Author: Beosin

On November 6, Trump won the US election, and benefiting from his friendly attitude towards the crypto industry, BTC has repeatedly hit new highs and breached the $90,000 mark. Trump's re-election has sparked market attention to financial policies, especially towards the cryptocurrency industry.

On November 13, according to The Verge, President-elect Donald Trump has appointed Elon Musk and Vivek Ramaswamy to lead the government efficiency department DOGE - to pave the way for his administration to "cut government bureaucracy, cut over-regulation, cut wasteful spending, and restructure federal agencies".

According to a statement posted on Truth Social, the department will operate in some way "outside of government" and work with the White House and the Office of Management and Budget. The statement said Musk and Ramaswamy must complete their work by July 4, 2026.

Source: Musk's X account

It can be seen that Trump's re-election as president and his active support for cryptocurrencies may become a key catalyst for the development of the US crypto market, thereby having a profound impact on the global crypto market. This may not only change the policy environment of the crypto industry, but also help attract institutional capital and innovative talents, propelling the US to a leading position in the global crypto economy.

1. Continued Growth of US Cryptocurrency Holders

Over the past few years, the number of cryptocurrency holders in the US has increased significantly. According to market research data, in 2023, more than 20% of US adults own some form of crypto assets, especially mainstream coins like BTC and ETH. This growth trend has been driven by multiple factors, including the uncertainty of the economic environment, fiat currency inflation, and the gradual penetration of blockchain technology in the financial industry. The market optimism after Trump's election may further drive an increase in the number of holders in the short term.

Cryptocurrency holders include not only retail investors, but also an increasing number of institutional investors. Banks, hedge funds, pension funds and other institutions have gradually entered the crypto asset management business, making the overall market participants more diversified. The entry of institutional investors has also played a positive role in the stability and liquidity of the market, and has promoted the further standardization of the cryptocurrency market.

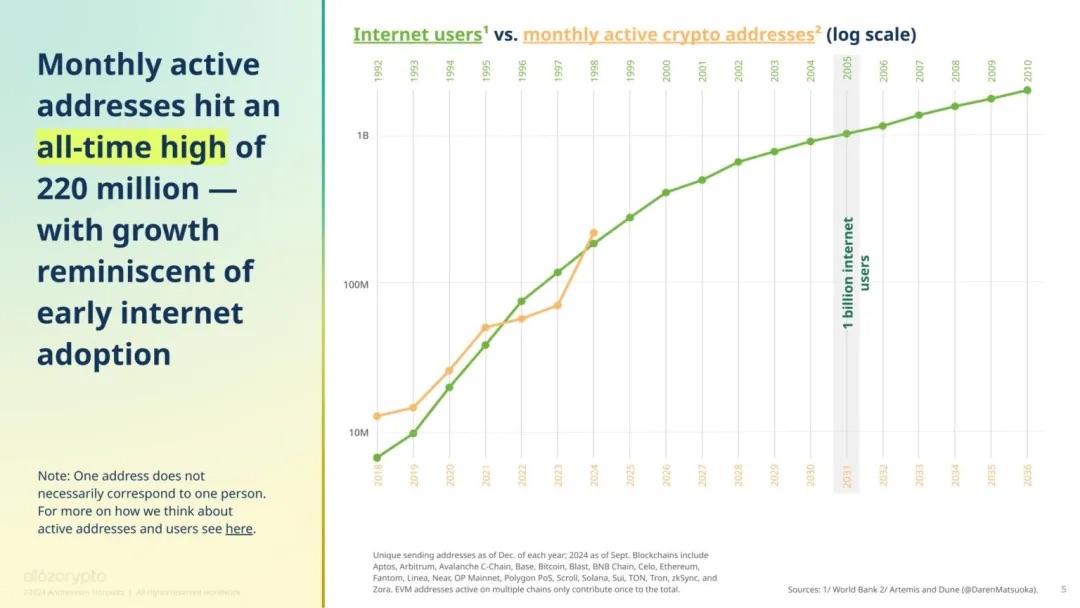

According to data, in September, there were 220 million addresses that had interacted with the blockchain at least once, more than double the number at the end of 2023.

