Author: Tanay Ved & Matías Andrade Cabieses Source: Coin Metrics Translation: Shanba, Jinse Finance

Key Points:

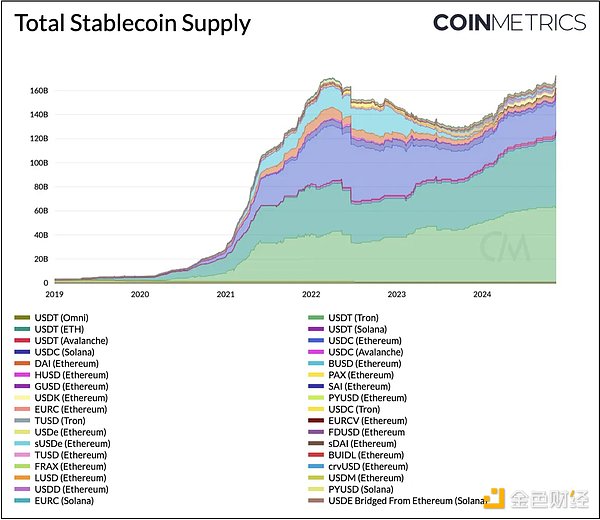

The total supply of issued stablecoins has expanded to $189 billion, with Tether's USDT accounting for $125 billion (66% of the total supply) and stablecoins issued on Ethereum accounting for $104 billion (55% of the total supply).

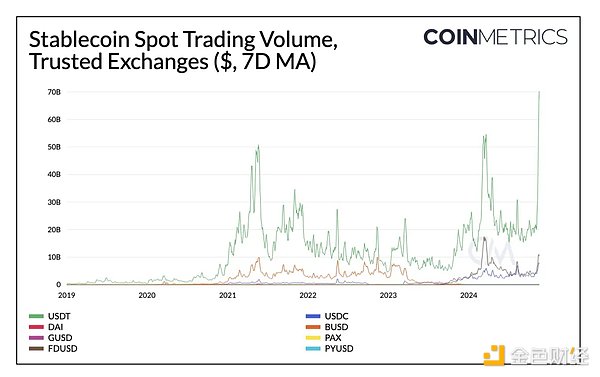

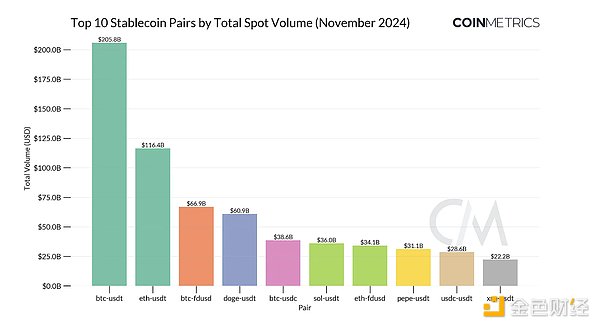

In addition to serving as a store of value, stablecoins are also crucial trading mediums during bull markets. After the elections, the stablecoin trading volume on major exchanges surged to $120 billion, with the largest trading pairs including BTC, ETH, SOL, and memecoins.

With the on-chain stablecoin transfer volume (in USD) breaking $50 billion in November, on-chain activity has shown an upward trend. Driven by the increased usage of USDC, the trading volume of Solana stablecoins reached a new high.

Driven by the bullish market sentiment and rising lending rates, Ethena's USDe and staked USDe (sUSDe) have experienced rapid growth since the third quarter, showcasing the evolving yield-driven dynamics of stablecoins.

Introduction

As the cryptocurrency market enters a bull run, stablecoins have also regained their upward momentum, with a total issuance exceeding $189 billion. This influx indicates that the liquidity environment is continuously growing, as users can capitalize on the price appreciation and opportunities emerging within the on-chain ecosystem. Merger and acquisition activities in the cryptocurrency space have also heated up, with Stripe acquiring the stablecoin payment platform Bridge for $1.1 billion in October and Coinbase acquiring Utopia Labs, further driving the industry's growth momentum. Stablecoins continue to be a central theme across the broader financial landscape and are poised to become the pillars of fintech, payments, and the global financial system.

In this week's Coin Metrics State of the Network report, we dive deep into the stablecoin landscape, discussing their critical role as a medium of exchange during bull markets and analyzing the on-chain adoption of key metrics.

Stablecoin Landscape

The stablecoin landscape continues to expand in depth and breadth. Following the significant profitability of incumbents like Tether, traditional finance and crypto-native issuers have been steadily entering the market, leading to a constant influx of stablecoins. At the same time, stablecoins are establishing a broader footprint across the cross-chain space, particularly as alternative Layer-1 and Layer-2 ecosystems mature. Consequently, Coin Metrics' stablecoin coverage has expanded to over 35 stablecoins and continues to grow.

