Compiled by Wu Blockchain about Blockchain

The opinions expressed here are the author's personal opinions only and should not be used as a basis for investment decisions, nor should they be considered as advice or opinions on participating in investment transactions.

https://cryptohayes.substack.com/p/black-or-white?r=aaog1&utm_medium=ios&triedRedirect=true

The elites who ruled America didn’t care if the economic system was capitalist, socialist, or fascist, only if the policies they were pursuing helped them stay in power. America ceased to be purely capitalist in the early 19th century. Capitalism meant that the rich lost money when they made bad decisions. That was subverted in 1913 when the Federal Reserve System was established. When the gains from privatization and the losses from socialization took their toll on the country and created a deep class divide between the vast inland population and the coastal elites, President Franklin Delano Roosevelt had to correct the situation and distribute some scraps to the poor through New Deal policies. Expanding government benefits for the forgotten was not a policy favored by the so-called capitalist rich, then or now.

In 1944, the top marginal tax rate on incomes over $200,000 was raised to 94%, and extreme socialism quickly turned to unfettered corporate socialism, which began during the Reagan era in the 1980s. Then, liberal economic policies of central banks promoting the trickle-down effect of wealth from top to bottom by issuing printed money to the financial services sector dominated the situation until the outbreak of the new crown epidemic in 2020. President Trump responded to the crisis by tapping into his inner Roosevelt complex and directly distributing the most money to the entire population since the New Deal. The United States printed 40% of all US dollars in 2020-2021. Trump started the "stimulus check" party, and after his term, President Biden continued the popular welfare policy. When evaluating the government's balance sheet, a strange thing appeared between 2008-2020 and 2020-2022.

2009 to the second quarter of 2020 was the peak of trickle-down economics, relying on central bank money printing to finance this practice, euphemistically called quantitative easing (QE). As you can see, the economy (nominal GDP) grew slower than the rate of debt accumulation at the national level. In other words, the rich were pumping government money into assets, and these types of transactions did not generate any real economic activity. Therefore, the distribution of trillions to wealthy financial asset holders, backed by debt, increased the debt-to-nominal GDP ratio.

Presidents Trump and Biden broke this trend from Q2 2020 to Q1 2023. Both presidents’ Treasurys issued debt that the Fed bought by printing money (QE), but instead of distributing the money to the rich, it was mailed to everyone. The poor got cash in their bank accounts. Apparently, JPMorgan Chase CEO Jamie Dimon took a cut of the government’s transfer fees… He’s the American Li Ka-shing; you can’t get away from paying the “old man.” The poor are poor because they spend all their income on goods and services, and they did during this period. Economic growth has accelerated rapidly as the velocity of money exceeds 1. That is, $1 of debt creates more than $1 of economic activity. And so, magically, the US debt-to-nominal GDP ratio has fallen.

Inflation soared because the supply of goods and services did not grow as fast as the debt-financed increase in purchasing power. The rich who held government bonds were unhappy with these populist policies, and these rich bond holders suffered the worst total return since 1812. The rich sent their "white knight", Federal Reserve Chairman Jay Powell, who began raising interest rates in early 2022 to curb inflation, and the public would have liked the policy of sending stimulus checks again, but this practice became taboo. US Treasury Secretary Janet Yellen stepped in to mitigate the effects of the Fed's tight monetary policy. She provided nearly $2.5 trillion in financial stimulus by shifting debt from long-term (bills) to short-term (bonds), draining the Fed's reverse repurchase facility (RRP), and mainly benefiting the rich who held financial assets, and asset markets rose accordingly from September 2022 to the present. Similar to the post-2008 period, these government subsidies to the rich did not generate real economic activity, and the US debt-to-nominal GDP ratio rose again.

Has Trump’s incoming administration learned the right lessons from recent U.S. economic history? I think so.

