Grayscale Investments has filed an updated registration statement for a Bit covered call ETF (exchange-traded fund).

The Commodity Futures Trading Commission (CFTC) has taken swift action after approving the listing of spot Bit ETF options.

Grayscale Pushes for Bit Covered Call ETF

The fund aims to provide exposure to Bit and the Grayscale Bit Trust (GBTC), actively managing call and put options on Bit exchange-traded products (ETPs) to generate income. The registration statement was first filed with the U.S. Securities and Exchange Commission (SEC) in January 2024.

According to the filing, the ETF will achieve its objective by providing exposure to GBTC. It will also employ a covered call strategy, which involves selling call options on Bit or GBTC to generate income.

"The fund primarily seeks to achieve its investment objective through actively managed exposure to the Grayscale Bit Trust (GBTC) and the purchase and sale of call and put option contracts that have GBTC as the reference asset," the January filing stated.

James Seyffart, an ETF analyst at Bloomberg Intelligence, commented on this development. He believes Grayscale is capitalizing on the approval of Bit ETF options.

"Grayscale didn't waste any time after the BTC ETF options approval. They've filed an updated registration statement for a Bit covered call ETF (no ticker yet). This fund will provide exposure to GBTC and BTC and generate income by buying or selling option contracts on Bit ETPs," Seyffart stated.

This comes after the SEC approved the trading of spot Bit ETF options. This regulatory milestone, announced last month, allows ETF issuers to integrate option strategies into Bit-centric funds, opening new avenues for investment.

The Office of the Comptroller of the Currency (OCC) is also preparing to enable options trading on Bit ETFs. Eric Balchunas, an ETF industry expert, emphasized the significance of the CFTC's decision, stating that it paved the way for more complex Bit investment products.

With options now available, funds like Grayscale's covered call ETF can provide tailored solutions for investors seeking to generate income from volatile asset classes.

Grayscale's ETF Strategy Diversifies Product Offerings

Grayscale's filing for a covered call ETF is part of a broader effort to establish a leading position in the cryptocurrency ETF space. In October, the SEC acknowledged Grayscale's application to convert its Digital Large Cap Fund into an ETF, demonstrating the company's commitment to product diversification.

Additionally, Grayscale is collaborating with the New York Stock Exchange Arca (NYSE Arca) to secure the listing approval of various ETFs focused on digital assets beyond Bit. These efforts reflect the company's strategy to bring institutional-grade financial products to the cryptocurrency market.

The ability to integrate options trading into Bit ETFs could be a turning point for the cryptocurrency industry. The covered call strategy, which involves selling options on the underlying assets, can enable funds to generate stable income, a feature that may attract a broader range of investors.

Grayscale's swift response to these developments and its pursuit of a Bit covered call ETF demonstrate the agility with which the company is navigating the evolving regulatory landscape. By filing an updated registration statement for the Bit covered call ETF, the company is positioning itself to capitalize on the growing interest in options-based cryptocurrency investments.

If approved, the Bit covered call ETF could pave the way for a new generation of investment products that combine traditional financial strategies with emerging digital assets. As the regulatory framework begins to accommodate such innovations, the cryptocurrency investment space can expect significant growth.

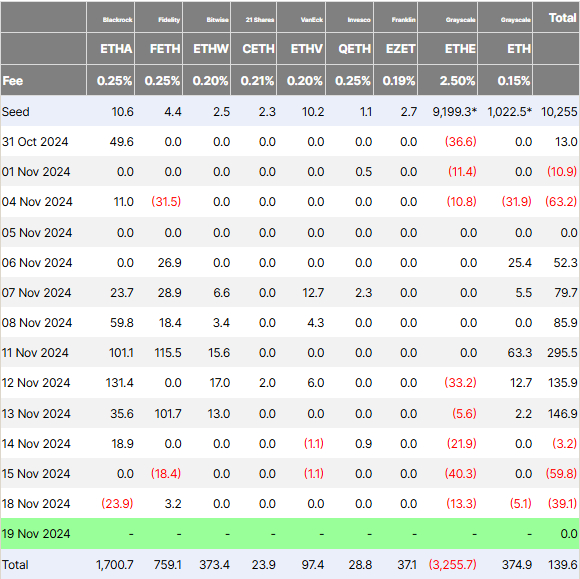

However, the company's Ethereum ETF has been impacted, experiencing five consecutive days of outflows starting November 12.