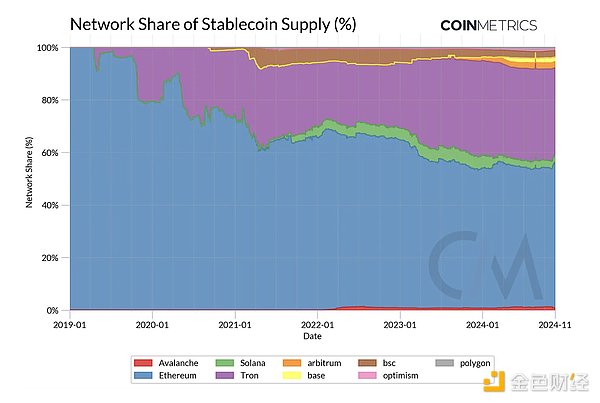

Tether's USDT maintains the largest market share of stablecoin issuance, with a total supply of $125 billion, accounting for 66% of the market. Circle's USDC closely follows with a total supply of $36 billion, representing 19% of the market. In terms of networks, Ethereum is the blockchain with the most stablecoin issuance, accounting for $104 billion (55%) of the total stablecoin supply. TRON continues to maintain a 33% network share of stablecoin supply, primarily driven by USDT. Solana and Ethereum Layer-2 networks (Arbitrum, Base, Optimism) collectively account for approximately 7.5% of the total stablecoin supply, reflecting their growing but still emerging stablecoin ecosystems.

Market Upswing, Surge in Stablecoin Trading Volume

As one of the earliest use cases, stablecoins have proven their role as mediums of exchange in both bull and bear markets. In uptrending markets, stablecoins serve as a bridge for users to access other tokens within the ecosystem, providing the necessary liquidity to facilitate on-chain and trading activity. During downtrends or volatile periods, they can also act as stores of value or savings vehicles, allowing users to park their wealth or earn yields from on-chain and off-chain sources. This makes stablecoins indispensable under various market conditions, geographies, and time zones.

With the post-election surge in the cryptocurrency market, the stablecoin trading volume on various exchanges has surpassed $120 billion as trading activity has increased. Tether's USDT accounted for approximately 80% of the spot trading volume recorded on November 12th, amounting to $95 billion. First Digital USD (FDUSD) also gained significant traction, with its daily spot trading volume spiking to $16 billion (around 17% of the total), while Circle's USDC reached $11 billion, setting a new high for its weekly average spot trading volume.

We can further delve into the specific stablecoins and crypto assets driving the November activity. Large-cap assets like BTC, ETH, and SOL, as well as memecoins like DOGE and PEPE, have prominent positions among the top 10 trading pairs across exchanges. While the dominance of mainstream currencies is not surprising, the influence of memecoins suggests that retail participation has increased as BTC sets new price highs. Consequently, the "Specialized" segment in datonomy ™ (including meme coins, privacy coins, and remittance coins) has been the best-performing sector, with a 63% return over the past 30 days.

On-Chain Economic Activity and Adoption

Stablecoins play a crucial role not only as trading mediums and sources of liquidity on exchanges but also for non-trading use cases, such as facilitating transactions and settling economic value on-chain. Stablecoins are ideal tools for consumer and B2B payments, remittances, storing wealth, or seeking economic stability and access to financial infrastructure, particularly in emerging markets.

By leveraging some on-chain metrics, we can better understand how stablecoin-driven economic activity has evolved over time and the extent of their impact on the usage of different public blockchains.

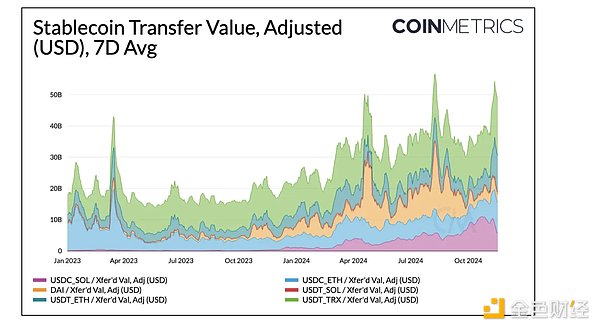

In November, the adjusted weekly transfer volume of native units between different stablecoin addresses exceeded $50 billion. Of this, $18.2 billion (38%) came from USDT on TRON, and $12.3 billion (23%) came from USDT on Ethereum, both setting new highs in transaction volume. USDC on Ethereum and Solana also exhibited greater appeal, with an upward trend in transfer volumes.