Scott Bassett, who most people think will be Trump’s new Treasury Secretary, has given many speeches on how to “fix” America. His speeches and op-eds detail how to execute Trump’s “America First Plan,” which has many similarities to China’s development plan (which began in the 1980s under Deng Xiaoping and continues today). The plan is to “heat up” nominal GDP by providing government tax credits and subsidies to drive the reshoring of key industries (shipbuilding, semiconductor factories, auto manufacturing, etc.). Qualified companies will receive cheap bank financing. Banks will once again scramble to lend to real companies because the US government ensures their profitability. As companies expand in the US, they must hire American workers. Higher-paying jobs for ordinary Americans means more consumer spending. These effects will be magnified if Trump limits the number of “dirty black” immigrants crossing the border from “shitty countries.” These measures boost economic activity, and the government gets a share of it through corporate profits and payroll tax revenues. The government deficit must remain high to fund these plans, and the Treasury finances the government by selling bonds to banks. Banks can now leverage up again because the Fed or lawmakers have suspended the supplementary leverage ratio. The ultimate beneficiaries are ordinary workers, companies producing “approved” products and services, and the US government, which sees its debt-to-nominal GDP ratio fall. This is QE on steroids for the poor.

Wow, that sounds great. Who could argue with such a magical era of American prosperity?

The losers are those who hold long-term bonds or savings deposits. Because the yields on these instruments will be deliberately maintained at a level lower than the nominal growth rate of the US economy. Workers will also lose if their wages cannot keep up with higher inflation. If you haven't noticed, unions are in fashion again. "4 and 40" is the new slogan. That is, in order to retain employees, wages need to increase by 40% in the next 4 years, that is, 10% per year.

For those of you who think you are wealthy, don’t worry. Here is a brief guide on how to deal with it. This is not financial advice; I am just sharing what I do with my portfolio. Every time a bill is passed and money is sent to an approved industry, read up and buy stocks in those verticals. Don’t keep your money in fiat currency bonds or bank deposits, buy gold (the baby boomer’s hedge against financial oppression) or Bitcoin (the millennial’s hedge against financial oppression).

Obviously, my portfolio starts with Bitcoin, other cryptocurrencies, and crypto-related company stocks, then gold stored in a vault, and finally stocks. I'll leave a small portion of dirty fiat in a money market fund to pay my Amex bills.

In the rest of this post, I will explain how QE for the rich and poor affects economic growth and money supply. I will then predict how the bank exemption from the supplementary leverage ratio (SLR) will once again create unlimited QE for the poor. In the final section, I will introduce a new index that tracks US bank credit supply and show how Bitcoin outperforms other assets after adjusting for bank credit supply.

Money Supply

I have great admiration for the quality of Zoltan Pozar's "Ex Uno Plures" series. I read all of his books during a recent long weekend in the Maldives between surfing, Iyengar yoga, and fascial massage. His work will be referenced frequently throughout the rest of this article.

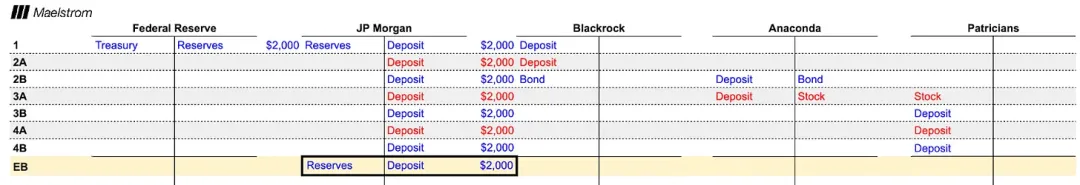

Next I will show you a series of hypothetical accounting books. Assets are on the left side of the T, and liabilities are on the right side. Blue entries represent appreciation, and red entries represent depreciation.

The first example focuses on the impact of the Fed's bond purchases through QE on money supply and economic growth. Of course, the following examples will be a bit exaggerated to increase interest and appeal.

Imagine you are Powell in March 2023 during the US regional banking crisis. To relieve stress, Powell went to the Racquet Tennis Club at 370 Park Avenue in New York City to play squash with an old friend who is worth hundreds of millions of dollars in finance. This friend was very excited. We will call him Kevin. He is an elderly financial tycoon. He said to Powell: "Jay, I may have to sell my house in the Hamptons. All my money is in Signature Bank, and obviously my deposit exceeds the insurance limit. You have to help me. You know how unbearable it is for Bunny if she stays in the city for even one day in the summer."

