The U.S. Securities and Exchange Commission (SEC) is reportedly holding quiet meetings with various issuers to discuss the approval of a Solana ETF, according to Fox Business reporter Eleanor Terrett. With the arrival of a pro-cryptocurrency Trump administration, the SEC appears more likely to approve such products.

However, the SEC's nominal head, the anti-cryptocurrency figure Gary Gensler, remains in place, and any public progress may not start until 2025.

Prospects for a U.S. Market SOL Spot ETF Approval Improve

According to a exclusive report by Fox Business reporter Eleanor Terrett, the SEC and several ETF issuers are discussing the approval of a Solana ETF. Brazil is currently the only country that has approved this product. As recently as September, PolyMarket had assessed the odds of the SEC approving it at a low 3%. However, this hesitation may soon change:

"Discussions between SEC staff and issuers wanting to launch a Solana spot ETF are 'ongoing,' and the SEC is now engaging on S-1 filings. Recent staff engagement and the arrival of a pro-crypto administration have sparked new optimism that a Solana ETF could be approved sometime in 2025." – Eleanor Terrett, Fox Business reporter

Terrett clearly explained the driving force behind the negotiation progress: the re-election of Donald Trump. Trump promised to dramatically reform U.S. cryptocurrency policy during his campaign, with the core being the firing of anti-cryptocurrency SEC Chair Gary Gensler. Gensler has acknowledged his own dismissal, and his successor will clearly be supportive of the industry.

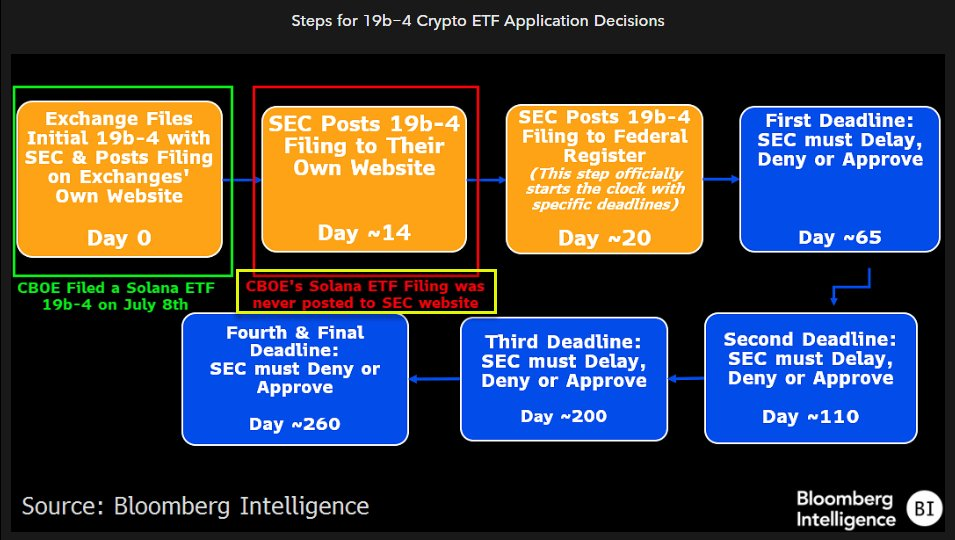

Previous attempts have failed at the early stages of the process. If the SEC formally acknowledges the filing, it must confirm approval or rejection within 240 days. Previous submissions have remained in limbo at this stage. However, the candidate list is now growing: Canary Capital filed for a Solana ETF in October, and Bitwise did the same earlier today.

Nevertheless, these positive negotiations remain mere anonymous rumors. The Commission has not publicly moved to initiate this process, and Gensler remains the nominal head. Terrett argues that the SEC will only achieve serious progress on a Solana ETF in early 2025. However, this is a complete turnaround from previous pessimism.