Source: https://a16zcrypto.com/posts/article/state-of-crypto-report-2024/

The surge in active addresses is mainly due to Solana, which has about 100 million active addresses. This is followed by NEAR (31 million active addresses), Coinbase's popular L2 network Base (22 million), TRON (14 million) and BTC (11 million). Among the EVM chains, the second most active chain after Base is Binance's BNB Chain (10 million), followed by ETH (6 million).

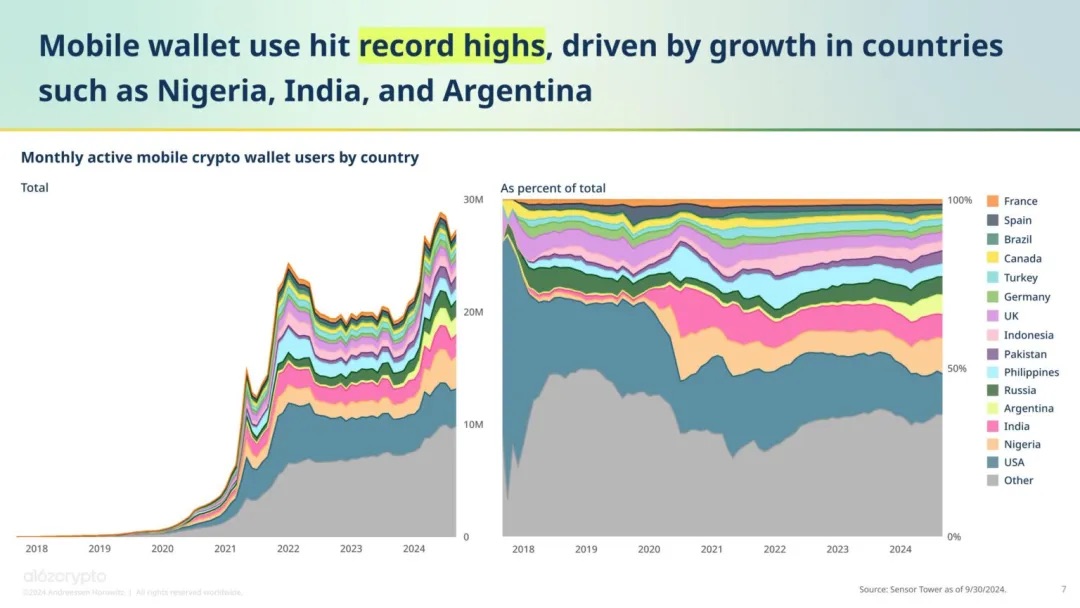

Meanwhile, in June 2024, the monthly number of mobile crypto wallet users reached a historic high of 29 million. While the US accounts for the largest share of monthly mobile wallet users at 12%, its share in the overall mobile wallet user base has been declining in recent years, as crypto adoption grows globally and more projects exclude the US through geo-fencing to seek regulatory compliance.

Source: https://a16zcrypto.com/posts/article/state-of-crypto-report-2024/

2. Changes in Regulatory Policies of the Trump Administration

In 2022, the collapse of the trading platform FTX led the Biden administration to intensify its crackdown on cryptocurrencies, causing dissatisfaction among crypto executives and investors. Since then, federal regulators have been committed to combating fraudulent activities, taxing crypto investment returns, and attempting to classify more digital tokens as securities to strengthen regulation.

Therefore, the US Securities and Exchange Commission (SEC) is the main regulatory body, and its chairman Gary Gensler has in recent years brought major lawsuits against large platforms such as Coinbase, Ripple and Binance, accusing them of violating investor protection regulations. All companies have denied these allegations.