Jay responded: "Don't worry, I'll help you. I'm going to announce $2 trillion in QE, which will be announced this Sunday night. You know the Fed will always have your back. Without your contribution, who knows what America would be like. Imagine if Trump returned to politics because of the financial crisis when Biden was in office. I still remember him stealing my girlfriend at Dorsia restaurant in the early 1980s, damn it."

The Fed launched the Bank Term Funding Program, which is different from traditional quantitative easing (QE) to address the banking crisis. But allow me to be a little artistic. Now, let's look at how $2 trillion of QE affects the money supply. All figures are in billions of dollars.

1. The Fed buys $200 billion of Treasury bonds from Blackrock and pays for it with reserves. JPMorgan Chase, as a bank, acts as an intermediary in this transaction, receiving $200 billion in reserves and depositing $200 billion into Blackrock's account. The Fed's QE causes banks to generate deposits, which eventually become money.

2. Blackrock now has lost its Treasury bonds, so it must lend that money to others, which means acquiring another interest-bearing asset. Larry Fink, the CEO of Blackrock, doesn’t hang out with the poor, he only works with industry giants. And at this time, he is quite interested in the technology industry. There is a new social app Anaconda, which is building a user community for sharing “busty” photos. Anaconda is in the growth stage, and Blackrock is happy to buy their $200 billion bonds.

3. Anaconda is a pillar of American capitalism. They captured the market by getting 18–45 year old males addicted to the app. Productivity in this group has plummeted because they are no longer reading books but are instead looking at photos. Anaconda avoids repatriating retained earnings by issuing debt to finance its stock buybacks. Reducing the number of shares outstanding not only drives up the stock price, but also increases earnings per share (even though overall earnings haven’t increased, but earnings per share are higher because the denominator has decreased). Therefore, passive index investors like Blackrock are more likely to buy their shares. In the end, the wealthy have $200 billion in the bank after selling their shares.

4. The wealthy shareholders of Anaconda had no urgent need to use the money. Gagosian threw a big party at the Miami Art Fair. The wealthy, under the influence of alcohol, decided to buy the latest abstract paintings to show their status as serious art collectors and to impress the young beauties in residence. The net effect of this "art" patronage was that the sellers' accounts were depleted and the buyers' accounts were increased.

After this chain of transactions, actual economic activity did not increase. The Fed injected $2 trillion of printed money into the economy, which ultimately only increased the bank balances of the rich. Even if this money was used to finance an American company, it did not generate any economic growth because the money only pushed up stock prices and did not create any jobs. $1 of QE increased the money supply by $1, but did not bring any economic activity. This is not an efficient use of debt. Therefore, the ratio of debt to nominal GDP during the period of QE of the rich increased from 2008 to 2020.

Now, let’s look at President Trump’s decision-making process during COVID. Think back to March 2020: Early in the COVID outbreak, Trump’s advisors advised him to “flatten the curve” (remember that rhetoric?). They advised him to shut down the economy and allow only “essential workers” (remember those poor people making deliveries for less than minimum wage?) to continue working.

TRUMP: “Is this a joke, I’m going to shut down the economy because some bullshit doctor thinks this flu is serious?”

Advisor: "Yes, Mr. President. I have to remind you that it is primarily old, obese baby boomers like you who will die from complications from COVID-19 infection. I also have to remind you that if the entire 65+ cohort gets sick and requires hospitalization, the costs will be very high. You will need to lock down all non-essential workers."

TRUMP: "That would crash the economy, send checks to everybody so they don't complain. The Federal Reserve could buy the debt issued by the Treasury, and that would finance those grants."

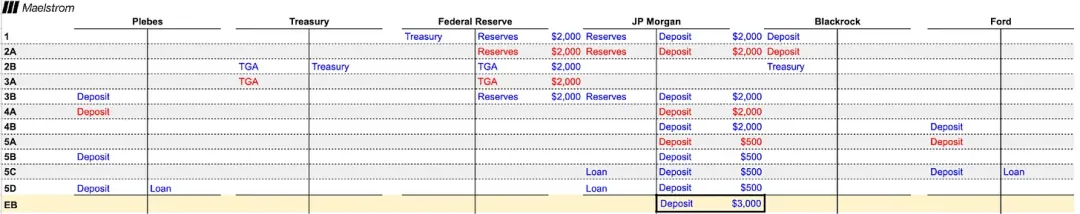

Now, let’s use the same accounting framework to look at how QE for the poor works.

