Author: Ignas | DeFi Research

Compiled by: BitpushNews Yanan

The market always likes to shout "this time it's different," but to be honest, I'm hoping the old routine can come back again: if Bitcoin's four-year cycle can continue, the price might set a new high again in the fourth quarter of 2025.

Then, it's the familiar process: BTC goes up, and mainstream Altcoins like ETH and SOL also surge, followed by another wave of tokens (maybe meme coins are the hottest). They all rush up.

However, the market has its own temperament. When it reaches a certain level, it has to turn a corner, and then we have to obediently enter a "cooling-off period" of two years. Thinking about it, who wouldn't be exhausted after such a crazy rise in a year? So, those two years of rest are like a short vacation for the market.

The Delphi Research team had predicted the peak in the fourth quarter of 2025 as early as mid-2023.

I had mentioned their forecast before, and these predictions are gradually becoming a reality. However, there are a few things the team did not foresee: the approval of the ETH ETF and the approval of the BTC ETF in the market triggered a strong FOMO sentiment, driving the BTC price to a new all-time high in early March.

Thank you very much for the insights from Delphi!

With Trump's victory, the government may introduce more favorable cryptocurrency regulations, and we may see the final catalyst for a super-crazy bull market.

The current optimism contrasts sharply with the cautiously optimistic market view I shared in July. Now, the market is no longer affected by negative factors such as the outflow of Grayscale ETF funds and the Diaoyutai incident.

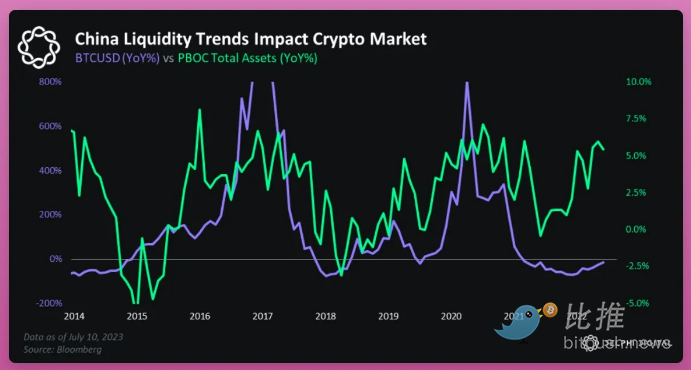

Delphi also mentioned that China is considering increasing the money supply due to the risk of deflation.

In fact, China has introduced the most proactive stimulus policies since the pandemic, but many still feel the intensity is not enough and call for further "printing of money".

From a historical perspective, whenever China takes measures to inject liquidity, it often has a positive impact on the global economy and the cryptocurrency market.

However, on the social media platform X, it seems that few people have noticed the potential positive change in China's attitude towards cryptocurrencies: not only may it stimulate the economy by increasing the money supply, but it may also adjust its restrictive regulatory policies on cryptocurrencies.

Most importantly, previous Bitcoin halving events have always culminated in a significant rise in the Bitcoin price, although this surge typically only becomes apparent about half a year after the halving: this time seems to be no exception.

If everything goes as planned, this will be the most predictable and easiest-to-grasp bull market in history.

How bullish is the market?

