Author: Donovan Choy, Blockworks; Compiled by Wu Zhu, Jinse Finance

Running Ethereum L2 has historically been very expensive. L2 must pay millions of dollars in data availability costs to L1.

The Dencun hard fork (EIP-4844) in March 2024 changed all this. It introduced a block space expansion called "blobs" for L2 to publish bulk data to L1 at extremely low cost. Blob space is in a separate fee market from L1. It is about an order of magnitude cheaper than L1 block space, making it a key aspect of Ethereum's rollup-centric roadmap.

To illustrate this, according to data from TokenTerminal, Base paid $9.34 million in fees in Q1 2024, which plummeted to $699,000 in Q2 2024 and $42,000 in Q3 2024.

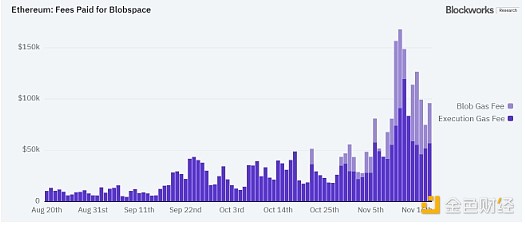

The bad news (or good news?) is that as on-chain activity increases in the bull market, blob space is becoming somewhat expensive again.

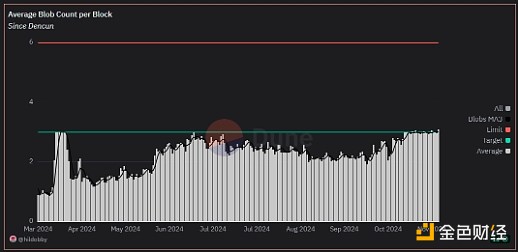

Currently, the limit for the number of blobs per mainnet Block is 6. When blob usage reaches 50% or the target limit of 3, a base fee will be introduced to regulate the demand usage across hundreds of L2s. When usage reaches 4 blobs, the base fee for the next Block will increase by up to 12.5% further.

This is exactly what has started happening in the past few weeks (see chart below).

In short, blobs are no longer free, and L2s need to start paying "rent". According to data from Ultrasound.money, Blob fees have consumed around 212 ETH in the past 30 days, generating significant Blob fees for the Ethereum mainnet.

So blobs are generally great. Lower operating costs for L2s, which is good for L2 users.

But people (ETH holders) are not happy, as it seems L2s are paying almost no fees to L1, thereby reducing the value of the ETH asset.

The core of this complaint is the pessimistic sentiment that blob usage will be high enough to return value to L1, for two reasons:

L2s are essentially a business. They will choose cheaper data availability providers like Celestia or EigenDA, or worse, centralized data availability committees (DACs) with weaker security properties.

When the blob market gets expensive, L2s will simply delay sending data back to L1, as we've seen Scroll and Taiko do in the past.

In the Devcon debate on blobs, Ethereum researcher Ansgar Dietrichs acknowledged the misaligned incentives for L2s, but countered that in the long run, as trust bottlenecks around bridges emerge, more L2 networks will converge around it, making Ethereum's DA more important.

Tim Robinson of Blueyard also made the argument that "blobs are a loss leader". He pointed out that while blobs currently don't generate much revenue, due to the economics of blob design, they will quickly generate revenue and provide massive dividends to Ethereum in the future. According to Robinson's Blob Simulator, assuming Ethereum L1 processes 10,000 TPS, with a Blob size of 16 MB (current Blob size is 125 KB), it would consume 6.5% of ETH per year.

This potential appreciation in the value of ETH is why blobs are fundamentally beneficial to Ethereum in the long run. In the short term, limiting blob limits or increasing blob fees to extract more value from L2s is essentially a bad "rent-seeking" idea.

Ethereum researchers are putting their money where their mouth is. In an Ethereum research paper published two days ago, Tony Wahrstätter called for a conservative increase to 4/6 blobs or a more aggressive 6/9 blobs.

In ACDE #197, Vitalik also proposed a 33% increase in blob space in the next Pectra hard fork, warning that this is critical. Otherwise, users will leave for other chains.

In summary, the complex debate around blobs boils down to the question of whether Ethereum wants to prioritize the ordinary L2 user and its "Ethereum-native" L2 ecosystem, or prioritize the value accrual of the ETH asset.

Ethereum researchers argue that prioritizing the latter may lead to users and developers migrating to cheaper chains, and correspondingly doubling down on expanding blob space in the long run. However, this damages the perception of ETH as an economic asset, thereby angering ETH token holders in the short term.

Either way, it's a tricky situation for Ethereum, requiring a herculean task of predicting the future and considering countless "what-ifs". Time will tell which path is the right one.