1. Just like in the first example, the Fed performs quantitative easing (QE) by purchasing $2,000 of Blackrock's Treasury bonds and paying for it using reserves.

2. The difference is that this time the Treasury is also involved. To pay for Trump's stimulus checks, the government had to borrow by issuing Treasury bonds. Blackrock chose to buy Treasury bonds instead of corporate bonds. JPMorgan helped Blackrock convert bank deposits into reserves that it could use at the Fed to buy Treasury bonds. The Treasury Department takes deposits at the Fed's Treasury General Account (TGA), which is similar to a checking account.

3. The Treasury Department sends stimulus checks to everyone — mostly Main Street. This causes TGA balances to shrink, and correspondingly, the Fed’s reserves increase, which become Main Street’s deposits at JPMorgan.

4. The general public will spend all their stimulus checks on new Ford F-150 pickup trucks. EV or not, this is "America" and therefore they are dependent on oil. VW's bank account is debited and Ford's is credited.

5. Ford does two things when it sells these trucks. First, they pay their workers, which transfers bank deposits from Ford's account to the accounts of its rank-and-file workers. Ford then asks the bank for a loan to expand production; you can see that the issuance of the loan creates deposits in Ford's account, increasing the money supply. Finally, the general public wants to go on vacation and gets a personal loan from the bank, which is happy to lend when the economy is strong and incomes are good. The bank loans of the average person are like Ford's borrowing, creating more deposits.

6. The final deposit balance is $3,000, which is $1,000 higher than the initial $2,000 injected by the Fed through QE.

As you can see from this example, QE for the poor stimulates economic growth. The Treasury's stimulus check prompted Volkswagen to buy trucks. As demand for its goods increased, Ford could pay its employees and take out loans to increase production. With high-paying jobs, employees were able to get bank credit, allowing them to spend further. $1 of debt generated more than $1 of economic activity. This is a good outcome for the government.

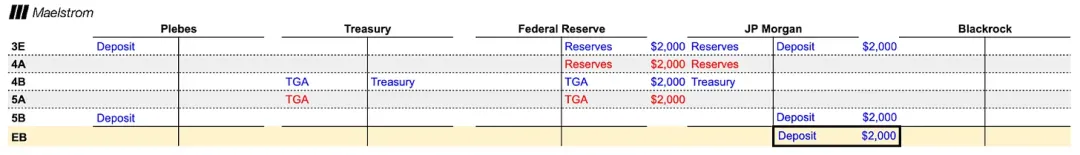

I would like to go further into how the banks can finance the Treasury indefinitely.

Let's start with step 3 above.

4. The Treasury issues another round of stimulus checks. To fund these checks, the Treasury auctions bonds, and JPMorgan Chase, as a primary dealer, buys the bonds using the Fed’s reserves. The sale of bonds increases the Treasury’s balance in the Fed’s TGA.

5. Like the previous example, the checks issued by the Treasury appear in the Main Street deposits at JPMorgan Chase.

When bonds issued by the Treasury are purchased by the banking system, it transforms the reserves held by the Fed — reserves that have no productive use in the economy — into deposits of the public that can be used to purchase goods and generate economic activity.

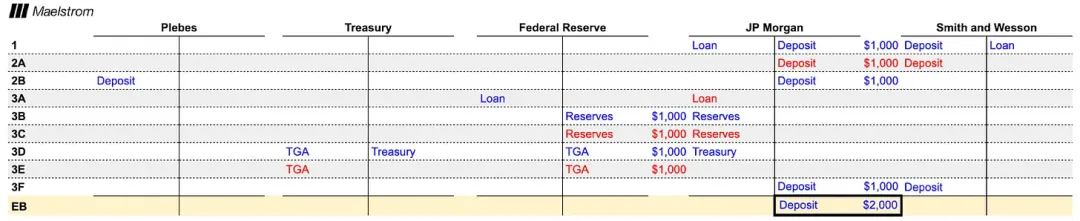

Let's look at another T account example. What happens when the government promotes the production of certain goods and services by promising tax cuts and subsidies?