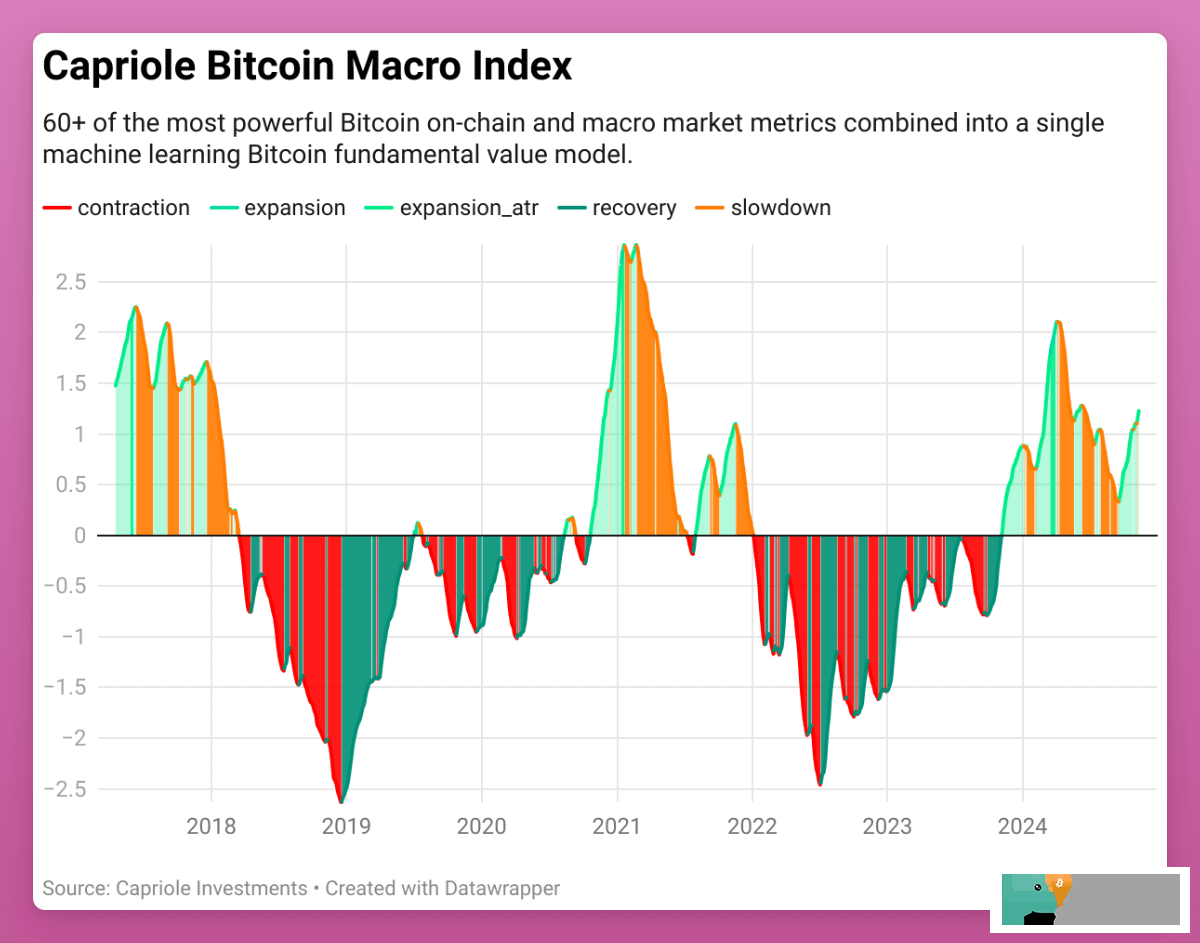

The research report charts provided by Capriole Investments are quite insightful and worth a closer look.

Their flagship product, the Capriole Bitcoin Macro Index, comprehensively considers over 60 key indicators related to Bitcoin, covering on-chain data (such as dormant flow, supply, hash rate distribution, active address count, etc.), macroeconomic indicators, and stock market indicators.

The index is divided into several stages, and we are currently in the second expansion period, but its level has not reached the high point of March 2024, nor is it close to the market peaks of 2017 and 2021.

In short, the outlook is bullish.

The founder of Capriole predicts that by the fourth quarter of 2025, the Bitcoin price will reach at least $140,000. When I directly asked him about his view on Ethereum (ETH), he expressed confidence that it will reach at least $5,000, and possibly even higher.

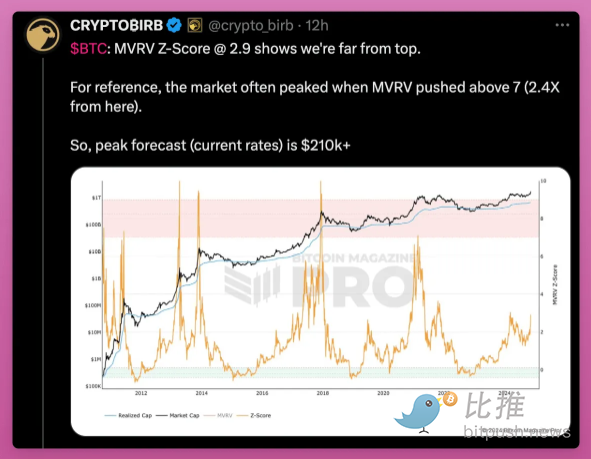

If you think the above forecasts are too conservative, and you believe in technical analysis, you may estimate the Bitcoin price peak to be as high as $210,000.

I plan to follow the strategy of the previous cycle, as I am deeply involved in SOL, ETH, and gradually exploring the DeFi field and meme coins.

As Bitcoin prices rise, many people feel frustrated that their Altcoins have not kept up. Don't worry, my dear investors, Altcoins often catch up after a sharp rise in Bitcoin prices.

And the market still has ample upside potential.