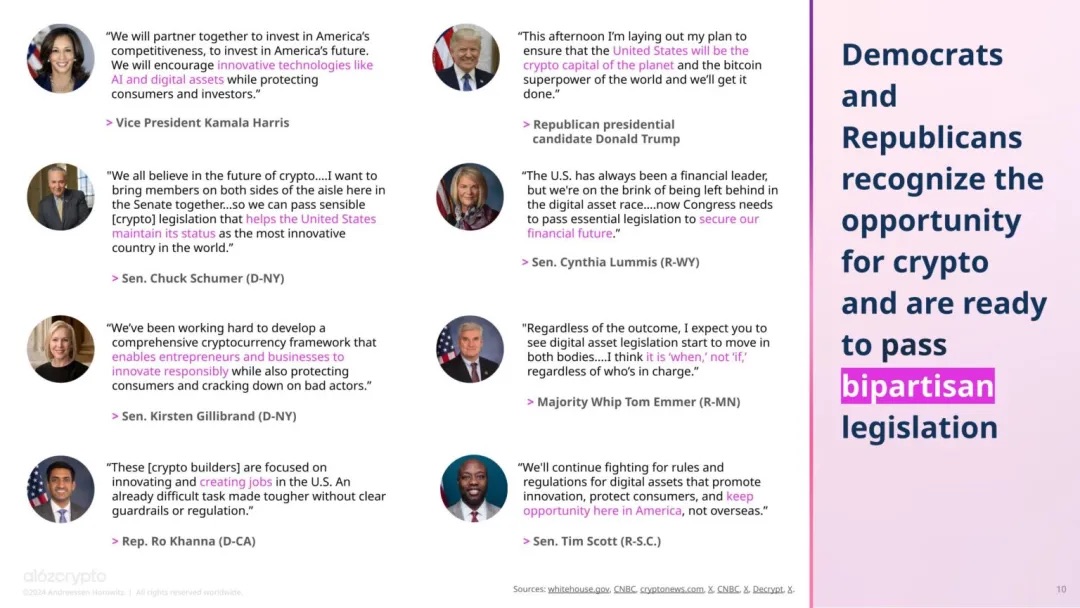

Before the election, many politicians expected the momentum to increase with the passage of bipartisan crypto legislation. More and more policymakers and politicians have taken a positive attitude towards crypto.

Source: https://a16zcrypto.com/posts/article/state-of-crypto-report-2024/

This year, the industry has also sparked other major policy initiatives. At the federal level, the House of Representatives, with bipartisan support, passed the 21st Century Financial Innovation and Technology Act (FIT21), with 208 Republicans and 71 Democrats voting in favor. The bill is awaiting consideration and approval by the Senate, and may provide much-needed regulatory clarity for crypto entrepreneurs.

Also significant is that at the state level, Wyoming passed the Decentralized Autonomous Organization (DUNA) Act, which legally recognizes DAOs and allows blockchain networks to operate legally without compromising decentralization.

Source: https://a16zcrypto.com/posts/article/state-of-crypto-report-2024/

At the 2024 Bitcoin Conference in Nashville, Trump promised to establish a committee of industry experts and implement crypto-friendly policies. He also promised to make BTC a "national strategic reserve" and fire SEC Chairman Gensler. These promises have sparked renewed enthusiasm after Trump's victory.

Cameron Winklevoss passionately wrote on social media: "Imagine if the crypto industry no longer had to spend billions of dollars fighting the SEC, but could invest those resources in the future of money. Amazing things are about to happen."