In this example, Pax Americana is running out of bullets in the Persian Gulf in a Clint Eastwood-style Western movie scene. The government passes a bill promising to subsidize ammunition production. Smith and Wesson applies for and is awarded a contract to supply the military with ammunition. Unable to meet the contract's demands, they go to JPMorgan Chase for a loan to build a new factory.

1. A JPMorgan Chase loan officer has secured a government contract and confidently loans $1,000 to Smith and Wesson. The act of making the loan creates $1,000 of money out of thin air.

2. Smith and Wesson built factories, which created wages for ordinary workers, which eventually became their deposits at JPMorgan Chase. The money created by JPMorgan Chase became deposits held by ordinary people with the highest propensity to spend. I have already discussed how the spending habits of ordinary people create economic activity. Let's change the example slightly.

3. The Treasury needs to issue $1,000 of new debt at auction to finance the subsidy to Smith and Wesson. JPMorgan Chase buys the debt at auction but does not have the reserves to buy the debt. Since using the Fed’s discount window is no longer stigmatized, JPMorgan Chase pledges its Smith and Wesson debt assets as collateral in exchange for a reserve loan from the Fed. These reserves are used to purchase the newly issued Treasury bonds. The Treasury then pays Smith and Wesson the subsidy, which becomes a deposit with JPMorgan Chase.

This example shows how the U.S. government, through industrial policy, caused JPMorgan to lend out its money, and the assets created by the loans were used as collateral in transactions with the Federal Reserve to purchase additional Treasury bonds.

Restrictions

It looks like this “magic money machine” operated by the Treasury, the Fed, and the banks is capable of one of the following:

• They can inflate financial assets for the wealthy without generating any real economic activity.

• They fill the bank accounts of the poor, who would normally use these funds to buy goods and services, thus generating real economic activity.

• They guarantee profitability to certain players in a particular industry. This allows businesses to expand using bank credit, thereby generating real economic activity.

So are there any limitations?

Yes, banks can’t create unlimited amounts of money because they have to provide expensive equity capital for every debt asset they hold. In technical terms, different types of assets have risk-weighted asset charges. Even so-called “risk-free” government bonds and central bank reserves attract equity capital charges. That’s why, at a certain point in time, banks can’t play a substantial role in bidding on U.S. Treasuries or making corporate loans.

There is a reason banks must provide equity capital against loans and other types of debt securities. If a borrower goes bankrupt — whether it be a government or a corporation — the losses must be borne by someone. Given that banks make decisions to create money to make loans or buy government bonds for profit, it is only fair that their shareholders bear the losses. When the losses exceed the bank’s equity capital, the bank fails. When a bank fails, depositors lose their money, which is bad. But what is even worse is that from a systemic perspective, the bank cannot continue to increase the amount of credit in the economy. Since the fractional reserve financial system requires continuous credit issuance to survive, a bank failure can cause the entire financial system to collapse. Remember — one participant’s asset is another participant’s liability.

When the banks’ equity credit runs out, the only way to save the system is for the central bank to create new fiat and exchange it for the banks’ lost assets. Imagine if Signature Bank had only loaned money to Su Zhu and Kyle Davies of the now-defunct Three Arrows Capital (3AC). Su and Kyle provided a false balance sheet that misrepresented the health of the company. They then took the cash out of the fund and gave it to their wives in the hope that the assets would survive liquidation, and when the fund went bankrupt, the bank had no assets to seize and the loans became worthless. This was fiction, of course; Su and Kyle are good people, they wouldn’t do such a thing ;). Signature made a large campaign donation to Senator Elizabeth Warren, who sat on the Senate Banking Committee. Using its political influence, Signature convinced Senator Warren that they were worth saving. Senator Warren called Powell and demanded that the Fed must redeem 3AC’s debt at par through the discount window. The Fed complied, Signature was able to redeem the 3AC bonds for fresh dollar bills, and the bank could respond to depositors’ withdrawals. This didn’t really happen; it was just a “funny” example. But the moral of the story is that if banks don’t provide adequate equity capital, it will eventually be borne at the expense of society as a whole, leading to currency devaluation.