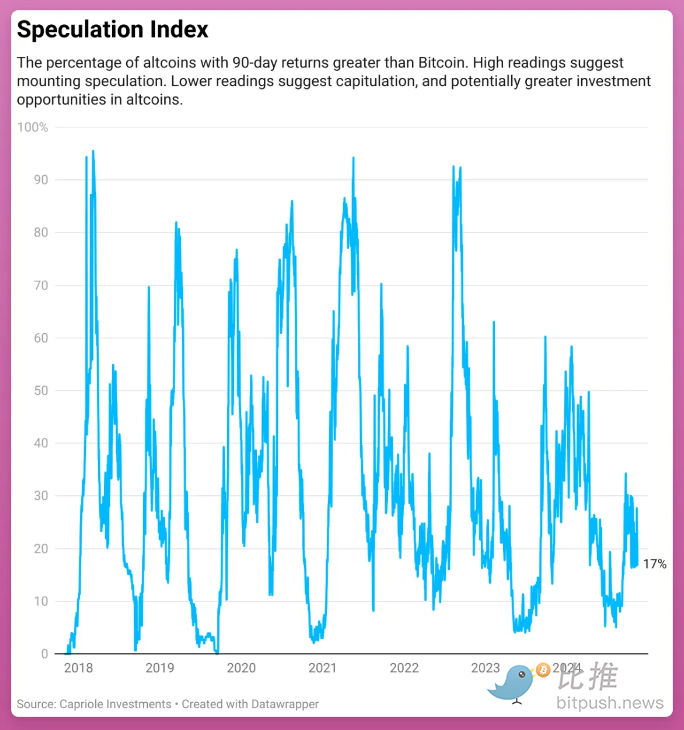

According to Capriole Investments' Altcoin Speculation Index, the rebound trend of Altcoins has not even truly started yet. A high percentage indicates a speculative market sentiment, while a low percentage may signal a reduction in speculation and suggest better Altcoin investment opportunities.

Everything in front of us seems too good to be true, which inevitably raises some concerns.

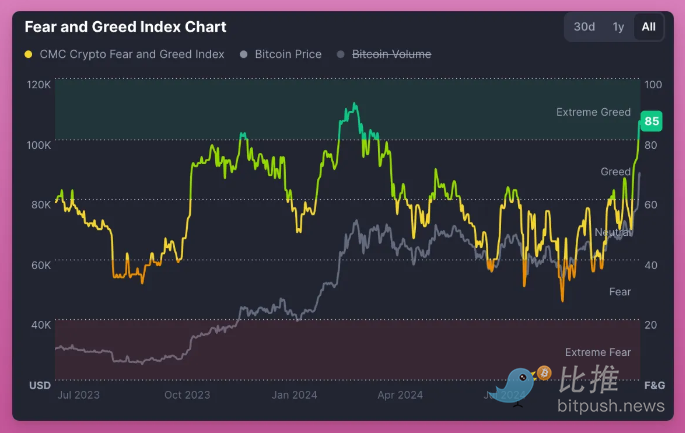

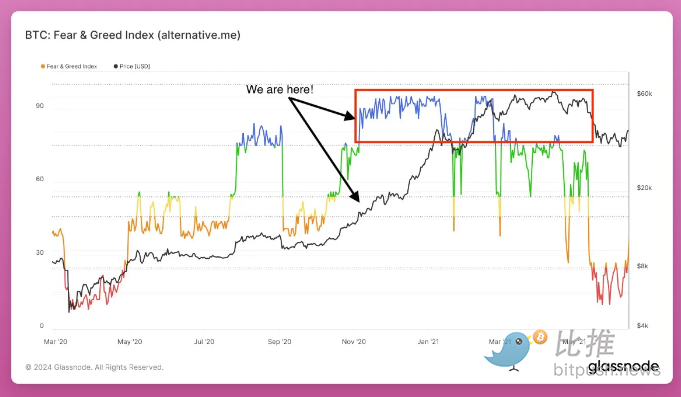

We have entered a state of extreme greed.

However, this greed sentiment may persist for quite some time. From November 2020 to March 2021, the index remained above 80, with very small corrections during that period. (Data source: Crypto Koryo)

In summary, even though the current situation looks extremely promising, we should remain calm and avoid blindly relying on leverage.

Memecoins

The other day, I read a Financial Times article titled "The Astonishing Rise of Bitcoin Cannot Be Ignored".

The comments from ordinary readers were quite interesting, with comments like Ponzi scheme, fraud, "it's worthless" and so on.

These self-proclaimed smart people clearly failed to grasp the true essence. And I suddenly had an epiphany.

Early cryptocurrency adopters held similar prejudices against meme coins: considering them fraud, worthless, and meaningless.

However, Bitcoin has stood firm amidst the skepticism, while meme coins have left those cryptocurrency veterans who were once doubtful in shock. Both their prices have been rising steadily, and their momentum is truly impressive. Just look at the amazing performance of meme coins after the election - their prices doubled in just ten days.

Meme coins have crossed a critical milestone: Binance and Coinbase have successively listed meme coins, which is an important step towards their normalization.

Before extensively introducing meme coins, Binance released an in-depth research report, pointing out that retail investors are actively exploring new paths to wealth growth, and meme coins embody the core idea of improving transparency and accessibility, "striving to narrow internal advantages and create a fairer participation environment for global investors".

