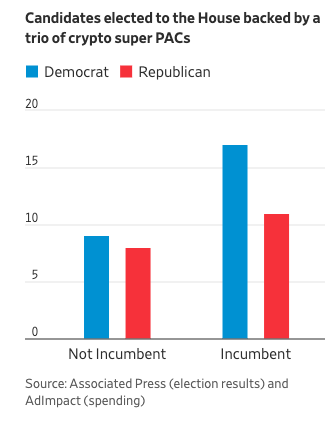

This effort has been hugely successful: the Associated Press projects that 50 out of 58 candidates supported by super PACs have won. As of Sunday (November 10) evening, 8 races were still too close to call.

This enthusiasm is also reflected in the markets. Bitcoin prices soared to record levels over the weekend, reaching $80,000 for the first time, and continued to surge to $88,000 as of Monday's close. This rally is simply incredible against the backdrop of the 2022 market crash that ultimately led to the collapse of the FTX exchange.

Now, the cryptocurrency world is looking forward to the next Congress, under the "red wave" led by President-elect Donald Trump, being able to fulfill its long-standing wish: to establish rules different from Wall Street.

Trump has vowed to ease the regulatory burden on cryptocurrencies and establish a reserve to store the US's Bit supply. Congress will soon be filled with lawmakers - both young and old - who believe that cryptocurrencies are a unique asset class that should not be regulated like stocks and bonds.

Eric Trump shared a meme of a Bit flag flying over the White House after his father's election, representing the hopes of many in the cryptocurrency world.

"We've turned the tide," said Kristin Smith, CEO of the Blockchain Association, an industry lobbying group. "The worst days for our industry are behind us, and we're on a path to developing appropriate and lasting policies."

Several industry executives have praised Bernie Moreno's victory and celebrated the role they played on social media.

"Opposing crypto is just bad politics," said Coinbase Global CEO Armstrong, referring to Brown's defeat.

"As a pro-innovation, pro-business candidate, I think Moreno is the kind of person we need in the Senate," said Ripple Labs CEO Garlinghouse, who personally donated to Bernie Moreno's campaign.

Some cryptocurrency industry executives see preventing over-regulation, gaining access to banking services, and stabilizing dollar-pegged cryptocurrencies as the industry's biggest challenges.

The cryptocurrency's biggest critics may soon be leaving Washington, which is a major boon for the industry. Trump is expected to replace the cryptocurrency industry's biggest adversary, SEC Chairman Gary Gensler, who believes cryptocurrency companies should follow the agency's investor protection rules.

Last year, regulators sued some of the industry's largest exchanges - Coinbase, Binance, and Kraken - alleging they should be subject to the rules governing securities exchanges. A series of lawsuits have angered cryptocurrency supporters, with Republican lawmakers opposing Gensler's use of his enforcement arm to try to control major cryptocurrency participants.

"We need to make sure they know what the rules are and how to comply, so the crypto industry can thrive here. We have to make sure this technology grows in America," said incoming Ohio Senator Bernie Moreno.

Meanwhile, Senator Tim Scott (R-South Carolina), the likely successor to Senate Banking Committee Chairman Brown, hopes to draft a new cryptocurrency regulatory framework that eases requirements for companies engaged in trading and custody.

With Republicans poised to control the Senate and maintain control of the House, some previously stalled legislation may have a better chance of progressing, even if it is rewritten by the Senate's new power brokers.

For example, in May, the House overwhelmingly passed the 21st Century Financial Innovation and Technology Act, which would shift more responsibility for regulating cryptocurrencies to the smaller and more crypto-friendly Commodity Futures Trading Commission, which the Democratic-controlled Senate has not advanced.

"I believe the industry hopes to see some action on these bills during the lame-duck period," said Rep. French Hill (R-Arkansas), who chairs the House Financial Services Committee's Digital Assets Subcommittee and is a co-sponsor of the FIT21 Act.

"If not, we'll be ready, and it will be a top priority for the new Congress," he added.

Earlier this year, Congress also overturned an SEC accounting policy, SAB 121, that made it difficult for banks to custody digital assets. President Biden vetoed Congress' action, and the SEC later relaxed its strict stance on the guidance.

Even as the cryptocurrency industry has scored some victories, other issues may be harder to solve. The industry has long struggled to gain banking services, sometimes needing to use intermediaries as a solution, as banks are reluctant to take on customers whose business models are primarily based on volatile assets. The failures of two crypto-friendly banks last year further reduced the already small pool of companies willing to deposit cryptocurrencies with banks.

Finding banks to custody cryptocurrencies (rather than just dollar deposits) has become even more difficult. Entering the banking system requires the involvement of multiple regulators, including the Federal Reserve, whose leadership will not face a full overhaul until 2025.

In April, another bill was rejected in the Senate Banking Committee that would have required crypto stablecoins to be backed by reserves, a key source of liquidity for the crypto industry that allows traders to purchase digital assets without accepting fiat currency on exchanges that don't accept it.

As Republicans prepare to take control of the Senate in January, both parties are positioning themselves for the contentious legislative session in 2025, and the legislative process for crypto bills is a marathon, not a sprint, with the competing interests of stakeholders determining its ultimate fate.