Maybe there is a grain of truth in my hypothetical example; here’s a recent Straits Times story:

The wife of Zhu Su, co-founder of collapsed cryptocurrency hedge fund 3AC, has managed to sell a luxury home in Singapore under her name for $51 million, despite a court freeze on some of the couple’s other assets.

Back to reality.

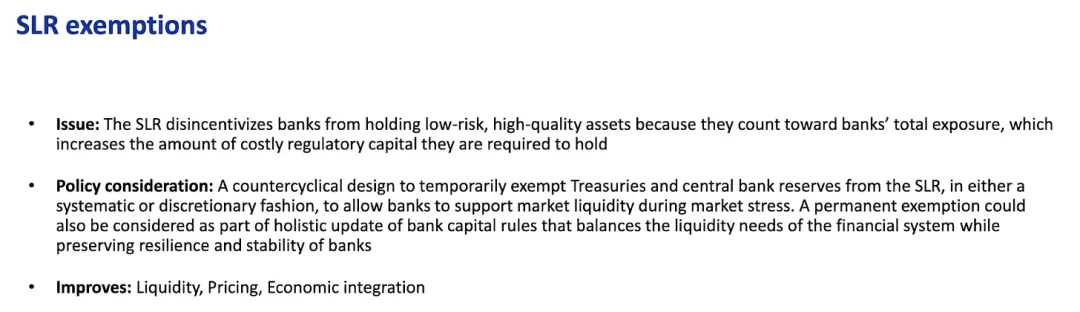

Assuming the government wanted to create unlimited bank credit, they would have to change the rules so that Treasury bonds and certain types of “approved” corporate debt (e.g. investment-grade bonds, or debt from specific industries, such as those issued by semiconductor companies) were excluded from the supplementary leverage ratio (SLR).

If Treasuries, central bank reserves, and/or approved corporate debt securities were excluded from the SLR, then banks could buy unlimited amounts of these debts without having to match expensive equity capital. The Fed has the power to grant exemptions. They did so before, between April 2020 and March 2021. At the time, US credit markets were in distress and the Fed needed banks to re-lend to the government by participating in Treasury auctions, as the government was about to dole out trillions of dollars in stimulus but had no tax revenue to pay for it. The exemption worked extremely well, and banks bought large amounts of Treasuries as a result. The negative side effect was that after Powell raised rates from 0% to 5%, the prices of the same Treasuries fell sharply, leading to the regional banking crisis in March 2023. There is no such thing as a free lunch.

The level of bank reserves also constrains the banking sector’s willingness to buy Treasury securities at auctions. When banks feel their reserves at the Fed have reached their minimum comfortable level of reserves (LCLoR), they will stop participating in auctions. The specific level of the LCLoR is usually only apparent after the fact.

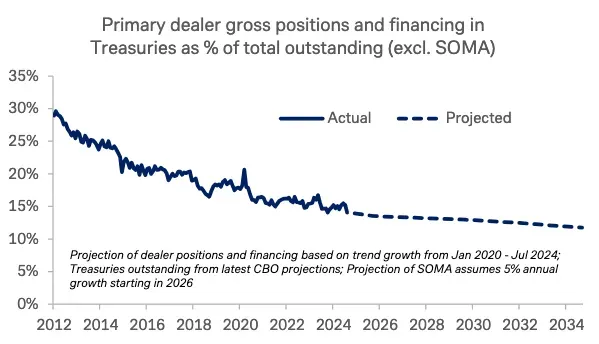

Here is a chart from the Treasury Market Financial Resilience report from the US Treasury Borrowing Advisory Committee (TBAC) on October 29, 2024. The chart shows the decline in Treasuries held by the banking system as a percentage of total outstanding, approaching the LCLoR. This is a problem because with the Fed (QT) and surplus country central banks selling (or not reinvesting) their net export earnings (de-dollarization), the marginal buyers in the Treasury market have become volatile bond trading hedge funds.