Meme coins are not only an investment tool, but also a microcosm of "the integration and profound transformation of value and cultural significance in the modern financial system".

Given Binance's natural tendency to list assets with upside potential, I have reason to believe that Binance will list more meme coins in the future.

SOL vs Ethereum

Oh, my dear Ethereum, when will you see the dawn of a price surge?

Watching the prices of meme coins soar, my holdings have become increasingly heavy.

FOMO is constantly tempting me to switch to those coins with more aggressive uptrends,

but I still hold on - hoping that the choice I made was not wrong.

In this crypto market cycle, Ethereum and its entire ecosystem seem to struggle to replicate the bull market glory of the past.

To move the $382 billion Ethereum giant, as well as the established DeFi projects and the newly emerged low-liquidity, high-FDV tokens, the required capital could actually stir up waves in other emerging fields, including DeSci, Runes, DeFi projects in the Solana ecosystem, other L1 projects, and even the aforementioned meme coins.

Ethereum and DeFi token investors have already made a fortune in the previous cycle, and now they are eager to triple or quintuple their wealth to achieve financial freedom. But perhaps the market will not give them that opportunity so easily? Let these coins grind a little longer.

The capital required to drive Ethereum's growth by 3x could potentially grow the ecosystems that are injecting new ideas into the crypto space by 10x.

This possibility is entirely plausible.

Recently, the ETH 3.0 (Beam Chain) roadmap proposed by Justin Drake has not generated much enthusiasm in the community. Moreover, the plan is expected to be implemented only by the late 2020s, which has clearly missed the current market cycle.

On the other hand, Solana is in its heyday.

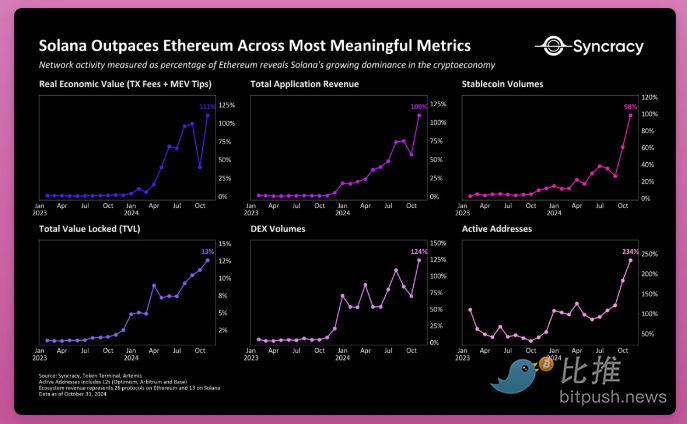

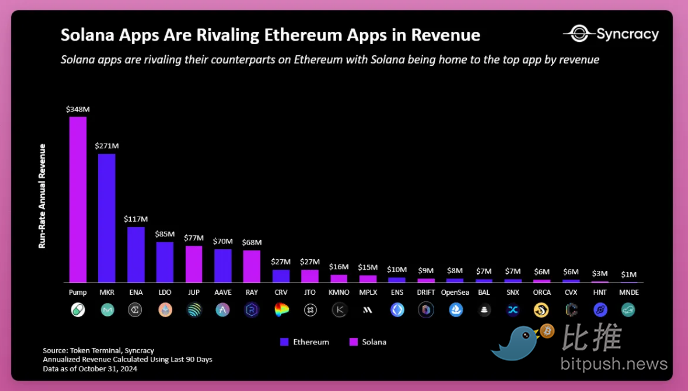

A recent research report by Syncracy provides a clear comparison of the competitive landscape between Ethereum and Solana.

Solana's rise in the previous cycle was driven by future potential, while this time it is driven by solid fundamentals.

Comparing network activity, Solana has performed well in terms of total value locked (TVL), decentralized exchange (DEX) trading volume, stablecoin trading volume, and active addresses.

Objectively speaking, directly comparing Solana to Ethereum's L1 layer may be somewhat biased, as theoretically, Ethereum's L2 layer should also be taken into consideration. However, as L2 layers are largely still seen as "parasites" dependent on the Ethereum mainnet, ordinary investors remain skeptical about the true value of L2 layers, making it difficult to accurately assess.

Even if we turn our attention to dApp revenue, we will find that dApps on Solana are now able to compete with dApps on Ethereum, demonstrating comparable strength.

Nevertheless, Solana's market cap is still only about a third of Ethereum's, and considering the strong economic indicators it has displayed, this undoubtedly suggests that it has significant growth potential and may even catch up to Ethereum in valuation in the future.

So, will SOL overtake ETH? In my view, when the narrative of "SOL will surpass ETH" becomes increasingly prevalent, that may be the time to consider reallocating and returning to ETH.

Historically, the moments when Ethereum's market cap surpassed Bitcoin have often been clear signals of the ETH/BTC ratio reaching its peak.