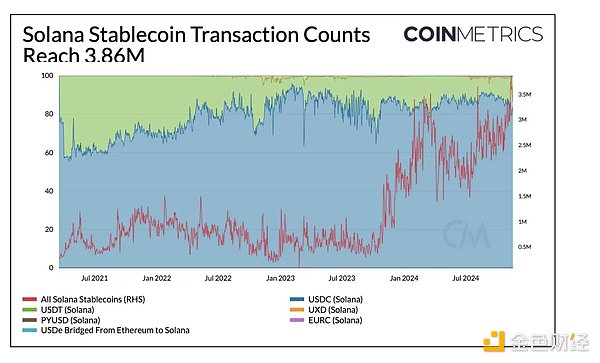

Notably, Solana's stablecoin transaction volume reached a historic high of 3.86 million transactions in November. USDC continues to be the preferred stablecoin on Solana, accounting for 83% of all stablecoin-related transactions on the network. Due to Solana's low transaction fees, the average transfer amount of USDC on the network is $20, compared to $1,400 on Ethereum. This has led to a higher transaction count on Solana, with 3.86 million stablecoin transactions in November, far exceeding Ethereum's 230,000 transactions, despite Ethereum's stronger stablecoin liquidity.

We can leverage several other metrics to further understand the on-chain stablecoin activity, including the supply held by smart contracts and externally owned accounts (EOAs), stablecoin velocity (turnover), active addresses, the number of addresses holding above a certain stablecoin amount, and supply distribution. These metrics can be further explored through our Stablecoin Dashboard, created using our charting tools.

Yield Demand: Higher Financing Rates Drive Ethena's Growth

Another way to drive stablecoin demand is to provide yield, which can serve as a form of passive income or risk management, whether in a bull or bear market. In order to compete with industry giants like Tether and Circle in terms of adoption, some stablecoin issuers are incentivizing stablecoin growth by passing on interest to holders, thereby enhancing their store of value properties. This covers a range of methods and risk profiles, from passing through a portion of the yield generated by real-world assets (RWAs) (such as US Treasuries) held off-chain, to passing through yields from on-chain collateral assets like staked ETH, or in some cases passing through revenue generated by on-chain protocols (in relation to the stablecoins they issue).

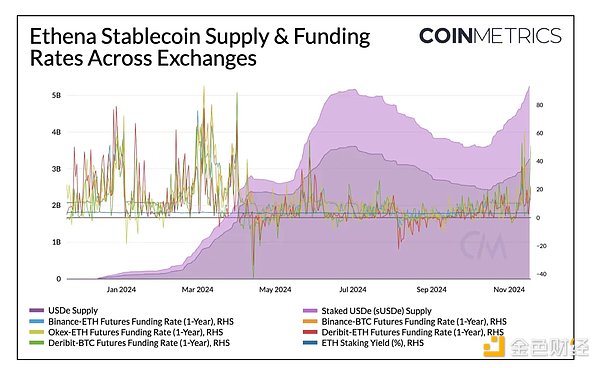

Ethena has brought a relatively new yield generation method to its synthetic US dollar USDe (dubbed the "Internet Bond"). It combines the hedging strategy of centralized exchanges with staking rewards, in order to generate yield while maintaining peg stability. Crypto assets are used as collateral (BTC, ETH) to establish short positions in the perpetual futures market, aiming to benefit from positive funding rates. Combining financing and basis, Ethena passes on the yield from ETH staking rewards in the form of the interest-bearing token sUSDe.

Notably, there is a close relationship between the USDe supply across different exchanges and the ETH financing rate. In an environment of positive financing rates, the supply of USDe and staked USDe (sUSDe) has seen growth, while in times of negative financing rates, the supply has declined or stagnated. Interestingly, Ethena recently announced plans to launch USTb, a new stablecoin collateralized by BlackRock's tokenized US Treasury bond fund BUIDL. This stablecoin is intended to serve as a backing asset for USDe, helping to manage risk during periods of market volatility that lead to soft financing rates. As the fastest growing stablecoin since Q3, Ethena is well-positioned to leverage the continuously rising financing rates.

Conclusion

Stablecoins remain the bedrock of the digital asset ecosystem, driving liquidity, facilitating payments, enabling on-chain economic activity, and serving as tools for savings and wealth preservation. According to multiple metrics, the adoption and usage of stablecoins continue to grow, demonstrating their widespread demand and utility. As stablecoins gain prominence, regulatory clarity in areas such as reserve transparency and issuance standards will drive innovation across the entire ecosystem and spur the growth of stablecoin-related businesses. With proactive regulatory efforts in the US and globally progressing, the stage is set for the next phase of stablecoin growth, with the potential to reshape the financial ecosystem.