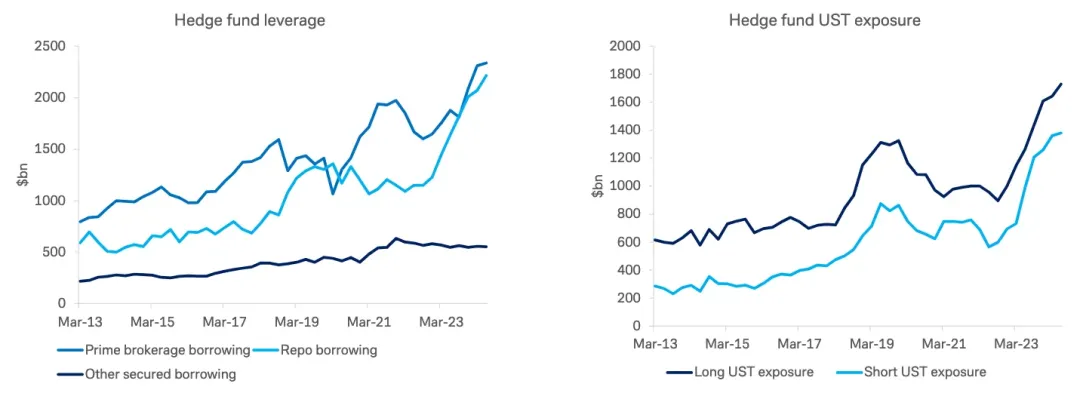

Here is another chart from the same report. As you can see, hedge funds are filling the gap left by banks. But hedge funds are not “real money” buyers. They are doing a carry trade, buying cheap spot Treasuries and selling Treasury futures contracts. The spot portion of the trade is financed in the repo market. Pricing in the repo market is based on the availability of commercial bank balance sheets. As balance sheet capacity shrinks, repo rates rise. If repo funding costs rise, hedge funds can only continue buying if spot Treasuries are cheap relative to futures prices. This means that Treasury prices at auction must fall and yields rise. This is not what the Treasury wants, because it wants to issue new debt at increasingly cheaper prices.

Due to regulatory restrictions, banks cannot buy enough Treasury bonds and cannot provide hedge funds with financing for low-priced Treasury bond purchases. Therefore, the Fed must once again exempt banks from SLR. This will improve liquidity in the Treasury market and provide unlimited QE for the production sector of the US economy.

If you're still not sure that the Treasury and the Fed recognize the importance of easing bank regulations, TBAC clearly states what's needed on page 29 of the same report.

Tracking Number

If Trump-o-nomics works as I have described, then we must focus on the amount of growth in bank credit. Based on the examples above, we know that QE for the rich works by increasing bank reserves, while QE for the poor works by increasing bank deposits. Fortunately, the Federal Reserve provides both of these data points for the entire banking system every week.

I created a custom Bloomberg index that combines reserves with other deposits and liabilities.

This is my custom index that tracks the amount of bank credit in the United States. In my opinion, it is the most important money supply indicator. As you can see, sometimes it is ahead of Bitcoin (like in 2020) and sometimes it is behind Bitcoin (like in 2024).

More importantly, look at how assets perform after adjusting for bank credit supply. Bitcoin (white), the S&P 500 (gold), and gold (green) have all been adjusted for my bank credit index. The index value is set at 100, and as you can see from the chart, Bitcoin has performed the best, up over 400% since 2020. If you can only do one thing to fight against fiat debasement, make it Bitcoin. The math doesn't lie.

The way forward

Trump and his economic team have made it very clear that they will push for policies that weaken the dollar and provide the necessary financing to reshape American industry. Given that the Republicans will control all three branches of government for the next two years, they can pass Trump's economic plans without effective opposition from the Democrats. I believe the Democrats will also join the money printing party, because no politician will refuse to give voters "welfare".

Republicans will start by passing bills to incentivize manufacturers of key goods and materials to expand domestic production in the United States. This will be similar to the CHIPS Act, the infrastructure bill, and the Green New Deal passed by the Biden administration. Bank credit will grow rapidly as companies accept these government subsidies and get loans. For those who consider themselves stock investors, you can buy stocks of companies related to the products that the government wants to be manufactured.