3. Anti-Money Laundering (AML) Remains Important in the Crypto Market

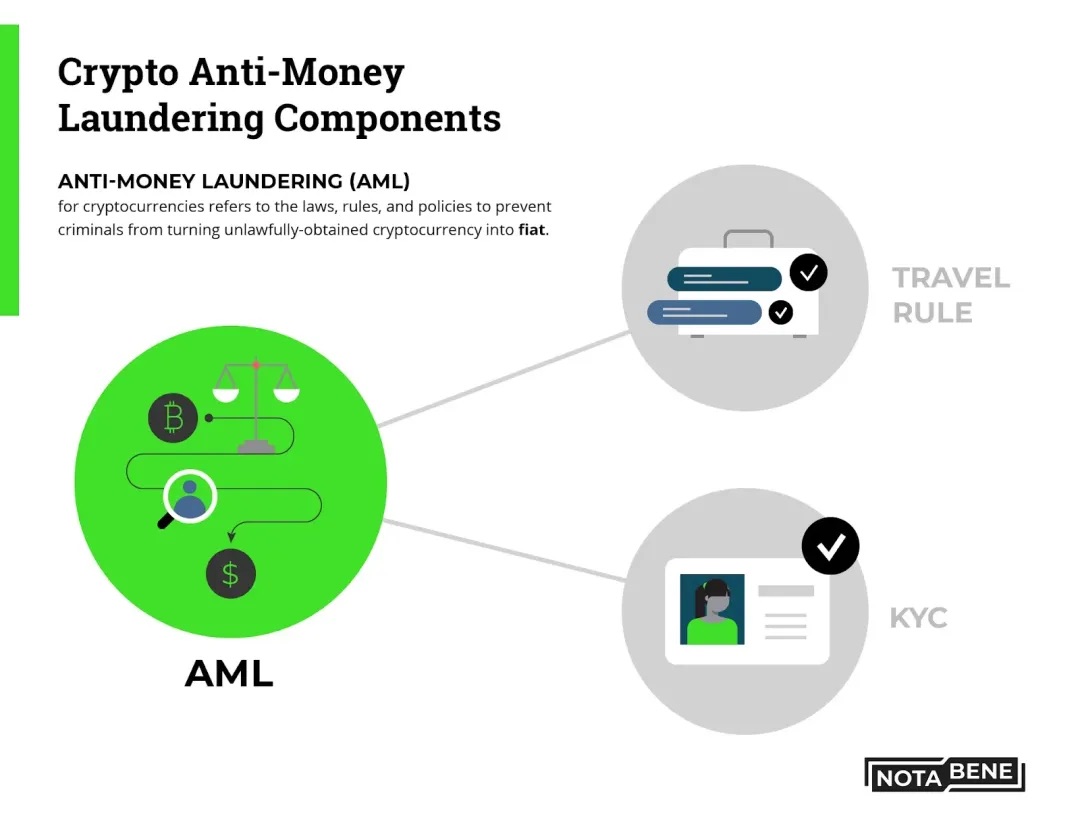

Anti-money laundering (AML) is crucial in the crypto market. The decentralization and anonymity of cryptocurrencies provide criminals with convenient means for money laundering. As the number of market participants increases, especially with the entry of institutions, AML requirements become increasingly important. The Trump administration may potentially adopt stricter AML policies in the future to curb illegal activities.

In 2014, FATF issued guidelines for crypto AML, prompting policymakers in FATF member countries to take swift action. The US Financial Crimes Enforcement Network (FinCEN), the European Commission, and dozens of other regulators have incorporated most of FATF's crypto AML recommendations into law.

The responsibility then falls on crypto exchanges, stablecoin issuers, and some DeFi protocols and Non-Fungible Token (NFT) markets (depending on the specific case), which FATF defines as Virtual Asset Service Providers (VASPs). In the future, VASP compliance officers must mandatorily conduct KYC checks and regularly monitor suspicious activities to prevent transactions potentially related to money laundering and terrorist financing.

Additionally, VASPs must report suspicious activities to relevant regulators and agencies, which are responsible for analyzing fund flows and using various tools, including blockchain analysis, to trace illegal activities to real-world identifiers.

Source: https://notabene.id/crypto-travel-rule-101/aml-crypto

In recent years, the U.S. Department of the Treasury has introduced a number of policies to strengthen anti-money laundering (AML) regulations on cryptocurrencies. The Trump administration is likely to continue this policy direction, and is expected to further strengthen the AML compliance review requirements for cryptocurrency exchanges. For example, cryptocurrency exchanges may need stricter identity verification measures and submit more detailed transaction records to ensure the compliance of all transactions. It is expected that under the push of this policy, cryptocurrency exchanges in the U.S. market will pay more attention to user identity verification in the future, and projects that meet AML standards will gain market recognition. Stricter AML policies may put some pressure on the short-term liquidity of the market, but in the long run, this will help improve the transparency and credibility of the market, paving the way for further entry of institutional investors. As regulatory policies are further implemented, exchanges and projects that meet compliance requirements may gain greater competitive advantages in the market.