At some point, the Fed will have to compromise and at least exempt the SLR for Treasury bonds and central bank reserves. Once that happens, the path to unlimited QE will be clear.

The combination of legislated industrial policy and SLR exemptions will lead to a surge in bank credit. I have shown that the velocity of money from such a policy is much higher than traditional QE targeted at the wealthy. We can therefore expect Bitcoin and cryptocurrencies to perform as well as, or better than, the period from March 2020 to November 2021. The real question is, how much credit will be created?

The COVID stimulus injected about $4 trillion in credit. This one will be much larger. Defense and health care spending alone are growing faster than nominal GDP. They will continue to grow rapidly as the US increases defense spending to cope with a multipolar geopolitical environment. The share of the US population over 65 will peak in 2030, which means that health care spending growth will accelerate between now and then. No politician will cut defense and health care spending or they will be quickly voted out. All of this means that the Treasury will be busy issuing debt every quarter to keep the basics running. I have shown before that the combination of QE and Treasury borrowing has a money velocity of more than 1. This deficit spending will lift the US’s nominal growth potential.

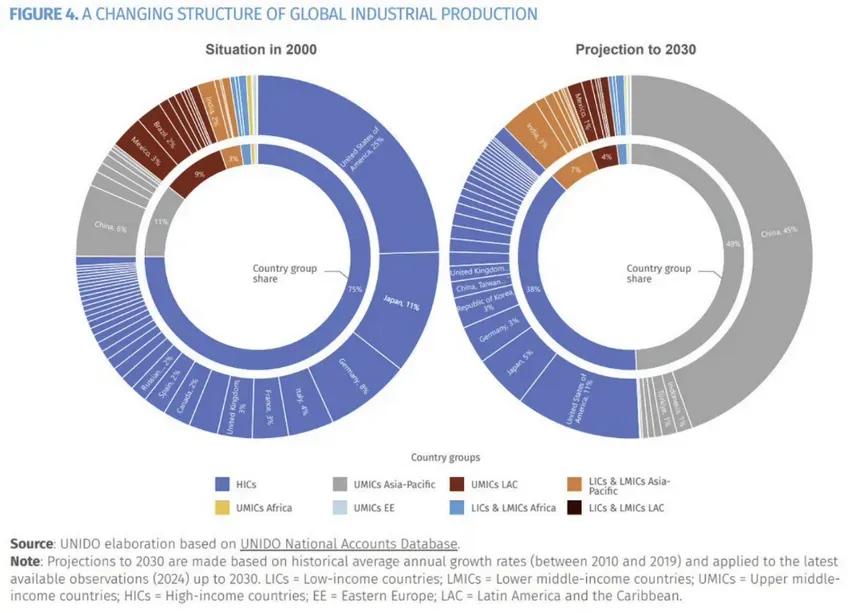

In terms of reshaping American manufacturing, the cost of doing so will also be in the trillions of dollars. Since China was allowed into the World Trade Organization in 2001, the United States has voluntarily handed over manufacturing to China. In less than three decades, China has become the world's factory, producing the highest quality products at the lowest prices. Even if companies want to diversify their supply chains to other lower-cost countries, they find that the integration depth and efficiency of suppliers on the east coast make it necessary to import intermediate components from China even if wages are lower in countries such as Vietnam. Therefore, it will be a difficult task to move supply chains to the United States, and extremely expensive if it must be done due to political necessity. I am referring to the trillions of dollars of cheap bank financing that has been provided to achieve the transfer of production capacity from China to the United States.

Last time it took $4 trillion to reduce the debt to nominal GDP ratio from 132% to 115%. Suppose the US further reduces it to 70% where it was in September 2008. Extrapolating linearly, this means $10.5 trillion of credit creation is needed to achieve this deleveraging. This is why Bitcoin is heading for $1 million, because prices are determined at the margin. As the freely traded supply of Bitcoin decreases, the largest amount of fiat ever will chase safe haven assets, and demand will pour in not just from Americans, but also from China, Japan, and Western Europe. Long and stay long. If you doubt the impact of my analysis of poor people's QE, just read China's economic history over the past three decades to understand why I call the new Pax Americana economic system "American capitalism with Chinese characteristics."